Part One: Statement of affairs and incomplete records

In our previous discussions in level one/beginner, two/intermediate and the current level three/advanced, the focus has been on accounting records or statements originating from complete recording of business transactions where by the rules of accountancy especially the generally accepted accounting principles were incorporated. This assumption is applicable in some businesses while in other cases, this rule such as double entry principle may not have been adhered to. This results to incomplete records where by books of accounts have been maintained without strict following of the GAAP and the laid down International Accounting Standards (IAS). Such accounting records are referred to as incomplete records. In other words, incomplete records is single entry accounting system as opposed to double entry accounting system.

Incomplete recording system is a misnomer for it makes the management hands tight in determining the profitability levels of the firm at the end of the financial period for some accounting information is lacking. This problem is common especially with the Small and Medium Enterprises (SMEs) who do not have the man power to maintain proper books of accounts. In this chapter therefore, the focus will be to guide entrepreneurs/learners on how to establish the correct books of accounts in a situation where no proper book keeping. The specific objectives will be;

i)To prepare statement of affairs

ii)To determine the missing item or items to make the accounting system complete

iii)To prepare complete ledger accounts using the missing item technique

iv)To prepare complete financial statement

Statement of affairs is a tool used in accounting to determine a missing item such as net profit/loss, asset value, capital or liability at some period of time. Statement of affairs is similar to balance sheet/statement of financial period although it is commonly used in determining the missing item of balance sheet nature as aforementioned. In other words, statement of affairs is the framework used in determining the missing item in a case of incomplete records.

Therefore, in the forthcoming lessons, our discussion will be pegged much on this tool and by extension, consider cases of determining missing item using the five classes of accounts as discussed in level one, namely asset, capital, liability, income and expense accounts. To achieve this objective, we will focus on basic, intermediate and advanced statement of affairs for the sake of incorporating the basic and advanced reconciliations.

Lesson One; Basic Statement of Affairs

Statement of affairs originates from balance sheet equation which is represented by the following formula;

A=C+L

Where; A= Value of Assets

C= Value of Capital

L= Value of Liabilities

In the case of basic statement of affairs, the concern of the entrepreneur is to determine the missing item such as total asset value, capital value or total liability value. This approach is common when we have information of the monetary value of at most two of the components of the balance sheet/statement of financial position at any given period of time, be it in the beginning or end of a financial period or otherwise.

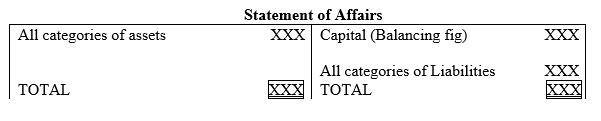

Statement of Affairs format

The basic format of the statement of affairs is expressed as follows;

The following illustration one will clarify how missing item/figure is determined

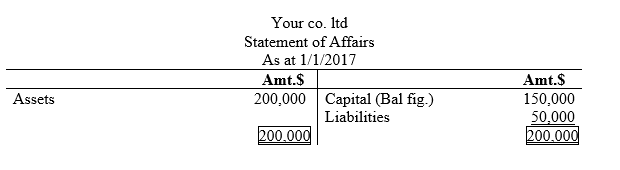

ILLUSTRATION ONE

Your co. ltd provided you with the following information for the year stating on 1st/1/2017

Total assets $200,000

Total Liabilities $50,000

Required

i)Determine the monetary value of opening capital

ii)Prepare corrected statement of financial position as at 1/12017

Solution

The entrepreneur need to take note that opening capital is the missing item and from past discussion, we know that the balance sheet/statement of financial position is expressed as;

A=C+L

Now that we know the monetary values of assets and liabilities, then;

A-L=C+L-L

In other words, from the original equation (A=C+L) we subtract the value of liabilities (ie L) from both the right hand side and the left hand side of the accounting/balance sheet equation. Many scholars say you make “C” the subject of the formula so as to be left with “C” on one side. But this is wrong mentality. How do we handle matters of equality or equation models?

The modeling principle we will use is that, since A=C+L is an equation which implies that both left and right hand components of the equation are the same, then if we are to maintain the same principle of equality, it means that the adjustment(s) that you do to the component(s) on the left hand side should also be equally done on the component(s) on the right hand side of the equation. Such that, if you subtract or add a certain value of one of the element/component of balance sheet equation on the left hand side of the balance sheet equation, the same value of that component should be subtracted or added on the right hand side of the balance sheet equation inn that order. A good scenario is the common beam balance model such as weighing balance machine. For the two sides of the weighing balance to be equal, you keep on adjusting both sides until they are the same. Therefore, in the above illustration and others which will follow, will assume this principle.

