Partnership accounts

This is one out of the many forms of businesses established in the market. Its formation is unique as compared to the other business categories. The specific objectives of this concept is

i). To be able form a partnership by acquitting on the formal documents required

ii). To familiarize on the types of partners that can form a partnership

iii). To prepare relevant accounts associated with partnership

iv). To prepare final accounts of partnership

Formation of partnership

In this chapter, we will first introduce the key terminologies as used in partnership. The term partnership originates from the word “partner” which is a party or a couple in agreement over a certain matter. Therefore the term partnership refers to a relationship that exists between two or more persons to undertake a certain task to achieve a common goal such as making profits especially in the case of an association which entails activities related to business.

Lesson One: Background of Partnership

In the previous levels of this accounting tutorials, our focus was on micro, small and medium businesses which are commonly owned by individuals known as sole proprietors or family members. However, sometimes the owner of the business may wish to expand the business and one way of doing so is to form partnerships. The reasons behind such formations are manifold as stated herein;

Reasons of partnership formation

There are manifold reasons that drive formation of a partnership. Some of those are as follows;

1). Increasing of the capital base; a sole proprietor operates at a small scale due to capital limitations. To synergize in terms of cash availability, he or she can engage some other persons with common interest by jointly contributing capital towards financing of the business

2). Increasing of market share; when the business expands due to coming together of two or more persons, the number of customers loyal to the products of the bigger company are more. The larger the business the more confident are the end users of its products

3). Managerial advantages; due to enlargement of the business through increased capital base, it becomes possible to engage qualified professionals such as managers, accountants, human resource managers just to mention but a few. This advantage is commonly referred to as managerial economies of scale.

4). Mitigating of operational risks; a large organization is strong in many ways as compared to a small one such as sole proprietorship. The bigger the organization, the less the risk of closure

5). Increased profitability; the bigger the organization, the more the profitability or increase in financial performance.

Formation of a Partnership

Since a partnership is an agreement between two or more persons, the agreement should be authentic hence the need of formalizing the terms and conditions of engagement. Therefore, this objective is achieved through preparation of a partnership deed. A partnership deed is a written document which outlines how the partnership will be operated and also the role played by each member.

Contents of Partnership Deed

A partnership deed has the following contents;

The names and postal address of the partners

Capital contribution by every member of the partnership

Profit and loss sharing ratios

Remuneration or salary for active partners

Interest paid on capital contributed which is based on the capital base for each partner and it is expressed in percentage form

Interest charged on withdrawals made by partners which is based on the withdrawal amount taken by a particular partner and it is expressed in percentage form

Procedure to be adhered to in case of admission of a new partner, dismissal of an old partner or dissolution of a partnership

Membership

A partnership has a minimum of two (2) persons and a maximum of fifty (50). This is the case unless the partnership involves professionals such as accountants, lawyers, engineers, medics. In such a case, the maximum number is twenty (20).

Types of partners

There are various types of partners in a partnership but the most common ones are as follows

Active Partner

An active partner is the one who contributes capital towards the start of the partnership and further plays a key role in the day to day running of the partnership business. For instance, he or she can be the managing director in the partnership or the accountant or can undertake any other responsibility for the sake of furthering the partnership business. In other words, he/she represents the other members of the partnership. The active partner is usually rewarded a salary to commensurate his/her services to the partnership. He also enjoys interest on capital he/she has contributed and enjoys profits and suffer losses in the agreed ratios respectively.

Inactive Partner

This is the opposite of the active partner we have just discussed. As the name suggests, inactive partner is the one who contributes capital towards the start of the partnership but does not play any key role in the day to day running of the partnership business. In other words, he/she does not represent the other members of the partnership in any specific role. Sometimes referred to as sleeping or dormant partner. This partner enjoys interest on capital he/she has contributed and enjoys profits and suffer losses in the agreed ratios respectively.

Nominal Partner

This is a person whether natural or artificial who qualifies to be a partner of a partnership by the virtue that he or she has allowed his name to be used by the partnership. This means that he/she does not contribute any capital but he allows his fame or good name or reputation to be used by the partnership so as to excel in the market. This means that, this partner does not enjoy any profits or suffer losses for he/she has not contributed any capital. A nominal partner does not have any actual or key concentration in the partnership firm. In other words, he is only lending his name to the firm and does not have any role to play in management of the partnership.

