Acquisition and Disposal of Non-Current Assets

The business may be involved in acquisition or disposal of its non-current assets. These nature of transactions may take place either in the beginning, at the middle or towards the tail end of the financial period. The question that arise is how do we account for such cases? To answer this question, you need to recall that non-current assets represent capital goods or capital expenditure whose intention of acquisition is not for re-selling to make profits in the normal or ordinary business transactions but for furthering the operations of the firm. Therefore, when dealing with the acquisition/purchase and sale of non-current assets certain specific ledger accounts are opened. That is, in case a purchase of non-current asset occurs, a corresponding non-current asset account is opened and when the asset in question is sold/disposed, the affiliated fixed asset disposal account is created. We will start with the simple examples of only one asset being bought and disposed in the beginning and at the end of the year respectively and then consider more complex transactions where by more than one asset are bought and disposed not only in the beginning or at the end of the financial period but also at any time of the year. To achieve this objective, several scenarios will be considered.

Scenario one; Acquisition and disposal of an asset at the beginning and end of the year

If a business acquires a non-current asset at the beginning of a financial period and dispose the same at the end of the same accounting period or after lapse of two or more financial periods, although it is unusual scenario, then the journal and ledger account entries are as follows;

a). Direct method

The following are the journal/accounting entry steps followed when direct method of depreciation is used

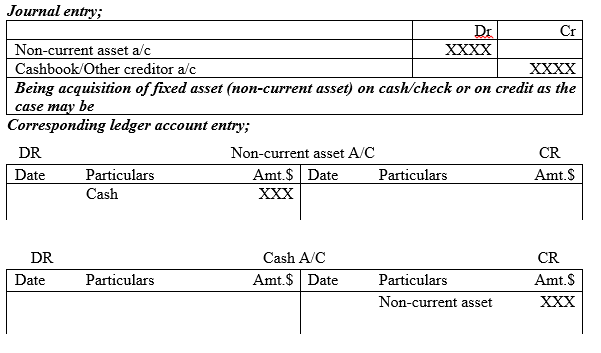

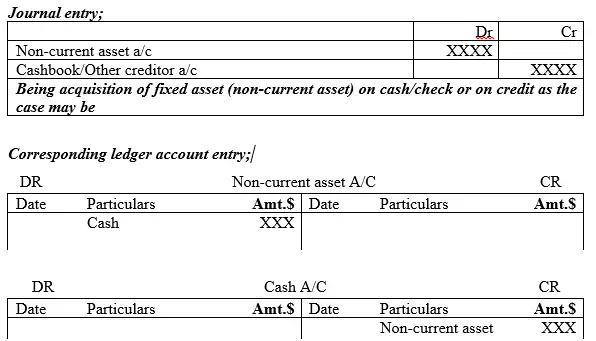

i). On acquisition at the beginning of the financial period

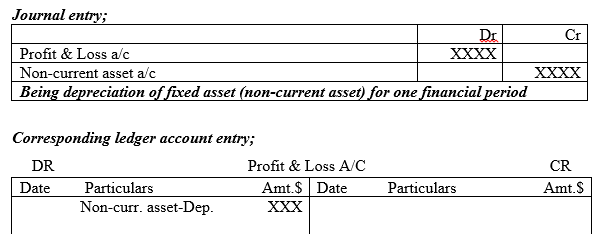

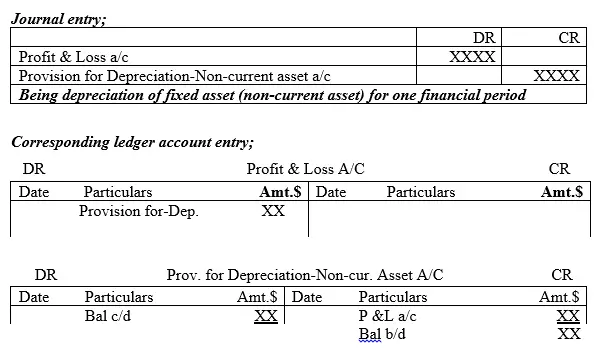

ii). On provision for depreciation of the non-current asset at the end of financial period

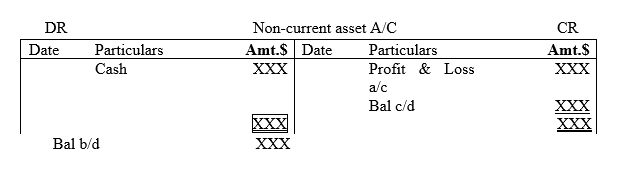

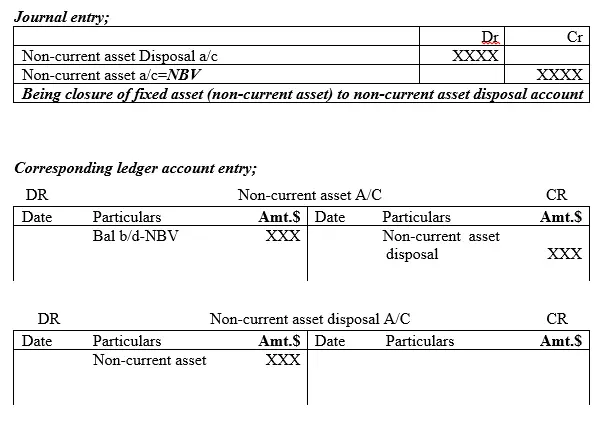

iii). On disposal/sale of non-current asset at the end of the financial period

The entrepreneur need to note the following points;

If a non-current asset is disposed/sold, this business activity calls for determination of whether the asset was disposed at capital gain or loss. To achieve this objective, the following entries are made in the books of accounts

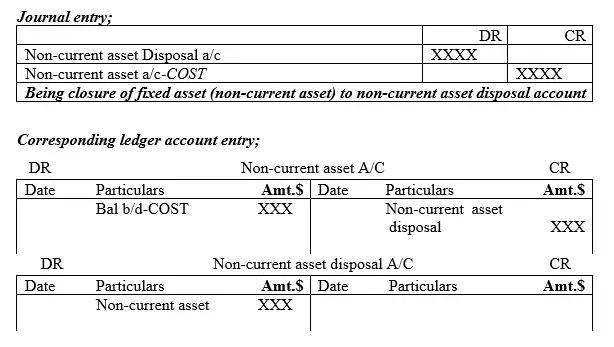

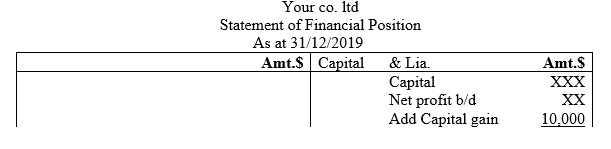

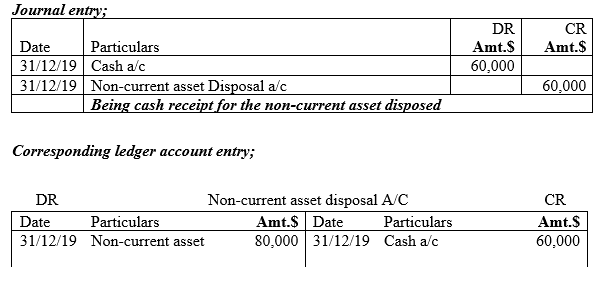

1. Close the non-current asset account to a new account known as non-current asset disposal account which is similar to the normal profit and loss account which is normally prepared at the end of the financial period

NB1: The closing figure should be the Net Book Value (NBV) of the fixed asset all the time whether direct or indirect method of depreciation is used or not.

