Introduction to cost accounting-Definition,Theory And Practice,Scope, Difference Between Cost Accounting And Financial Accounting

1.1 Specific Objectives

This article has been prepared with an intention of making Cost Accounting practical to all interested parties such as large-scale manufacturers, entrepreneurs, service providers, innovators just to mention but a few. Therefore, the reader of this study materials will end up being able;

- To understand the theory and Practice of Cost Accounting

- To describe the nature and scope of Cost Accounting as a discipline

- To appreciate the importance of cost accounting in an organization

- To understand the areas of coverage of cost accounting

- To comprehend the distinct roles of a cost account in an organization

- To differentiate between cost accounting and financial accounting

1.2 Definition of the term Cost Accounting

What is Cost Accounting?

There are many definitions from different scholars that describe this term. In addition to those definitions as recorded below, I have suggested also a more suitable definition for the sake of in-depth understanding especially in this era of post Covid-19.

- Cost accounting is an aspect of managerial accounting whose aim is to incorporate all the costs associated to production or service delivery whether of variable or fixed nature so as to summarize the total cost thereof. (Investopedia).

- Cost accounting is a systematic established procedures for capturing and reporting cost measurement involved in manufacture or production of goods or services by the firm. It entails the process of diagnosing, categorizing, allotting, combining and reporting such costs and comparison of the same with standard costs (Wikipedia)

- Cost accounting is the formation of budgets, setting of standard costs and comparing the same with the actual costs of operations, procedures, events or products, accompanied by further variance analysis, profitability perspective or the social use of financial resources (I.M.A. London). `

- Cost accounting is the process of categorization, recording and correct appropriation of resources (i.e., Expenditure) so as to establish the overall cost of paid or incurred on a product or service so as to enable the process of control by the management (Wheldon).

** “Cost Accounting” is therefore all the activities which are systematically undertaken to capture all cost elements associated with production of a product (goods and/or services) associated to an individual or an organization. These activities entail identification of the nature of the product being produced, identification of cost elements thereof, classification of cost elements, recording the cost elements and summarizing of the cost elements as per particular product, computation of the cost per unit/service and keeping in custody the cost record for future references.

This definition is a little bit longer than the rest for the aim here is to portray the sensitivity associated with cost accounting concept. In summary, we can define Cost Accounting as a branch of accounting which is more affiliated to actual production or provision of services such as wheat flour and medical care services and all costs associated to such products.

Cost Accounting is a managerial methodology of capturing the total cost incurred or paid to produce a complete unit of a good or service.

Cost Accounting then therefore entails measuring of the cost of all the product elements making up the complete unit of a product.

Cost Accounting: Theory And Practice

Is Cost Accounting a Theory? This is the first question I would like us to answer before we consider a second and more elaborative question

I will borrow the academic observation of Guthrie and Parker, (2017) who noted that Management Accounting research does not have an impact on practice. This is because according to Tucker and Lowe, (2014), Management Accounting is fundamentally an applied field, focusing on provision of solutions for practical problems of organizations. Similarly, the big question is; “Is Cost Accounting also a Theory?”.

First of all, what does this term “theory” mean? A theory is an idea or a concept. A theory is what is practical in the natural phenomenon. For example, in our article entitled “theoretical foundation” found in our Accountingnest.com website, we have given several examples to elaborate the meaning of this term. Further, a concept is a case where two or more variables have a correlational implication. So, since Cost Accounting entails numerous activities which are correlated or multi-correlated (i.e., practical), then it qualifies to be referred to as a Theory. That is, the discipline provides practical solutions to businesses whether small or large in scale as we shall see in the proceeding example one of Boz ltd a manufacturing firm in United Kingdom.

But unfortunately, many business practitioners such as entrepreneurs does not appreciate the role of Cost Accounting and as a result, all activities involved in Cost Accounting are ignored in their decision making. This has made such organizations such as Small and Medium Enterprises (SMEs) to perform poorly and the worse happened to them during the Covid-19 Pandemic episode. Most of those firms did not see the light of the day and up to date they cannot revive for their Cost Accounting systems are non-existent or malfunctional.

