Inventory valuation in a business

In our level one in this accounting tutorial series, we discussed the concept of inventory. It was established that, inventory is a current asset just like the other similar items that were revealed in level one. However, we realized that inventory is unique for unlike other assets, inventory account does not keep track of changes that affect this item.

Further, inventory item is recorded in books of account in both quantitative and monetary terms. The quantitative perspective involves, considering the number of units available in the business premises at a particular period of time especially at the beginning or at the end of the financial period. The monetary perspective involves, considering the monetary equivalence of the physical units of inventory available in the business premises at a particular period especially at the beginning or at the end of the financial period. The latter perspective (ie monetary) call for valuation exercise to be undertaken by the management to determine this value. This objective is achieved through stock/inventory taking.

Inventory or stocktaking is an accounting activity of determining the monetary value of the physical units of inventory available in the business premises through physical counting of those units. International Accounting Standard (IAS-No. 2) governs this activity. As an entrepreneur/learner, it is necessary to understand the international perspective of the accounting treatment of inventory. In this discussion we will focus on inventory from the viewpoint of definition, scope, recognition of inventory related expenses, disclosure, measurement and approaches of inventory valuation.

Lesson One; IAS-2; Definition

According to IAS-2, inventory is any asset that is held by the business with intention of selling in the ordinary course of business, or in the process of production (work in progress) for sale in the ordinary course of business or raw materials kept by the business to be consumed during actual manufacturing or production of finished goods for sale in the ordinary course of business.

Operational Definition terms used for Inventory;

i) Intention of Selling

This term refers to the motive behind the acquisition/purchasing of the good in question. In level one, we discussed the difference between revenue and capital expenditure. We realized that the intention of acquiring a good whether small or big in size, determines whether the asset falls under inventory or capital good. Therefore, if the business acquire goods with a primary intention of re-selling, this is categorized as inventory hence a current asset. Otherwise the good will fall under capital category.

ii) Ordinary Course of Business Activities

The definition of the term inventory is expressed in three aspects where by the environment should be in the ordinary course of business. What does this mean to you as an entrepreneur/learner? Remember in level two we briefly discussed the issue of business ordinary and extra ordinary activities. For ordinary business activities, it entails the main activities that a business undertakes as per the object clause in the memorandum of association. From prior accounting knowledge, we know that when a business is being formed, the promoters should prepare a memorandum of association which a public document where they disclose five clauses one of them being objective clause.

The objective clause states to the public the aim of forming/incorporating the organization. In other words, the promoters of the business explains the nature of business they will undertake. According to commercial law, the business is expected to undertake the activities that are charted in the object clause. In this case, we say that the business is operating intra vires, which means operating within the legal power or authority of an individual or company. This is what is referred, to as ordinary business activities of the organization. Therefore, if the business operates outside this main objective, it is said to be operating ultra vires unless it is incidental. In other words, we say it is operating illegally. The issue of operating intra vires is common with private and public corporations but it does not apply for small businesses for they can operate any business activity so long as it is legal according to common law of the country. Therefore, a case of ordinary business is when according to the object clause, the business was formed with the aim of buying and selling cereals. In this case, purchase and sale of food stuffs represent trading activities.

iii) Inventory-Finished goods

This refers to goods of merchandize nature. This type of inventory is common with firms that deal with buying and selling of completely manufactured goods. The firm does not do any kind of production. Therefore, on purchasing the goods, the available unsold goods at the end of financial period represents the closing inventory of finished goods.

iv) Inventory-Work in Progress (WIP)

Inventory of work in progress nature refers to goods which are partly in raw material and partly in finished form. In other words, at the time the financial period come to an end, the goods are in a state of transition, having a certain degree of completion. Such goods form part of inventory of the business.

v) Inventory-Raw Materials

This refers to goods acquired to be used as inputs for production of finished goods. The inputs may take the form of physical/tangible goods or liquid form such as chemicals. It can also take the form of gases such as domestic cooking gas.

Lesson Two: IAS-2; Scope

Inventory covers all aspects of goods unused, unsold or incomplete at the end of the financial period except;

-WIP for service and construction related assignments which is governed by IAS-11 in lieu of IAS-2

-Financial instruments such as market securities, which are governed by IAS-32 and IFRS-9 in lieu of IAS-2

-Biological assets affiliated to agricultural activities, which are governed by IAS-41 in lieu of IAS-2

Lesson Three: IAS-2; Recognition of Inventory related Expenses

Inventory has two facets, revenue generation and cost associated to the sold inventory. The IAS-18 governs the recognition of revenue realized when inventory is sold. At the same time the cost/expense associated with the inventory sold is also recognized as the carrying amount of inventory which is also referred to as Cost of Goods Sold (COS).