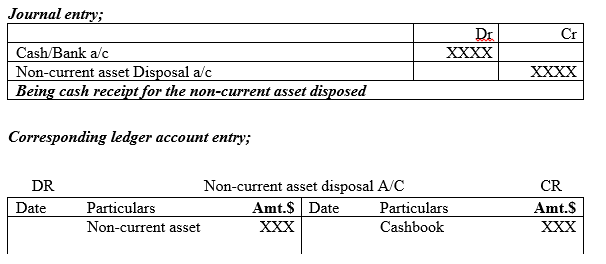

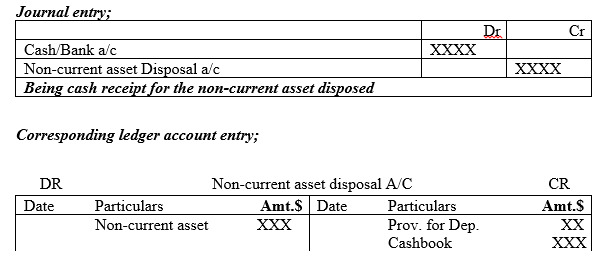

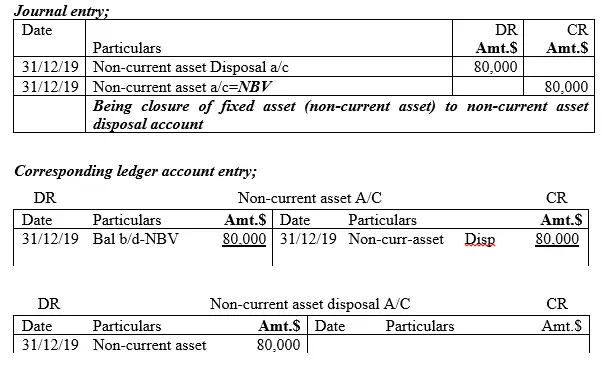

1. If cash is actually received, whether hard cash or check, make the corresponding entries in the non-current asset disposal account and the cashbook which can take the form of either cash account or bank account

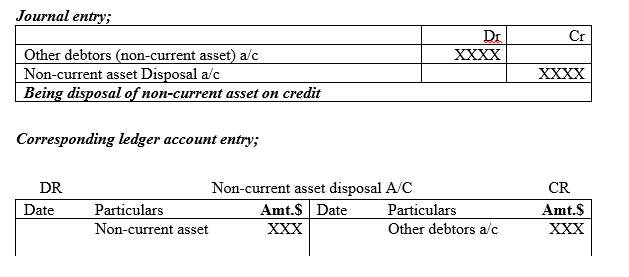

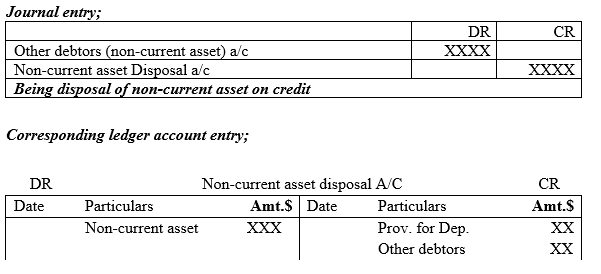

2. If the non-current asset was disposed on credit terms, then “other debtors account” will replace cashbook for no immediate cash has been received. The account is treated like any trade debtors account in the statement of financial statement.

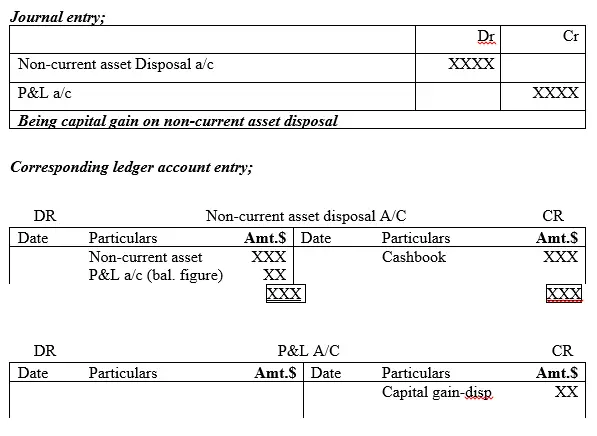

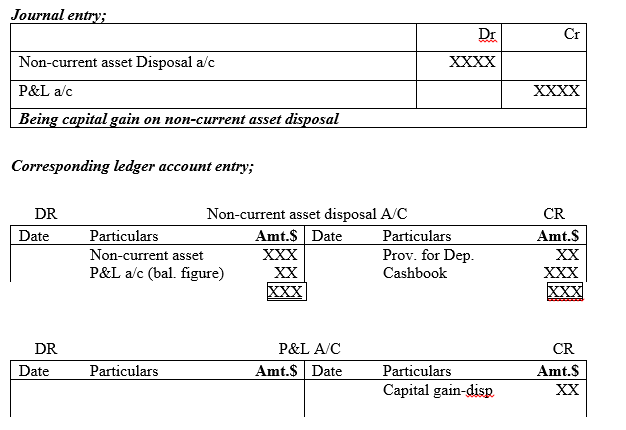

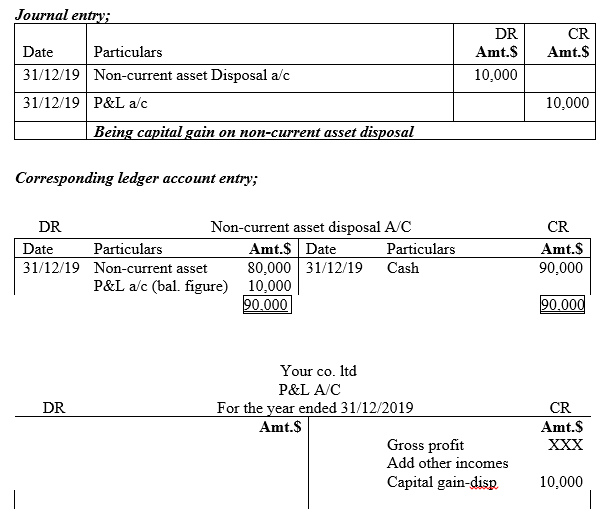

3. On making capital gain on disposal of the non-current asset; close the non-current disposal account to profit and loss account with the amount of capital gain