How is Cost Accounting a Theory? This is the second question that if we answer it, then it will be empirically evident that for sure this discipline is a Theory! Let’s go…….

Before I answer this question, let me justify why we need to ask such a question. In the past, even today I have witnessed scholars and students talk of the term “theory” in a very casual manner. For example, one; if a tutor does bogus teaching work in class and students have not understood the topic of the day, the students say they were “Only taught Theory”

Example two; also in politics, I have heard people comment that the political leaders are just “Theoretical and not Practical” especially when the political figure give false promises of what they will do in the future and they do not fulfill that. In other words, they give lip service.

Ladies and gentlemen, the word “Theory” is everything mankind need to unleash his/her potential. This term “Theory” is bigger than the Galaxy in the universe. This term means what is practical or what is do-able in the natural phenomenon or physically. Theory is what is logical or plausible. In summary, let me use this formula;

THEORY=IDEA=CONCEPT=PRACTICAL=PLAUSIBLE=LOGICAL=REASONABLE

Further, a CONCEPT is relational (i.e., from the word relationship) linkage between two or more variables/factors or constructs.

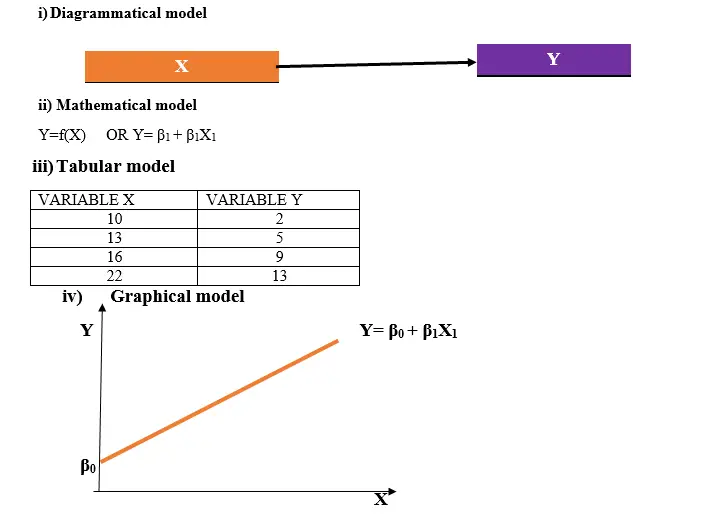

For example, the relationship between X and Y is a CONCEPT, if and only if (i.e., iff) it is logical or practical. So, if X causes Y to change in value or Y changes directly or indirectly when X changes, then this is a CONCEPT (Idea or Theory). It is further summarized in form of graphical, diagrammatical, tabular or mathematical form referred to as a model as follows;

NB: A theory is always summarized in form of an empirical model as shown in i-iv

So, in summary, is Cost Accounting a Theory and how is it a Theory? The answer is YES! This is because Cost Accounting entails aspects which relate to one another. For example, the aspect of cost elements and output or production elements. They have inherent relationships. The following example will portray how the output factor relate with cost of production. In our example, I will use the SPSS computer program to provide evidence.

Example one

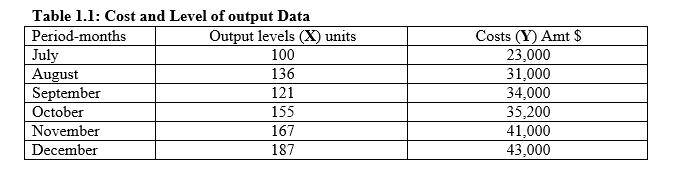

Assume that Boz ltd is a manufacturing firm in United Kingdom and the production manager has no idea of how the elements of Cost Accounting, namely production levels and fixed and variable relate with one another. So, for the last couple of months (six) the manager has not been in a position to make a decision the optimal level of output he can rely upon. Fortunately, the technical personnel in the factory have been keeping cost and output data for that period. The data was as shown in Table 1.1 below;

