Manufacturing accounts

This is the eighth chapter which touches a key form of business for manufacturing firms deals with activities which are of value addition. For your information, it is much relevant aspect for most small and medium enterprises purpose to be innovative by introducing new products in the market which entail actual transformation of raw materials in to finished goods. The objectives to be achieved after reading this topic are;

i). To acquint on the manufacturing model of input-output for accounting purposes

ii). To identify and categorize components associated with manufacturing

iii). To prepare production statement and manufacturing accounts

iv). To prepare trading and profit and loss account of a manufacturing organization

v). To prepare balance sheet of a manufacturing organization

Introduction to manufacturing firms

So far we have looked at several aspects of accounting records. All our concerns has been on businesses dealing with purchase and sale of finished or merchandized goods. Sometimes entrepreneurs may be engaged in production of finished goods which involves actual production process using raw materials and other necessary inputs to realize the final output. This approach is common especially where the entrepreneur want to add value to the goods he or she has acquired in form of raw materials or farm produce. For instance, an entrepreneur may opt to further process tomatoes to tomato sauce or mangoes to mango juice. This aspect calls for additional accounting information to be captured in the books of accounts of the organization.

Lesson One; Manufacturing process

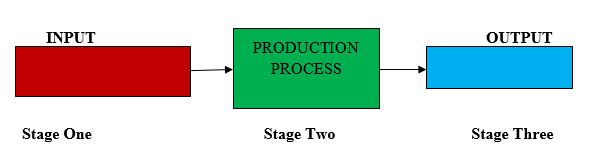

The entrepreneur/learner need to understand that the process of manufacturing involves transformation of raw materials in to finished goods which are more valuable, that is value addition process. Manufacturing process consider the input-output model whereby inputs are all manner of efforts applied or utilized so as to arrive at the final results. On the other hand, Output is the final products produced at the end of the efforts made. Therefore, the input-output production process is a three stage model whereby inputs are put under transformation process to realize final products such as finished goods or service. This model is as demonstrated below;

Explanation

Stage One

Stage one is also referred to as the input stage and it is the starting level in production or manufacturing process and it entails all resources that are used in production. The resources will vary from one category to another for it depends on the nature of goods being produced. At this stage, only inputs directly related to production of the final goods are considered. They include direct raw materials and direct labour. For instance, if an entrepreneur is planning to produce fruit juices, he/she will acquire the fruits, use water, preservatives and may be direct labour such as fruit harvesters or fruit supplier cost/price also referred to as raw material purchase price. Other direct expenses are such as transport cost of the raw materials to the destination of production also referred to as carriage inwards of raw materials.

Stage Two

This stage entails the actual production/manufacturing process hence referred to as production stage. It is the process of transforming the raw materials into finished goods or services. As it is in stage one, in this stage, there are direct costs such as labour cost such as production supervisor salary and heat and power cost. Further, there are other indirect production costs such as electricity lighting, watchman salary/wages etc.

Stage Three

This is the end result stage of the production or manufacturing process. Although it is part of the input output production model, it does not represent manufacturing perspective. This stage represents the final accounts perspective

In conclusion, stage one and two are the two stages involved in the actual manufacturing process and therefore they majorly form manufacturing accounts.

Components affiliated to manufacturing

In lesson one above, we have summarized the production process using input-output process or model. The following lessons will interrogate the in depth issues of those manufacturing and other indirectly associated components involved in actual manufacturing process. They are broadly classified in to prime cost, production overhead costs and other expenses.

Here we go…..

Lesson One; Direct Raw Materials

As the name suggests, direct raw material cost are expenses paid or incurred to acquire raw materials which are directly utilized in the production of a particular product or provision of a particular service. The common cost of such nature is purchase price of raw materials. If the materials are not homegrown for farm related products or excavated from a deposit such as quarry or any other raw material deposit, then the option of purchasing the raw materials from the suppliers is classified as direct raw material cost. This cost is directly associated with the production of the final product and it can physically be traced on the product produced.

Therefore, if the cost is a direct one, it will be proven by being straightaway identifiable. For instance,

1. Construction of a house will entail materials such as;

-Cement;

-Timber;

-Construction metals for making windows and doors

-Building blocks/bricks

-Water;

2. Cloth making will use;

-cloth fabric

-Buttons

-Threads

-Iron box

3. Making of chairs will require

-Nails

-Timber

-Wood glue

Wood ladder

Lesson Two; Direct Labour

Just as it is in the case of direct raw material cost, direct labour cost are expenses paid or incurred to employ laborers to directly organize or plan for the production of a particular product or provision of a particular service. The common cost of such nature is direct labour wages. This cost is directly associated with the production of the final product such as production machine operator or production supervisor. For instance, making of chairs or tables require;

-Hiring of carpenter wages

Making of a house require

Hiring of mason and foreman etc etc.

Lesson Three; Direct Expenses

Direct expenses are costs associated with production or manufacturing process straightaway. They include items of expense such as electric heat and power cost or any other source of heat and power used in the direct transformation of the raw materials.

Note that: Direct materials, direct labour and direct expenses is generally referred to as PRIME COST. These three categories of cost are straightaway charged in the production of the goods. That is, these cost form part of production cost of the final good.

Lesson Four; Indirect Costs

As the name suggests, the cost is partially associated with production/manufacturing of the final product. It is also referred to as production or factory overhead cost. In other words, the whole amount of cost incurred or paid by the organization may not wholly be for manufacturing purpose but for the whole organization in general. Due to the nature of this expense, it calls for apportionment or allocation of the cost in to the related sections/or departments, production department being one of them. At this level, the allocation instructions will be given in percentage or fractional form. Such cost are such as electricity lighting and other indirect labour costs associated to factory activities.

Note that: Prime cost and indirect cost form the total production cost. Therefore, the manufacturing accounts is composed of those two aspects of cost

Lesson Five; Administration Expenses

This is cost or expense incurred or paid for the whole organization. The reason we need to factor this cost is because it is incurred to ensure the day to day operations of the organization is okay, production activity being one of those operations. Sometimes, administration cost is reported together with the indirect cost although a demarcation has to be put in place to know the proportion of the total indirect cost which represent the administration cost.

Lesson Six; Selling and Distribution Expenses

This is cost or expense incurred or paid for the facilitation of selling and distribution of the goods produced. The reason we need to factor in this cost is because it is incurred to ensure the day to day operations of the organization is okay, selling and distribution of the produced goods being one of those operations. Sometimes, selling and distribution cost is reported together with the indirect cost although a demarcation has to be put in place to know the proportion of the total indirect cost which represent the selling and distribution cost.

NB: That both administration and selling and distribution expenses are considered in preparation of trading and profit and loss account or statement