Partner by Estoppel

An estoppel partner is a partner by the virtue that he displays by his or her words, physical action or conduct that he is one. By the fact that he has presented himself/ herself in the manner that he is a partner in that particular partnership, then he qualifies to be one. Sometimes we say he/she is a partner by holding out. In such a scenario, this persons becomes liable to the credits and loans of the partnership although he/she has not contributed any amount of capital toe the partnership.

Partner in Profits Only

As the name suggests, this type of partner enjoys profits generated by the partnership for allowing his/her goodwill to be used by the firm. In other words, he does not suffer losses when the firm is underperforming as it is in the case of other partners. Such a partner does not participate in management decision making

Minor Partner

The law of the land in any country allows minors to become partners. Such persons are the individuals who have not attained the majority age as of that country. Each country has guidelines on how to deal with a minor partner.

Secret Partner

This is a partner who is a bona fide partner/member of the partnership for he/she contributes capital and share profits and losses like any other partner only that his identity is kept in secret from the public domain

Incoming Partner

This is a partner who is joining an existing partner based on the agreement set. For example, an incoming partner may come in by paying some capital or goodwill. For an incoming partner to be accommodated, the old partnership has to dissolve and a new one formed. In accounting, such an act is incorporated in books of accounts.

Outgoing Partner

This is a partner who is leaving/exiting an existing partner based on the agreement set. For example, an outgoing partner may leave the partnership with set terms and conditions. For an outgoing partner to leave, the old partnership has to dissolve and a new one formed whereby the exiting partner is excluded. In accounting, such an act is incorporated in books of accounts.

Limited Partner

This is a partner whose liability is limited to the capital amount he/she has contributed. That is, in case the partnership makes losses, then the amount of cash this partner contributes towards making good the debts to be cleared will be up to the capital he contributed and therefore this means that if the partnership has fully utilized the capital available, this partner will not use his/her personal cash or property to assist the partnership in paying the debt. A limited partner is a partner whose liability is only up to the extent of his contributions for the capital of the partnership firm.

Quasi Partner

This is somebody who initially was a member of the partnership but quits the partnership leaving his/her share capital to be used as source of finance to the business. Therefore, by the virtue that his capital is still in use in the partnership, he or she is liable to all debts.

Lesson Two; Accounting for Partnership

Partnership accounting is similar to sole proprietorship accounting except that ownership of the business involves two or more personalities. Therefore, when one is preparing the financial reports, those parties should be incorporated. There are several unique types of accounts and financial statements that are utilized in partnerships. They include, partner’s capital account, partner’s current account, partner’s drawing account, partner’s interest on capital and drawings accounts respectively. Partnerships use the same financial statements as it is in the case of the other businesses discussed earlier only that an additional profit and loss appropriation account is prepared to aid in appropriation of profits or losses among other items. In the proceeding sections/sub-titles, they will involve interrogation of each account aforementioned, how to prepare them, their format, accounting treatment and their role in presentation of financial affairs of such businesses.

a). Partners’ Capital Account

When partners contribute capital to start a partnership business, the amount contributed is recorded in the partnership capital account. That is, this is a onetime contribution although partners may contribute more capital in the future. Due to the onetime capital contribution, the partners’ capital account is referred to as fixed capital account. This account represents the permanent interests of each partner. Further, the level of interest is determined by the amount of capital contribution such that the more one has interest in the partnership the more the capital contribution he or she makes. On the other hand, a partner with lesser interest will also contribute less capital towards the partnership. This is the reason why all the partners has to state categorically in the partnership deed the ratio of capital contribution. Therefore, the bigger the ratio the more the interest the partner has towards the partnership as we has observed earlier.