Using research approach, I utilized an SPSS program to generate the mathematical model derived from the graphical model above as follows;

Interpretation

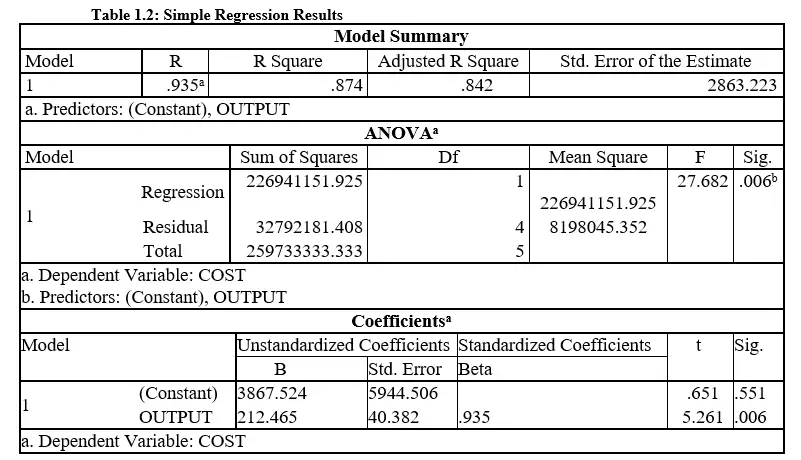

For the sake of full understanding of the reality, I will explain the meaning of each of the three models, namely; Model summary, ANOVA and Coefficient generated by SPSS computer program. For those students who are not used to research, this may be a bit tricky but I will be simple in my explanations.

This is the point;

Using the data from Table 1.1, the SPSS automatically established the relationship between output and cost

Model one: Model Summary

The R value of 0.935 is commonly referred to as Coefficient of Determination and it shows the extent to which the level of output explains the changes in cost. In this case, the 0.935 or 93.5% means that the change in the level of output in production explains 93.5% of the changes occurring on cost of production.

Model two: ANOVA

ANOVA means Analysis of Variance and the model shows the level of significance of the influence of output levels on the changes on cost value. In this case, it is clear that the level of output significantly influence changes in cost of production for F statistics is 27.682 (p-value=0.006).

**Model three: Coefficient model

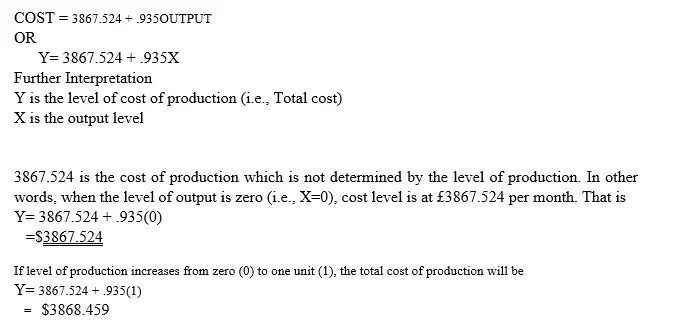

This is my main focus model for it portrays the mathematical model that is formed from the data collected for cost and output levels. From the model, the relationship between cost (Y) and output level (X) is extracted from this table as follows;

Quick Assignment

- Suppose the level of output was 10; or 25 or 40, how much will be the total cost of production for those respective levels of output?

- Is the relationship between cost and output in the example above a Theory?

- Which other term are an equivalent of the term “Theory”?

- Is the model developed in the example above useful? If yes or no explain the case.

Conclusion

Now we can confidently conclude that Cost Accounting is a Theory for it involves components or elements which relate with one another in a plausible or logical manner. By extension, in the natural phenomenon, at the factory place or any other production setting, like in farming, costs of production is always positively influenced by the level of output. Such that as production level increases, the level of total cost increases and the vice versa is true. In other words, Cost Accounting is practical or provides practical solutions to the organization.

