Accounting for non-profit making organizations

This are no profit making firms formed by individuals who have a common characteristic such as being members of a particular setting such as a club or society.

This chapter focuses on organizations whose primary purpose of formation is to aid the welfare of its members. Since it is a unique formation, several lessons will highlight the key concerns of this kind of organization. The specific objective for this topic that an entrepreneur need to achieve is

i). To identify the diverse sources of finance for non-profit making organizations

ii). To prepare accounts related to non-profit making organization

iii). To prepare final accounts of non-profit making organizations plus its end of year adjustments

Lesson One; Background of Non-Profit Making Organization

Most organizations that are formed by the promoters have one aim of making profits. However, for non-profit making organizations, their primary aim of formation is not making profits. The main aim of forming such organizations is to aid members to achieve their welfare objectives. This implies that, these organizations still generate profits/or suffer losses for they still undertake income-generating activities. Such organizations include football affiliated clubs, sports affiliated clubs, welfare associations and any other societies such as charitable organizations.

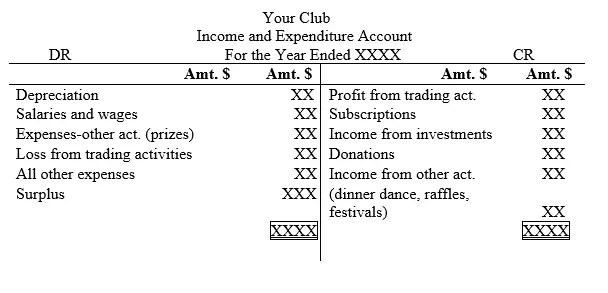

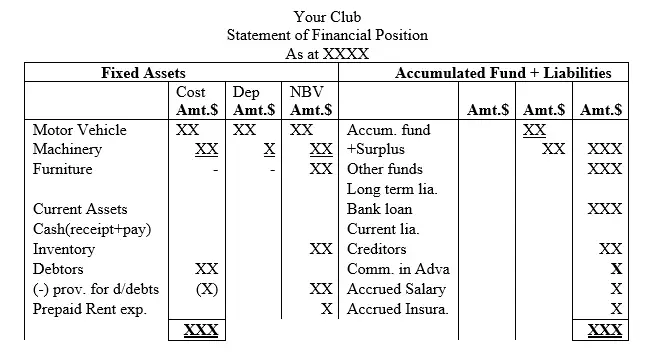

Apart from the business activities that these business undertake within the premises which use the normal ledger accounts, clubs and societies keep unique set of accounts which replace the normal ones. Such accounts include receipts and payment accounts instead of cashbook; income and expenditure in lieu of profit and loss account (also referred to comprehensive income statement) and due to the fact that such organization are financed in different ways, financing associated accounts are used such as members’ contribution if financed by members. Or donation account if funded using donations, income from investment or accumulated fund instead of capital account.

NB1: If the total income is more than the total expenditure, then the income and expenditure account will have excess income which is referred to as surplus and not net profit as it has been the case in the normal business terms we used earlier. Whereas, if the total income is less than the total expenditure, then the income and expenditure account will have excess expenditure which is referred to as deficit and not net loss as it has been the case.

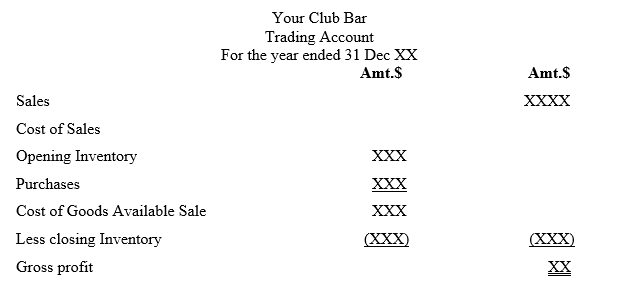

NB2: As stated earlier, if the club or society undertakes any trading activity, then an additional trading account is prepared in addition to the income and expenditure account. The net profit/(loss) gotten is posted to the income and expenditure account as other incomes or expense.

NB3: Statement of financial position is prepared as usual except a few adjustment as we shall discuss in the illustrations used. Therefore, in lesson two below is a summary of the various accounting format tailor made to suit clubs and societies

Lesson Two; General Ledger account and Financial Statement format for Clubs and Societies

NB1: In addition to the accounts and financial statements aforementioned, a club or society organization may have additional trading and profit and loss account for income generating Centre prepared separately whereby the closing surplus or deficit is closed down to income and expenditure account. The format is as shown below

NB2: Gross profit is posted to income and expenditure account if the operating expenses associated to the income generating Centre is not separated from the overall operating expenses of the whole organization. Otherwise, after determining the gross profit/loss, further deduction of operating expenses distinctly associated to the income generating Centre is deducted from the gross profit/loss amount then the net profit/loss is posted to the I&E account as indicated in the income and expenditure account aforementioned in lesson two (7.1.2) on general ledger account and financial statement format for clubs and societies.

