Comprehensive Income Statement

Comprehensive income statement was previously referred to trading and profit and loss account before IAS was revised to IFRS and is composed of two distinct aspects, namely; incomes and expenses as stated earlier in level two of this accounting tutorials. The two items are further classified to trading and operational income and expense respectively. In this lesson we will focus on the accounting treatment of each component of comprehensive income statement before culminating to the preparation of the final accounts.

Trading Income

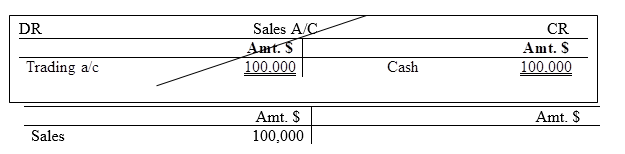

In level two, we concluded that the intention of business promoter is to generate income out of the ordinary business activities as governed by the objective clause of memorandum of association. Such income is referred to as trading income. When this income is earned or cash is received, a sales account is created as shown herein;

If goods sold in the course of the financial period were for lets say $100,000 in cash or otherwise, accounts prepared are;

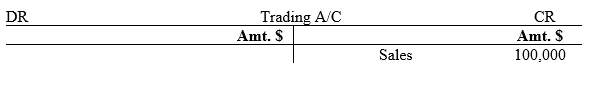

At the end of financial year, the sales account is closed down to trading account as shown herein. Therefore, trading account is correspondingly opened.

Trading Expenses

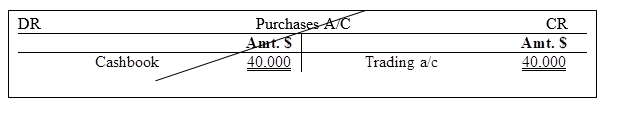

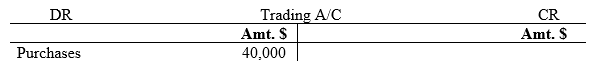

If goods purchased in the course of the financial period were for $40,000 in cash or otherwise, accounts prepared are;

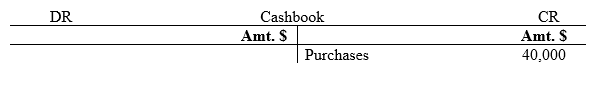

At the end of financial year, the purchases account is closed down to trading account as shown herein. Therefore, trading account is correspondingly opened.

Opening Inventory

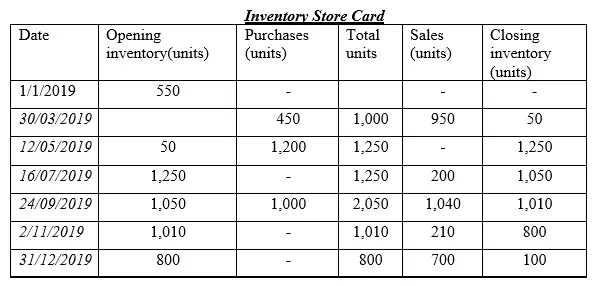

Opening inventory in the beginning of every financial period is usually the same as the closing inventory of the previous financial period, whether of raw materials, WIP or finished goods. Also remember that the determination of its monetary value is through inventory valuation process whereby IAS-2 and FIFO method applies. In the previous discussion, we concluded that the value is on the basis of cost or net realizable market price, whichever is lower. Now, in case of opening inventory, the assumption is that it will be sold before newly purchased goods are sold to the market. Since this item is a current asset of the organization for it will be sold in the current financial period, it is recorded in the inventory store card as the available inventory in the beginning of the period for in Accountancy, we do not open an inventory account as it is with other ledger account items.

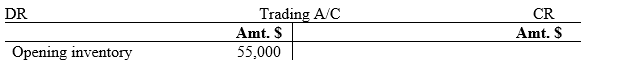

At the beginning of the financial period, the amount representing opening inventory is closed down to the debit side of the trading account. You see, the essence of doing so is to sum up/add the purchases of the year and the opening inventory for it is assumed that (using FIFO approach) the opening inventory will be sold in the current financial period before we start selling the purchases acquired in the current financial period. This aspect is well demonstrated as follows;

NB: If the market and the corresponding cost value of the opening inventory (ie for 550 units) is $66,000 and $55,000, then, post the item to the debit side of trading account as the opening inventory at the end of the financial period of 31/12/2019

Argument;

Since the cost value is lower than the market value of the opening inventory, then the cost value is considered for it is lower than the market value according to IAS-2. Therefore, you debit 55,000 in the trading account as follows;

