Accounting treatment of closing balance sheet items

Sometimes entrepreneurs/learners find it difficult to get started in the next financial period as far as book keeping procedures are concerned for they do not know whether to open new ledger accounts or to continue with the existing ones. The answer to this challenge is simple. That is, we still consider the existing accounts as indicated in the statement of financial position (ie the balance sheet). Then the next question is how do we go about it? Again it’s simple for one need to open corresponding ledger accounts as shown in the closing balance sheet of the previous financial period. The point of detail on how to go about it is explained in lesson below

For your information, this lesson highlights the aspects of balances appearing in the balance sheet and the accounting treatment of the same when a new year commences. The account balances appearing in the closing statement of financial position (balance sheet) are usually the corresponding opening balances in the respective ledger accounts in the New Year except the closing inventory value. The following procedural steps are helpful to the entrepreneur/learner in learning how this is carried on in the books of accounts.

Step one;

When you cross over to a new financial period/year, open the respective ledger accounts as per the closing balance sheet.

Step two;

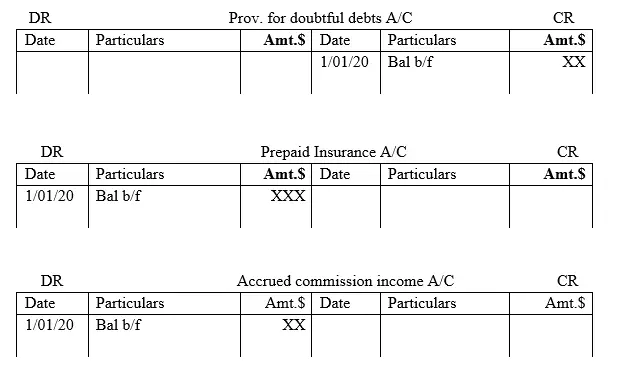

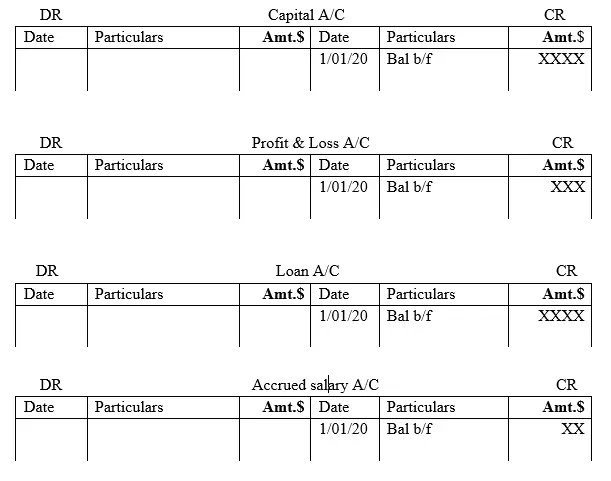

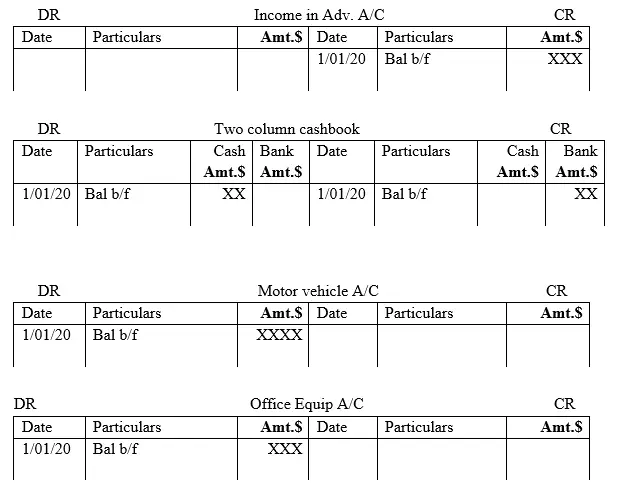

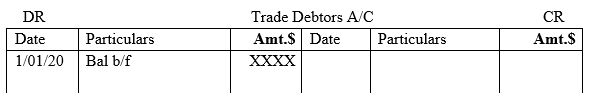

Post the monetary values of the balance sheet items as balance brought forward, abbreviated as (bal. b/f) in the respective debit and credit sides of the relevant accounts. That is, for all ASSETS, whether current or non-current assets should be recorded on the debit side of their respective ledger account as balance brought forward (bal b/f). This is inclusive of all prepaid expenses and accrued income. Similarly, for all LIABILITIES, whether current, non-current or capital should be recorded on the credit side of their respective ledger account. This is inclusive of all accrued expenses and income in advance.

NB1: In summary, the entrepreneur/learner need to note that in the previous discussions, we treated various ledger accounts as balance brought down (bal b/d). This accounting treatment is a common practice in accountancy especially when we are referring to balances as per end of a financial period. But, if we are crossing over from one financial period to a new year, we talk of balance brought forward, abbreviated as (bal. b/f). This is common practice in accountancy as stated earlier whereby all accountancy practicing entrepreneurs/learners are expected to adopt.

NB2: That the monetary value of the closing inventory, whether, of raw materials, Work in Progress (WIP) or finished goods becomes the opening balance for the new financial period. Remember that in the case of inventory, no ledger account is opened as it is the case with other ledger accounts. The entrepreneur/learner should note that as more business transactions take place as the new financial period advances, determination of the closing inventory value will be through inventory / stock taking.

Step three;

Step three entails further recording of corresponding business transactions in the respective source documents as it is usually the case, then the same transactions are transferred to the respective books of original entry and later posted to the respective ledger accounts. Remember that practically, we do not post transactions to ledger accounts directly but should follow the step three approach only. The following illustration gives further general guidelines.

Illustration

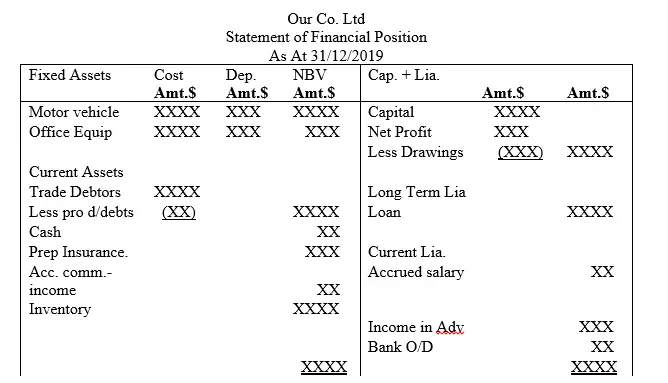

The following is a general statement of financial position of Our co. ltd as it was prepared on 31/12/2019

Required;

Show the respective opening balance brought forward (ie bal b/f) in the new year January, 2020

Solution

Comment1: If computation of the per annum depreciation amount for the non-current assets was on reducing balance method, then the balance brought forward (bal. b/f) as it is in the above case will represent the Net Book Value (NBV). However, if the depreciation method used was that of straight line, then the balance brought forward (bal. b/f) will be the cost.

Comment2: The balance brought forward (bal b/f) for debtors is recorded in the respective ledger account at gross amount for the provision of doubtful debts is netted from debtor value to determine the net book value of trade debtors/accounts receivable.