Lesson Four: IAS-2; Disclosure

When preparing the financial statement, the following issues pertaining inventory should be considered for disclosure;

Accounting policies governing all aspects of inventory treatment

Carrying amounts related to the inventory for all associated classes of entity in an appropriate manner

Carrying amount of inventories recorded at fair value net of cost associated with selling

Amount of inventories recognized as an expense during the financial period

The following are some of the cost items categorized as operating expense hence charged in the P&L A/C although they do not form part of inventory costs. These costs are;

i) Abnormal amounts of wasted material inventories, labour and other directly incurred costs in production

ii) All storage costs. The cost of storage which necessitates further production process to take place expected from the list of costs in (i).

iii)Any administration related costs such as overheads which does not aid in availing inventory to their present locality or condition

iv)Cost related to selling of the inventory.

Lesson Five: IAS-2; Measurement

Under the aspect of measurement, we will focus of two issues, namely; the IAS-2 advocacy on the parameter to be used to value the unsold purchases/inventory and two, the various methods used to prioritize category of inventory to be assumed to form the closing/opening inventory.

Case one; inventory measurement parameters

The parameter used to value inventory is;

i) The corresponding cost of purchasing the inventory OR

ii) The Net Realizable selling Price or Value (NRV).

Whichever is Lower

Explanation

i) The first option (ie purchase cost) implies that, the cost that was incurred or sacrificed by the business for that particular category of inventory should be used to determine the value of the closing inventory items. Therefore, if the remaining units of inventory were acquired at a uniform cost of $150, then the total cost will be the product of that cost and the unsold units of inventory. If the category of the units of inventory unsold were different in the sense that the remaining unsold units of inventory were purchased at different costs, then we match the costs as per each category such that if category one of inventory cost $200 and category two was $150 in that order, then valuation process will consider the categories such that the sum of the product of the two categories is determined. For instance, assume that the total units of inventory at the end of the financial period was 1000 whereby 700 were purchased at $200 per unit (hence cost $140,000) and the balance of 300 at a cost of $150 per unit (hence cost $45,000). Then, the total cost of closing inventory is the sum of the two categories, which is $185,000.

ii) The second option of Net Realizable Value (NRV) refers to the net selling price of that unsold inventory at the end of the financial period. That is, the projected selling price of that inventory if it was to be sold at that moment. What does this mean? This assumption considers the current prevailing market price of the inventory if it is sold at that particular time and in addition any expense that may be incurred/paid to ensure that the inventory is sold at the prevailing market price. For instance, assume the unsold inventory at the end of the financial period is as per (i) above and that the prevailing market price is $140, then the net realizable value will be $140,000 (ie $1000*140) if there are no associated expenses to be incurred/paid to ensure the process of selling is successful. In case there are selling related expenses, the net value is determined by subtracting such item from the selling price to arrive at NRV. For example, if the selling expense is $7,000, then the NRV will be $133,000 (ie 140,000-7,000).

NB: The option adopted by the business is the lower of either (i) or (ii). The following illustrations clarifies the above scenario.

Illustration one

On 31/12/2019, Your Co. ltd had closing inventory of 1000 units, which had been purchased at a cost of $100. The current market price is $130 per unit.

Required;

Determine the value of the closing inventory as at 31/12 2019

Solution

In this case, the cost value is lower than the current prevailing market price. Hence, the cost of inventory is $100,000 (ie 1000*100)

Illustration two

Assume the fact of illustration one above and that the cost and prevailing market price of the inventory is $100 and $90 respectively.

Required

Determine the value of the closing inventory as at 31/12 2019

Solution

In this case, the current prevailing market price/value is lower than the cost value. Hence, the cost of inventory is $90,000 (ie 1000*90).

Illustration three

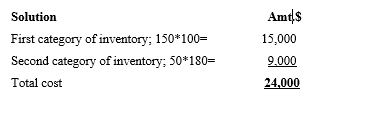

Suppose on 31/12/2019, Your Co ltd had 200 units of closing inventory whose cost per unit was $100 for the first 150 units and the balance of 50 units was acquired at $180 per unit respectively. If the current prevailing market price is $250, determine the value of the closing inventory.

NB That the cost value is lower than the current market price and as a result, cost value is considered to determine the inventory value.

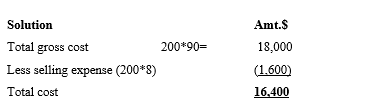

Illustration four

Suppose on 31/12/2019, Your Co ltd had 200 units of closing inventory whose cost per unit was $100. If the current prevailing market price is $90, and the expenses paid to enable selling of the units is assumed to be $8 per unit, determine the value of the closing inventory.

NB: That the current prevailing market price is lower than the cost value hence it is used to compute the inventory value. Further, the selling expense is also deducted to determine the net realizable value.

In conclusion, the entrepreneur/learner need to note that it is the lower of cost or NBV price which is considered when determining the inventory value at the end of the financial period. If there are any expenses incurred or paid to ensure that the inventory is sold, if that be the case, then such expenses are incorporated in determining the net realizable value.

