Preparation of manufacturing accounts

The focus of this part three is majorly the preparation of manufacturing accounts to demonstrate the components of manufacturing and the accounting treatment of several manufacturing items.

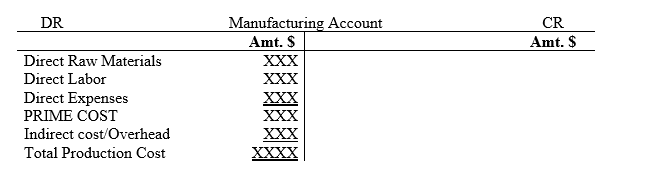

Lesson One; Manufacturing Account

Manufacturing account is a ledger account used by manufacturing firms for establishment of the total cost incurred/paid in the production of finished goods. Sometimes a production cost statement is prepared to present the summary of the total cost incurred/paid on a particular product. In the following two illustrations, we will look at the two versions of presenting this information

ILLUSTRATION ONE

Statement of total Production Cost

Amt. $

Direct Raw Materials XXX

Direct Labour XXX

Direct Expenses XXX

PRIME COST XXX

Indirect cost/Overhead XX

Total Production Cost XXX

ILLUSTRATION TWO

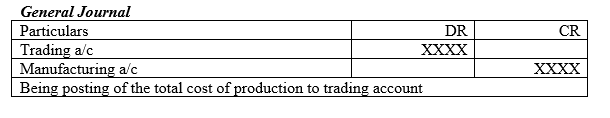

NB: The entrepreneur need to know that both total production cost statement and the manufacturing accounts are one and the same thing. Therefore, we make use of both presentations to post the cost record to the final accounts of the organization. This can be explained by use of the following general journal

In lesson one, the assumption is that the sales monetary value realized was of the finished goods produced and hence should be matched with the corresponding total cost incurred in production of the same finished goods.

ILLUSTRATION THREE

Your co. Ltd manufactures fruit juice for commercial purposes. On 31/12/2020, you were furnished with the following production cost information for the whole financial year

Cost of; Amt.$

Purchase of Fruits 1,600

Distilled water 400

Flavors 1,000

Labour-Fruit harvesting 500

Factory supervisor wages 1,200

Factory light overhead 300

Required

Prepare manufacturing account for the year and determine the total cost of production

Solution

Workings (w)

w-1: Computation of direct raw material cost

Direct raw materials;

Purchase price of fruits 1,600

Purchase of distilled water 400

2,000

w-2: Computation of direct labour cost

labour cost of fruit harvesting 500

Factory supervisor wages 1,200

1,700

NB: The entrepreneur/learner need to understand that it is not real to have all raw materials being fully used up in production of finished goods at the end of the financial/production period. Similarly, there is no coincidence of a 100% production of complete units of a particular product at the end of the financial/production period. Sometimes, goods remain incomplete at the end of the financial period regardless of the degree of completion. Such goods in manufacturing terms is referred to as Work in Progress (WIP). On the same breath, at the end of the financial/production period there are completely produced goods which are not yet sold hence existence of closing inventory of finished goods. Therefore, in the next three lessons, we will focus on accounting treatment of those three aspects of inventory.

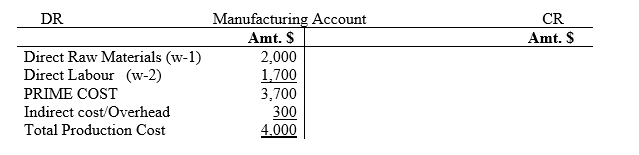

Lesson Two; Raw Material Inventory and Manufacturing Account

When raw materials are acquired, the intention is to utilize them to manufacture/produce final goods. In an ideal situation, all the raw materials will fully be used up to produce complete goods. But in reality, this circumstance is not possible for at the end of every financial/production period, some raw materials will remain unused. Such resources which are not utilized at the end of the production period will be referred to as raw material closing inventory. In such a case, such raw materials are part of closing inventory at the end of the production period and should be recorded in the statement of financial period as a current asset. In the proceeding period, the closing Raw Material (RM) inventory from the previous period becomes the opening inventory for the period in question and this trend continues every other time. In the next two scenarios, we will demonstrate how the inventory of raw materials are treated in the books of accounts.