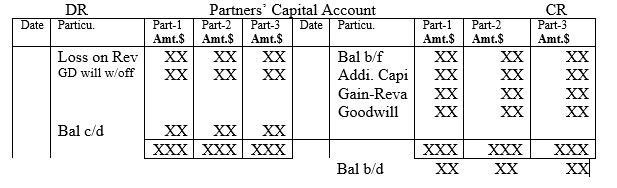

The amount of capital contribution made by the partners is usually recorded in capital account referred to as partners’ capital account. This re-naming does not change the original purpose of this type of account and the accounting treatment is the same as that of the sole proprietorship. The format of partners’ capital account is as shown below

Summary of Accounting Treatment of partners’ Capital affiliated Items

On capital contribution by the partners;

DR Cash/Bank or otherwise

CR Partners’ Capital Account

On contributing additional capital

DR Cash/bank or any other resource

CR Partner’s Capital Account

On making gain on fixed asset revaluation

DR Fixed asset a/c

CR Partner’s Capital a/c

On making loss on fixed asset revaluation

DR Partner’s Capital a/c

CR Fixed asset a/c

On realization of good will-either on entry or exit of a partner

DR Good will a/c

CR Partner’s Capital a/c

On writing off good will

DR Partners’ Capital a/c

CR Good will a/c

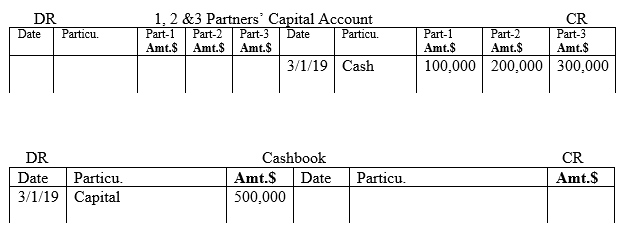

ILLUSTRATION ONE

On 3rd/1/2019, partners one, two and three started a partnership business by the name 1-2-3 partnership with partner one contributing $100,000, partner two $200,000 and partner three $300,000 in cash. This transaction is recorded in the books of accounts as follows;

1. Partners’ Interest on Capital

When partners contribute capital, it implies that they have invested their financial or non-financial resources with an anticipation of getting some returns which is in many forms such as dividends or interest on capital. This interest represents the forfeited current benefits (opportunity cost) with expectation of a gain in the future. The interest paid to the partners is a gain to them although it is a cost to the partnership itself. Again the interest on capital gotten broaden the capital base of the partners. Hence, the original capital will grow with time purely due to interest generated. Computation of interest on capital is based on a certain percentage of the existing capital.

When interest on capital is generated, it is recorded in the book of accounts as follows;

When partner(s) interest on capital realized at the end of financial period, it becomes a liability to the partnership hence credited to the partners’ current account and debited in the appropriation of profit and loss account as follows;

DR Appropriation of Profit and Loss account.

CR Partners’ current account

2. Partners’ Drawings

This is the amount of drawings made by the partners in the course of the financial period. Interest on drawing is also recorded herein.

When partners withdraw cash or otherwise, the accounting entries made are as follows;

DR Partners’ current account

CR Cashbook or the respective resources

NB: That withdrawal of cash or any other form of resource leads to an adverse effect to the current account of that particular partner.

3. Partners’ Interest on Drawings

Partners has a right to withdraw some of their capital and since the amount withdrawn is no longer a source of finance to the partnership, then interest is charged. The interest on drawing is based on the amount of capital withdrawn.

On charging interest on drawing;

Dr. Partner’s current account

Cr. Appropriation P&L Account

4. Partners’ Salary

Amongst the types of partners we have discussed earlier is the active partners. An active partner is a member of the partnership who plays additional role other than being a partner. For instance, he/she can be the accountant, manager, salesperson or any other key role in the day to today operations of the partnership. Such roles are rewarded in terms of salary. The payment made is charged to cashbook and in the appropriation and profit and loss account.

Hence;

On payment of salary;

DR Partner’s Salary a/c

CR Cashbook

At the end of the financial period;

DR Appropriation P&L account

CR Partner’s Salary

5. Partners’ share of Profit and losses;

When profit/loss is realized after charging all the items of number 1-5 above, then the excess income or loss is shared amongst the partners as per their profit/loss sharing ratio. In this case, the accounting entry is as follows;

DR Appropriation and Profit and Loss a/c

CR Partners’ Current a/c

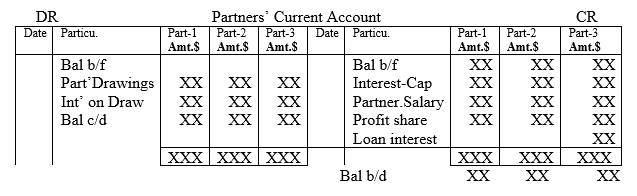

b). Partners’ Current Account

NB1: That the balance brought forward or down can be both a credit and also debit entry for some of the partners may have overdrawn their capital amount. In case of termination of the partnership, the rule of Garner and Murray will apply always.