The entrepreneur/learner need to further take note of the following argument of IAS-2;

One; that, the lower price is considered in inventory valuation for this ensures that net profit of the business is not exaggerated.

Two; that inventories are usually written down to net realizable value/price on an item by item basis, unless it is more proper to group the similar inventory items together.

Three; in the case of service provision, if there exists closing inventory, they should be measured using their direct production cost incurred or paid such as direct labor and other directly affiliated overheads.

Case two; Methods of Inventory Valuation

Methods of inventory valuation has wide spectrum of facets to consider before discussing the specific methods. In this discussion, we will first state the main and some of the specific objectives that motivate business to undertake this exercise. Then interrogate on issues to do with accounting concepts that underpin inventory valuation and the implications thereof.

The main objective of valuing inventory is to ensure correctness of the item for it is a current asset.

The specific objective therefore are;

i) To ensure that errors associated with inventory valuation are eliminated

ii) To determine the appropriate value of income by comparing the associated revenue generated at that specific period and the costs thereof.

iii)To ensure that the investors are provided with the correct information on inventory for it is one of the aspects of investments

iv)To ensure correctness in computation of financial ratios such as solvency ratio so as to ensure correct solvency/liquidity state of the business is established

v) To confirm physical existence of the inventory items as indicated in the books of accounts.

Accounting Principles and Conventions Associated with Inventory Valuation

As much as inventory valuation is governed by international accounting standards number two (2), there are still some accounting principles and conventions that guide the treatment of inventory of a business. They include;

1. Matching Principle; It is referred to as matching of expenses against incomes. It means that all incomes and expenses relating to the financial period to which the accounts relate should be taken in to account without regard to the date of receipts or payment. This implies that the cost of inventory should be appropriately determined so as to undertake the correct cost-revenue matching to avoid profit exaggeration. As an entrepreneur/learner, you may be asking yourself where the issue of inventory is coming in as far as cost or expenses is concerned. This is then the point that accurate valuation of cost of inventory will aid in determining the accurate cost of sales for it involves considering the opening inventory, plus purchases of that period less closing inventory. Therefore, if inventory is wrongly valued, it may either result to over or under estimation of net profit of the business.

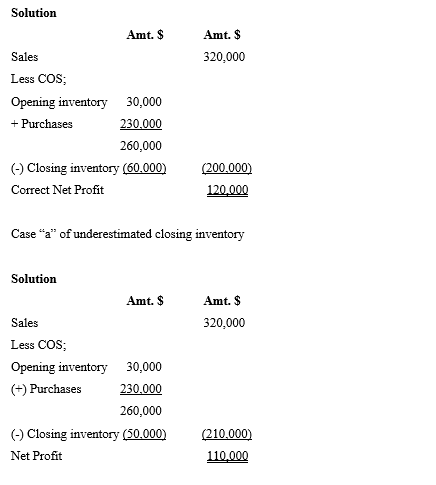

Illustration one

Assume the following per annum accounting data of Your Co. ltd on 31/12/2018;

Amt. $

Sales 320,000

Opening inventory 30,000

Purchases 230,000

Closing inventory 60,000

If closing inventory is distorted as in case “a” and “b” below;

a) $50,000

b) $70,000

(Hint; assume there are no operating expenses)

Required

i) Determine the correct net profit for the year

ii) Using the closing inventory as per case a and b, determine the net profit for the year and comment on the answer.

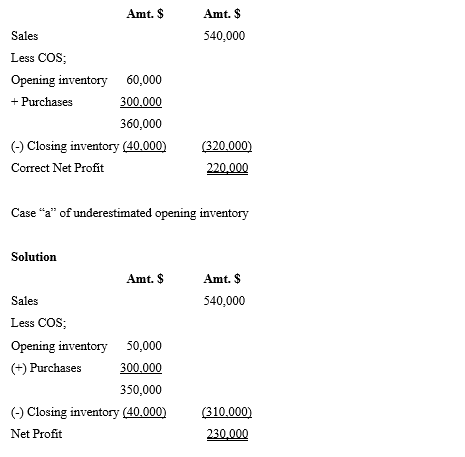

Comment;

In case “a”, If the closing inventory is underestimated, the Net Profit will also be underestimated.

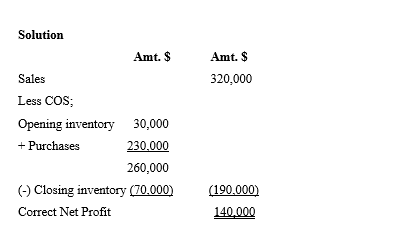

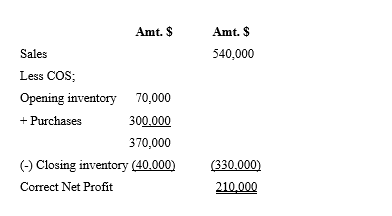

Case “b” of overestimated closing inventory

Comment;

In case “b”, If the closing inventory is Overestimated, the Net Profit will also be Overestimated.