Closing Inventory

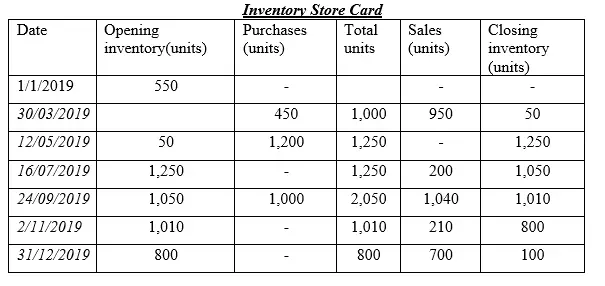

Closing inventory at the end of every financial period becomes the opening inventory in the proceeding financial period be it of raw materials, WIP or finished goods. As discussed earlier the determination of its monetary value is through inventory valuation process whereby IAS-2 and FIFO method applies. That is, the value is on the basis of cost or net realizable market price, whichever is lower.

Now, in the case of closing inventory, the assumption is that it is the unsold units of the newly purchased goods. Since this item is a current asset of the organization although it will be sold in the next financial period, it is recorded in the inventory store card as the available inventory at the end of the financial period for in Accountancy we don’t keep inventory account.

Note that closing inventory is a current asset, it is recorded in the statement of financial position at the end of the financial period but it is excluded in the trading account for it does not form part of the goods purchased and sold in that current period of time. Therefore, it appears as a footnote in the trial balance as additional information and also excluded in the trading account. So it is credited in the trading account. To demonstrate this fact, let us use the same inventory store card in the case of opening inventory as shown below;

NB: If the market and the corresponding cost value of the closing inventory (ie 100 units) is $12,000 and $10,000, then, post the item to the credit side of trading account as the closing inventory at the end of the financial period of 31/12/2019

Argument;

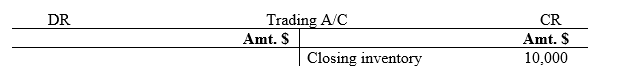

Since the cost value is lower than the market value of the closing inventory, then the cost value is considered for it is lower than the market value according to IAS-2. Therefore, you credit $10,000 in the trading account as follows;

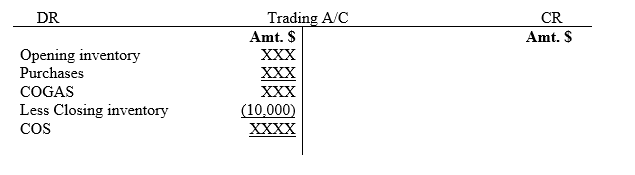

At the end of the financial period, the amount representing closing inventory is closed down to the credit side of the trading account. You see, the essence of doing so is to deduct the unsold purchases of the year for it is assumed that (using FIFO approach) sales made in the current financial period comprised some of the purchases of the year. The common practice in Accountancy is that closing inventory is directly deducted from the trading account which is as good as crediting the same amount in the trading account. So the above trading account entry can be re-written as follows;

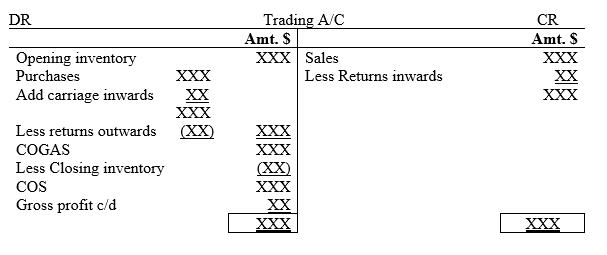

In Summary;

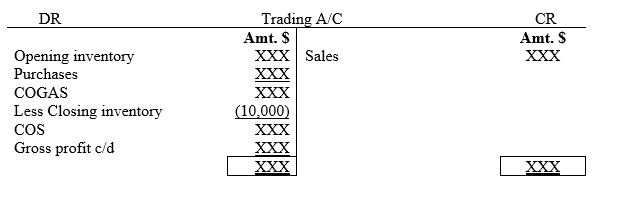

If we prepare trading account separately to determine the gross profit/loss, the format will be as follows

But the above case is idealistic and not reasonable for it is not practical to purchase all goods without cases of additional cost being incurred to transport the goods from the seller’s destination to the buyer’s locality and again cases of discrepancies which result to some goods being returned to the seller or from the customer to the business in that order. Therefore the aspect of carriage inwards, returns inwards and outwards in that manner are common and need to be incorporated in this discussion. The accounting treatment of these aspects are briefly discussed below as follows;

Carriage Inwards

Carriage inwards is also referred to as transport expense on purchases and it is classified as trading expense. Many entrepreneurs/learners categorize this expense as an operating expense which is not in order.