Therefore, C= A-L

i) C= 200,000-50,000

=$150,000

ii).

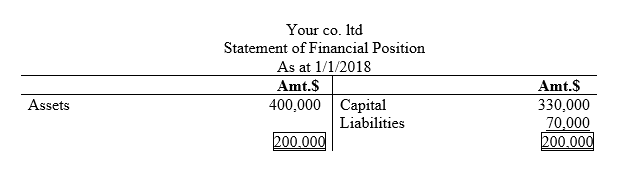

ILLUSTRATION TWO

Suppose Your co. ltd furnished you with the following accounting information for the year ended 31/12/2018

Capital $330,000

Liabilities $70,000

Required

i)Determine the value of total assets as the missing item in the balance sheet model

ii)Prepare the statement of financial position of Your co. ltd as at 31/12/2018

Solution

This is a straight away case and the balance sheet equation does not require any further adjustment. Therefore, the answer to this problem is as follows

i) A=330,000+70,000

= $400,000

ii)

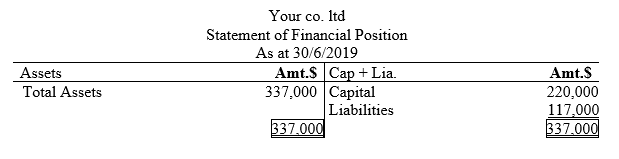

ILLUSTRATION THREE

You are the accounting consultant for Your co. ltd and the accounts clerk provided you with the following accounting information covering a period of six months which ended on 30/6/2019 which seemed incomplete as follows;

Capital $220,000

Machinery $210,000

Debtors $70,000

Inventory $23,000

Cash in hand $34,000

Required

i) Determine the missing item

ii) Prepare the statement of financial position

Solution

i) The approach to solve this problem is similar to the previous two cases we have solved only that the assets have been decomposed in to individual asset elements, that is more than one and in such a case, the approach entails first summation of all the assets to establish a single figure and then determine the missing item as usual as follows;

Total assets=210,000+70,000+23,000+34,000

=$337,000

Capital=$220,000

The missing item is liabilities which is determined as follows;

A-C=C-C+L

A-C=L or L=A-C

L=337,000-220,000= $117,000

ii)

Lesson Two; Intermediate Statement of Affairs

This lesson focuses on intermediate statement of affairs which is a buildup of the basic statement of affairs we have discussed with A=C+L model. That is, it incorporates all transactions affecting capital which include drawings, additional capital (ie investment), net profit and or net loss.

The intermediate statement of affairs is used to determine the net profit/loss of the business for the current period. The formula is expressed as follows;

P=CC+D-AC-OC

Whereby;

P=Net Profit or net loss if the value is negative.

CC=Closing Capital

OC=Opening Capital

AC=Additional capital

D=Drawings

ILLUSTRATION ONE

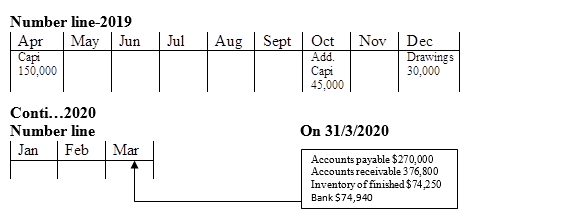

After incorporation of Your co. ltd on 1st/4/2019, the capital introduced into this business by the owner was $150,000. Unfortunately, no complete records was maintained. However, the following information was made available to you that;

During the financial year on 10/10/2019, $45,000 additional capital was introduced by the owner to boost the business in check form.

During the same financial period, he withdrew $30,000 on 31/12/2019 to clear his son’s college fees.

On 31st/3/2020, his assets and liabilities were as follows;

Accounts payable $270,000

Accounts receivable 376,800

Inventory of finished goods $74,250

Bank $74,940.

Required

Determine profit or loss made by the business during the first year of operation.

(Hint use statement of affairs approach).

Solution

To determine the net profit or loss, consider the number line diagrammatic demonstration as follows;

NB: The entrepreneur/learner need to note that since we want to determine the net profit/loss for the current financial period and the closing capital is not expressly stated, we make use of the balance sheet information available as 31st/3/2020 to determine the missing item which is closing capital as follows;

Step one; Determination of closing capital

Total liabilities=270,000

Total assets=376,800+74,250+74,940=$525,990

C=A-L

=525,990-270,000

=$255,990

Step two; Determination of profit/loss

P=CC+D-AC-OC therefore

P=255,990+30,000-45,000-150,000

P= $90,990

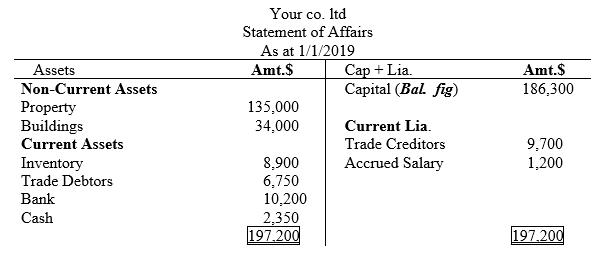

ILLUSTRATION TWO

1/1/2019 Your co. ltd had the following available information of assets and liabilities; Property $135,000