NB2: The loan interest indicated on the credit side of the current account arise when a partner has lend a loan to the partnership. The same item will appear on the debit side especially when the partner has borrowed from the partnership.

6. Loan to a Partner

Sometimes the partnership in its capacity as an organization can extent loan to one of its members either with or without interest. Such a transaction is categorized as an investment and should be treated as so. Therefore, when a partner borrows, the accounting entries are as follows;

On lending the partner;

Dr. Loan to a Partner

Cr. Cashbook/or respective asset a/c

On charging interest on the loan

Dr. Partner’s current a/c

Cr. Appropriation P&L Account

7. Loan from a Partner

If the partnership borrow from a partner, this activity can either be referred to as internal or external borrowing depending on the type of partner. Whichever way, such transaction should be incorporated in the books of account of the partnership. To understand this concept in a better way, let us consider diverse options of borrowing;

i) Borrowing from an existing partner

If the partnership borrows from an existing partner, then loan from a partner is created just like in the case of external borrowing. The accounting entry is as follows;

Dr. Cashbook XXX

Cr. Loan from a partner A/C XXX

On the partner realizing interest against loan he/she has extended to the partnership

DR Appropriation P&L a/c

CR Partner’s current a/c

NB: The partners’ current account is dynamic hence it is said to be flexible. The entrepreneur need to understand that, partners can maintain the two accounts separately or jointly. If maintained separately, the same accounts appear in the statement of financial position independently. However, if the partners decide to combine the two accounts, then the current account is closed down to the partners’ capital account.

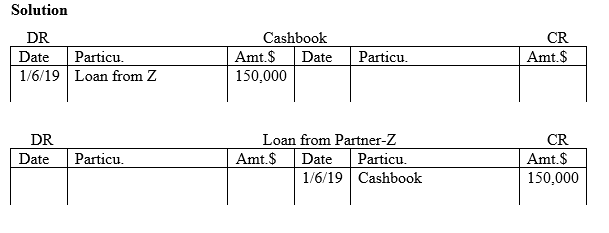

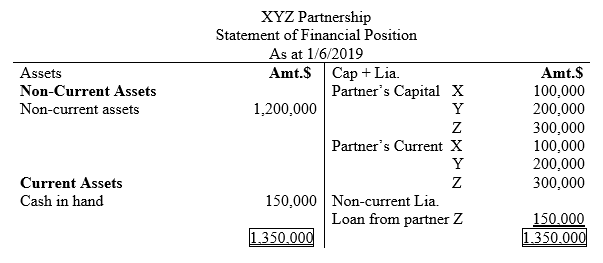

ILLUSTRATION TWO

1st/1/2019, X, Y and Z who had formed a partnership by the name XYZ partnership had both capital and current account balance brought down as shown below

Capital account Amt. $

X 100,000

Y 200,000

Z 300,000

TOTAL 600,000

Current account Amt. $

X 50,000

Y 100,000

Z 150,000

TOTAL 300,000

Additional information

On 1st/6/2019, partner Z extended a loan of $150,000 to the partnership in cash, repayable in five years period. Interest was payable on semi-annual basis at 5% of the principle amount

Total non-current assets $1,200,000

Required

a) Show the accounting entry in the relevant books of account

b) Prepare statement of financial position as at 1st/6/2019

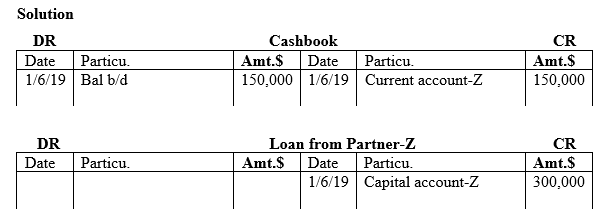

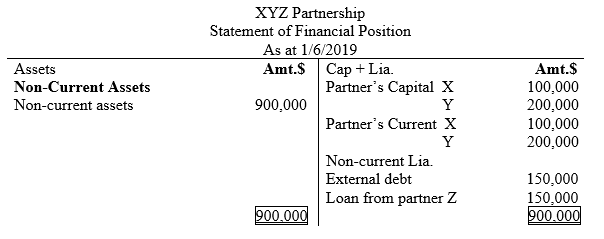

ii) Borrowing from a Retired Partner

When a partner leaves the partnership either due to retirement reasons, he or she is no longer a member of that partnership and therefore should be refunded his or her capital. This implies that the capital of this particular partner stops being a source of financing to the partnership. Alternatively, the partners may agree that the resigning partner should convert his or her capital contribution to be a loan to the partnership. In such a case, the credit amount in the current account is refunded to the exiting partner and the capital account converted to a loan. Illustration three portrays this concept