Lesson Three: Sources of Finance for Clubs and Societies

Just as it is in the case of the normal businesses, clubs and societies are financially facilitated from different sources which commonly include, investment, specific funds, life membership fund and annual member subscription fund. This is as explained below;

i) Investments

Investment entails foregoing current consumption of an asset in form of cash to be consumed in the future. For instance, when the club acquires shares of another club or society or even sometimes securities of large organizations. Some clubs also consider investing the excess cash in zero risk investments such as treasury bills. The income generated from such investment can be used to fund the operations of the club or society. The investment income further is classified in to two; income and capital gain/(loss). Income gain is realized when money is generated through interest or dividend income. On the other hand, capital gain is realized when the investment is disposed/old.

ii) Specific Purpose Fund

This is a special fund that is set aside for a particular purpose as the name suggests. For instance, education fund is an account set aside for financing education affiliated activities such as sponsoring the members on a certain educational matter or educating the poor children. Building fund is set aside for construction purposes etc.

iii) Life Membership Fund

Members may have an option of registering to become life time members of a club. This may entail a onetime contribution other than the normal annual contribution. The amount they contribute once is spread across the number of years they will qualify to be members.

iv) Member Subscription

This refers to the annual contributions made by members. The common practice for a club or society is that members make annual contribution towards the organization. This amount is meant to retain membership and it is therefore an income to the organization. The annual contribution may be further broken into monthly amounts but the sum amount at the end of the financial period should translate in to a one year’s amount. Since this amount is an income to the organization, it is reported in the income and expenditure account at the end of the financial period.

In reality, this contribution may not be paid by the members of the club or society as supposedly hence at the end of the financial period, some might have paid the full amount, others paid an amount more than one year’s amount and others may have paid less amount than expected. Therefore, from this explanation, there are three categories of contribution that may feature in the books of accounts of a club or society, namely; per annum contribution; subscription in advance and subscription in arrears. According to accrual concept recognition of both cash and credit transactions is of great concern for the clubs and societies. In the case of a cash transaction, owner’s equity is instantly affected as cash either is received or paid. However, this concept advocates that income should not only be recognized and recorded when actual cash is received, but also when it is earned. As an entrepreneur/learner, you should know that just like the normal operation income that is generated by a business as we discussed in level two of this accounting tutorial series, end of year adjustment is necessary to determine the per annum member subscription to be charged against operating expenses of that particular financial period. The details are as explained herein.

Lesson Four; End of year Adjustments for Income and Expenditure Account Components

The components of income and expenditure account which replaces the normal profit and loss account is also subjected to both the matching principle and the accrual concept. This is the component of operating income. The Accrual Concept advocates that income should not only be recognized and recorded when actual cash is received, but also when it is earned. According to these Generally Accepted Accounting Principles (GAAP) and concepts aforementioned, the aspect of accrual should be incorporated such that member subscription incomes received and earned are considered when matching the total incomes and total expenses for a particular period of time. Therefore, the learner need to note that member subscription income earned, apart from the per annum subscription income actually received, is the amount of cash the business is expecting to receive (also referred to as member subscription receivable or debtor for member subscription) in a future date for services it had provided to the member. This is sometimes referred to as subscription in arrears. Similarly, member subscription income in advance, apart from the per annum subscription income actually received for the year, is the amount of cash the business has received for future period not yet covered (also referred to as member subscription payable or creditor for member subscription) in a future date for services it has not yet provided to the member.

To understand this perception better, cross-examine the following scenarios.

Scenario one: Accounting Treatment of Member Subscription Income

Member subscription income is society gain or returns incidentally generated or earned within a specific period of time usually one year.

Case 1: Per Annum Member Subscription

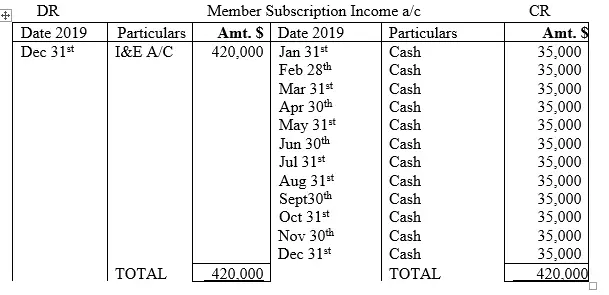

In this case, the business receives only one year member subscription income amount, whether in cash or by check. See illustration 1

ILLUSTRATION 1

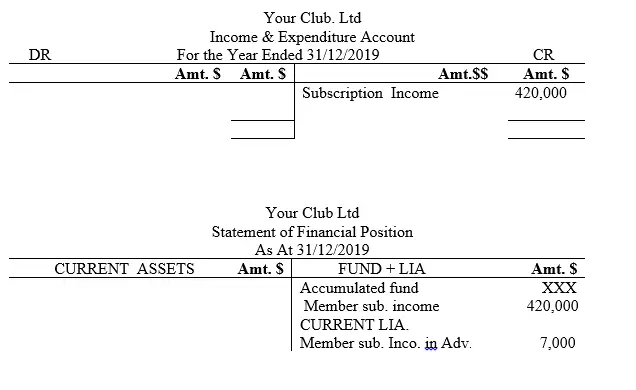

Assume that Your Club. ltd received membership subscription income of $35,000 per month in cash for twelve months for the year 2019 from twenty (20) registered members.