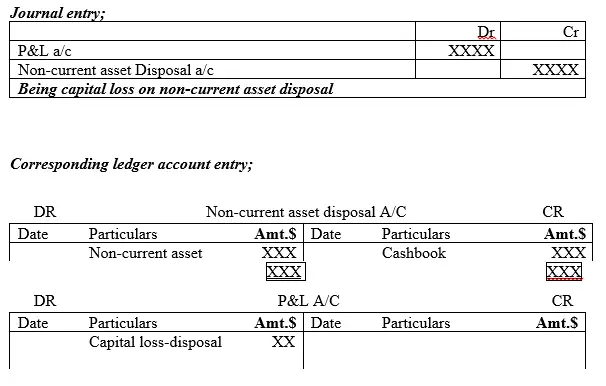

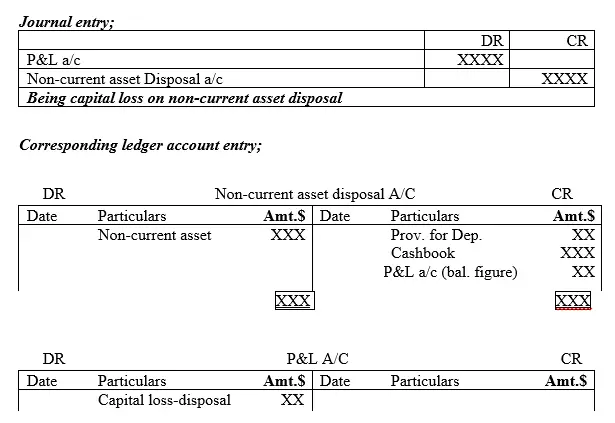

4. On making capital loss on disposal of the non-current asset; close the non-current disposal account to profit and loss account with the amount of capital loss

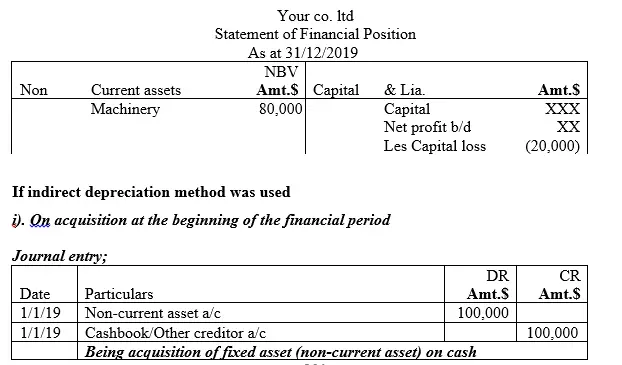

a). Indirect method

The following are the journal/accounting entry steps followed when indirect method of depreciation is used

i). On acquisition at the beginning of the financial period

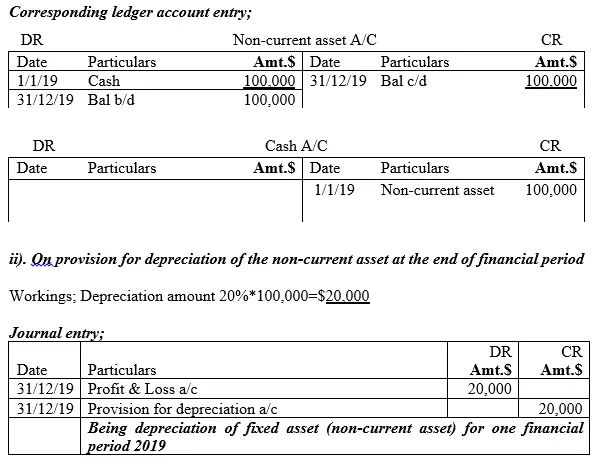

ii).On provision for depreciation of the non-current asset at the end of financial period

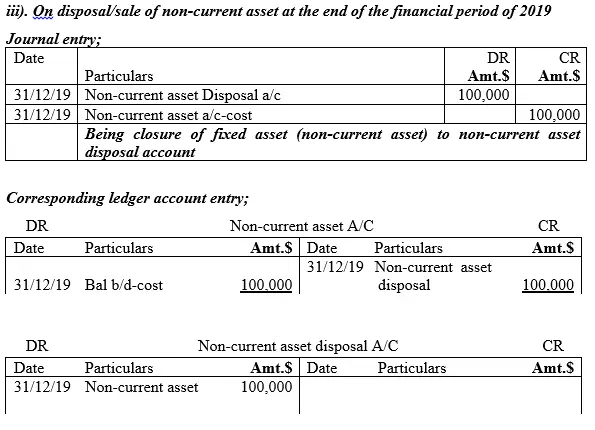

iii). On disposal/sale of non-current asset at the end of the financial period

The entrepreneur need to note the following points;

If a non-current asset is disposed/sold, this business activity calls for determination of whether the asset was disposed at a profit or loss. To achieve this objective, the following entries are made in the books of accounts.

1. Close the non-current asset account to a new account known as non-current asset disposal account which is similar to the normal profit and loss account prepared at the end of the financial period

NB1: The closing figure should be the Net Book Value (NBV) of the fixed asset all the time whether direct or indirect method of depreciation is used or not. Therefore, in the case of indirect method, a further accounting entry is introduced whereby the provision for depreciation is closed to non-current asset disposal account so as to adjust it to reflect the net book value amount which is also referred to as carrying amount.

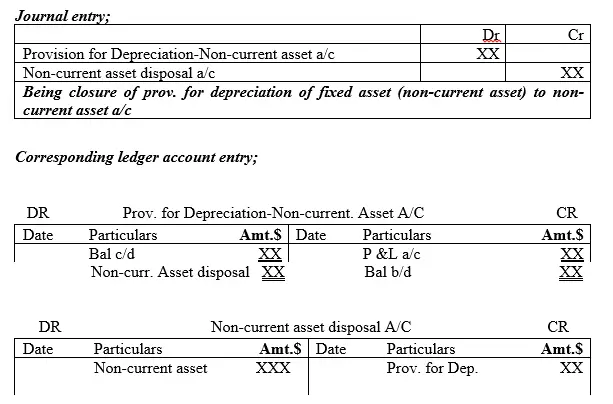

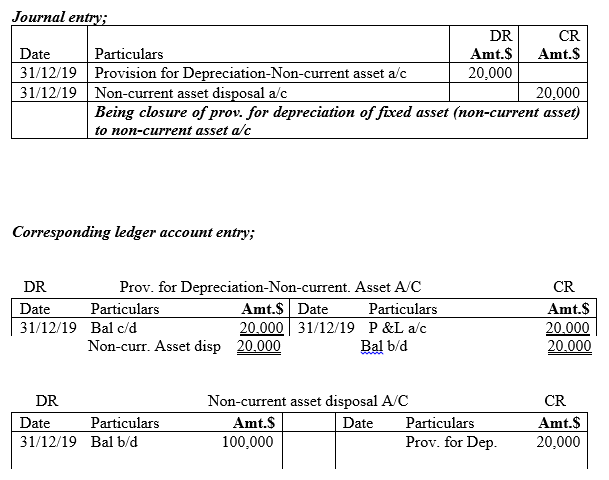

2. Closure of provision for depreciation account to disposal account

NB: In a nutshell, once the provision for depreciation is closed to the non-current asset disposal account (credit entry), then it implies that the disposal account has balance brought down of net book value before actual cash is received.

Here we go;

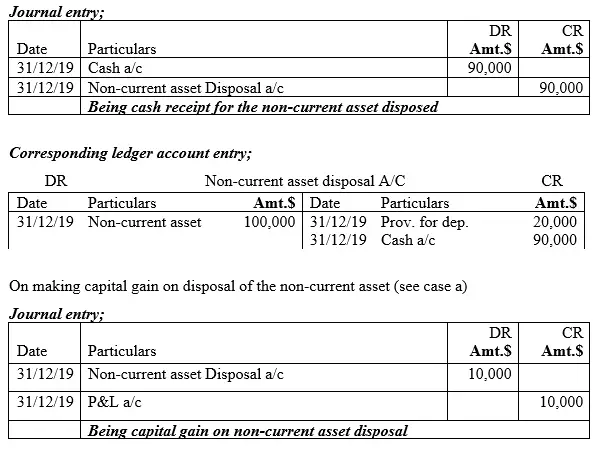

3. If cash is actually received, whether hard cash or check, make the corresponding entries in the non-current asset disposal account and the cashbook which can take the form of either cash account or bank account

4. If the non-current asset was disposed on credit terms, then “other debtors account” will replace cashbook for no immediate cash has been received. The account is treated like any trade debtors account in the statement of financial statement.