NB: It should be noted that on introducing raw material inventory, the FIFO method of inventory valuation will be incorporated.

Scenario one: Raw Material Closing Inventory and the Matching Principle

If some materials are unused at the end of the production period, they should be excluded in the determination of cost of production of the complete units of finished goods. According to matching principle, the cost of such unused materials should be excluded.

Suppose;

Your manufacturing firm purchased raw materials amounting to $23,000.

At the end of the production period, raw materials of $3,000 were not consumed in producing the 100 units of good Zed (Z).

Required

i) Prepare a manufacturing account and show the accounting treatment of raw material inventory.

ii) Using manufacturing account, determine the total cost of raw materials used in producing both complete and incomplete units

iii) Extract a statement of financial position to show the accounting treatment of raw material closing inventory.

Solution

Quick conclusion

So, you can see that the closing inventory of raw materials is treated as a current asset for it is a resource owned by the organization even if it is not yet converted to finished goods. Therefore, as long as these raw materials were acquired using financial resources of the organization, then they have a monetary implication hence classified as current asset.

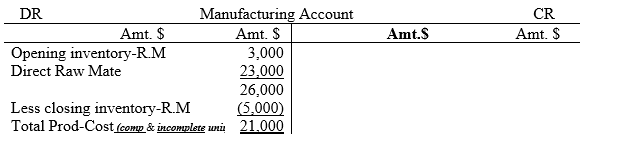

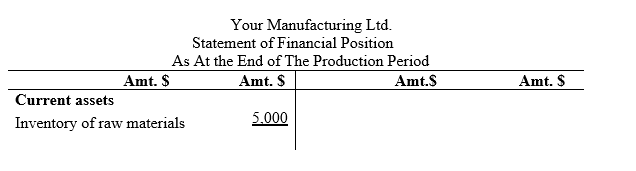

Scenario two: Opening and Closing Inventory of Raw Materials and the Matching Principle

Sometimes the manufacturing firm may be faced by a scenario of opening and closing inventory of raw materials. That is, when a new production period is in place, there may be some raw material carried forward from the previous production period (MR opening inventory) and similarly, at the end of the current production period, another raw material inventory is realized (ie RM closing inventory). Look at this case

Suppose;

Your manufacturing firm purchased raw materials amounting to $23,000. If the opening inventory of raw materials was $3,000 before the current year’s purchase of additional raw materials and $5,000 closing inventory of raw materials was not consumed in producing the 100 units of good Zed (Z).

Required

i) Prepare a manufacturing account and show the accounting treatment of inventory of raw materials.

ii) Using manufacturing account, determine the total cost of raw materials used in producing both complete and incomplete units

iii) Extract a statement of financial position to show the accounting treatment of the closing inventory of raw materials.

Assume FIFO method in inventory valuation process according to IAS-2

Solution

If we go by the FIFO assumption, then it implies that both complete and incomplete units of product Zed produced utilized the opening inventory of raw materials and some of the currently purchased raw materials which again were not all fully utilized hence there existed some balances of closing inventory of raw materials. This means that the opening inventory of raw materials became part of the units fully or partially produced whereas the closing inventory was not part of the good Zed produced. Hence the total cost of production was translating to $21,000 as indicated in the manufacturing account.

Quick conclusion

So, you can see that the closing inventory of raw materials is treated as a current asset for it is a resource owned by the organization even if it is not yet converted to finished goods. Therefore, as long as these raw materials were acquired using financial resources of the organization, then they have a monetary implication hence classified as current asset.

Also, remember that according to IAS number 2 the opening inventory of raw materials was first utilized to manufacture goods before using the purchased materials in the current financial/production period/year (Refer to IAS-2) if FIFO method was used. That is why it is not part of closing inventory of raw materials appearing in the above statement of financial position.

Lesson Three; Work In Progress (WIP) Inventory and Manufacturing Account

Sometimes goods being produced or manufactured may be incomplete by the time the production period ends. The degree of completion will not be discussed at level three of this accounting tutorials. So, if the units are incomplete, it is not possible to sell them to generate some income for the organization. Then it means that the complete units produced are separated from such goods and treated differently in the books of accounts. Therefore, just as it is in the case of raw materials, at the end of every production period, there is closing inventory of Work in Progress (WIP). The same inventory becomes the opening inventory of WIP in the next production period. The trend continues from one period to the other.