NB: Member subscription per month per person is $1750

Required;

i) Record the transactions in the member subscription income account

ii) Extract an income and expenditure account for the year ended 31/12/19

iii) Extract statement of financial position as at 31/12/19

Solution

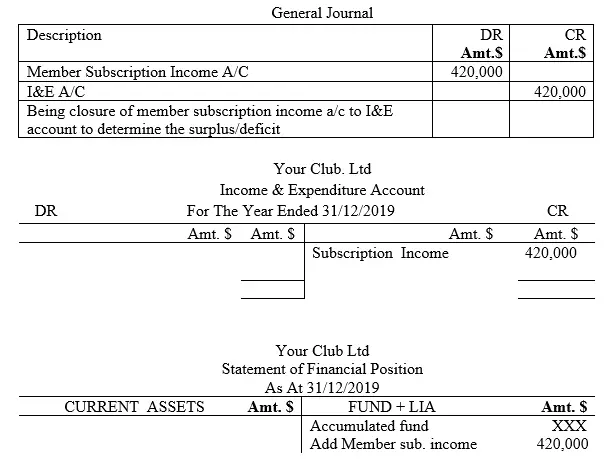

NB1: All income accounts have a credit totals. Therefore, all operating incomes are usually closed down to income and expenditure account at the end of the financial period with one year’s amounts as it is in the normal case of profit and loss account. For instance, in this case, the member subscription income account is closed to I&E a/c with $420,000. This is because in scenario one, case one the income received of $420,000 was for a period of one financial period. To understand the accounting treatment, the following journal entry is made

NB2: Although the rule of charging a one year’s amount is a general rule in accounting, in reality, the member subscription income received may either be more or less than one year’s amount. If the total income received is less than the expected one year’s amount, the amount of member subscription income not yet received is referred to as earned member subscription income and forms part of the total per annum income although not yet received at the end of the period under investigation. The earned member subscription income is also known as accrued member subscription income or member subscription income in arrears. On the other hand, if the member subscription income received in a particular year is more than one year’s amounts, the excess income received is referred to as member subscription income in advance and the extra income received is not part of that year’s income.

NB3: That the rule we have already learned in level one accounting tutorial; that all income accounts have credit TOTALS does not hold as far as the case of accrued member subscription income and member subscription income in advance scenarios are concerned. Therefore, in level three tutorial series, you will realize that an member subscription income account can assume either a debit or a credit balance brought down (b/d).

The accounting treatment of this type of transactions is twofold, that is direct and indirect approach. Therefore, the entrepreneur can opt to use either a direct or indirect accounting methodology when recording the transaction in the books of accounts.

Option One: Direct Accounting Approach

In this case, the member subscription income account is directly closed to I&E account whereby one year’s amount is charged in the respective income account as though the whole amount of member subscription income had been received by the organization at the end of the financial period. As a result, the income account will have either a debit or credit balance brought down (b/d). If it is a DR balance b/d, this represents member subscription income in arrears or accrued member subscription income hence classified as a current asset in the statement of financial position. If it is a CR balance b/d, this represents member subscription income in advance hence it is classified as current liability in the statement of financial position (balance sheet).