Illustration two

Assume the following per annum accounting data of Your Co. ltd on 31/12/2019 whereby, the closing inventory of last year, 2018 is the opening inventory of the current year and the current year facts are as follows;

Amt. $

Sales 540,000

Opening inventory 60,000

Purchases 300,000

Closing inventory 40,000

If opening inventory is distorted as in case “a” and “b” below;

a) $50,000

b) $70,000

(Hint; assume there are no operating expenses)

Required

i) Determine the correct net profit for the year

ii) Using the opening inventory as per case a and b, determine the net profit for the year and comment on the answer.

Solution

Comment;

In case “a”, If the opening inventory is underestimated, the Net Profit will be Overestimated.

Case “b” of overestimated opening inventory

Solution

Comment;

In case “b”, If the opening inventory is Overestimated, the Net Profit will be underestimated.

In conclusion, the entrepreneur need to understand that if closing inventory is under estimated, net profit will follow suit, that is it will also be under estimated. Similarly, if closing inventory is over estimated, net profit will follow suit that is it will also be overestimated. This implies that there is a direct relationship to the direction the closing inventory takes as compared to the net profit. Further, it should also be concluded that if opening inventory is under estimated, net profit will be overestimated and if opening inventory is over estimated, net profit will be under estimated. This implies that there is an inverse (ie indirect) association to the direction the opening inventory takes as compared to the net profit.

1. Materiality Convention; the issue of materiality cut across matters of information, monetary amount, procedure and nature. For instance, Error in description of an asset or wrong classification between capital and revenue expenditure would lead to materiality of information problem. Say, if stationery of ` $500 remain unused at the end of accounting period, the same may not be considered for recognizing as inventory on account of materiality of amount. Again, the procedure laid down by a specific firm dictates whether a materiality problem has occurred or not. For instance, one firm may classify an expense as general expense while a similar expense is specifically classified otherwise. As far as nature of a transaction is concerned, some transactions are by nature material irrespective of the amount involved. e.g., audit charges, loan to directors etc.

Therefore, the issue of materiality is important in valuation and recognition of items forming inventory. The implications thereof can be discussed as follows;

i) Unused inventory items such as goods bought with intention of re-selling in the ordinary course of business activities, the items will be treated as closing inventory

ii) Unused stationery items will be also treated as inventory of stationery nature and will be classified as current asset hence disclosed in the balance sheet but will not be included in the closing inventory of the business.

iii)If the business deals with buying and selling of stationery items in the normal/ordinary course of business activities, then the unsold stationery items will form part of closing inventory for it is material to the business

2. Consistency Convention; this concept states that the accounting practices should not change or must remain unchanged over a period of several years. That is if a transaction is classified as a fixed asset in the current period, it should not be treated as current asset in the next period. However, this does not mean that a firm cannot change the policy. The implication of this convention is that items classified as inventory should continue being classified as so as long as there is no change in inventory policy. For instance, if item “X, Y and Z are classified as inventory”, they will form closing inventory at the end of the financial period. Therefore, for them to qualify to be classified as such, they must be traded in the course of the ordinary business activities. The concept of capital and revenue expenditure should always guide the entrepreneur on whether an item is of inventory or capital good.

If the policy changes and a capital good is categorized as inventory, then this change of policy should be added in the footnote of the financial statement.

Stock Taking Process

Valuation of inventory is possible if the entrepreneur carry out physical counting of the inventory items. This is referred to as stock/inventory taking. The common practice is that at the end of the financial period, the entrepreneur or owner of the business does physical counting of the unsold goods so as to ascertain the value. The frequency of doing so is determined by the counting system that a business adopts.

Systems used in inventory counting

The frequency of actual physical counting of inventory is based on two systems;

i) Perpetual system

ii) Periodic system

The perpetual system propagates that the counting of the inventory items and their valuation be undertaken on a continuous basis such that it is possible to determine the profit of the business after every transaction. This approach assumes that changes in inventory value is not only brought about by purchasing and selling of the goods but by other related transactions such as returns, discounts and other related transactions. Therefore, the approach ensures that the inventory account balance remain accurate. In the case of perpetual approach, the business maintains an inventory account

The periodic system on the other hand as the name suggests involves physical counting of the inventory items at the end of specific period of time. This implies that the correctness of the purchases account is only determined at the end of a certain predetermined period is over. In the case of periodic approach, the business maintains purchases account.

Lesson Six: IAS-2; Approaches of Inventory Valuation

There are four main methods of valuing or assigning cost on inventory items. This are;

1. Specific identification method

2. First in First out (FIFO) method

3. Last in First out (LIFO) method

4. Weighted average method

NB: To determine the value of inventory, a stores ledger control card/record also known as inventory card is utilized. The inventory card format may vary based on the desire of individual firm.