Buildings $34,000

Inventory $8,900

Bank $10,200

Cash $2,350

Trade debtors $6,750

Trade creditors $9,700

Accrued salary $1,200

Withdrawal $14,400 for personal use

Additional capital $3,200 in the course of the financial period

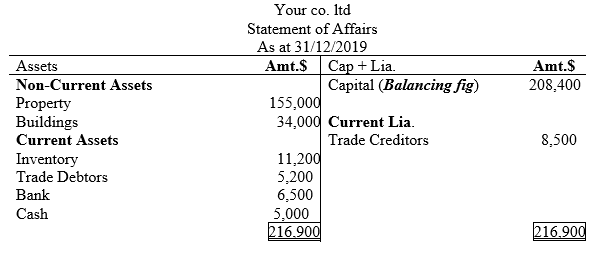

On 31st/12/2019 the following information was made available;

Property $155,000

Buildings $34,000

Inventory $11,200

Bank 6,500

Cash $5,000

Trade debtors $5,200

Trade creditors $8,500

Required

Calculate the profit made by Your co. ltd during the year using both mathematical and statement of affairs method.

Solution

The first step is to determine the opening and closing capital which can either be established in two approaches; mathematically or using balance sheet financial statement as follows

1(a). Computation of Opening capital-Mathematical approach

A=C+L

A-L=C+L-L

C=A-L

Total asset value= 135,000+34,000+8,900+10,200+2,350+6,750

=$197,200

Total liabilities=9,700+1,200

=$10,900

C=197,200-10,900

=$186,300

1(b). Computation of Opening capital-

Statement of Affairs approach

2(a). Computation of closing Capital-Mathematical approach

Total asset value= 155,000+34,000+11,200+6,500+5,000+5,200

=$216,900

Total liabilities =$8,500

C=216,900-8,500

=$208,400

2(b). Computation of closing Capital- Statement of Affairs approach

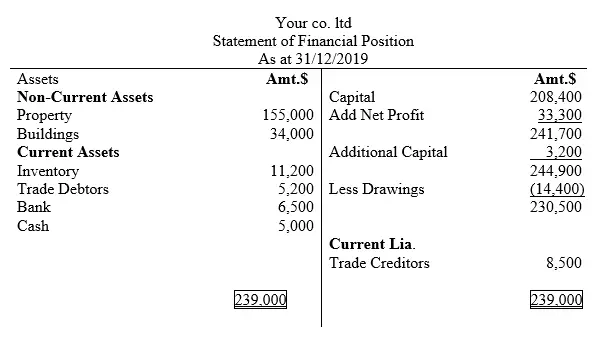

1. Computation of Net profit/loss for the current financial period

P=CC+D-AC-OC

=208,400+14,400-3,200-186,300

= $33,300

2. Preparation of closing statement of financial position as at 31/12/2019

Lesson Three; Advanced Statement of Affairs

This lesson focuses on the specific ledger accounts which has incomplete information and the approach to be incorporated to determine the missing item in every scenario introduced to you as an entrepreneur or learner. The missing item in every nature of account is dictated by the available information. So there is no specific missing item that should be computed whenever a certain accounting incomplete record problem arises although there are those common missing items that are always determined using the statement of affairs approach.

Therefore, for the case of advanced statement of affairs, we will re-visit the diverse accounts used in bookkeeping and discuss the probable missing items based on those nature of accounts. Those nature of ledger accounts which we also discussed in our level one of this accounting tutorial series are; assets, liabilities, capital, expenses and incomes. For each case where applicable, we will discuss and determine the respective missing value and prepare the relevant financial statements.

Scenario one; Probable Missing Item under Asset Category

Assets are properties or goods owned by an individual, firm or an institution and can be assigned a monetary value. Assets assume diverse characteristics/categories based on the criteria used. But the most common categories are non-current assets and current assets. For the entrepreneur/learner to establish the missing item in the case of assets, he/she should be able to comprehend the components or transactions which affect that particular asset.

Case one; Non-Current Asset

Non-current assets are also referred to as Properties, Plants and Equipment (PPE). They are goods or properties that exist in an organization for a period of more than one financial period and they are utilized for the purposes of furthering the operations of the business. They also lose their economic value on use through the process of wear and tear commonly referred to as depreciation. This implies that for non-current assets that appreciate with time such as land and buildings/premises, they are not under non-current assets hence they fit in real estate category although most accounting books consider them as non-current assets for the sake of book keeping purposes.