Option Two: Indirect Accounting Approach

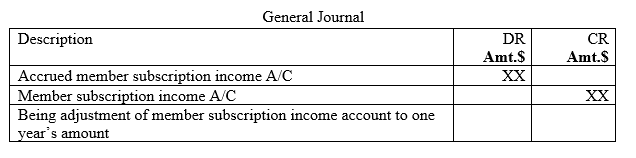

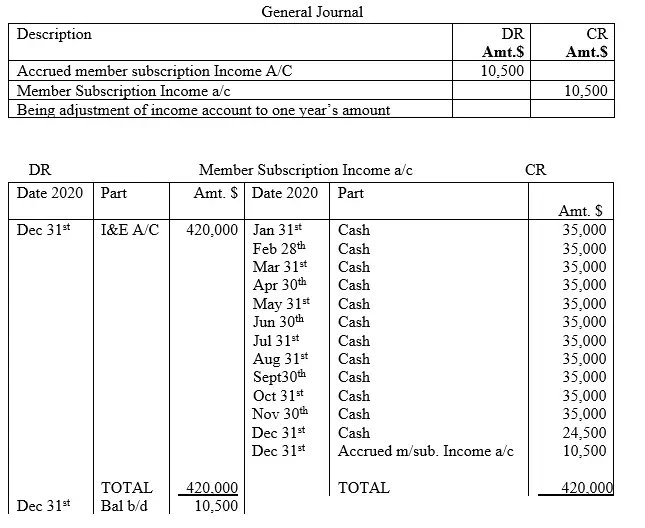

In this case, a new account is introduced to record either the amount in shortage or in excess of what is expected in that particular year. If it is a case of accrued member subscription income, a corresponding accrued member subscription income account is opened whereby the amount needed to fill one year’s income is posted in this account and at the same time recorded to the respective income account. Using a general journal, this process can be demonstrated as follows;

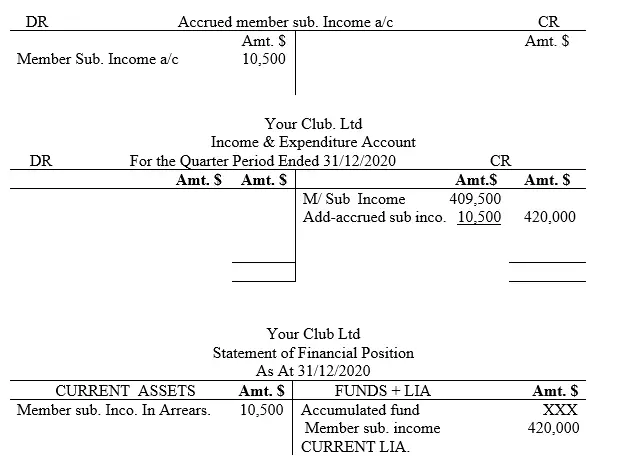

After creating a new accrued member subscription income account, double entry is made as shown in this general journal hence making the member subscription income account reflect a whole year’s amount. At this point the account is closed down to I&E account. For the new accrued income account, it represents a current asset hence posted to the statement of financial position at the end of the financial period.

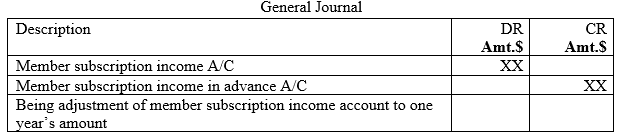

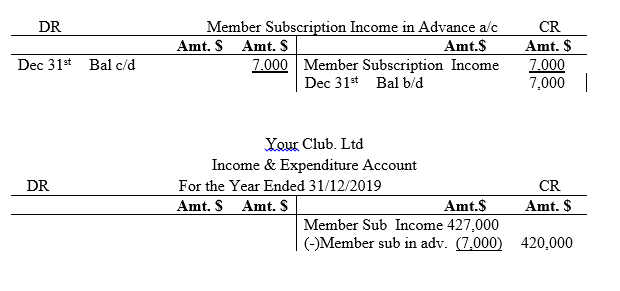

On the other hand, if it is a case of member subscription income received in advance, a corresponding member subscription income in advance account is opened whereby the excess amount over and above the year’s member subscription income is posted in this account and at the same time recorded to the respective income account so as to adjust it to reflect one year’s income. Using a general journal, this process can be demonstrated as follows;

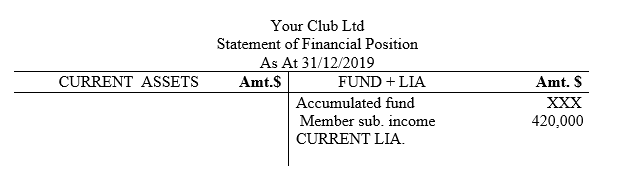

After creating a new member subscription income in advance account, double entry is made as shown in this general journal hence making the income account reflect a whole year’s amount only. At this point the account is closed down to I&E account. For the new member subscription income in advance account, it represents a current liability hence posted to the statement of financial position at the end of the financial period.

Case 2: Member Subscription Income in Advance

In this case, we will focus on income received in excess of the expected one financial period’s income. The following illustration 2 demonstrates the accounting treatment

ILLUSTRATION 2

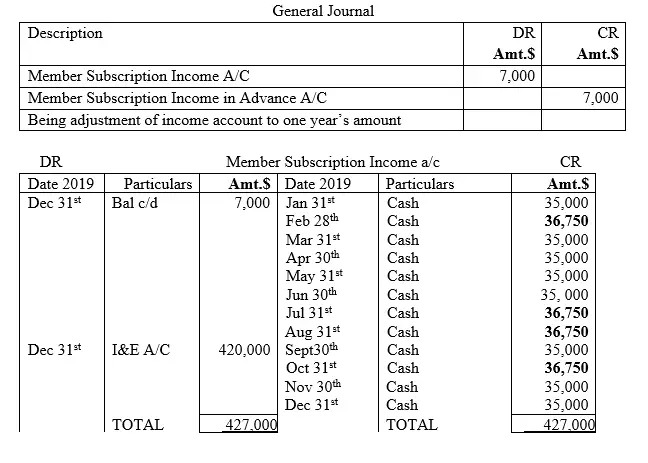

Suppose Your Club. ltd has 20 members contributing $1750 per person for each month and by 31/12/2019, cash received as member subscription income was $427,000?