1. Specific Identification Method

It is a method of inventory valuation appropriate especially for firms dealing with goods, which are big in size such as machinery or motor vehicles. The methodology advocates attaching actual cost to an identifiable unit of product. To achieve this objective, the business first allocates or assigns a specific serial number to each inventory item unique to it. This identification tag makes identification process easy. The method is not a common one amongst firms for not all firms deal with such unique items of inventory.

2. First in First out Method

This approach assumes that the sales made are gotten from goods which were bought at an earlier period as compared to the recently acquired ones although that may not be the case. That is, the goods being sold are assumed to be the ones which were acquired in the early days of the financial period as long as the purchasing price has varied over time. In this approach, the entrepreneur/learner will consider the purchase/cost of the older batch of inventory until it is cleared then consider the next batch in that order. The aim of this approach is twofold, for it ensures that the closing inventory recorded in the statement of financial position as current asset is presented at the most fairly price to the market one hence more accuracy is observed. Secondly, the method focuses on ensuring that the cost of goods sold is fairly presented in the income statement.

Steps in FIFO method

The entrepreneur/learner need to understand that the aspect of FIFO method implies first in first out approach where the assumption is that goods which were acquired first are the first one to leave the business premises through sale/issuance. Therefore, the valuation of the remaining goods (ie closing inventory at time‘t’) will be valued using the cost/purchase price of the recently acquired goods.

The entrepreneur need to understand that the matching of costs and the units issued and those unsold should be consistent. Therefore, to value the closing inventory at the end of every given period of time should adhere to the following guidelines;

Step one; match the goods issued and goods bought based on time

Step two; when goods are sold/issued, consider whether the quantity sold is equivalent to the oldest batch of inventory acquired in that period or otherwise.

If units sold/issued equal to the oldest batch acquired, then assign the oldest purchase price to the batch of inventory issued. This implies that the value of the closing inventory as at that time will be the cost of the recently acquired goods.

If units sold/issued are less than the oldest batch acquired, then assign the oldest purchase price to the batch of inventory issued. Now that, the issued units of inventory are less than the oldest batch of inventory acquired, this call for considering the next units of inventory sold in the future to assign the same old purchase price.

This process of assigning purchase price of old inventory batch continues as more inventories are sold/issued until the total units sold equals the old units acquired. Once the units of old inventory matches the total units sold, the next oldest inventory purchase price is considered for the proceeding sales being made.

If units sold/issued are more than the oldest inventory bought, then the units sold/issued are partly assigned the price of the oldest inventory and the next older one and so on and so on until the sold/issued units equal the units of old inventory batches.

Step three; this step involves allocating the monetary value of the closing inventory units whereby if the batches were purchased at the same cost, then the common cost is used to value the closing inventory. But if the goods were acquired at different costs, the valuation process will entail allocating each batch to the corresponding cost price.

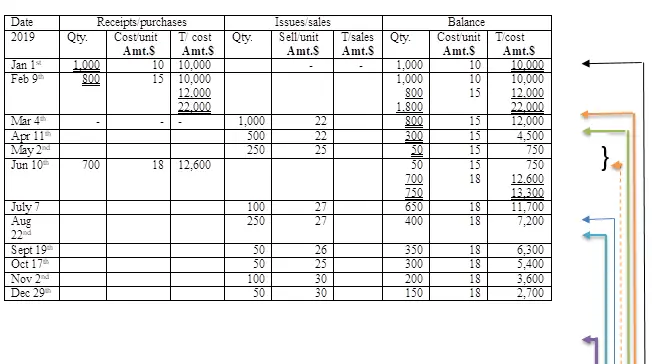

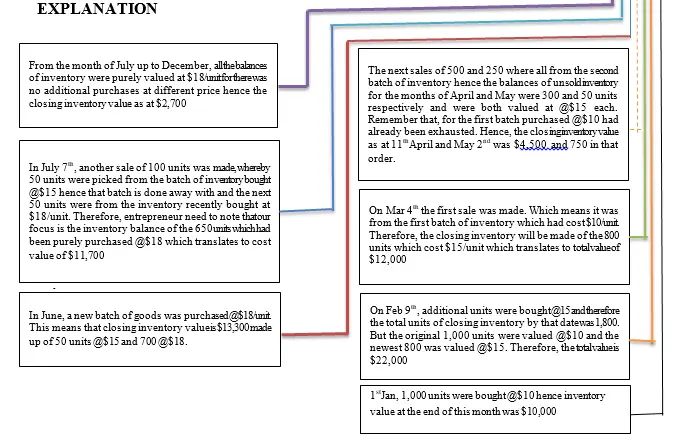

The following illustrations will clarify this concept by using an inventory card as shown below;