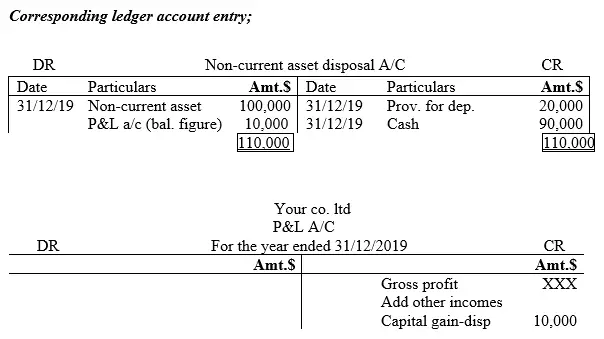

5. On making capital gain on disposal of the non-current asset; close the non-current disposal account to profit and loss account with the amount of capital gain

6. On making capital loss on disposal of the non-current asset; close the non-current disposal account to profit and loss account with the amount of capital loss

ILLUSTRATION ONE

The following information of Your co. ltd was provided to you concerning the transactions that took place in 2019

1st/01/2019 Purchase of Machinery for $100,000

31ST/12/2019 Disposed machinery

a) Made capital gain (received cash $90,000)

b) Made capital loss (ie received cash $60,000)

Assume per annum depreciation was of 20% on cost

Required;

i). Prepare the relevant journals and ledger accounts and record the above transactions for the year 2019 for both case (a) and (b)

ii). Extract statement of financial position as at 31/12/2019 for both case (a) and (b)

Solution

If direct depreciation method was used

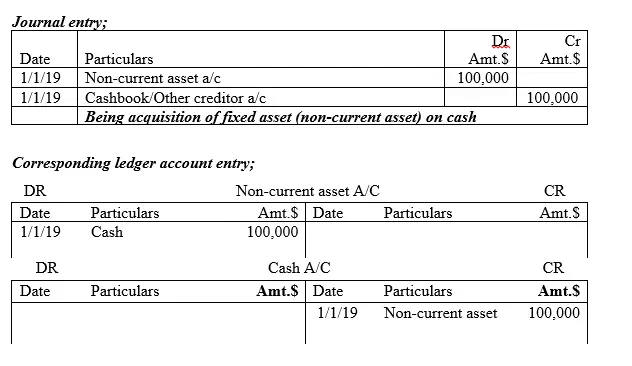

i). On acquisition at the beginning of the financial period

ii). On provision for depreciation of the non-current asset at the end of financial period

Workings; Depreciation amount 20%*100,000=$20,000

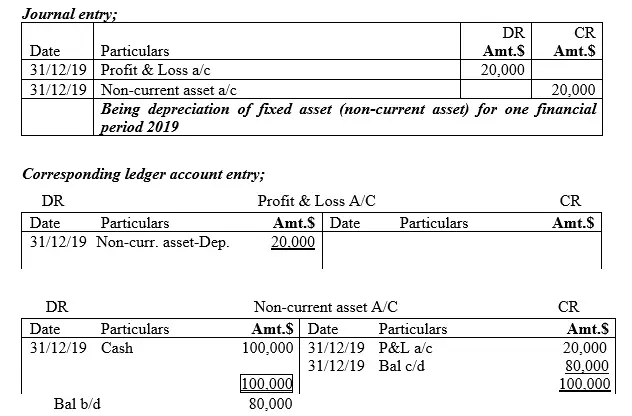

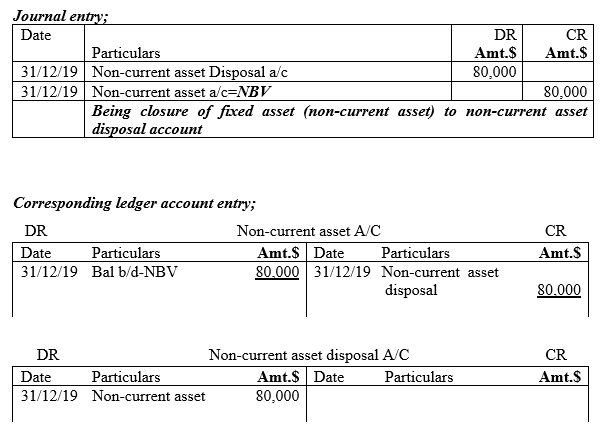

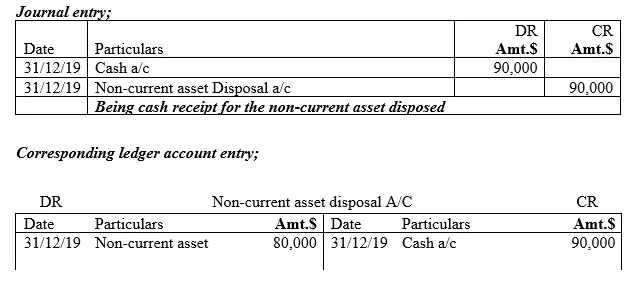

iii). On disposal/sale of non-current asset at the end of the financial period of 2019

NB1: The closing figure should be the Net Book Value (NBV) of the fixed asset all the time whether direct or indirect method of depreciation is used or not. In the case of direct method, it is already in that form (ie NBV)

If cash is actually received, whether hard cash or check, make the corresponding entries in the non-current asset disposal account and the cashbook which can take the form of either cash account or bank account

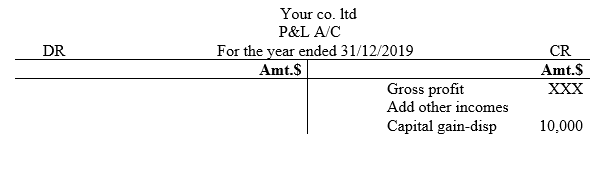

On making capital gain on disposal of the non-current asset (see case a)

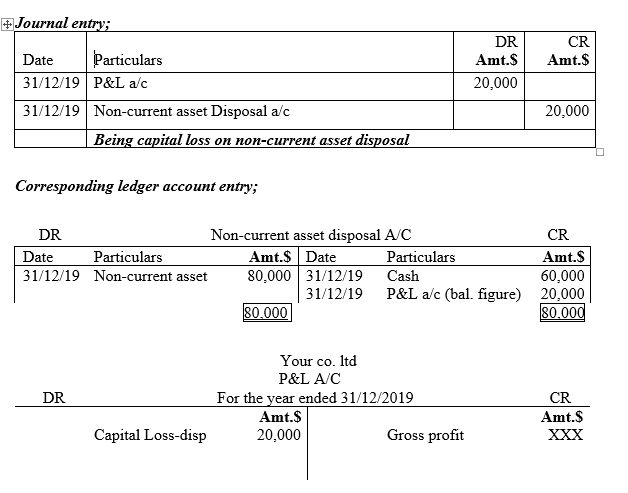

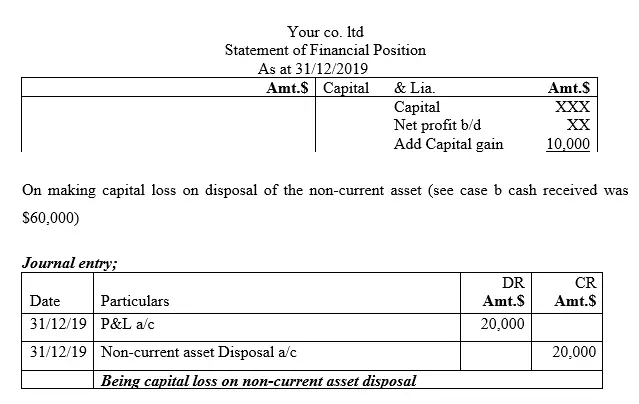

On making capital loss on disposal of the non-current asset (see case b cash received was $60,000)

