Creditors’ Control Account

As stated earlier, when a business expand, similarly the number of trade creditors also increase hence it necessitates the preparation of corresponding creditors’ control accounts. This type of account is within the general/master ledger or book that shows the sum or the total transactions associated to creditors. According to IFRS, It is also referred to as accounts payable control accounts. This is the term we will adopt instead of the conventional one.

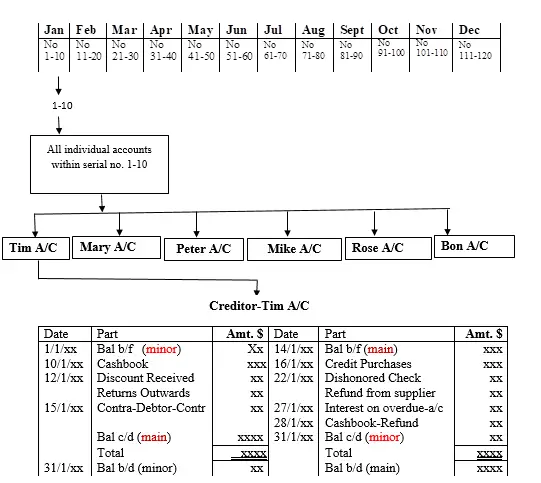

Just as it is in the case of debtor/receivable control accounts, the daily transactions related to creditor/payable control are treated in the same manner. Therefore, before we look at the preparation of an account payable control account, the following number line has been used to demonstrate the creditor transaction scenario that necessitates preparation of the corresponding control account.

Notes

For each month of the year, various transactions related to all trade creditors take place on a daily basis. The transactions are recorded in the respective individual creditor’s account on daily basis by the accounts clerk or the accounting officer responsible for that assignment. For instance, the creditor Tim account is one of the creditors in the current financial period indicated above which range between January to December. At the end of each month, balances brought down (ie bal. b/d) are extracted. The entrepreneur/learner need to note that the closing balance brought down for each individual creditor become the opening balance brought down in the following month before more transactions are recorded for the proceeding month. This procedure continues for all the twelve months for each individual creditor account.

Administratively, organizations normally create partitions or subdivisions in their accounting/finance department commonly referred to as accounts receivable and payable sections. In the payable section, several accounting officers are assigned, the clerical work of managing the specific payable accounts whereby all transactions related to those accounts in that particular category are in their control. At the end of each month, balances brought down are extracted.

The number line represent the twelve months of the calendar year, whereby for each month, there may be hundreds or thousands of each category of the creditors. In this case there are 1-120 categories based on the serial order starting with the lowest serial range of 1-10 up to the last one of 111-120.

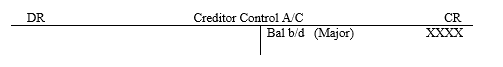

Preparation of Payable Control Account

The same steps followed during the preparation of receivable control account is used in this case. The only difference between the two types of control accounts is the nature of transactions which take place for payable control accounts.

Transactions affecting Creditors’/Payable Control Account

The transactions that affect this type of control account is similar to the ones affecting trade creditor account as we have already discussed in the previous lessons in level one and two of this accounting tutorial series. In this lesson we will consider a further explanation of the same specific transactions and how to adjust the payable control account to determine the correct value thereof. In addition, we will incorporate other transactions that we did not focus on in the previous discussions. To accomplish this task, journal entries will be used.

-

Credit purchases; this are purchases made by the business of our concern from a supplier or several suppliers whereby payment of cash, whether on cash or through the bank is at a later date. The goods or services are purchased/provided immediately, but the cash is paid after either one week , or one month, or two or three months or a period more than this depending on the credit terms agreed upon. Purchase of goods on credit increases the organization’s creditor/payable control account monetary value. Credit purchases form part of main credit balance brought down (ie bal. b/d) in the creditor/payable control account if the debt is not yet paid by the business at the end of the financial period as follows;

If the business is newly formed and has made credit purchases from various suppliers, then the journal entries will be as follows;

Journal Entry;

Dr Purchases A/C XX

Cr Accounts Payable Control A/C XX

-

Discount Received; this is financial relief extended to the business of our concern by suppliers to prompt quick payment of the debt. As a result, the business receiving such allowances enjoy financial benefits/gain which decrease the creditors’ monetary value.

