Debtors’ Control Account

When a business grows and the number of debtors become numerous, it becomes necessary to create corresponding debtors’ control accounts. Debtors’ control account is an account within the general/master ledger that shows the sum or the total transactions associated to debtors. According to IFRS, It is also referred to as accounts receivable control accounts. This is the term we will adopt instead of the conventional one.

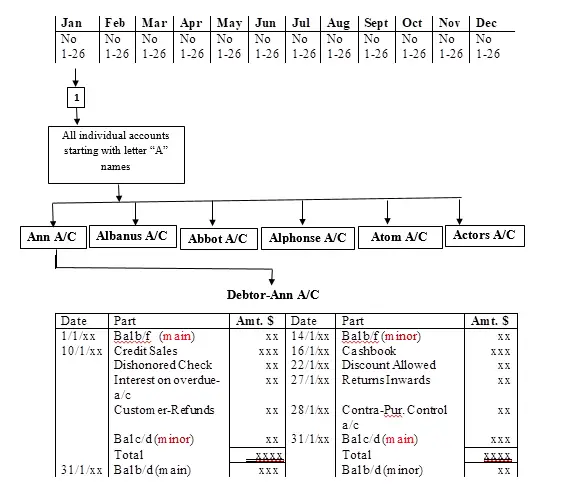

Remember that transactions related to debtors take place on daily basis and at the end of every month, for a financial period, several of them take place affecting all the affiliated debtors. Recording these transactions are tedious and voluminous. An accounts receivable control account will aid the keeping of such transactions. This is achieved by dividing the individual debtors into groups or categories with identity number so as to differentiate them. Either, a unique number can be used or the alphabet letters, A to Z.

Also digits such as 1-10; 11-20; 21-30 etc can be utilized so long as it is workable. The entrepreneur, need to know that, regardless of the numerous transactions that take place, all recording of such transactions adhere to double entry principle. Before we look at the preparation of an account receivable control account, the following number line has been used to demonstrate the debtor transaction scenario that necessitates preparation of the corresponding control account.

Notes

For each month of the year, various transactions related to all trade debtors take place on a daily basis. The transactions are recorded in the respective individual debtor’s account on daily basis by the accounts clerk or the accounting officer responsible for that assignment. For instance, the debtor Ann account is one of the debtors in the current financial period indicated above which range between January to December. At the end of each month, balances brought down (ie bal. b/d) are extracted.

The entrepreneur/learner need to note that the closing balance brought down for each individual debtor become the opening balance brought down in the following month before more transactions are recorded for the proceeding month. This procedure continues for all the twelve months for each similar individual debtor account, namely; for Albanus, Abbot, Alphonse, Atom and Actors as indicated in the number line shown.

Administratively, organizations normally create divisions or sections in their accounting/finance department commonly referred to as accounts receivable and payable sections. In the receivable section, several accounting officers are assigned the clerical work of managing the specific receivable accounts whereby all transactions related to those accounts in that particular category are in their control. At the end of each month balances brought down are extracted.

The number line represent the twelve months of the calendar year, whereby for each month, there may be hundreds or thousands of each category of the debtors. In this case there are 1-26 categories based on the alphabetical order of names of debtors starting with “A” to “Z”.

Preparation of Receivable Control Account

To prepare receivable ledger control account which is conventionally referred to as debtors’ control accounts, a rolling back technique is used. The steps to be used are as follows;

Step one; involves the daily posting of business transactions affecting each debtor account for each month for the twelve months of the year. At the end of each month, balance brought down is always extracted which becomes the opening balance brought down in the proceeding month. (The specific transactions affecting the debtor account will be discussed at the end of the steps stated below).

Step two; the balances brought down (ie bal. b/d) for all individual debtor accounts are work out. Then a single balance brought down (bal b/d) figure for each category of debtors as per organization’s system is further determined by the accounts clerk or the accounting officer responsible for that task.

Step three; lastly, a combined (ie total) balance brought down (bal b/d) figure is calculated which is a summation of all the balances brought down of each debtor category.

NB: The step three balance brought down is what is utilized to prepare financial statement at the end of the year.

Step four; the information pertaining all the other specific debtor related transactions are summed up in the same way and utilized to determine the correct total balance for the debtor/receivable control account. This is achieved by adjusting the receivable control account using the affiliated transactions that affect this account as it is explained below;

Transactions affecting Debtor/Receivable Control Account

The transactions that affect the debtor/receivable control account are the ones we have already discussed in the previous lessons in level one and two of this accounting tutorial series. In this lesson we will consider a further explanation of the same specific transactions and how to adjust the receivable control account to determine the correct value thereof. In addition, we will incorporate other transactions that we did not focus on in the previous discussions. To accomplish this task, journal entries will be used.