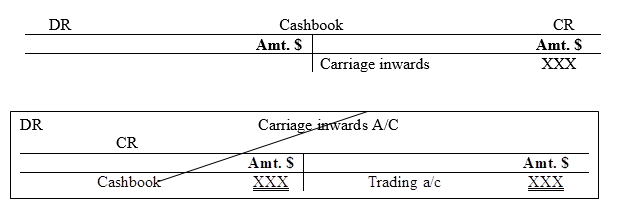

Carriage inwards is an additional expense paid on top of purchases cost. Remember that, for the sake of setting the selling price of the goods purchased, there is need of incorporating that transport so as to establish the aggregate cost related to purchases. If the aspect of carriage inwards is ignored by the trader, then selling price set will not cover all the average cost associated with purchases and chances of making losses are high. As a result, carriage inwards is added to the purchases cost. To achieve this objective, the entrepreneur combines purchases cost with carriage inwards expense by simply debiting the trading account with carriage inward expense. How does he/she go about this? When the carriage inwards expense is paid whether in cash or check,

DR Carriage inwards a/c XXX

CR Cash/Bank a/c XXX

This is done as follows;

At the end of the financial period, carriage inwards account is concurrently closed down to trading account as afore indicated above.

Returns Inwards

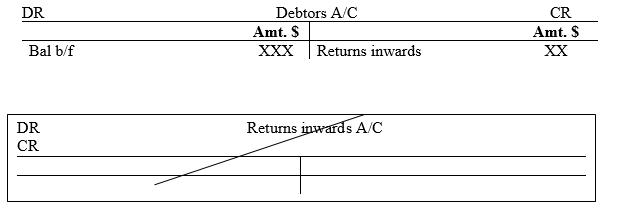

These are goods returned by the customer in to the business. The entrepreneur/learner need to consider the directional movement of the goods. They are from the customer back to the organization’s destination. Hence the term returns inwards for the goods flow back in to the business whose accounts are our concern. Once these goods are returned, we

DR Returns inwards a/c

CR Debtors a/c

This is done as follows

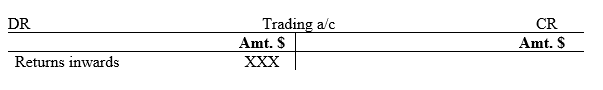

At the end of the financial period, return inwards account is concurrently closed down to trading account as afore indicated above.

The common practice in Accountancy is that returns inwards is directly deducted from the sales which is as good as debiting the same amount in the trading account. So the above trading account entry can be re-written as follows;

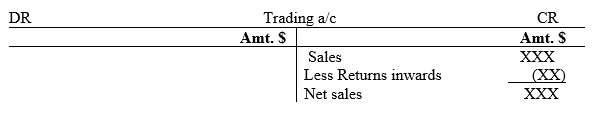

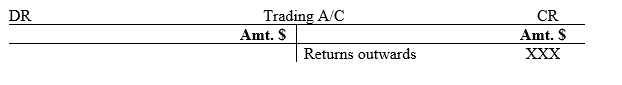

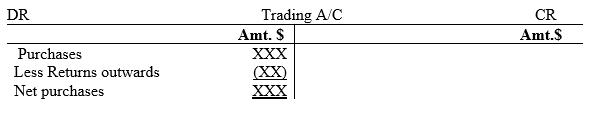

Returns Outwards

These are goods returned by the business in question to the supplier. The entrepreneur/learner need to consider the directional movement of the goods. The goods are from the business back to the supplier’s destination. Hence the term returns outwards for the goods flow back in to the supplier. Once these goods are returned, we

DR Creditor a/c

CR Returns outwards a/c

This is done as follows

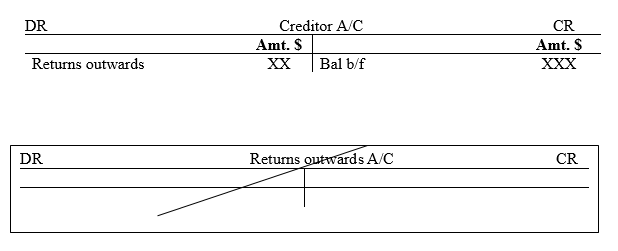

At the end of the financial period, return outwards account is concurrently closed down to trading account as afore indicated above.