Whether assets are of real estate or are non-current nature, the entrepreneur need to know the specific transactions that affect that particular asset. In the next session, we will critically look at the various transactions which affect specific non-current or real estate assets as follows;

a) Properties Plants and Equipment (PPE), Land and Buildings

The various transactions affecting PPE which may either cause an increase or decrease in its value are;

i) Acquisition of new or second hand PPE which can either be in form of cash, check, credit or a trade in case also referred to as payment in kind. An acquisition transaction causes an increase in value of PPE

ii) Disposal of PPE-This involves selling of PPE either in cash or credit or whichever other mode used. As a result, PPE value decreases.

iii) Capital gain-it involves a case whereby on disposal/sale of PPE, some income is realized. Capital gain is registered in the P&L account but it does not increase or decrease the PPE value.

iv) Capital loss-it a transaction which is the opposite of (iii) above and it involves a case whereby on disposal/sale of PPE, some loss is realized. Capital loss is registered in the P&L account but it does not increase or decrease the PPE value.

v) Appreciation which arises when PPE is revalued due to some circumstances such as accessing of loan facility from a financial institution or during a merger or acquisition and also in partnership businesses especially when a new partner is being admitted or an old partner is quitting the partnership. Appreciation means increase in value of PPE value

vi) Depreciation which is the opposite of (v) above and it involves loss of economic value of PPE. Therefore, it is obvious that the PPE value declines.

vii) Balance brought down (abbreviated as bal. b/d)-this is also a business transaction for we concluded that any activity that can be assigned any monetary value is classified as a business transaction. Bal b/d is the excess amount of asset value after considering all other transactions causing decrease in that particular asset. In other words, it is the net value of assets which is always a debit balance except in the case of bank account which can assume both options of debit or credit balance. This nature of balance brought down is recorded on the debit side below the total value for that particular asset.

NB1: It should be noted that the term balance brought down (abbreviated as bal. b/d) applies when recording the net monetary value of an asset at the end of the financial period when accounts are being balanced. The higher that value is the higher the value of excess debit entries are as compared to credit entries in a particular asset account.

viii) Balance carried down (abbreviated as bal. c/d)-is a business transaction that represents the difference (ie deviation) between the debit totals and credit totals of a particular asset ledger account. It is usually recorded on the side of the ledger account with a shortage. Such that, if the credit side of a ledger account is smaller than the debit side, then the balance carried down (bal. c/d) is recorded therein to make the two sides be equal. Similarly, if the debit side of the asset account is smaller as compared to credit side as it is in the case of bank overdraft, then the balance carried down is recorded on the debit side as balance carried down (abbreviated as bal. c/d) to make the two sides balance.

NB2: It should be noted that the term balance carried down (abbreviated as bal. c/d) applies when recording monetary value difference of an asset at the end of the financial period when accounts are being balanced.

NB3: It should also be noted that balance b/d value and balance c/d for a particular asset account is always the same. (bal b/d=bal c/d). This implies that, given either one of them in an examination or in a case of incomplete records, you can guess the value of the other balance although they are always recorded in the opposite side of that particular ledger account.

ix) Balance brought forward (abbreviated as bal. b/f)-this is also a business transaction. Bal b/f is the excess amount of asset value after considering all other transactions causing decrease in that particular asset. In other words, it is the net value of assets which is always a debit balance except the case of bank account which can assume both options of debit or credit balance. This nature of balance brought forward is recorded on the debit side below the total value for that particular asset.

NB4: It should be noted that the term balance brought forward (abbreviated as bal. b/f) applies when recording the net monetary value of an asset at the beginning of the next proceeding financial period when accounts are being posted from the closing statement of financial position (ie balance sheet) to respective opening asset ledger accounts. In fact, the closing balance brought down (bal. b/d) is the one which is recorded as bal. b/f in the new respective ledger account.

x) Balance carried forward (abbreviated as bal. c/f)-is a business transaction that represents the difference between the debit totals and credit totals of a particular asset ledger account. It is usually recorded on the side of the ledger account with a shortage. Such that, if the credit side of a ledger account is smaller than the debit side, then the balance carried forward (bal. c/f) is recorded therein. Similarly, if the debit side of the asset account is smaller as compared to credit side as it is in the case of bank overdraft, then the balance carried forward is recorded on the debit side as balance carried forward (abbreviated as bal. c/f).

NB5: It should be noted that the term balance carried forward (abbreviated as bal. c/f) applies when recording an asset monetary value difference at the end of the next/proceeding financial period when accounts are being balanced.