Objectives Of Cost Accounting

As it has been evident in our discussion that Cost Accounting is a theory or concept which organizations find practical solution to their daily operations. So, in a nutshell, this discipline has several specific objectives that are useful to the end users. These are;

(1) To guide in projecting future levels of production volumes. Since the cost per unit is known, it is possible to estimate the volumes attainable in the future

(2) To eliminate or reduce the rate or resource wastage such as idle time, material wastage and other inefficiencies.

(3) To establish the cost per unit for all different costing method used in business for the sake of comparative purposes with cost standard.

(4) To help in determining the economies of scale. With the relationship between level of output and the cost of production levels, it is possible for the production manager to know at what level of cost he should produce at. Normally, production should take place where the marginal cost is at the lowest point.

(5) To ensure that cost data analysis process translates to cost classification as per nature of the product in question.

(6) To aid in preparation of regular profit and loss and financial position reports as may be required by the management for well-informed decision making.

(7) To aid in pricing. To the final consumers of the product, the cost incurred in producing a product is the purchasing price. With clear breakdown of all costs incurred or paid in production of a product, it is possible for the management to set the selling price in a fair manner.

(8) To support stock taking process. Stock taking is the physical counting of the units of inventory unsold at the end of a financial period and then assigning of the total cost of such goods. This mission can only be accomplished if the firm has a system Cost Accounting to provide the ascertained cost report of the available goods.

So, those are some of the specific objectives a Cost Accounting discipline would aim at achieving in an organization. This leads us to the fact that the discipline has paramount importance to the organization. This aspect is as discussed below

Importance Of Cost Accounting

Mostly, Cost Accounting is for internal use especially by the management for the sake of decision-making purposes. Some of the key importance of cost accounting are;

i).Pricing policy

Cost accounting aid the management in determining the minimum price they can set for the goods or services they are offering. For example, the management will ensure that the selling price is not below the average cost (AC). This is possible if the cost accounting system can establish the average cost of a product.

ii). Preparation of profit and loss account

Although financial accounting is another form of accounts, it is needed for external use especially the potential and current investors among other users. But this final report cannot be prepared without accessing some details from cost accounting. For instance, the cost of the opening and closing inventory is computed using cost accounting formula.

iii). Avoidance resource wastage

Cost accounting is a tool for minimizing or eliminating resource wastage. This is because cost accounting is used in budgeting and budgetary control. This way, efficiency in allocation of both financial and non-financial resources is improved.

iv). Evaluation tool

The management make use of the cost accounting reports to assess their performance. With two consecutive years’ report, the management can compare their success in investing strategies and take the right measures to correct any anomaly.

v)Opportunity cost

Opportunity cost is the benefit of the next alternative forgone. This concept is useful for the management are in a position to know how to optimally allocate the scarce resources. So how does this happen? The management makes use of marginal revenue and marginal cost concept to decide at what point to use certain resources to produce. In economics, optimal level is at a point where the Marginal Cost (MC) is equal to Marginal Revenue (MR). That is (MC=MR).

vi). Forecasting of production levels in the future

Cost accounting is more of allocating resources in production of output. Since, the cost per unit is determined using the costing approach which is a sub-set of cost accounting, the projection of what to produce in the future is easy to establish

vii). Inventory control

Inventory of a business represents a case of short-term investment. As you know, that any investment involves tying of cash which could be used in other ways. So, the management need to be careful of the amount of cash they tie in inventory for if the inventory is slow moving, it means losses will be experienced. To avoid this challenge, the cost accounting tool guide the management on how to strike a balance between the much to invest in inventory to avoid idle cash.

viii). Planning tool

Cost accounting is yardstick used by the management in planning function. Planning entails setting of goals and objectives of the organization and laying down courses of action. These activities are possible when using the avenue of cost accounting which entails details of the resource availability and schedules for future production and selling plans.