If cash is actually received, whether hard cash or check, make the corresponding entries in the non-current asset disposal account and the cashbook which can take the form of either cash account or bank account

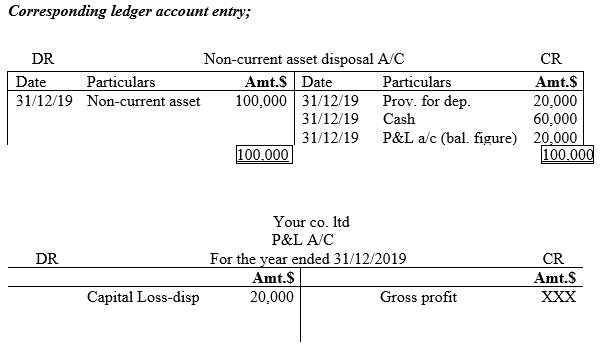

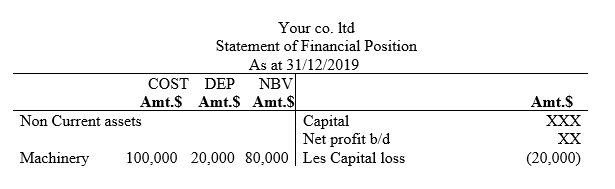

On making capital loss on disposal of the non-current asset (see case b)

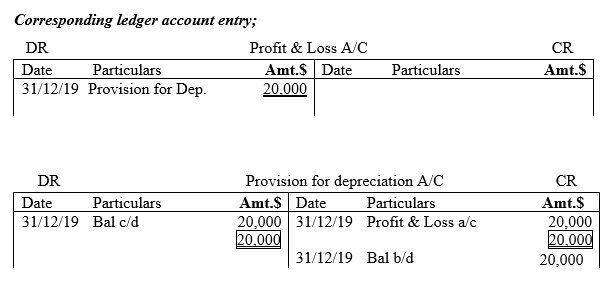

NB1: The closing figure should be the Net Book Value (NBV) of the fixed asset all the time whether direct or indirect method of depreciation is used or not. Therefore, in the case of indirect method, a further accounting entry is introduced whereby the provision for depreciation is closed to non-current asset disposal account so as to adjust it to reflect the net book value amount which is also referred to as carrying amount.

1. Closure of provision for depreciation account to disposal account

NB: In a nutshell, once the provision for depreciation is closed to the non-current asset disposal account (credit entry), then it implies that the disposal account has balance brought down of net book value before actual cash is received. You can see that the net amount of $80,000 (ie 100,000-20,000) of the debit and credit side amounts is the same as the net book value which we got in the case of direct method previously discussed.

So, here we go……

If cash is actually received, whether hard cash or check, make the corresponding entries in the non-current asset disposal account and the cashbook which can take the form of either cash account or bank account

Scenario two; Irregular acquisition and disposal of non-current assets

In scenario one, we considered only one non-current asset acquired and disposed in the beginning and at the end of the financial period correspondingly. This is not realistic for it is not possible to have a case where by the purchase of the non-current asset is so timely to take place on the first day of the beginning of a financial period. Again, an organization does not buy only one non-current asset at a time. On the other hand, it is not easy to dispose the non-current asset at exactly the last date of the year end. Therefore, in scenario two, we will incorporate the aspect of acquisition of several number of these assets at different time periods and similarly, the disposal of some of the assets when the management decide to do so irrespective of the timing.

Therefore, scenario two introduces some complexity in handling depreciation transactions for the number of non-current assets acquired are more than one and again the timing is irregular. Further complexity will arise when business disposes all or some of the non-current assets in the future. To solve this accounting challenge, we incorporate the two types of depreciation policy the commonly applied in accountancy. These are;

i) Ratable depreciation policy

ii) Full year depreciation policy

Ratable Depreciation Policy

The ratable policy advocates determination of depreciation amount on proportional basis such that

i) If non-current asset exists in the business premises for one financial period, then a one year’s depreciation is computed and accounted for in the profit and loss account at the end of the financial period and this is no problem.

ii) On the other hand, if non-current asset exists in the business premises for a shorter period of time, then a fractional or proportional depreciation amount is considered. Such that, if the non-current asset existed in the business for half a year period, then this aspect is incorporated in determining the amount of depreciation to be charged in the profit and loss account at the end of the financial period.

NB: If a non-current asset is purchased on a different date other than 1st day of the month or on 30/31st of the month, then the following assumptions should be made;

1. If acquisition of the non-current asset is done on any date of the month, then that month the asset was purchased forms part of the time duration to be considered for depreciation.

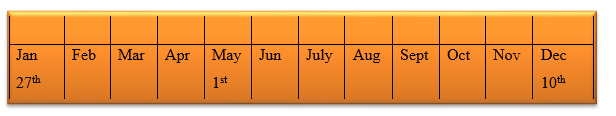

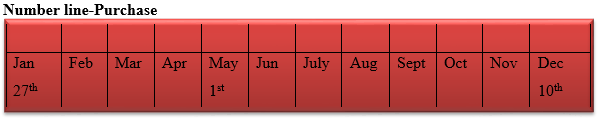

Number line-Purchase

If purchase was done on 27th January, then depreciation will be based on twelve months (ie the whole month of January is inclusive) for it is taken as if non-current asset was purchased on 1st January

If purchase was done on 1st May, then depreciation will be based on eight months (ie the whole month of May is inclusive) for it is taken as if non-current asset was actually purchased on 1st May which is the beginning of the month and that is no problem at all.

If purchase was done on 10th December, then depreciation will be based on one month (ie the whole month of December is inclusive) for it is taken as if non-current asset was purchased in the beginning of the month of December.

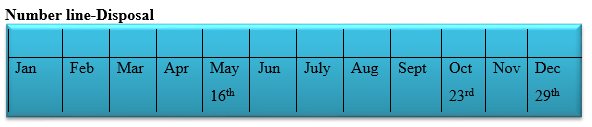

2. If disposal/sale of the non-current asset is done on any date of the month, then that month the asset was disposed is excluded from the time duration to be considered for depreciation.

If disposal was done on 16th May, then depreciation will be based on four months (ie the whole month of May is excluded) for it is taken as if non-current asset was disposed on 30th April.

If disposal was done on 23rd October, then depreciation will be based on nine months (ie the whole month of October is excluded) for it is taken as if non-current asset was disposed on 30th September.

If disposal was done on 29th December, then depreciation will be based on eleven months (ie the whole month of December is excluded) for it is taken as if non-current asset was disposed on 30th November.

Full year Depreciation Policy

Full year depreciation policy advocate that full depreciation should be charged in the year of non-current asset acquisition/purchase and no depreciation is charged in the year of disposal.