NB6: It should also be noted that balance b/f value and balance c/f for a particular asset account is always the same. (bal b/f=bal c/f). This implies that, given either one of them in an examination or in a case of incomplete records, you can guess the value of the other balance although they are always recorded in the opposite side of that particular ledger account.

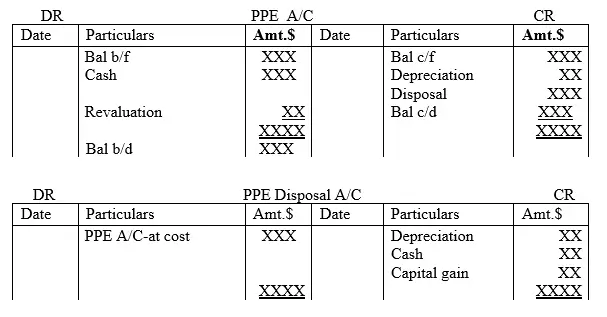

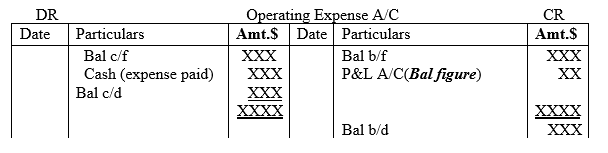

SAMPLE ONE

Therefore, if one is provided with all information pertaining PPE account except one, then the balancing figure of the two sides turns to be the missing item and it can be either of the indicated items. Hence no law for it is the responsibility of the entrepreneur to make the right interpretation or judgement to establish the missing item in each scenario

Case two; Current Asset Accounts

Current assets are properties or goods that exist in the firm’s premises for a period of less than one year. They may be of cash or non-cash nature and they are not subject to depreciation. Although there are many categories of current assets, the focus of this discussion in this lesson will be trade debtors also referred to as accounts receivable.

a) Trade debtors

Trade debtors arise when goods or services are sold on credit by the business under investigation. The transactions that affect trade debtors are;

i) Credit sale-this involves sale of goods for a deferred receipt of cash in form of hard cash or check in a future period. This transaction increases the trade debtor monetary value

ii) Receipt of cash in form of cash, check or otherwise from customer/debtors which reduce the monetary value of trade debtors. This occurs when the debtor has paid the amount due in full or partially.

iii) Returns inwards-also referred to as sales returns and occurs when goods with discrepancies are returned in to the business by the customer/trade debtor. This transaction reduce the amount of cash expected to be received from the customers/debtors by the business in the future.

iv) Discount allowed-is a financial relief extended to trade debtor to prompt him or her to make quick payment to avoid cases of bad debts written off. It results to a decrease of the trade debtor monetary value

v) Bad debts written off-is a financial loss suffered by the business when the customer defaults payment of the amount due. The transaction translates in to reduction of the trade debtor value

vi) Provision for doubtful debt-allowance provided on the basis of good debtors accounts to avoid overstating the net profit of a business. This provision reduce the total monetary value of debtors.

vii) Interest charge to a customer for outstanding account balance. This occurs when the debt to a customer is long overdue. As a result, it attracts some interest which bulge the value of trade debtors.

viii) Dishonored check-this occurs when a customer pays his or her debt using a check which bounces at a later date. This transaction results to a reverting of the previous credit entry made in the trade debtor account so as to restore the original amount due if that be the case. Dishonored check causes an increase in debtor value.

ix) Balance brought down

x) Balance carried down

xi)Balance brought forward

xii) Balance carried forward

NB: ix-xii are as explained earlier

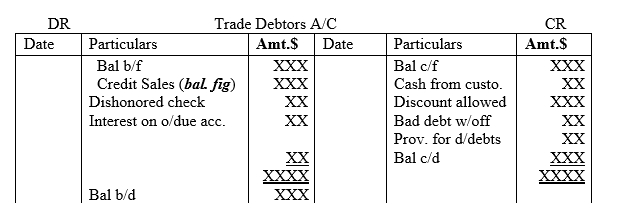

SAMPLE TWO

Therefore, if one is provided with all information pertaining trade debtor account except one, then the balancing figure of the two sides turns to be the missing item and it can be either of the above indicated items. Hence no law for it is the responsibility of the entrepreneur to make the right interpretation or judgement to establish the missing item in each scenario. For trade debtors, the most common missing item is credit sales.

Scenario two; Probable Missing Item under Liabilities Category

Liabilities are debts which belong to an organization, individual or an institution and are broadly classified in to non-current and current liabilities.