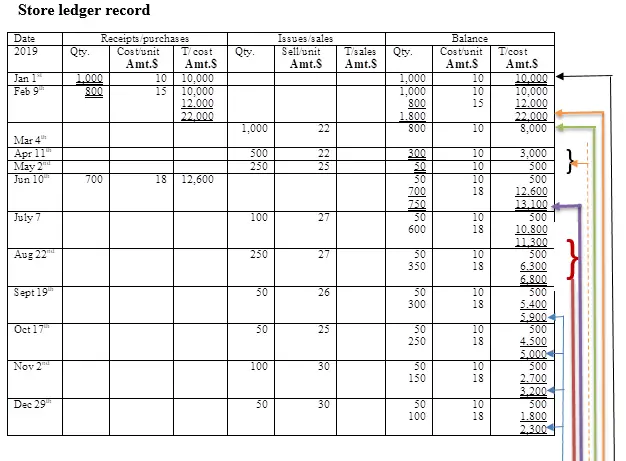

Illustration one

The following inventory information for Your co. ltd was presented to you by the management to determine the closing inventory value of good X for the year ended 31/12/2019

Jan 1st Purchased 1,000 units at a price of $10 per unit

Feb 9th Purchased 800 units at a price of $15 per unit

Mar. 4th sold 1,000 units for $22 on cash

Apr. 11th sold 500 units for $22 on cash

May 2nd sold 250 units for $25 by check

June 10th purchased 700 units at a price of $18 per unit

July 7th sold 100 units for $27 by check

Aug. 22nd sold 250 units for $27 by check

Sept. 19th sold 50 units for $26 by cash

Oct. 17th sold 50 units for $25 by check

Nov. 2nd sold 100 units for $30 by check

Dec. 29th sold 50 units for $30 by cash

Required

Determine the value of the closing inventory at the end of 31/12/2019 using FIFO method

According to FIFO method, the value of inventory is $2,700

Advantages of FIFO method

i) In the case of raw materials, the manufacturing firms assume that the inventory that is used up in the factory is assigned the oldest cost and this results to the recently acquired raw materials to be valued at a current cost/price and this approach avoids cases of obsolete items.

ii) The value assigned to the closing inventory is near the prevailing market price hence the balance sheet item (ie inventory-RM) is appropriately valued

iii)It is a good practice for it provides a good basis for determining cost of goods sold which can be compared with other subsequent periods.

iv)It is a good approach for the purposes of preparing final accounts and statement of financial position.

Disadvantages of FIFO Method

i) The method may not fit well with the matching principle for in determining income for the aspect of historical cost are incomparable with current revenue

ii) Not appropriate in an economy facing high inflation rate for it would exaggerate profits leading to high tax costs

iii)The FIFO method translates in to fluctuations in income due to changes in prices.

3. Last in First out Method

The LIFO method advocates that the most recently purchased inventory/goods be sold first. This implies that the items of inventory currently being sold are valued at the cost of recently purchased inventory/goods. This approach assumes that the sales made are gotten from goods which were bought recently as compared to the earlier acquired ones although that may not be the case. In this approach, the entrepreneur/learner will consider the purchase/cost of the newer batch of inventory until it is cleared then consider the immediate previously acquired batch in that order. In other words, he/she will adopt a rolling back technique. The aim of this approach is, that the closing inventory recorded in the statement of financial position as current asset is presented at the oldest price as compared to the prevailing market one.

Steps in LIFO Method

The procedure of determining the cost or value of closing inventory is similar to FIFO although there are some variation as explained herein;

Step one; match the goods issued and goods bought based on time

Step two; when goods are sold/issued, consider whether the quantity sold is equivalent to the newest batch of inventory acquired in that period or otherwise.

If units sold/issued equal to the newest batch acquired, then assign the newest/most recent purchase price to the batch of inventory issued.

If units sold/issued are less than the newest batch acquired, then assign the newest purchase price to the batch of inventory issued. Now that, the issued units of inventory are less than the newest batch of inventory acquired, this call for considering the next units of inventory sold in the future to assign the same newest purchase price for the units sold will be from the recently purchased batch. This process of assigning purchase price of newest inventory batch continues, as more inventories are sold/issued until the sum of all sold units equals the newest/recently acquired units are cleared. Once the units of newest inventory matches the total units sold, the previously newly acquired inventory purchase price is considered for the proceeding sales being made.

If units sold/issued are more than the newest/recently acquired inventory, then the units sold/issued are partly assigned the price of the newest inventory and the previously newly acquired one and so on and so on until the sold/issued units equal the units of recently acquired inventory batches.

Step three; The assigning of prices of the newest inventory to the currently sold/issued inventories continues until the unsold batch of inventory is realized whereby its valuation will again follow suit. That is the prices allocated to the unsold units of inventory will consider prices of the oldest to the newest inventory. Therefore, the old inventory is valued at old cost/purchase price.