Required;

i) Record the transactions in the member subscription income account

ii) Extract a I&E account at the end of the year 31/12/2019

iii.) Extract a statement of financial position as at 31/12/2019

Solution

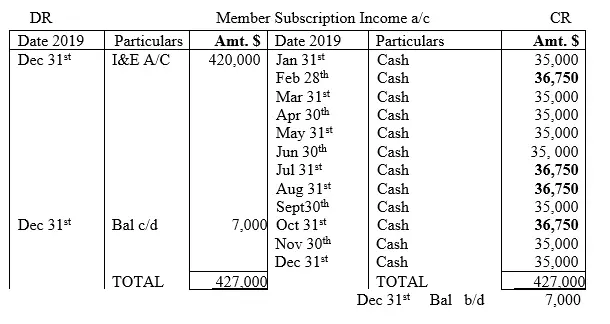

NB: The entrepreneur/learner need to understand that, sometimes a member or more than one member may decide to pay more money for subscription than it is required. May be for his or her own convenience in the future. When this happens, it means that the extra cash received should be excluded from the year’s annual member subscription income for this amount belong to the next financial period. It is referred to as member subscription income in advance. In this illustration three aforementioned, where the member has paid more than the month’s amount, that amount is bolded. In regard to this case, the amounts of the month of February, July, August, and October are bolded to distinguish them from the rest of months where normal member subscription income was received.

Therefore, as a result, the club received $427,000 in cash by the end of the year. The accounting treatment therefore is as follows,

Option one: Direct Accounting Approach

Option two: Indirect Accounting Approach

Journal Entries

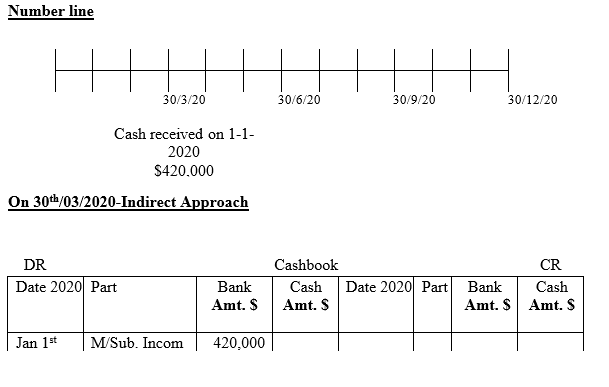

Special Case 3: Member Subscription Income in Advance

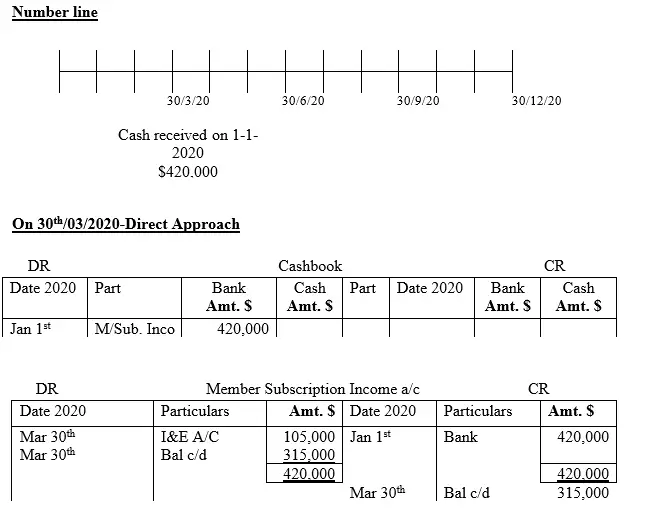

Sometimes members may pay their subscription in the beginning of the year. This implies that the organization has received cash before providing any service to its members and of course this is usually the case only that by the time books of accounts are being prepared, the subscription income received in the beginning of the year is already accounted for and the element of income in advance may not be traced at this point. Otherwise, if the organization has to prepare interim account like on quarterly or semi-annual basis, the accounting treatment will expressly imply income in advance as long as the year has not ended. The following number line used in illustration three (3) will aid in demonstrating this perspective.

ILLUSTRATION 3

Assume that Your Club. ltd received membership subscription income of $35,000 per month by check for twelve months for the year 2020 from twenty (20) registered members on 1st/01/2020.