Case one; Non-Current Liability

This is a debt whose repayment period of the principle and interest amount is for a period more than one financial year. It is also referred to as long term liability

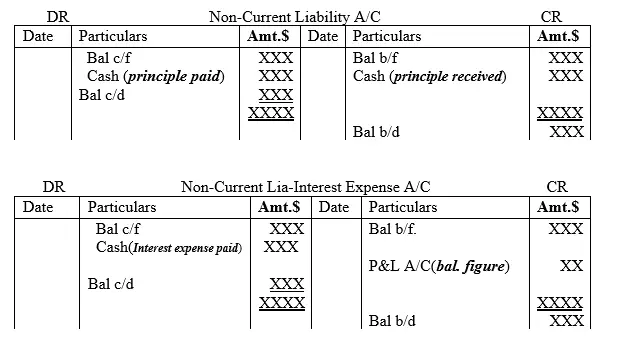

SAMPLE ONE

Therefore, if one is provided with all information pertaining non-current liability account except one, then the balancing figure of the two sides turns to be the missing item and it can be either of the indicated items. Hence no law for it is the responsibility of the entrepreneur to make the right interpretation or judgement to establish the missing item in each scenario.

NB: For interest expense account, the balance brought forward or down is either zero implying that all such expenses were paid in total by the end of the financial period or such balance is on the credit side implying that the interest expense is due, ie accrued interest expense.

Case two; Current Liability

Current liabilities are debts that are repayable for a period of less than one year. Although there are many categories of debts, the focus of this discussion in this lesson will be trade creditors also referred to as accounts payable. Trade creditors arise when goods or services are bought on credit by the business under investigation. The transactions that affect trade creditors are;

i) Credit purchases-this involves purchase of goods for a deferred payment of cash in form of hard cash or check in a future period. This transaction increases the trade creditor monetary value.

ii) Payment of cash in form of cash, check or otherwise to suppliers/creditors which reduce the monetary value of trade creditors. This occurs when the business in question has paid the amount due partially or in full.

iii) Returns outwards-also referred to as purchases returns and occurs when goods with discrepancies are returned to the supplier by the business in question. This transaction reduce the amount of cash expected to be paid by the business in the future.

iv) Discount received-is a financial relief extended to the business in question to prompt quick payment to avoid cases of bad debts to be suffered by the supplier. It results to a decrease of the trade creditor monetary value.

v) Interest charged by a supplier for outstanding account balance. This occurs when the debt to the business in question is long overdue. As a result, it attracts some interest which bulge the value of trade creditor.

vi) Dishonored check-this occurs when a business pays his or her debt using a check which bounces at a later date. This transaction results to a reverting of the previous debit entry made in the trade creditor account so as to restore the original amount due if that be the case.

vii) Balance brought down

viii) Balance carried down

ix) Balance brought forward

x) Balance carried forward

NB: ix-xii are as explained earlier

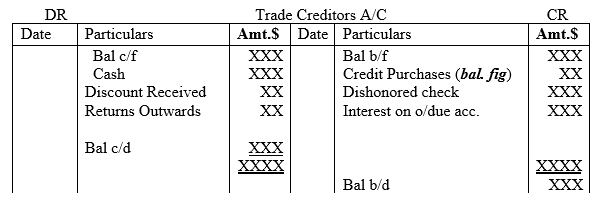

SAMPLE TWO

Scenario three; Probable Missing Item under Expense Category

Expenses are nominal in nature and can be classified in to trading and operating categories. Whichever classification, the determination of the missing item follow the same procedure as it is the case with the previously discussed accounts. If we consider operating expense, the approach will be as per the sample one below;

SAMPLE ONE

Therefore, if one is provided with all information pertaining operating expense account except one, then the balancing figure of the two sides turns to be the missing item and it can be either of the indicated items. Hence no law for it is the responsibility of the entrepreneur to make the right interpretation or judgement to establish the missing item in each scenario.

NB1: If the balance brought down (abbreviated as balance b/d) is on the credit side, then that represents accrued expense which is categorized as current liability.

NB2: If the balance brought down (abbreviated as balance b/d) is on the debit side, then that represents prepaid expense which is categorized as current asset.

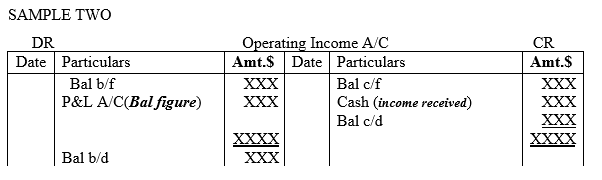

Scenario four; Probable Missing Item under Income Category

Income are nominal in nature and can be classified in to trading and operating categories. Whichever classification the determination of the missing item follow the same procedure as it is the case with the previously discussed accounts. If we consider operating income, the approach will be as per the sample two below;

Therefore, if one is provided with all information pertaining operating income account except one, then the balancing figure of the two sides turns to be the missing item and it can be either of the indicated items. Hence no law for it is the responsibility of the entrepreneur to make the right interpretation or judgement to establish the missing item in each scenario.