-

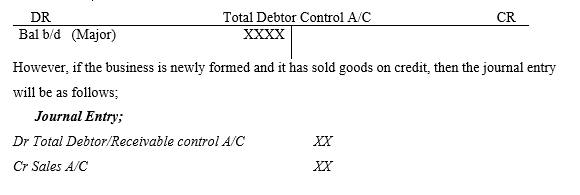

Credit sales; this are sales made by the business of our concern to a customer whereby receipt of cash, whether on cash or through the bank is done at a later date. The goods or services are sold/provided immediately, but the cash is received after either one week or one month, or two or three months or a period more than this depending on the credit terms agreed upon. Sale of goods on credit increases the organization’s debtor/receivable control account. Credit sales form part of main debit balance brought down (i.e bal. b/d) in the debtor/receivable control account if the debt is not yet paid by the customer at the end of the financial period as follows;

-

Discount Allowed; this is financial relief extended to the customer/buyer to prompt quick payment of the debt. As a result the business offering such discount suffer financial loss which decrease the debtor monetary value.

Journal Entry;

Dr Discount Allowed XX

Cr Total Debtor Receivable control A/C XX

-

Returns Inwards; this are goods returned in to the business by the client/customer. They result to reduction of the total amount of cash to be paid to the business.

Journal Entry;

Dr Returns Inwards A/C XX

Cr Receivable Control A/C XX

-

Customer Refund; the business of our concern may be faced with a scenario whereby some of its debtors account have credit balances brought down (ie minor balance brought down-bal. b/d). This may be due to either;

1. Goods returned to the business by the customer (ie returns inwards) were not adjusted in the respective debtor’s account or

2. The customer paid in excess of what is due to him/her.

Scenario one;

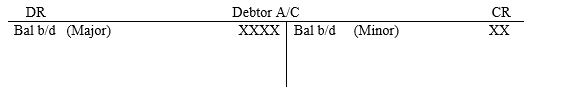

If the customer has not been refunded the excess cash reflected in his/her debtor account by the time books of accounts are prepared (especially at the end of the year), then a credit balance brought down (ie minor bal b/d) will appear on the the debtor’s account (receivable control account).

NB: the debtor account will be as shown below;

The same balances are posted to the corresponding receivable control account at the end of the financial year.

Scenario two;

If the customer is refunded before the end of the financial period, then the journal entry will be as follows;

Journal Entry;

Dr Receivable Control A/C XX

Cr Cashbook-Customer Refund XX

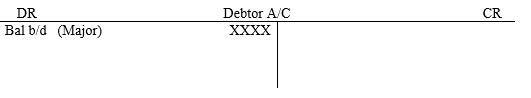

NB1: the debtor account will be as shown below;

NB2: In scenario two, there will be no minor credit balance brought down. It will be eliminated (set-off) by the refund amount debited in the receivable control account if it has an equivalent monetary value. Otherwise if the customer refund amount is not equal to the total minor credit balance brought down, there will still be some minor balance indicated in the control account.

-

Bad debts written off; is financial loss that is suffered by the business when the customer(s) default payment of their debts due to reasons beyond their control. In this case, the business will lose part of the debtors value expected in the future.

Journal Entry;

Dr Bad debt written off A/C XX

Cr Accounts Receivable Control A/C XX

-

Cash Receipt from Customers; when the customers pay their dues, whether in cash or using check or other mode of payment, this results to reduction of the debtor’s monetary value and the accounting entry will be;

Journal Entry;

Dr Cashbook XX

Cr Accounts Receivable Control A/C XX

-

Dishonored Checks from the Customer; sometimes cash received from the customer may be in form of check which when presented at the business bank is declined due to some discrepancies such as shortage of cash in the customer’s account or wrongly written check. This implies that the deduction that was made by the business in the respective debtor’s account need to be reverted. Therefore, the entry is as follows;

Journal Entry;

Dr Accounts Receivable Control A/C XX

Cr Cashbook/Debtor XX

Narration-debtor/receivable control account is charged (ie debited) with the same amount earlier on credited to the respective debtor a/c.

-

Interest Charged on Customer Overdue Accounts; this transaction occurs when the customer has an overdue account balances and not yet paid at the end of the financial period. In such circumstance, the business charges some fee based on the provisions given. This results to increase of the amount of monetary value of the debtors due. Hence the entry will be as follows

Journal Entry;

Dr Accounts Receivable Control A/C XX

Cr Interest on overdue accounts (income) XX

-

Contra Entry Transactions; this is an inter-transfer that take place between the business and the customer such that the latter who is a customer is also at the same time a supplier to the business. Such inter-account settlements are solved by setting off the accounts affected. The accounting entry is as follows;

Journal Entry;

Dr Purchases Control A/C XX

Cr Accounts Receivable Control A/C XX

-

Bills of Exchange Receivable

A bill of exchange is a negotiable instrument which is a source of short term financing for an organization. It is prepared by the business to its customer asking him/her to acknowledge the debt due. If customer acknowledges the same, he or she appends signature on the face of the bill document and return it to the business. The accepted bill of exchange becomes bill of exchange receivable to the drawer (ie the business in question-drawer) and bill of exchange payable (ie the customer promising to pay in the future-drawee).

The accounting entry will be as follows;

Dr Bills of Exchange Receivable A/C XX

Cr Accounts Receivable Control A/C XX

NB1: Bill of exchange receivable should be deducted from the receivable control account to reduce the total value of total debtors value.

NB2: All those transactions from i-xii are as summarized in the number line afore discussed.