If purchase was done on 27th January, then depreciation will be based on twelve months (ie the whole year’s depreciation) for it is taken as if non-current asset was purchased on 1st January

If purchase was done on 1st May, then depreciation will be based on whole year for it is taken as if non-current asset was actually purchased in the beginning of the year.

If purchase was done on 10th December, then depreciation will be based on the whole year for it is taken as if non-current asset was purchased in the beginning of the year.

If disposal was done on 16th May, then the whole year when disposal took placed is ignored and therefore we only consider depreciation for the previous periods up to the end of the year which has just ended.

If disposal was done on 23rd October, then the whole year when disposal took placed is ignored and therefore we only consider depreciation for the previous periods up to the end of the year which has just ended.

If disposal was done on 29th December, then the whole year when disposal took placed is ignored and therefore we only consider depreciation for the previous periods up to the end of the year which has just ended.

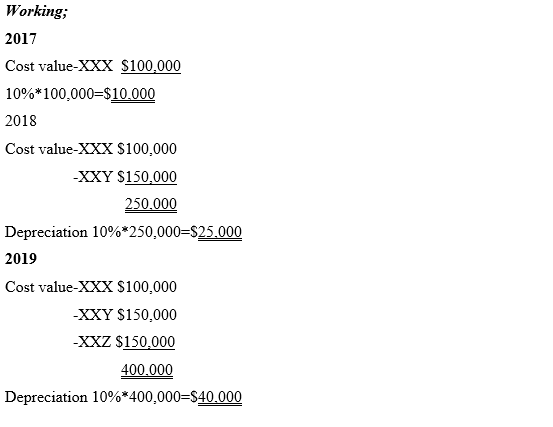

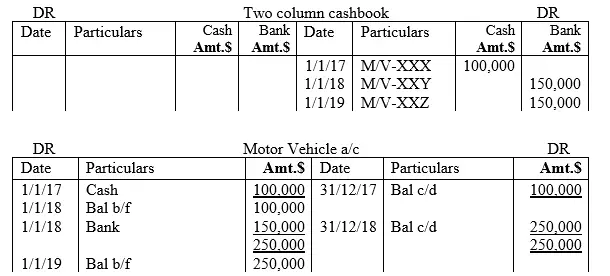

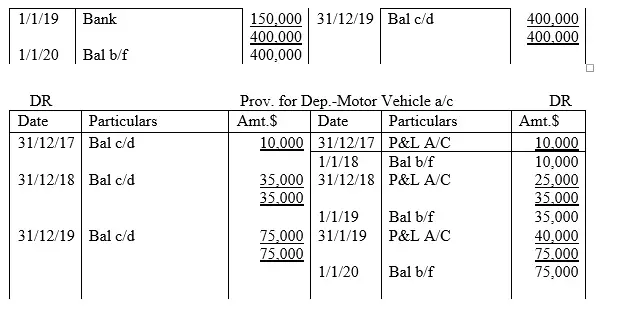

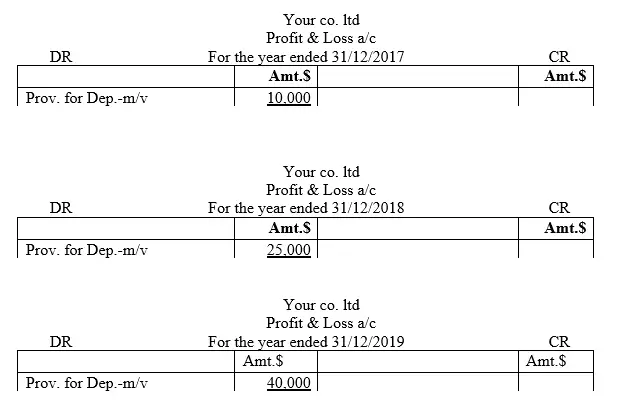

ILLUSTRATION ONE

The following information was extracted from the books of accounts of Your co. ltd

1st/1/2017 Purchased motor vehicle registration number-XXX on cash $100,000

1st/1/2018 Purchased motor vehicle registration number-XXY by check $150,000

1st/7/2019 Purchased motor vehicle registration number-XXZ by check $150,000

Note that depreciation policy is 10% per annum at cost

Required;

i) Record the transactions above in the respective ledger accounts for the year, 2017, 2018 and 2019

ii) Extract statement of financial period for 2017, 2018 and 2019

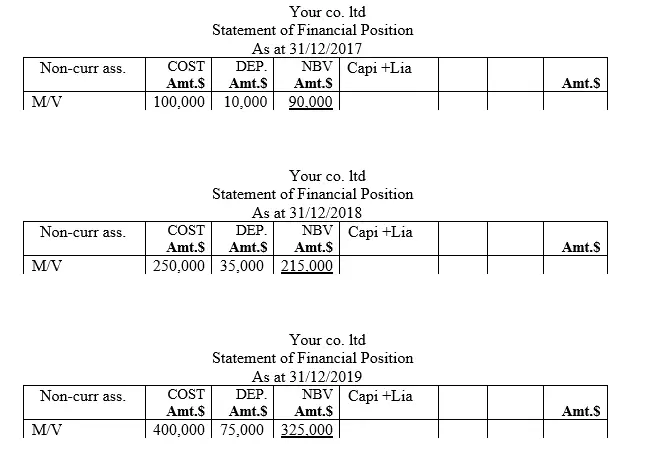

Solution

COMMENT

In the case of the previous illustration one, all the transactions were of purchase/acquisition nature and where initiated in the beginning of a particular financial period. Again, there was no in between or intermediate purchases or disposals hence it was a simple case to understand. In the next illustrations that follow, we will assume some of the facts of illustration one and also consider cases of additional purchases and disposals of the non-current assets thereof. The entrepreneur/learner should also note that the two policies discussed earlier will apply, either one or both.