NB1: If the balance brought down (abbreviated as balance b/d) is on the debit side, then that represents accrued income which is categorized as current asset.

NB2: If the balance brought down (abbreviated as balance b/d) is on the credit side, then that represents income in advance which is categorized as current liability.

In conclusion, we have discovered that based on the available information pertaining a particular ledger account, it is possible to determine the missing item and if this exercise is to be undertaken for several accounts, it becomes possible to compute the net profit/loss of a business and thereafter prepare the necessary financial statements. Therefore, in the following two illustrations, we will demonstrate how incomplete ledger account are used to determine the missing items in each case.

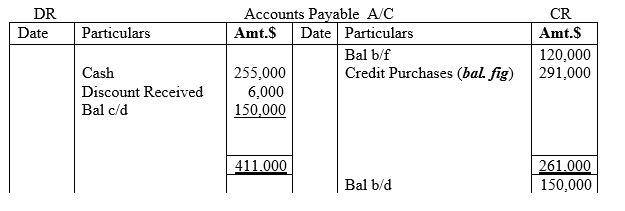

ILLUSTRATION ONE

Determination of Credit Purchases;

Suppose the following business events relating to Your co. ltd took place in the month of June 2019 as follows; Amt.$

Opening balance of accounts payable 120,000

Closing balance of accounts payable 150,000

Cash Payment made 255,000

Discount received 6,000

The total accounts payable will be prepared as follows:

Solution

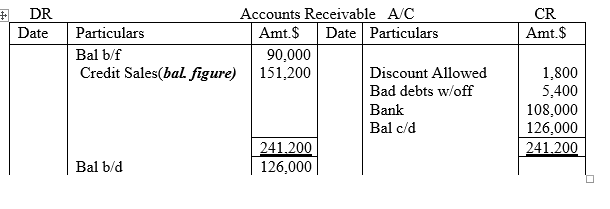

ILLUSTRATION TWO

Determination of credit sales;

The following information was gotten from the books of accounts of Your co. ltd

Amt.$

Accounts receivable on 1/1/2018 90,000

Accounts receivable 31/12/2018 126,000

Check received from trade debtors 108,000

Discount allowed 1,800

Bad debts written off 5,400

The total debtors account will be prepared as follows :

Solution

Lesson Four; Cash Summary Missing Item Approach

From the previous lessons in chapter five in this accounting tutorial series, we considered determination of missing item or figure using statement of affairs approach, specific accounts such as debtor, creditor, and income and expense categories. However, sometimes the missing item/figure may be in connection to the amount of cash paid to the creditors or amount of cash received from debtors. In other cases, the opening or closing amount of cash balances, either of cash or bank category may be missing. This therefore calls for preparation of cash book summary to guide the entrepreneur to determine the specific cash related figures.

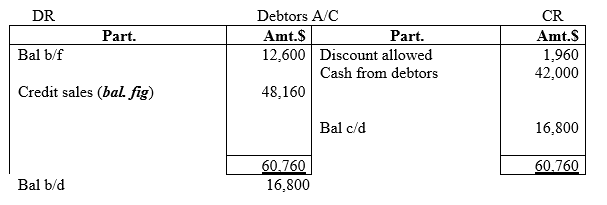

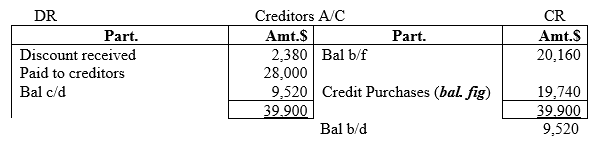

To ascertain any missing item, be it of cash receipt or cash payment nature, a cashbook summary portraying all receipts and payments for the current period is prepared whereby the balancing figure is assumed to be the missing item. Nevertheless, sometimes, the amount of cash received from the debtors and/or paid to creditors may be missing. To determine the missing figures for the two accounts respectively, total debtor and total creditor accounts are prepared as discussed earlier in the previous lessons.