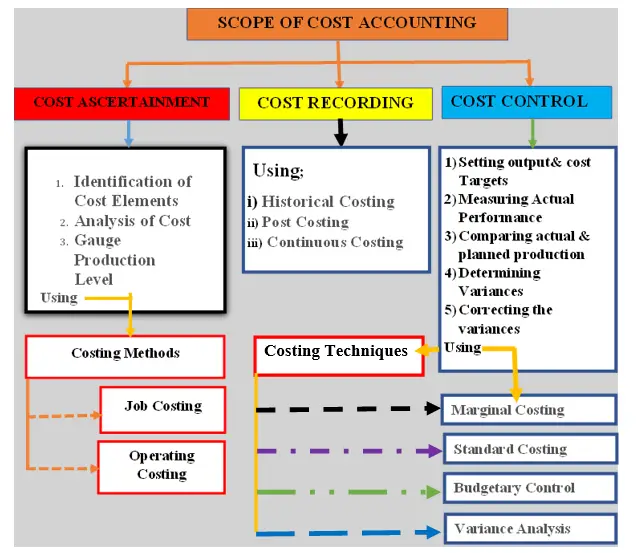

Scope Of Cost Accounting

Scope of cost accounting refers to the facet coverage array addressed by this discipline. Cost accounting is one of the types of accounting other than financial accounting and management accounting and it is unique on its area of focus. This is as summarized below;

Cost Accountant And Cost Accounting Decision Making

Cost Accounting is a discipline that is distinct in the field of academia and practically, in big organization there exists a cost accounting department or section headed by the cost accountant. The role of a cost accountant is unique in every business as discussed below;

1).Establishment of cost accounting system

Establishment of cost accounting system so as to continuously record all production activities and relevant costs thereof. With this role, the organization cannot have omissions of costs or exaggerations in cost ascertainments.

2).Cost analysis role.

The cost accountant does the work of interrogating the structure of cost elements so as to learn cost behaviors. This guide him or her on how to make decisions to regularize the costs incurred in production.

3).Internal cost audit

Cost accountant undertakes audit role. For your information, audit exercise is not only in financial accounting but also the accountant needs to investigate on the cost related activities to avoid over charging of costs on products which can adversely affect the pricing of the products. For example, physical confirmation of goods or raw materials bought to see if physically exist.

4).Ensure adherence to Generally Accepted Accounting Principles (GAAP) by other accounts department stakeholders.

The cost accountant has to keep a watch on level of compliance of the GAAP. This helps in ensuring that the preparation of the final financial report is free from errors. For instance, GAAP is needed for inventory valuation where by the principles advocate that the value of should be the lower of

- i) Cost value or

- Net realizable market price

5).Profit optimization

The cost accountant computes and keeps the marginal information on cost and revenue which is useful in determining the level of production an organization need to stick to to optimize profits. For instance, for a profit maximizing firm, marginal cost should be equal to marginal revenue.

6).Control function

Control function is one of the functions of management and it entails the activity of setting levels of expected output in the beginning of a period and comparing the actual levels of production so as to correct the variances or the deviations.

7).Stores management

The cost accountant is responsible of supervising the activities related to storage of either the raw materials, work in progress or finished goods. This aid in eliminating wastage of the organization’s resources.

8).Reporting to management

Cost accountant on regular basis prepares the reports needed by the management for decision making. The composition of the report entails aspects of production, costs behaviors and other relevant information or data which shade light to management to make well-informed decisions.

9).Participate in budget preparation

The cost accountant is privileged to deal with the resources of the organization more often as compared to other accountants. He/she is therefore actively involved in the preparation of master budget which aids in optimal utilization of the available resources.