Further explanation;

The opening inventory of WIP becomes part of cost of production of the current units which are complete for the assumption is that, before new units are produced, the incomplete ones transferred from the previous period are cleared first then we move on to produce new ones according to FIFO approach.

Similarly, if some units are incomplete at the end of the production period (closing WIP), it means that it does not form part of production cost of the complete units hence should be excluded from the complete ones. Such an item of manufacturing account is treated as a current asset in the statement of financial position. So, the big question is, how do we determine the total production cost of the complete units? The answer is simple, see the two scenarios below;

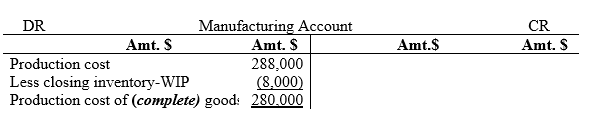

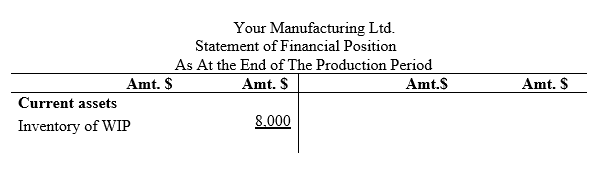

Scenario one: WIP Closing Inventory and the Matching Principle

If some goods are incomplete at the end of the production period, regardless of the degree of completion, they should be excluded in the determination of cost of production of the complete units of goods. According to matching principle, the cost of such incomplete goods should be excluded.

Suppose;

Your manufacturing firm produced Zed (Z) goods which cost $288,000 at the end of the production period out of which, the incomplete units had cost $8,000.

Required

i) Prepare a manufacturing account and show the accounting treatment of inventory of WIP.

ii) Using manufacturing account, determine the total cost of completely produced units of good Zed (Z).

iii) < Extract a statement of financial position to show the accounting treatment of the closing inventory of WIP.

Solution

NB1: So you see, the $288,000 is the total cost of production of both complete and incomplete units of that particular product. Since the $8,000 forms the incomplete units and cannot be sold as it is, then there is need to knock it out. This is why we have subtracted that amount from $288,000. So, our focus is on the cost of the completely produced goods which is $280,000.

Quick conclusion

So, you can see that the closing inventory of WIP is treated as a current asset for it is a resource owned by the organization even if it is incomplete. Therefore, as long as these WIP compose raw materials which were acquired using financial resources of the organization, then it has a monetary implication hence classified as current asset.

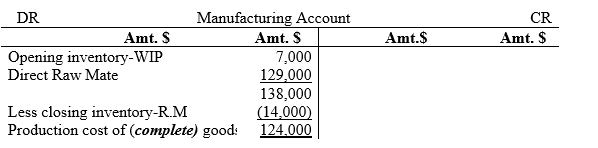

Scenario two: Opening and Closing Inventory of WIP and the Matching Principle

Suppose;

Your manufacturing firm produced good Zed (Z) amounting to $129,000.

Further analysis revealed that out of the $129,000 worth good Zed (Z), there was opening inventory of WIP which needed additional input cost of $7,000 to be complete. Also, the $129,000 amount was inclusive of raw materials for both complete and incomplete units. Out of this two categories of units, closing inventory of WIP was $14,000 of good Zed (Z).

Required

i) Prepare a manufacturing account and show the accounting treatment of inventory of WIP.

ii) Using manufacturing account, determine the total cost of completely produced units of good Zed (Z).

iii) Extract a statement of financial position to show the accounting treatment of the closing inventory of WIP.

Assume FIFO method in inventory valuation process according to IAS-2

Solution

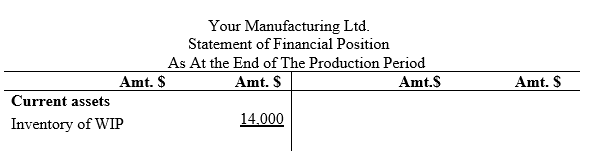

NB2: Therefore, if we go by the FIFO assumption, then it implies that the complete units of product Zed (Z) produced composed of the additional input cost of $7,000 of opening inventory of WIP and the cost of the currently produced goods less the cost of $14,000 of the closing inventory of WIP. Therefore, the closing inventory was not part of the good Zed produced. Then the total cost of production was translating to $124,000 as indicated in the manufacturing account.