The following illustrations will clarify this concept by using an inventory card as shown below;

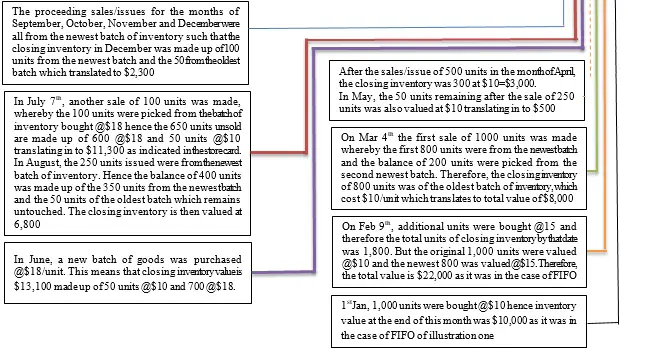

Illustration two

For comparison purposes, assume the facts of illustration one, which considered FIFO approach of inventory valuation and use it for LIFO approach as follows;

The following inventory information for Your co. ltd was presented to you by the management to determine the closing inventory value of good X for the year ended 31/12/2019

Jan 1st Purchased 1,000 units at a price of $10 per unit

Feb 9th Purchased 800 units at a price of $15 per unit

Mar. 4th sold 1,000 units for $22 on cash

Apr. 11th sold 500 units for $22 on cash

May 2nd sold 250 units for $25 by check

June 10th purchased 700 units at a price of $18 per unit

July 7th sold 100 units for $27 by check

Aug. 22nd sold 250 units for $27 by check

Sept. 19th sold 50 units for $26 by cash

Oct. 17th sold 50 units for $25 by check

Nov. 2nd sold 100 units for $30 by check

Dec. 29th sold 50 units for $30 by cash

Required

Determine the value of the closing inventory at the end of 31/12/2019 using LIFO method

Solution

According to LIFO method, the value of inventory is $2,300

Advantages of LIFO method

i) Complies to matching principle for it considers cost of closing inventory of the recently acquired goods which is compared with the sales revenue determined using current selling price in the market

ii) It is appropriate in an economic state with high inflationary rate

iii) LIFO method provides correct information about income statement and funds available

Disadvantages of LIFO method

i) In the case of raw materials, the manufacturing firms does not assume that the inventory that is used up in the factory is assigned the newest cost and this results to the recently acquired raw materials to be valued at a oldest cost/price and this approach is affected by obsolesce perspective.

ii) The value assigned to the closing inventory is far from the prevailing market price hence the balance sheet item (ie inventory-RM) is inappropriately valued

iii)It is not a good practice for it provides unreliable basis for determining cost of goods sold which cannot be compared with other subsequent periods.

iv)It is not a good approach for the purposes of preparing final accounts and statement of financial position.

4.Weighted Average Method

The weighted average method is also referred to as the moving average cost methodology. It assumes that the goods available for sale carry the same cost value especially where the items of inventory are identical. The average cost can be computed periodically or every time a new purchase is made. The weighted average method is the in-between the FIFO and LIFO approaches. Therefore, the method balances the extreme approaches of FIFO and LIFO.

Steps in Weighted Average method

The approach is the simplest one for the computation of the average cost entail;

1. Determine the total cost of all units available for sale when a new purchase is made

2. Determine the total number of units available as per no (1) above

3. Average cost

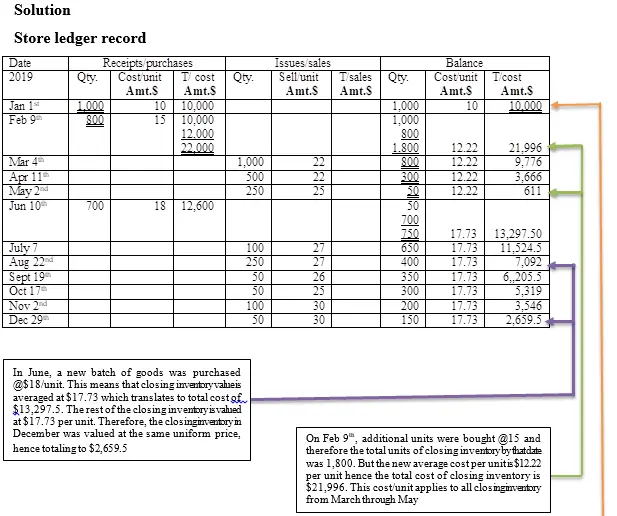

Illustration three

For this illustration, we will borrow the facts in the previous illustrations (1&2) to be able to do comparison and make general conclusions.