Journal Entry;

Dr Accounts Payable Control A/C XX

Cr Discount Received A/C XX

-

Returns Outwards; this are goods returned to the supplier(s) by the business. They result to reduction of the total amount of cash to be paid to the suppliers.

Journal Entry;

Dr Accounts Payable Control A/C XX

Cr Returns Inwards A/C XX

-

Customer Refund; the business of our concern may be faced with a scenario whereby some of its creditor accounts have debit balances brought down (ie minor balance brought down-bal. b/d). This may be due to either;

1. Goods returned by the business to the suppliers (ie returns outwards) were not adjusted in the respective creditor’s account or

2. The business of our concern paid the supplier(s) excess cash.

Scenario one;

If the business of our concern here has not been refunded the excess cash reflected in his/her creditor account by the time books of accounts are prepared (especially at the end of the year), then a debit balance brought down (ie minor bal b/d) will appear on the creditor’s account (payable control account).

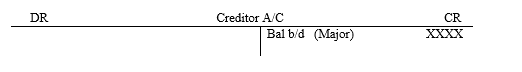

NB: the creditor account will be as shown below;

The same balances are posted to the corresponding payable control account at the end of the financial year.

Scenario two;

If the business is refunded the cash by the supplier(s) before the end of the financial period, then the journal entry will be as follows;

Journal Entry;

Dr Cashbook XX

Cr Accounts Payable Control A/C-Refund XX

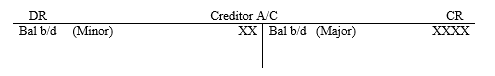

NB1: the creditor account will be as shown below;

NB2: In scenario two, there will be no minor debit balance brought down. It will be eliminated (set-off) by the refund amount credited in the payable control account if it has an equivalent monetary value. Otherwise if the business is refunded an amount which is not equal to the total minor debit balance brought down, there will still be some minor balance indicated in the control account.

-

Cash Payment to Suppliers; when the business pay its dues, whether in cash or using check or other mode of payment, this results to reduction of the creditor’s monetary value and the accounting entry will be;

Journal Entry;

Dr Accounts Payable Control A/C XX

Cr Cashbook XX

-

Dishonored Checks from the Supplier; sometimes cash paid to the suppliers may be in form of check which when presented at the supplier’s bank is declined due to some discrepancies such as shortage of cash in the supplier’s account or wrongly written check. This implies that the deduction that was made by the business in the respective creditor account need to be reverted. Therefore, the entry is as follows;

Journal Entry;

Dr Cashbook XX

Cr Accounts Payable Control A/C XX

Narration-creditor/payable control account is charged (ie credited) with the same amount earlier on debited to the respective creditor a/c.

-

Interest Charged by Supplier on Overdue Accounts; occurs when the business has an overdue account balances and not yet paid at the end of the financial period. In such circumstance, the supplier charges some fee based on the provisions given. This results to increase of the amount of monetary value of the creditor to be paid. Hence the entry will be as follows.

Journal Entry;

Dr Interest on overdue accounts (income) A/C XX

Cr Accounts Payable Control A/C XX

-

Contra Entry Transactions; this is an inter-transfer that take place between the business and the suppliers such that the former who is a customer is also at the same time a supplier. Such inter-account settlements are solved by setting off the accounts affected. The accounting entry is as follows;

Journal Entry;

Dr Accounts Payable Control A/C XX

Cr Purchases Control A/C XX

General Notes

The entrepreneur/learner need to consider the following points when preparing the control accounts;

-

All cash sales or cash purchases should not be included in the respective control accounts.

-

Trade discounts are not part of control accounts hence should be ignored.

-

Although interest due on either debtor or creditor control account is considered when preparing the corresponding control accounts, it is ignored when determining total sales or total purchases in the case of incomplete records