Quick conclusion

So, you can see that the closing inventory of WIP is treated as a current asset for it is a resource owned by the organization even if it is incomplete. Therefore, as long as these WIP compose raw materials which were acquired using financial resources of the organization, then it has a monetary implication hence classified as current asset.

Also, remember that according to IAS number 2 FIFO method the opening inventory of WIP was further processed to complete units before producing the new ones using the available raw materials in the current financial/production period/year (Refer to IAS-2). That is why it is not part of closing inventory of WIP appearing in the above statement of financial position.

Lesson Four; Inventory of Finished goods and manufacturing account

The main objective of undertaking production of finished goods is to generate profits. Therefore, after manufacturing the goods, the next step is to sell the completely produced goods to the end users. This calls for the normal preparation of the trading and profit and loss account in addition to manufacturing account whereby the total cost of the manufactured/produced goods are posted to the final accounts to determine the net profit/loss at the end of the financial/production period.

Now, the same argument to that of inventory of raw materials and WIP comes in. That is, sometimes completely produced goods may all be sold or some balances may exist at the end of the financial period. In such cases, this is referred to as closing inventory of finished goods. The same closing inventory becomes the opening inventory of finished goods in the proceeding financial period.

In conclusion, as an entrepreneur/learner, you need to understand that for the first two categories of inventory, that is; raw materials and work in progress inventory are factored in the manufacturing account to first determine the actual cost of the finished goods. Whereas, inventory of finished goods is incorporated in the trading and profit and loss account so as to establish the gross and net profit/(loss) in that order. This is well demonstrated in the following two scenarios.

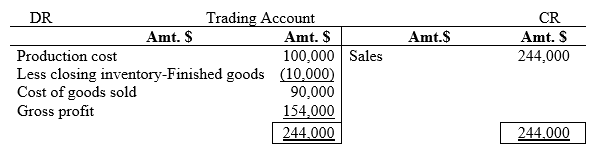

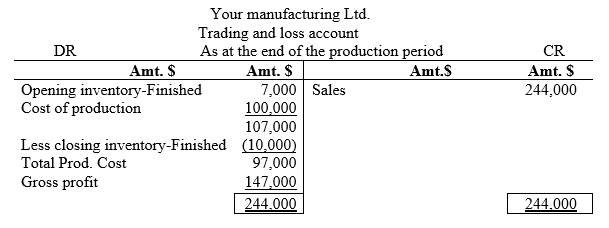

Scenario one: Closing Inventory of Finished goods and the Matching Principle

If some goods are not sold at the end of the financial period, they should be excluded in the determination of cost of goods sold. According to matching principle, the cost of such unsold goods should be excluded. This is because our concern is the cost of goods completely produced and actually sold so as to compare such cost and sales value. This approach is in compliance with that matching principle.

Suppose;

Your manufacturing firm produced 100 units of good Zed (Z) at a cost of $100,000.

At the end of the financial period, 90 units were sold at $244,000.

Required

i)Prepare trading account and show the accounting treatment of inventory of finished goods.

ii)Using trading account, determine the Cost of Goods Sold (COS) of good Zed (Z).

iii) Extract a statement of financial position to show the accounting treatment of the closing inventory of finished goods.

Solution

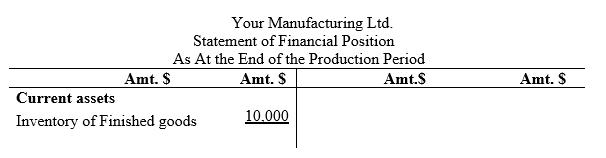

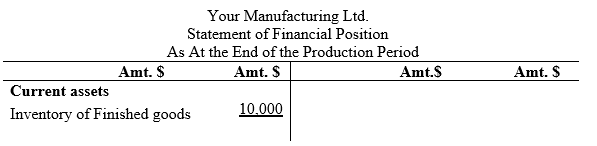

First, you should note that if 90 units of good Z(Zed) were sold, the ten units which remained unsold represents the closing inventory of finished goods and its cost/net market value is $10,000 (Refer to IAS-2).Therefore;

NB1: So you see, the $90,000 is the total cost of goods sold but not $100,000 for goods costing $10,000 were not sold hence according to the matching principle, such goods are excluded from cost of goods sold. Since the $10,000 forms the inventory of finished goods and not yet sold, then there is need to knock it out. This is why we have subtracted that amount from $100,000. So, our focus is on the cost of the sold units which is $90,000.