ILLUSTRATION THREE

Assume the previous example of illustration one where by on 1/6/2019 the partners agreed that the current account balance brought down (bal. b/d) for partner-Z should be refunded to him and his capital converted into a loan attracting a per annum interest of 7%.

Required

Show the necessary accounting entry and statement of financial position as on 1st/6/2019

Solution

Remember that the case was as follows;

1st/1/2019, X, Y and Z who had formed a partnership by the name XYZ partnership had both capital and current account balance brought down as shown below

Capital account Amt.$

X 100,000

Y 200,000

Z 300,000

TOTAL 600,000

Current account Amt. $

X 50,000

Y 100,000

Z 150,000

TOTAL 300,000

Total external debt $150,000

Additional information

On 1st/6/2019, the partners agreed that on retirement of partner Z, the current account balance brought down (bal. b/d) for partner-Z should be refunded to her in cash and her capital converted into a loan attracting a per annum interest of 7%.

Total non-current assets $900,000 and cash in hand $150,000

Required

a) Show the accounting entry in the relevant books of account

b) Prepare statement of financial position as at 1st/6/2019

NB: The entrepreneur/learner need to note that the treatment of loan from a partner depends on the agreement set. So, there is no specific way of dealing with this matter and therefore we cannot cover all aspects pertaining such loans from a partner.

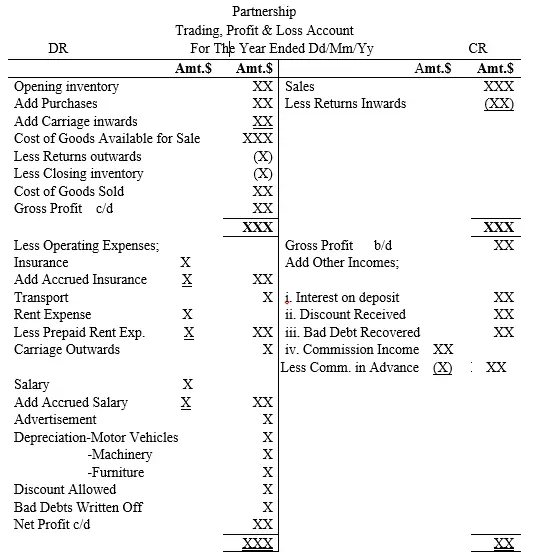

8. Partners’ Comprehensive Income Statement

The comprehensive income statement that is prepared in partnership is similar to the one prepared in the normal business of a sole proprietor or large organizations. However, as it is in large organizations, the entrepreneur/learner need to note that this profit and loss account statement is prepared with one sole purpose of comparing the total business income and business expenses so as to establish the net profit or loss for the financial period.

Note one: Nature of business expenses

Business expenses are activities that involve actual cash outflow whether immediate or in the future. When we talk of actual cash out flow now or in the future, we imply that cash flows from the business as an entity or artificial persons to a third party who is totally an outsider such as trade creditor, employee or other persons. This does not include the directors or partners of a partnership. Examples of such expenses are; loan interest, employee salary, electricity, insurance, advertisement, capital loss due to fixed asset disposal, discount allowed, bad debts written off and airtime expenses etc. Therefore, the entrepreneur/learner need to understand that in the case of business expense, the cash payment is done by the business to a third party.

Note two: Nature of business income

On the other hand, business income are activities that involve actual cash inflow whether immediate or in the future. When we talk of actual cash inflow, we imply that cash flows from a third party who is totally an outsider such as trade creditor or other persons in to the business as an entity or artificial persons. This does not include the directors of the company or partners of a partnership. Examples of such incomes are; interest from overdue trade debtor accounts, interest from an investment, capital gain due to fixed asset disposal and discount received etc.

Therefore, the entrepreneur/learner need to understand that in case of business income or gain, the cash receipt is done by a third party to the business.