The common practice in Accountancy is that returns outwards is directly deducted from the purchases which is as good as debiting the same amount in the trading account. So the above trading account entry can be re-written as follows;

So in summary, if we incorporate those aspects aforementioned, the trading account format will be as follows;

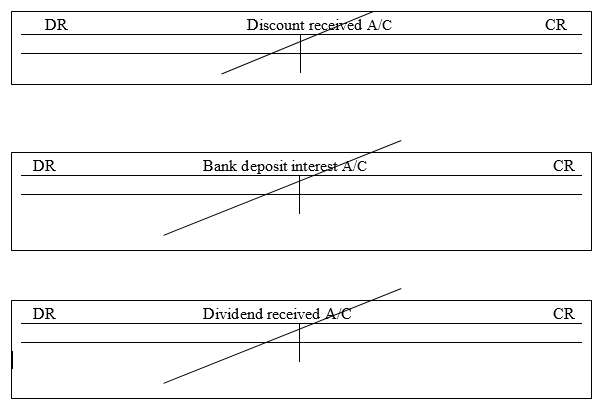

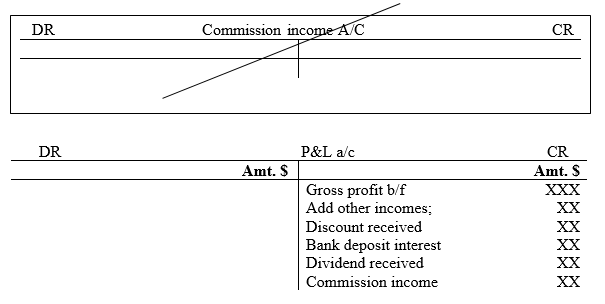

Operating Income

As discussed in level two of this accounting tutorial series, operating income are incidental income that is generated by the organization over and above the trading income/returns gotten from the normal/ordinary activities. Some of those incomes may include bank deposit interest, agency commissions, dividends from investment, interest from fixed securities such as bonds, debentures etc, discount received, rent income and so on. At the end of the financial period such items are closed down to profit and loss account as follows;

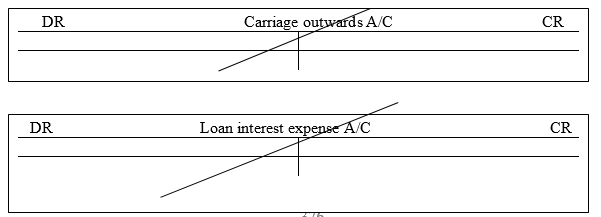

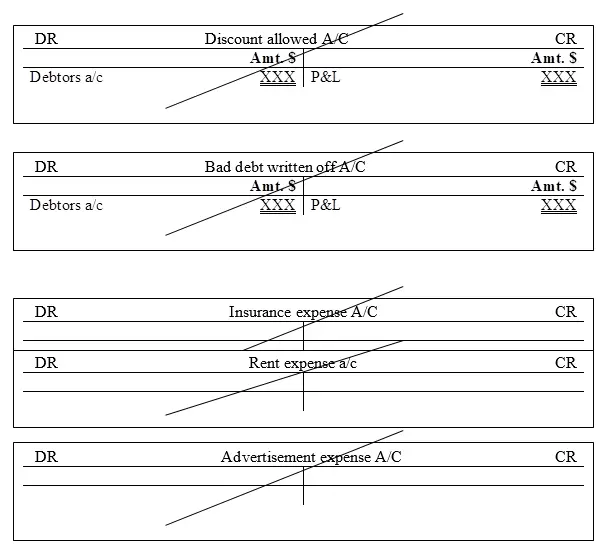

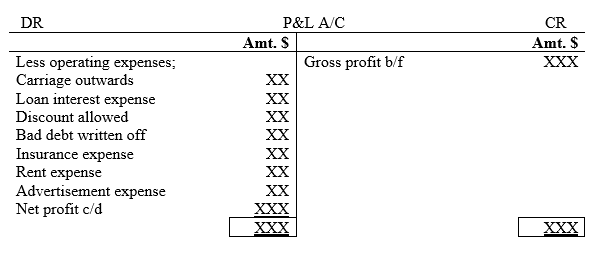

Operating Expense

Also, as discussed in level two of this accounting tutorial series, operating expenses are incidental expenses that is incurred or paid by the organization over and above the trading expenses incurred/paid as a result of undertaking the normal/ordinary activities of the organization. Some of those operating expenses may include carriage outwards, loan interest, discount allowed, bad debts written off, insurance expense, rent expense, advertisement expense etc. At the end of the financial period such items are closed down to profit and loss account as follows;

In conclusion

The preparation of comprehensive income statement has nothing to do with just listing income and expense related items in that order in the profit and loss account as many learners do but it involves application of double entry principle where all the components of both trading and profit and loss account are closed down to the respective financial statement. Therefore, as we prepare comprehensive income statement, we should note that double entry principle should be adhered to.