Quick conclusion

So, you can see that the closing inventory of finished goods is treated as a current asset for it is a resource owned by the organization even if it is not yet sold. Therefore, as long as the closing inventory of finished goods compose raw materials which were acquired using financial resources of the organization, then it has a monetary implication hence classified as current asset.

Scenario two: Opening and Closing Inventory of Finished goods and the Matching Principle

Since we have gotten the concept of inventory of finished goods and how to treat it in books of accounts as per scenario one, let us assume the same example given thereof as follows;

Suppose;

Your manufacturing firm produced 100 units of good Zed (Z) at a cost of $100,000.

At the end of the financial period, 90 units were sold at $244,000.

Also, assume that the opening inventory of finished goods had cost $7,000

Required

i)Prepare trading account and show the accounting treatment of inventory of finished goods.

ii)Using trading account, determine the Cost of Goods Sold (COS) of good Zed (Z).

iii) Extract a statement of financial position to show the accounting treatment of the closing inventory of finished goods.

Assume FIFO method in inventory valuation process as per IAS-2

Solution

NB2: Therefore, if we go by the FIFO assumption, then it implies that the opening inventory of finished units of product Zed (Z) were sold in the course of the current period and whereas, the closing inventory was not part of the good Zed sold hence it is knocked out or subtracted from the cost of goods available for sale.

Quick conclusion

So, you can see that the closing inventory of finished goods is treated as a current asset for it is a resource owned by the organization even if it is not yet sold. Therefore, as long as it is compose of raw materials which were acquired using financial resources of the organization, then it has a monetary implication hence classified as current asset.

Also remember that according to IAS number 2 FIFO method, the opening inventory of finished goods is assumed to have been sold before the newly manufactured goods were also sold in the current production year (Refer to IAS-2). That is why it is not part of closing inventory of finished goods appearing in the above statement of financial position.

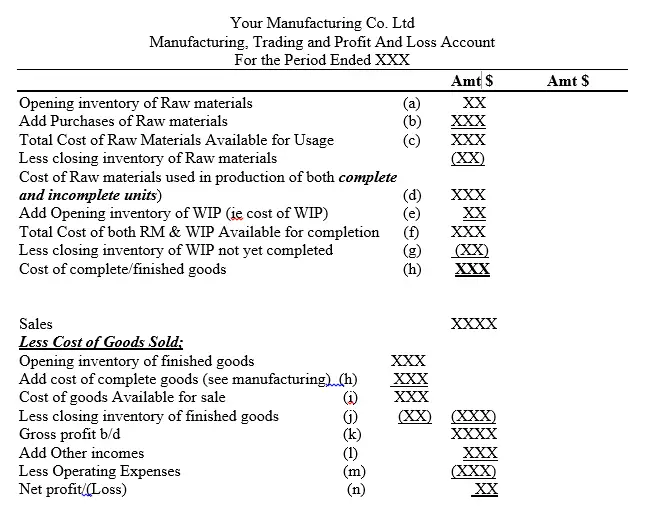

In summary;

We are saying the following steps should be followed by all entrepreneurs/learners engaging in manufacturing activities;

Step one (ie Cost of raw materials used to produce both complete & incomplete goods) Determine the actual cost of raw materials used up in production of both complete and incomplete units. Remember that the total cost of raw materials used applies to both the completely produced goods and the goods which were incomplete. In other words they are work in progress. At this point, we cannot stop at this level for the incomplete units cannot be sold as they are. This calls for step two

Step two (ie Cost of complete goods available for sale)

Determine the actual cost of completely produced goods. At this level, we would like to know the exact cost of the goods which have consumed the organization’s raw materials and are actually complete and ready for sale. Once we determine that, next step is to establish the total cost of completely produced units which were actually sold. Hence leading to step three below

Step three (ie Cost of Goods Sold)

To determine the actual cost of goods sold, it is necessary to establish the closing inventory of complete and unsold goods in the previous financial period, then we add the ones which were complete in the current period net of those goods which were not sold in the current period. This procedure is summarized as follows;

Opening inventory of complete/finished goods XXX

Add complete units produced in the current period XXXX

Cost of Goods Available for Sale (COGAS) XXXX

Less closing inventory of complete/finished goods (XXX)

Cost of Goods Sold (COS) XXX

This three steps culminates to the following format of combined manufacturing and trading and profit and loss account.