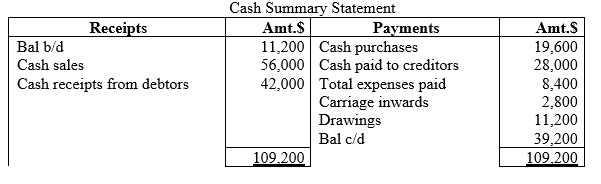

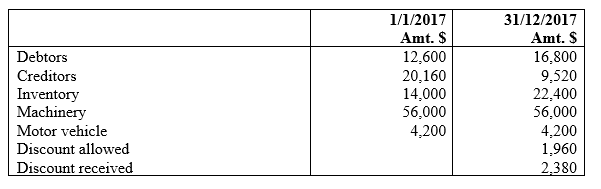

ILLUSTRATION ONE

Your co. ltd provided you with the following accounting information which portrayed incomplete records of various business events in 2017

Additional information;

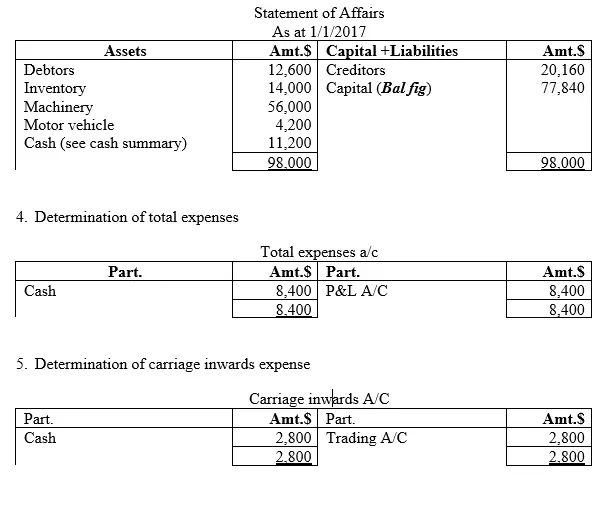

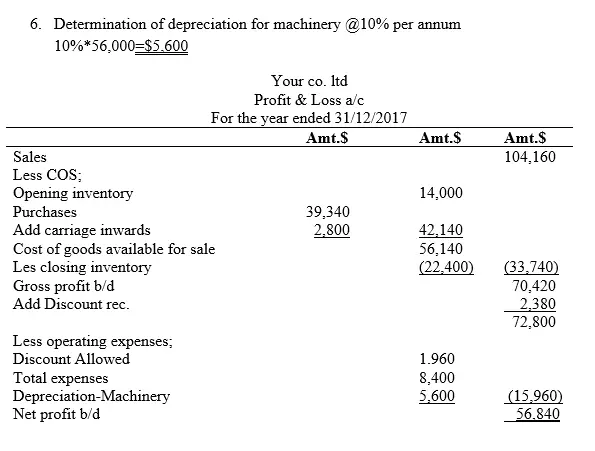

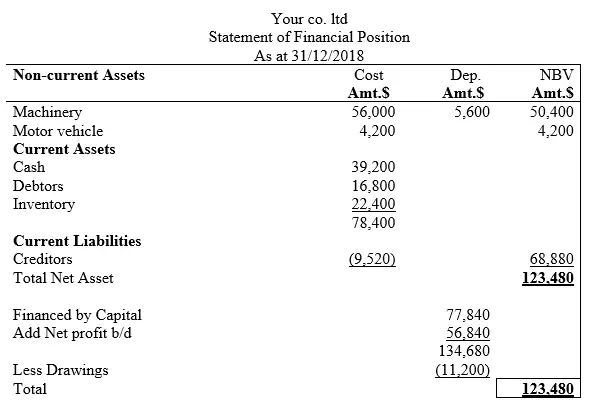

Workings;

1. Determination of total sales (ie cash sales+credit sales)

Total sales=56,000(from cashbook)+47,600=$104,160

2. Determination of total purchases (ie cash sales+credit sales)

Total purchases=19,600(from cashbook)+19,740=$39,340

3. Determination of opening capital

Summary

The matter of incomplete records is key in Accountancy for most of the firms in the world operate under small scale and they do not have enough and qualified accounting professionals to maintain the double entry accounting system as expected. As a result, it becomes necessary to incorporate some appropriate methodologies to solve this issue.

This chapter dealt with the most common approaches of determining the gaps to be filled to enable proper book keeping. The statement of affairs is the common approach used in accountancy and it is almost a replica of the statement of financial statement only that the statement of affairs has an option of balancing figure while the balance sheet/statement of financial position is a complete system.

The incomplete records aids the entrepreneur/learner to determine the missing items such as credit sales, credit purchases, capital, net profit/(loss) and other related items which once determined, aid in the preparation of complete financial statements such as trading and profit and loss account and the statement of financial position. Sometimes, cash summary is considered to determine some missing items especially when the available information is too scanty. Further, although it was not discussed in this chapter five, accounting ratios can be utilized to determine the missing items such as closing inventory and cost of goods sold amongst other items. The chapter of incomplete records is also helpful in the proceeding chapter of accounting for non-profit making organizations.