NB: Member subscription per month per person is $1750 and books of accounts are usually prepared on quarterly basis. That is on 30th/4/2020; 30th/6/2020; 30th/9/2020 and 31st/12/2020

Required;

i)Record the transactions in the member subscription income account in quarterly basis as stated above

ii) Extract an income and expenditure account for the periods ended in quarterly basis as stated above

iii) Extract statement of financial position in quarterly basis as stated above

Hint: In this question, we will consider both approaches. ie Direct and Indirect methodology

Solution

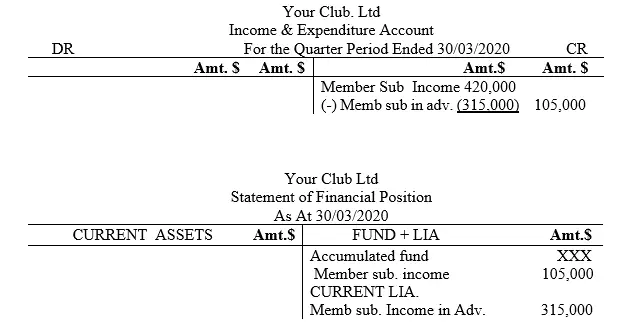

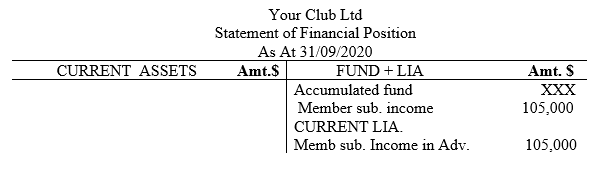

The solution for this question will be pegged on the direct approach where by the balance brought down (bal b/d) on the credit side of member subscription account will represent income in advance.

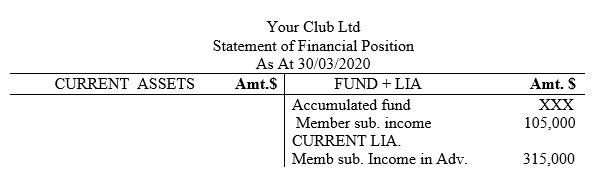

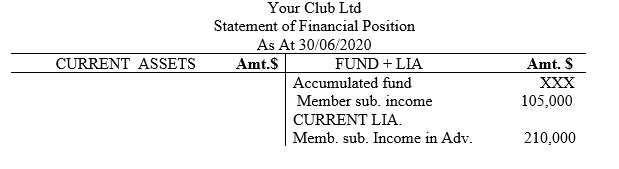

NB: You see, the amount that has been charged to I&E account is $105,000 as per the FIRST quarter of the financial year which ended on 30th/03/2020. The balance of $315,000 represents member subscription income in advance which is classified as current liability in the books of accounts of the organization.

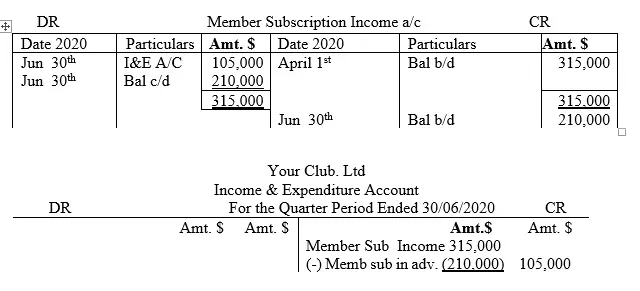

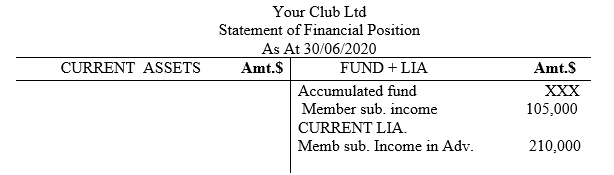

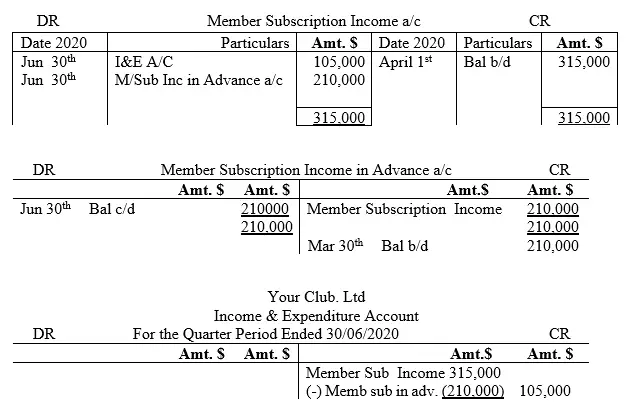

On 30th/06/2020-Direct Approach

NB: You see, the amount that has been charged to I&E account is also $105,000 as per the SECOND quarter of the financial year which ended on 30th/06/2020. The balance of $210,000 represents member subscription income in advance which is classified as current liability in the books of accounts of the organization.