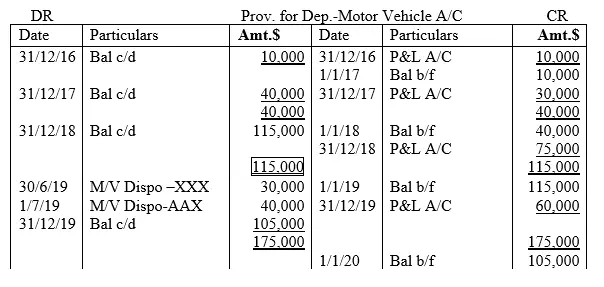

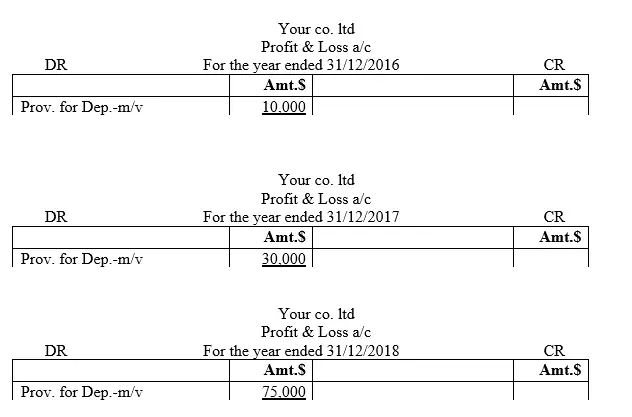

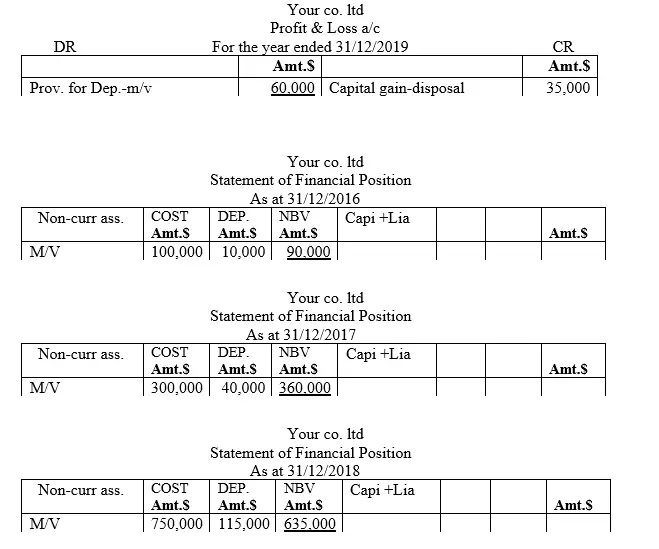

ILLUSTRATION TWO

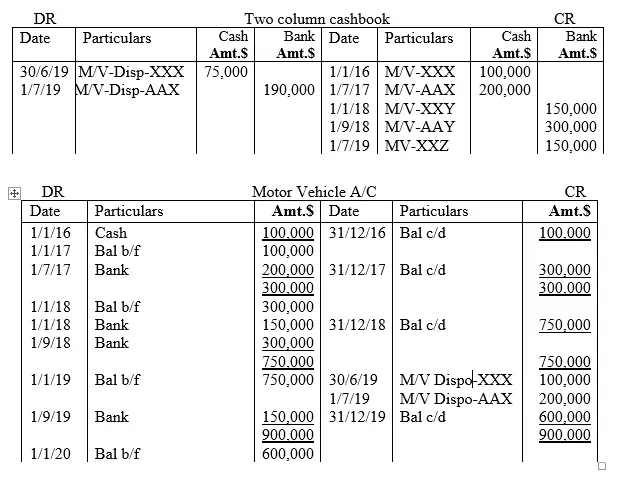

The following information was extracted from the books of accounts of Your co. ltd

1st/1/2016 Purchased motor vehicle registration number-XXX on cash $100,000

1/7/2017 Purchased motor vehicle registration number-AAX on cash $200,000

1st/1/2018 Purchased motor vehicle registration number-XXY by check $150,000

1/9/2018 Purchased motor vehicle registration number-AAY by check $300,000

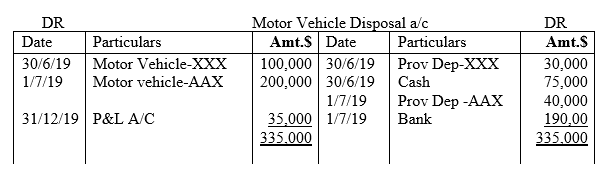

30/6/2019 motor vehicle registration number-XXX was disposed for $75,000 on cash

1st/7/2019 Purchased motor vehicle registration number-XXZ by check $150,000

1st/7/2019 motor vehicle registration number-AAX was disposed by check $190,000

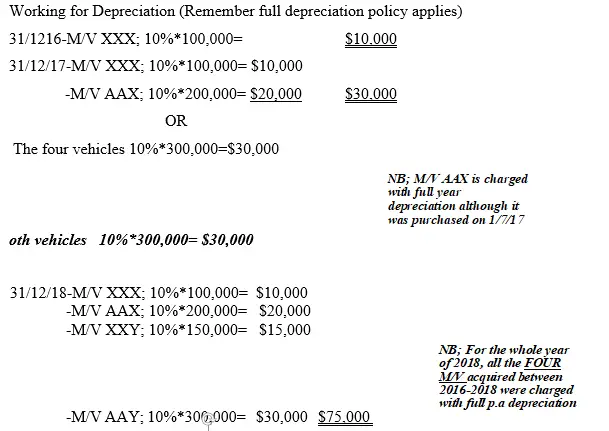

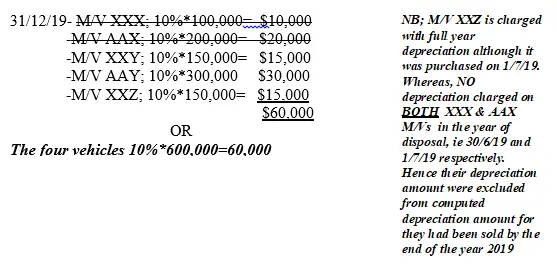

Note that full depreciation policy applies and depreciation amount is 10% per annum at cost

Required;

i) Record the transactions above in the respective ledger accounts for the year, 2016, 2017, and 2018

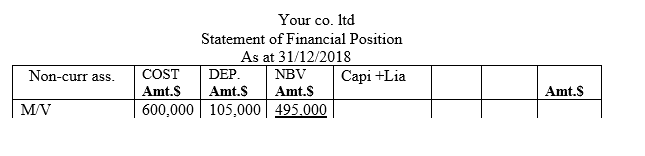

ii) Extract statement of financial period for 2017, 2018 and 2019

Solution

ACCOUNTING ENTRIES

NB: Remember that, when a non-current asset is disposed/sold, we knock out its original cost value from the non-current asset account, if the non-current asset account was maintained at cost. Similarly, if the account of non-current asset had been kept at Net Book Value (NBV), it is the net amount that is closed down to non-current asset disposal account.

NB: From the provision for depreciation account, we knock out the accumulated depreciation amount so far, for that particular non-current asset that has been disposed. The amount of accumulated depreciation for the disposed non-current asset is determined by the depreciation policy applied.

NB: Remember that according to full depreciation policy, we ignore depreciation element in the year when the non-current asset was disposed. In this case motor vehicle-XXX existed in the business premises for six (6) months but the associated economic loss through depreciation was assumed not to have occurred. On the same note, motor vehicle-AAX existed in the business premises for six (6) months but the associated economic loss through depreciation was assumed not to have occurred.