Note three: Nature of business provisions

Apart from the actual cash outflows, there are other items that are affiliated to profit and loss account statement, commonly referred to as statement of comprehensive statement. These are provisions. Expense provisions are allowances that are created to take care of cases of either overstating or understating the net profit of the business. Although these provisions/allowances are charged in the profit and loss account as if they are business expenses, they do not entail actual cash outflow as it is in the case of business expenses. But already we have seen the reason as to why we treat such items in that manner.

Key note: The entrepreneur/learner in conclusion should comprehend that the sole purpose of preparing trading account, profit and loss account is to establish the gross profit/(loss) and net profit/(loss) at the end of the financial period. So, the expected end results in this endeavor is either profit or loss generated or suffered by the business.

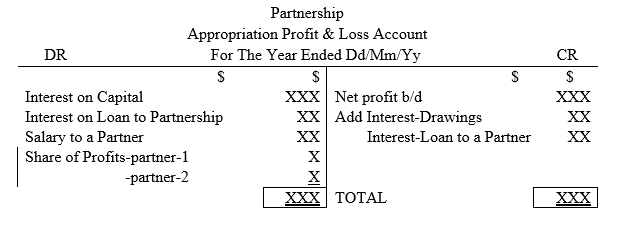

9. Partners’ Appropriation of Profit and Loss Account

Appropriation of profit and loss account is a financial statement that is prepared after comprehensive income statement/profit and loss account. The term “appropriation” is used to imply, first; distribution of business resources, whether financial or non-financial to insiders of the business. Insiders are the owners of the business such as directors who may have full or partial shareholding or partners in a partnership setting. Examples of such appropriations/distributions are salary to a partner, interest paid to a partner due to capital contribution he/she has made, share of profits/loss also referred to as dividends, interest of loan from a partner or Second; the internal generation of income from the owners of the company or partnership such as interest on drawings by a partner or loan interest from a loan extended to a partner/director by the partnership.

Therefore, at the end of the financial period, there are three financial statements to be prepared, namely; trading and profit and loss account, appropriation of profit and loss account and statement of financial position although this last statement I have mentioned will be explained in the next step. So, this is what we should master, that we first prepare the trading and profit and loss account to determine the net profit or loss at the end of the financial period and then transfer the net profit/loss to the appropriation account to do further adjustments using the items discussed earlier. The format and the content of these two statements are as illustrated below;

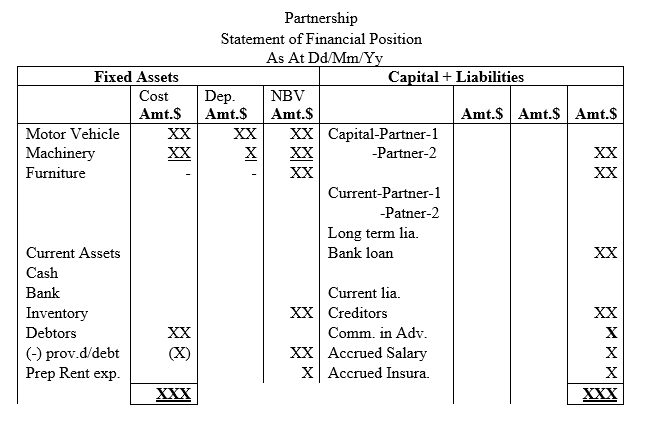

10. Partners’ Statement of Financial Position

Partnership statement of financial position is similar to the normal business only that there is an additional category for partners’ capital account and current account respectively. The format is as shown below

Summary

Partnership business is the next level of business as pertains size after sole proprietorship. Its ownership structure involves two or more persons who join their efforts in terms of capital contribution and other aspects such as new ideas and market share. A partnership is assumed to be larger than a sole proprietorship although this may not be true all the time.

After formation of a partnership, the members has to adopt a partnership deed which guide all members and third parties on how the business is run. The partnership deed specifically provide guidelines on accounting procedure as we have discussed. Therefore, the accounting approach used differ a bit from that of sole proprietorship for in this case, a demarcation for partners’ capital and drawings is provided.

Additional current account is created to take care of frequently transacted activities such as share of profits, drawing interest, interest on capital and salaries paid to partners. One thing as an entrepreneur/learner you need to know is that for the trading and profit and loss account, the approach is as the one for the normal businesses.