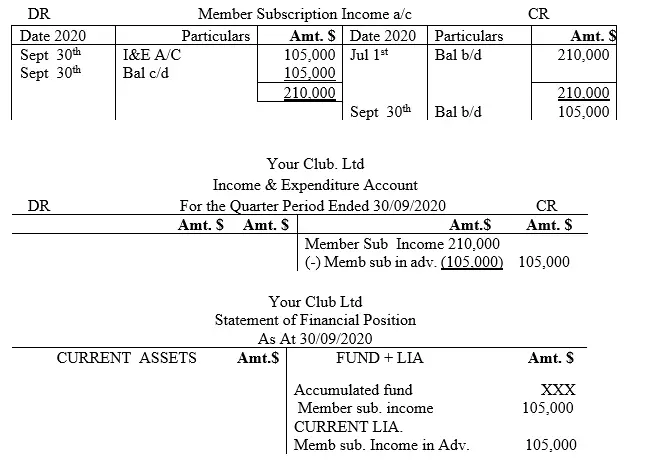

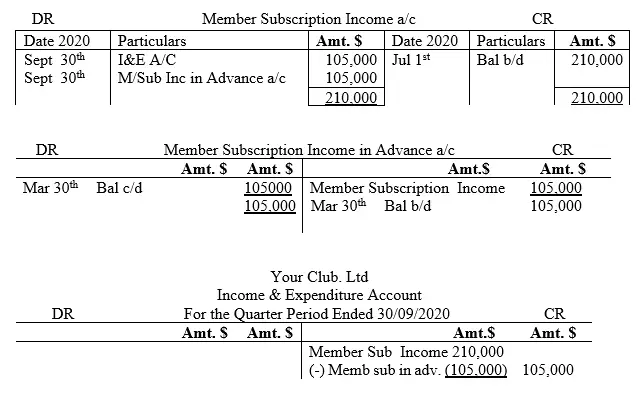

On 30th/09/2020-Direct Approach

NB: You see, the amount that has been charged to I&E account is also $105,000 as per the THIRD quarter of the financial year which ended on 30th/06/2020. The balance of $105,000 represents member subscription income in advance which is classified as current liability in the books of accounts of the organization.

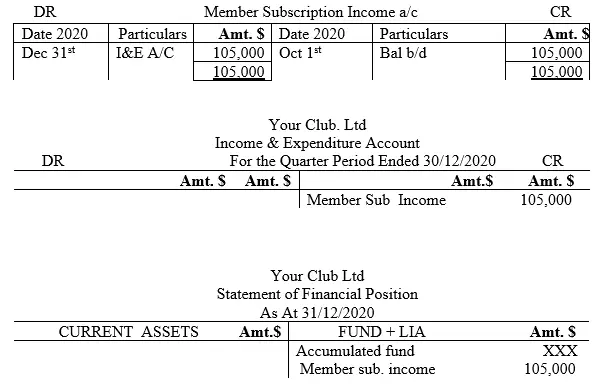

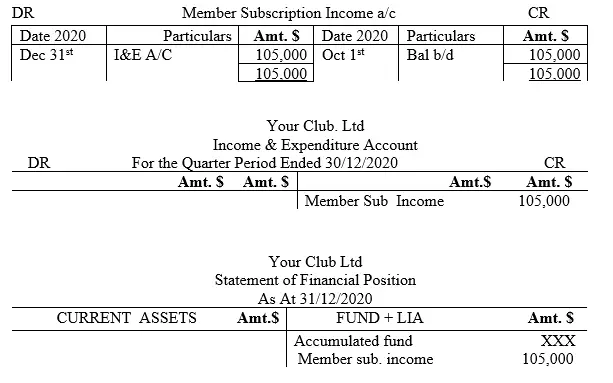

31st/12/2020-Direct Approach

For the direct method of preparing the ledger accounts, we do not introduce income in advance account. On the other hand, the indirect approach, we bring on board the income in advance account where we post the amount contributed in advance. The account falls under current liability class. Although in a nutshell, the recording of those transactions are the same, the difference is on the accounts used to record the transactions. To demonstrate this aspect, the same illustration is solved using the indirect approach as demonstrated below

Solution

NB: You see, the amount that has been charged to I&E account is $105,000 as per the FIRST quarter of the financial year which ended on 30th/03/2020. The balance of $315,000 represents member subscription income in advance which is classified as current liability in the books of accounts of the organization.