The following inventory information for Your co. ltd was presented to you by the management to determine the closing inventory value of good X for the year ended 31/12/2019

Jan 1st Purchased 1,000 units at a price of $10 per unit

Feb 9th Purchased 800 units at a price of $15 per unit

Mar. 4th sold 1,000 units for $22 on cash

Apr. 11th sold 500 units for $22 on cash

May 2nd sold 250 units for $25 by check

June 10th purchased 700 units at a price of $18 per unit

July 7th sold 100 units for $27 by check

Aug. 22nd sold 250 units for $27 by check

Sept. 19th sold 50 units for $26 by cash

Oct. 17th sold 50 units for $25 by check

Nov. 2nd sold 100 units for $30 by check

Dec. 29th sold 50 units for $30 by cash

Required

Determine the value of the closing inventory at the end of 31/12/2019

According to weighted average methodology, the value of inventory is $2,659.5

Advantages of weighted average method

i) The method eliminates the problem of extreme high and low inventory values determined using the FIFO and LIFO approaches respectively through the process of smoothening (ie averaging)

ii) Appropriate for identical units of goods produced or manufactured

iii) Closing inventory value is close to the current market price

iv) The method allows for easy computerization as compared to other two methods

v) Acceptable by the taxman for tax purposes

Disadvantages of Weighted Average Method

i) The approach entails determination of new weighted average value every time a new purchase is made. This results to several calculations which are tiresome

ii) Most of the average values have decimal points which may be undesirable t the entrepreneur

Summary

Chapter two is an advanced focus on preparation of ledger accounts whereby control accounts have been incorporated, provision for discount allowed was also factored in and the valuation of inventory as one of the components of current assets in the statement of financial position. This is summarized as follows;

Control accounts are ledger accounts prepared at the end of either month or year. It reflects the summation of all balances brought down for both receivable and payable accounts in every month. Therefore, with the assumption that accuracy has been maintained during accounting entry exercise, the summed up totals as indicated by the control account should be the same as the balances brought down for all subsidiary/individual ledger accounts in that period.

The balances brought down for the control accounts are of two categories, namely, the main balance brought down which is the normal balance expected for each type of control account. Such that, for sales ledger/receivable control account, the main balance brought down is of debit kind. Whereas, for the purchases/payable control account is of credit nature. This balances brought down arise due to the main activities of credit sales and purchases respectively. Secondly, there are minor balances brought down and they appear on the opposite sides of the normal main balances brought down at the end of the financial period. Such that for sales ledger control account, they are recorded on the credit side. Whereas, for the purchases ledger control account are on the debit side. These minor balances brought down are associated with overpayments either by the customer or the business in question in that order. Therefore, when this overpayment is not refunded, it results to such minor balances. This means, if timely refunding is done, such balances will not appear in the control accounts.

The entrepreneur/learner need to note that the aim of preparing control accounts is to establish the main balances to be brought down at the end of the financial period. Therefore, the preparation of the respective control accounts requires incorporating of other related transactions apart from credit buying and selling of the products of the business, which aid in adjusting the control account to arrive at the correct main balance to be used in financial statement.

To achieve this objective, the receivable control account, also known as sales ledger or total debtor control account is further adjusted using receipts from customers whether in cash or check form, discount allowed, refunds to customers, dishonored checks from customers, bad debts written off, bill of exchange receivable, returns inwards, contra entry settlements, interest charged on customer accounts due to such accounts being overdue and sometimes allowances to customers which may arise due to the business extending some benefits of reduced price in excess of discount allowed.

Similarly, for payable control account, also known as purchases ledger or total creditor control account is adjusted using payments made to creditors whether in cash or check form, discount received, refunds from suppliers, dishonored checks returned by suppliers, returns outwards, contra entry settlements, interest charged by suppliers due to payable accounts being overdue and allowances from suppliers.

Since control accounts are prepared using information from the respective personal accounts of debtors and creditors, it is only the credit transactions that are considered. Otherwise cash sales and cash purchases are supposed to be excluded in the preparation of both sales ledger control and purchases ledger control accounts in that order.

For provision for discount allowable and discount receivable cases, the focus was on the extension of allowance that a business can provide to the debtors over and above the normal discount allowed and received in that order. The major focus was on provision for discount allowable only and aimed at demonstrating how a business need to consider the fact that debtors in the future may comply with terms of sale on credit apart from the already realized discount allowed. For your information, in the discussion on this subject, we realized that discount allowed occurs when the debtor has done an actual payment of his or her debt hence discount allowed is an operating expense. For the case of provision for discount allowable, it is an estimation or allowance that the business expects either to actualize in the future hence affecting the determination of the net profit of the business. It is a provision similar to provision for doubtful debts although it is based on the net useful debtor balances at the end of the financial period.

Chapter two also tackled the issue of inventory. This is one of the components of current assets in the statement of financial position (ie balance sheet). The chapter highlighted all the aspects of inventory such as types of inventory that is handled by diverse businesses, IAS no 2 governing treatment of inventory and also the aspect of inventory valuation where four methodologies were considered.