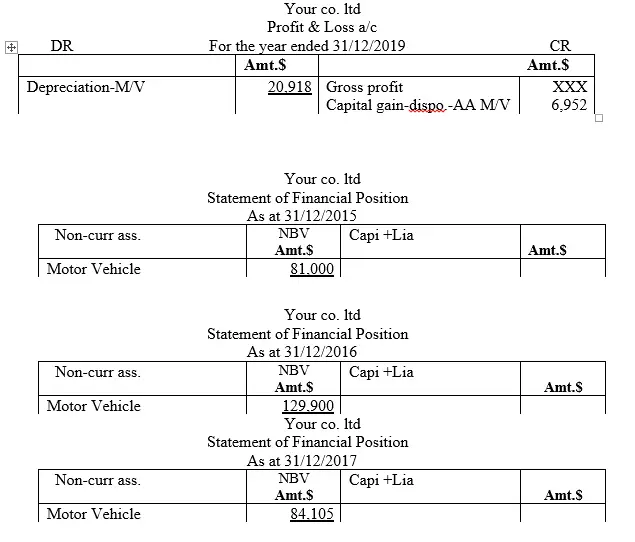

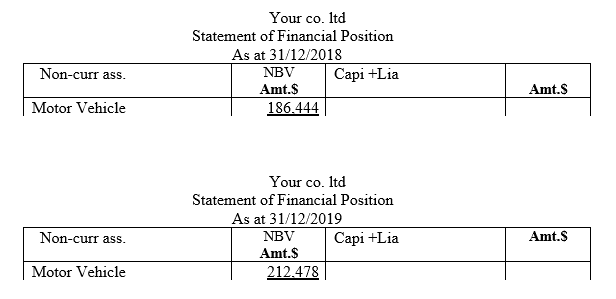

ILLUSTRATION THREE

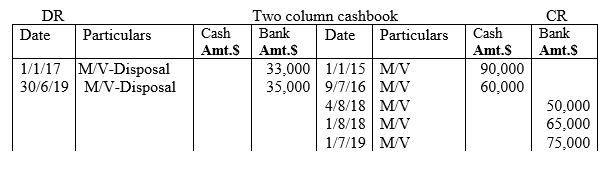

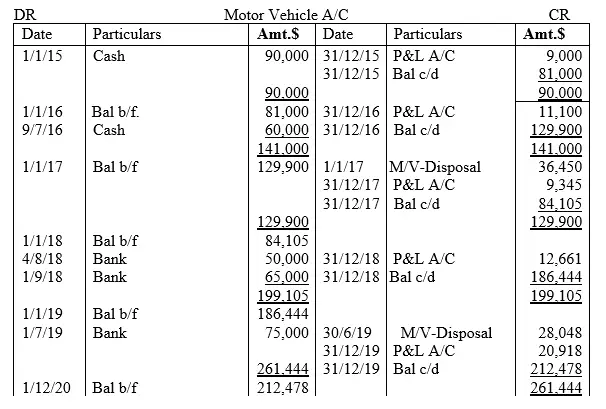

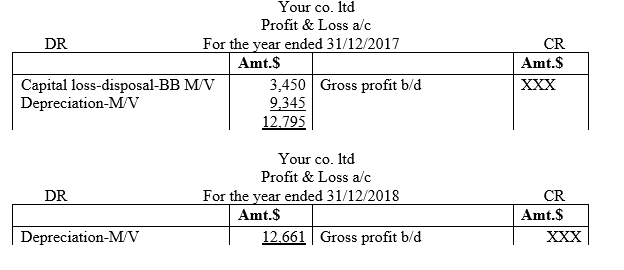

The following information was extracted from the books of accounts of Your co. ltd

1st/1/2015 Purchased TWO motor vehicles registration number-AA and BB on cash at $45,000 each

9th/7/2016 Purchased a motor vehicle registration number-CC on cash $60,000

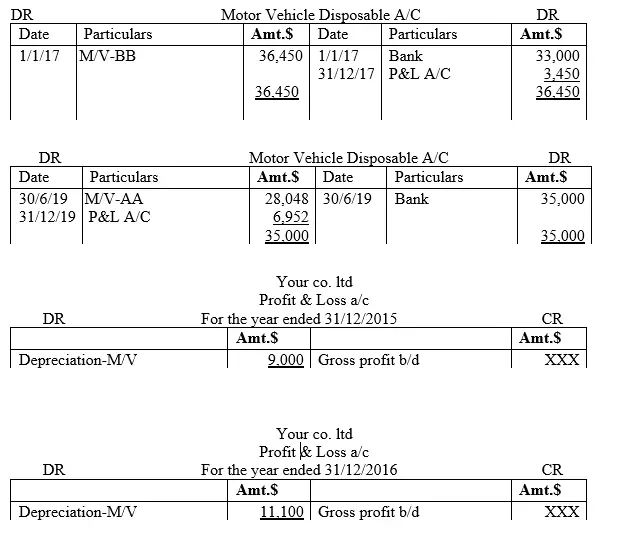

1st/1/2017 disposed motor vehicle registration number-BB and received a check of $33,000

4th/8/2018 Purchased motor vehicle registration number-DD by check $50,000

1/9/2018 Purchased motor vehicle registration number-EE by check $65,000

30/6/2019 motor vehicle registration number-AA was disposed for $35,000 by check

1st/7/2019 Purchased motor vehicle registration number-FF by check $75,000

Note that ratable depreciation policy applies and depreciation amount is 10% per annum on reducing balance method

Required;

i) Record the transactions above in the respective ledger accounts for the year, 2015, 2016, 2017, 2018 and 2019

ii) Extract statement of financial period for 2015, 2016, 2017, 2018 and 2019

Solution

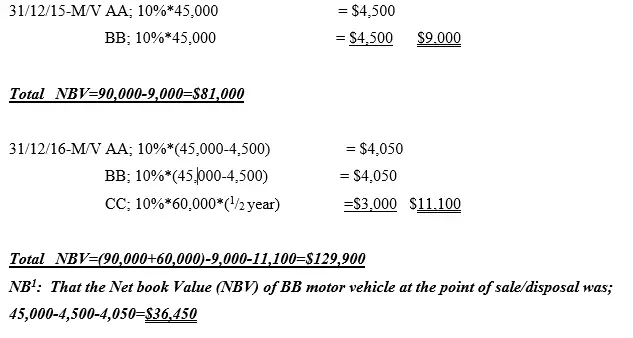

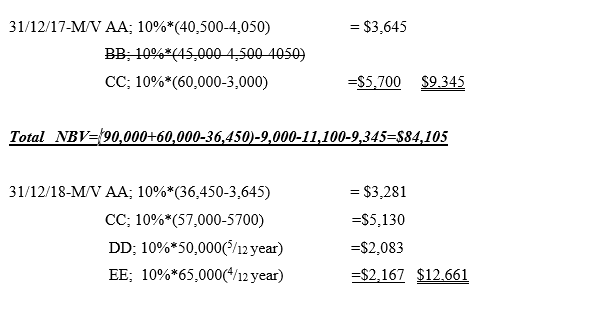

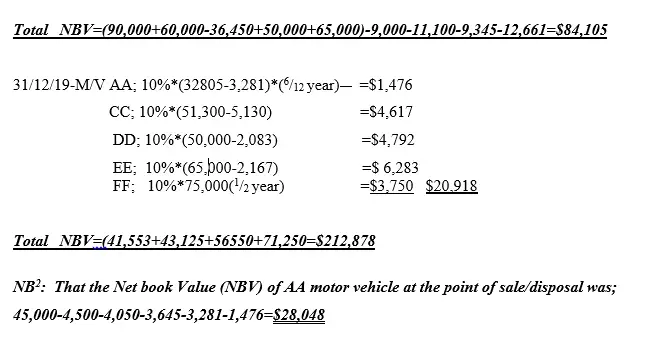

Working for Depreciation (Remember Rateable depreciation policy applies)

The entrepreneur/learner should also note that BB motor vehicle is no longer in the business premises so it is missing in the next computation for depreciation in 2017 and beyond

The entrepreneur/learner should also note that AA motor vehicle is no longer in the business premises from 1/7/2019 so it is missing in the next computation for depreciation of half year period of 2019 and beyond

ACCOUNTING ENTRIES

NB: The learner need to note that determination of capital gain or loss on disposal of non-current asset involves getting the difference between the Net Book Value (NBV) and the sales proceeds. That is;

Capital gain/loss=NBV-Sales proceeds. Therefore, whether the accounting system maintains non-current asset at cost or at net book value, the aspect of NBV-Cash proceeds should be factored in.