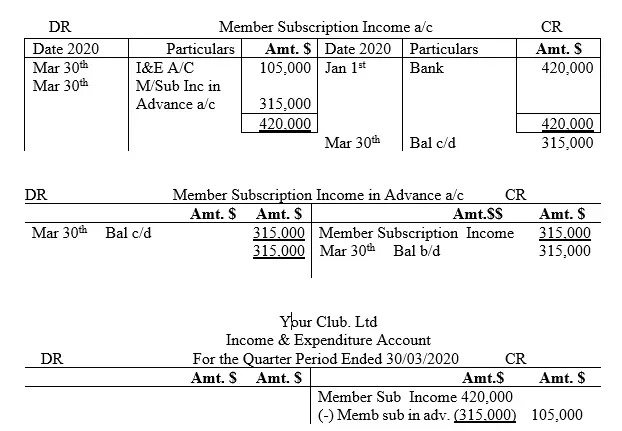

On 30th/06/2020-Indirect Approach

NB: You see, the amount that has been charged to I&E account is also $105,000 as per the SECOND quarter of the financial year which ended on 30th/06/2020. The balance of $210,000 represents member subscription income in advance which is classified as current liability in the books of accounts of the organization.

On 30th/09/2020-Indirect Approach

NB: You see, the amount that has been charged to I&E account is also $105,000 as per the THIRD quarter of the financial year which ended on 30th/06/2020. The balance of $105,000 represents member subscription income in advance which is classified as current liability in the books of accounts of the organization.

31st/12/2020-Indirect Approach

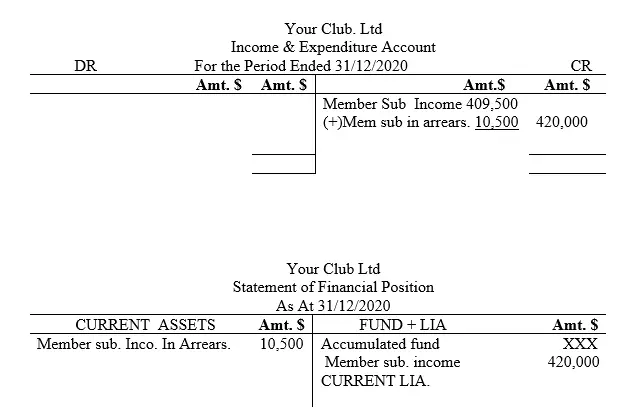

Case 4: Accrued Member Subscription Income

Accrued member subscription income is earned income. It is income that has been generated by the organization but cash associated to that income is not yet received by the time the year comes to an end. It is also referred to as member subscription income in arrears and it is classified as a current asset for it represents cash yet to be received by the club or the society in the future.

ILLUSTRATION 4

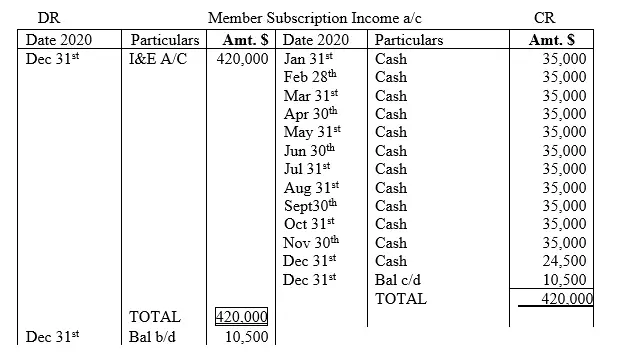

Assume that Your Club. ltd received membership subscription income of $35,000 per month in cash for eleven(11) months for the year 2020 from twenty (20) registered members. Due to COVID-19 pandemic, only fourteen (14) members of the club managed to pay full membership contribution by 31st/12/2020

NB: Member subscription per month per person was $1750

Required;

i)Record the transactions in the member subscription income account

ii)Extract an income and expenditure account for the year ended 31/12/20

iii)Extract statement of financial position as at 31/12/2020

Solution

Option one: Direct Accounting Approach

Option Two: Indirect Accounting Approach

Journal Entries

Summary

The topic of non-profit making organization afore mentioned is an interesting aspect in the business frontier for most of the businesses formed target maximization of profits. Contrariwise to that approach, the non-profit making organization as said earlier does not consider making profits per se’ although such organizations can establish income generating projects such as a shop, bar and restaurant and so on.

Non-profit making organizations are owned by members who become owners through their per annum or life time contribution. The contributions made can further be classified in to special purpose fund such as education fund, building fund and others categories based on the task to be undertaken. The contribution made form part of accumulated fund which is used for the financing of the organization.

The accounting perspective of a non-profit making organizations are slightly different from the other organizations for there are some alterations. But basically, the accounting format and the accounting treatment of most accounting items is similar to any other business. One unique component that deviate from the normal business is the member contributions which are paid on monthly or yearly basis. The contribution can be paid by members in the beginning of the financial period, or in arrears. In such a case, the accounting treatment is the same as that of any other business for advance and arrears contributions are treated as current liabilities and current assets in the balance sheet. Further, the preparation of respective financial statement is the same as the normal business cases.