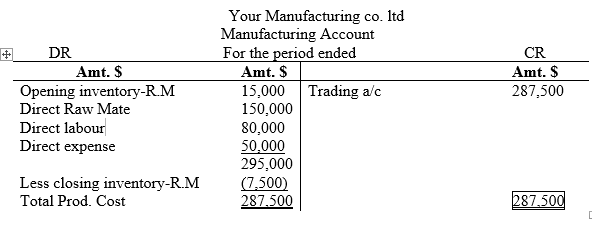

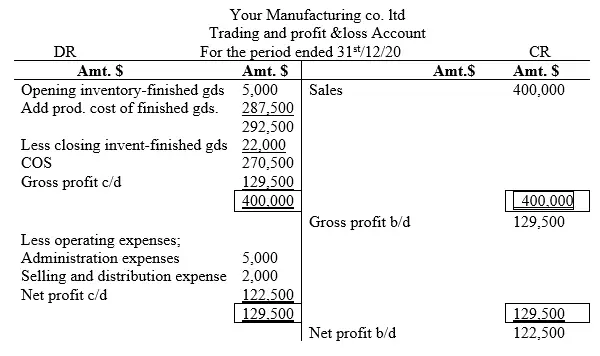

ILLUSTRATION ONE

Assume that the following information was provided to you by your manufacturing firm as at 31st/12/2020

Amt. $

Direct raw materials 120,000

Direct labour 80,000

Direct expenses 50,000

Factory overheads 10,000

Administration expenses 5,000

Selling and distribution expense 2,000

Opening inventory-raw materials 15,000

Finished goods 5,000

Closing inventory-raw materials 7,500

-Finished goods 22,000

Sales 400,000

Required

Prepare manufacturing, trading and profit and loss account for the period ended 31/12/2020

Solution

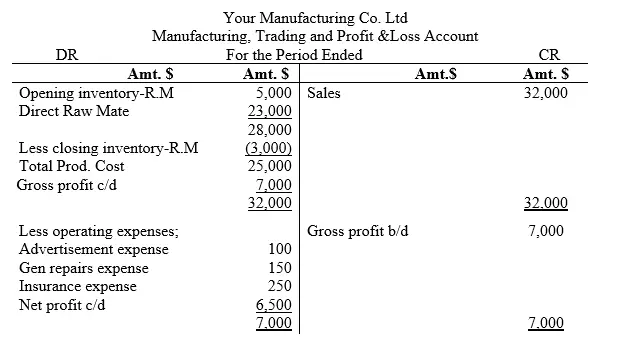

ILLUSTRATION TWO

Suppose Your manufacturing firm sold 100 units of good Zed (Z) by the end of the production period for $63,000. Suppose the firm also had purchased raw materials amounting to $32,000. If the opening inventory of raw materials was $14,000 before the current year’s purchases and at the end of the production period, raw materials of $12,000 were not consumed in producing the 100 units of good Zed (Z).

Additional information Amt.$

Advertisement expense 100

Gen repairs expense 150

Insurance expense 250

Required

Prepare the manufacturing, trading and profit and loss account to determine the net profit for the year.

Solution

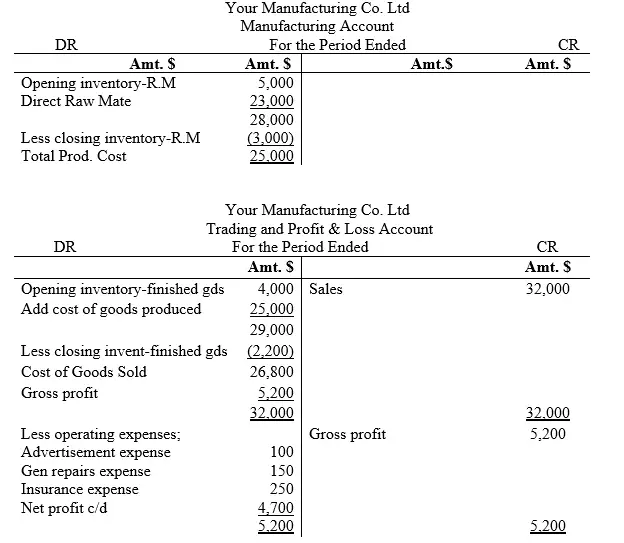

Sometimes, the opening and closing inventory of an organization may take the form of both raw materials and finished goods. In such a case, both aspects of manufacturing and trading and profit and loss accounts are put in to consideration. Illustration three will provide this clarity.