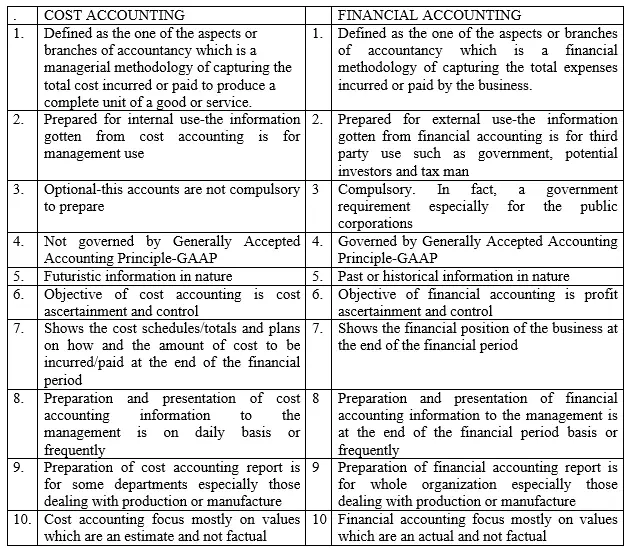

Difference Between Cost Accounting And Financial Accounting

Advantages Of Cost Accounting

1).Optimal utilization of organization’s resources

Cost accounting in a nutshell, aids in ensuring that the resources of the business, whether financial or non-financial in proper allocations which translates to increased operations efficiency. This assures the firm of its continuity.

2).Cost minimization

With a good cost accounting system, transparency and accountability of how costs are incurred or paid for production of the final products is high. This helps the organization to reduce costs and on the other hand maximize profits.

3).Tapping of profitability opportunities

A good cost accounting system where by the production capabilities of the organization are well articulated makes the strategic managers be in a position to know whether the firm can tap a profitable venture or not. For example, if the production manager knows of the production capacity of the firm, the manager can decide to produce more to meet an abrupt increase in demand of the goods the firm is dealing with.

4).Opportunity cost

Cost accounting is a tool that can be utilized by the management to determine the opportunity cost of a certain course of action the management wants to undertake. For example, the decision of whether to Make or Buy a particular product.

5).Pricing policy

Cost incurred in producing a good or service is only ascertainable from cost accounting point of view and it is on the strength of this records that the marketing manager can set the profit mark up for it is based on the total cost of a product. Imagine if the marketing manager did not have the records!

6).Control function

The management relies on the cost accounting information to make decisions of reverting adverse variances. For instance, with the use of the budget information, negative deviations can be corrected.

7).Computation of tax liabilities

The accountant is in a position to determine the amount of tax liability if proper cost accounting records are kept. This will avoid the mistakes of paying the tax authority more taxes than expected. For example, the value added taxes which are based on the value-added form the point of raw materials up to the final consumption point.

8).Determination of break-even point

The point at which a firm should be producing at so as to shift from loss making to profit making is possible if the data pertaining cost of production is available. So, with cost accounting system, it is possible to identify that level.

9).Yard stick for the preparation of profit and loss account

The financial statements such as profit and loss account and statement of financial position is prepared on the basis of the coast accounting information. For example, the opening and closing inventory. Therefore, these financial reports depend on the cost accounting system.

10).Safeguarding of business assets

Proper cost accounting procedures and guidelines such as it is in the case of cost ascertainment processes and budgets preparation helps in ensuring that assets of the organization are protected against misuse by individuals. For example, misappropriation of funds and fixed assets.

Disadvantages Of Cost Accounting

Not all firms maintain cost accounting system. For your information, these accounts are not a compulsory to all the firms although it is necessary. So those firms which maintain this system also face some challenges which are;

1).Costly

Installation of cost accounting system in addition to financial accounting implies an additional cost for the firm. This turns to be expense and on the other hand this action may result to eating of profits of the business.

2).Bound to failure

Cost accounting system is complicated in nature and hence requires qualified personnel. So when the firm does not get the right accounting manager, the end results will be failure of the system which may translate to collapse of the firm.

3).Duplication of efforts

Some of cost accounting activities overlap with the activities of financial and management accounting such that there exists some element of idle labor. In other words, one accountant can play the role of cost and management and financial accounting role.

4).Lack of uniformity

Cost accounting is not governed by any set universal standards such as International Accounting Standards (IAS) so each firm even if in the same industry have dissimilar costing system. This makes it impossible to compare inter-firm performance.

5). Prone to source of misleading information

Since cost accounting is not universally governed by international standards, cost accountant can take advantage of absence of watchdog governance from external interested parties and collude with other corrupt employees to swindle the firm its resources.