Change in depreciation policy

The policy behind any method of depreciation embraced by an organization is determined by the policy adopted by the management. Therefore, there is no law as to which method of determining depreciation used unless it has to do with matters of tax law. This implies that the matters of determining the depreciation method is subjective to the management. This is because the method adopted by the business is based on the pattern in which the future economic benefits of the non-current asset is expected to be consumed. Whichever method of depreciation to be adopted, the entrepreneur/learner should ensure that the net book value (also referred to as carrying amount) should fairly reflect the remaining equivalent economic benefits to be derived from the non-current asset.

Consistency Convention and Change in Depreciation Policy

Issues pertaining change of any accounting policy are governed by the accounting convention referred to as consistency and it states that; accounting practices should not change or must remain unchanged over a period of several years. That is, if a transaction is classified as a fixed asset in the current period, it should not be treated as current asset in the next period. Also, if a firm adopt one method of computing depreciation, a different approach will not be considered in the proceeding financial period(s).

However, this does not mean that a firm cannot change the policy. Hence, depreciation policy can be altered. For instance, a firm may have used straight line approach in computing depreciation for the last four or five years then after a while can change to reducing approach or any other methodology. Therefore, although firms may be operating in the same industry, they may adopt diverse methods of computing depreciation. This implies that even if their gross profit/loss is the same, then their net profit or loss will vary substantially.

Accounting Treatment of Change in Depreciation Policy

When depreciation policy change, there are accounting implications. Therefore, the entrepreneur/learner need to incorporate this changes in the book of accounts. The common practice in accountancy is that the Net book Value (NBV) brought forward from the previous financial period is maintained as we cross over to the new financial period characterized by the new depreciation policy to be used. That is, if the NBV of the non-current asset in the previous period was let say $145,000, then the same amount will be considered as the opening NBV balance brought forward to be subjected to the new depreciation policy. This implies that we cannot overhaul all the previous entries for depreciation made before the new change.

Therefore, the remaining depreciable amount is subjected to the new depreciation rate and also life span which may have changed. The following brief illustration will guide you to understand this concept better.

ILLUSTRATION ONE

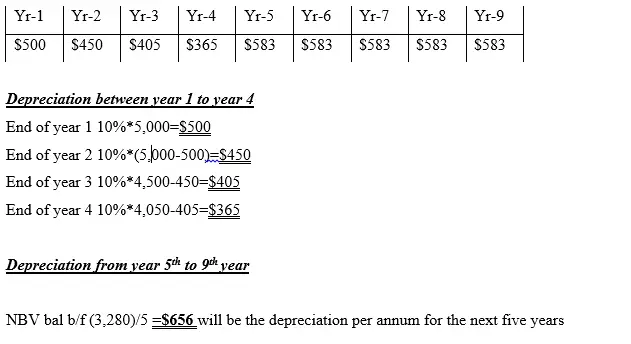

Your co. ltd purchased a machine of $5,000 on cash and it was depreciated at a rate of 10% per annum on reducing approach. However, after four years, the accountant realized that straight line method was more appropriate for it reflected the exact carrying amount of economic benefits of the non-current asset for a period of the next five (5) years.

Required;

Compute the per annum depreciation amount per annum for the next five (5) years.

Solution

Number line