ILLUSTRATION THREE

Assume the facts of illustration one above and that the opening and closing inventory of finished goods in addition to the ones of raw materials was $4,000 and $2,200 respectively as shown below;

Suppose Your manufacturing firm sold 100 units of good Zed (Z) by the end of the production period for $63,000. Suppose the firm also had purchased raw materials amounting to $32,000. If the opening inventory of raw materials was $14,000 before the current year’s purchases and at the end of the production period, raw materials of $12,000 were not consumed in producing the 100 units of good Zed (Z). In addition the opening and closing inventory of finished goods were $4,000 and $2,200 respectively

Additional information Amt. $

Advertisement expense 100

Gen repairs expense 150

Insurance expense 250

Required

Prepare the manufacturing, trading and profit and loss account to determine the net profit for the year.

Solution

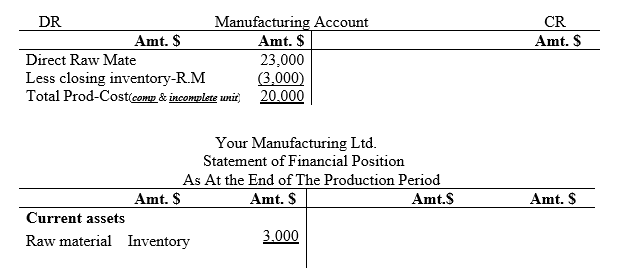

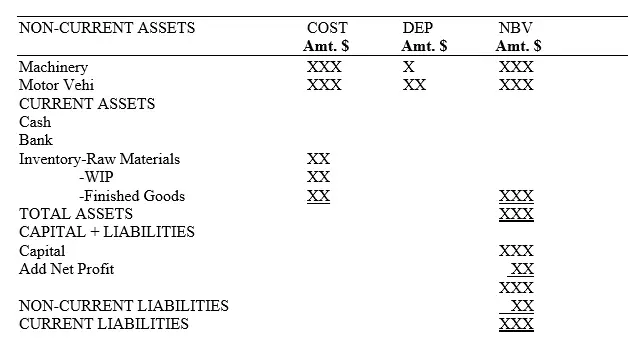

Lesson Five; Statement of Financial Position of a Manufacturing Organization

Once the net profit or loss of the manufacturing organization is determine, the preparation of statement of financial position is undertaken. This statement is similar to any other of normal businesses. The only difference is that inventory for both raw materials and work in progress is incorporated. The following format will aid in portraying this concept of balance sheet for a manufacturing firm.

Format for statement of financial Position

Summary

The chapter on manufacturing account is unique in the sense that it entails the actual production of the final goods instead of purchasing merchandised or already manufactured goods. Even though manufacturing perspective is incorporated in accounting for those organizations dealing with manufacturing activities, the end results is the preparation of trading and profit and loss account to establish gross and net profit/(loss) in that order. Preparation of manufacturing account entails factoring of both direct and indirect costs. The direct cost are referred to as prime cost while the indirect cost is referred to as factory or production overhead. The summation of the prime and the overhead production cost translate to total production cost.

If there are any opening and closing inventory of raw materials, it is considered to establish the exact cost incurred in production of both incomplete and the completely finished goods. Thereafter, the manufacturing account is closed down to trading and profit and loss account to determine the gross and net profit/loss for the current financial period accordingly if the aspect of work in progress is not featuring. However, if the perspective of WIP is occurring, then, the entrepreneur need to first determine the actual cost of completely produced goods by incorporating opening and closing inventory of WIP

On the same breath, opening and closing inventory of finished goods is also factored in the determination of the cost of goods manufactured and actually sold. Lastly, preparation of the statement of financial position is considered and it is similar to that of normal business only that we consider the three types of inventory, namely; raw materials, work in progress and finished goods as current assets.