Statement of Financial Position

According to IFRS, a balance sheet is referred to as statement of financial position. This brings out more clearly the role played by this statement. The balance sheet as traditionally known is a tool used to represent the financial position of the business. Most books of accounting purport that the starting stage or level of business bookkeeping process is when business transactions take place. Either one undertakes a purchase or sale transaction. This is not true for when the organization is just incorporated/or registered with the right authority, at that moment the business has a financial status implied, even when no cash or non-cash resource has been pumped in to it as capital. For your information, at this point, the business has a zero financial position.

According to IFRS the implication to the accounting information users is that, bookkeeping always starts with asking ourselves about the financial position of the business. This aids the entrepreneur or the learner to appreciate the fact that even when the plans of the business owner is to pump millions of finances into the business, the financial position at that juncture is zero and not the large amounts in the hands of the owner. In fact, this approach by IFRS further guide the entrepreneur/learner to appreciate the concept of separate entity whereby the implication portrays that the cash in the hand of the entrepreneur turns out to be different once transferred to the accounts of the business. That is, it becomes capital for the newly formed organization.

Therefore, although conventionally the term balance sheet has been in use for several decades to represent the financial position of a business within a specific period of time, the use of the term “statement of financial position” in accountancy is good practice according to IFRS. Note that the principle of preparing the financial statement has changed, but the new approach is more appealing to the accounting users. Further, the entrepreneur need to note that as per IFRS, the names used for some of the balance sheet components have been changed, as we shall discuss. The following lessons will focus on in depth aspects of the statement of financial position of business which entail balance sheet formats used in accounting and the implications statement of financial position components have on the entrepreneur’s business.

Statement of Financial Position Format

In level one/beginner, it was stated that the balance sheet/statement of financial position is presented in two main formats. Based on the criteria of the structure of arranging or recording the statement of financial position components, the vertical and the horizontal versions are used as it was mentioned in level one of this accounting tutorial series. In this lesson one we will demonstrate what this means. Of course the entrepreneur or the learner need to note that the two approaches are not different. It is just a matter of how the statement of financial position components are presented. The entrepreneur also need to note that the terms used will be as per the IFRS set. Further, the statement of financial position is classified in to gross and net asset format based on owners’ claim perspective as it will be demonstrated.

a). Statement of Financial Position; Vertical Format

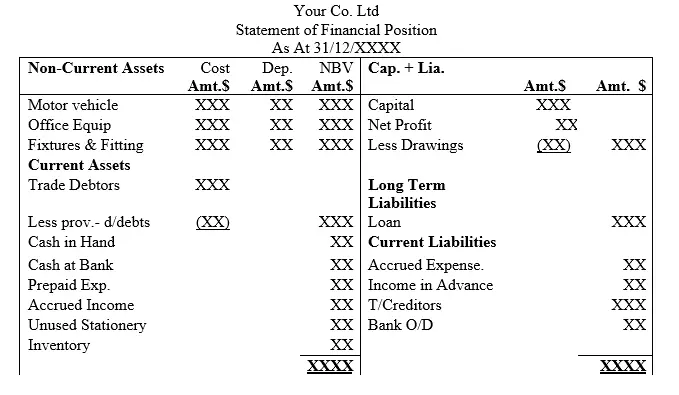

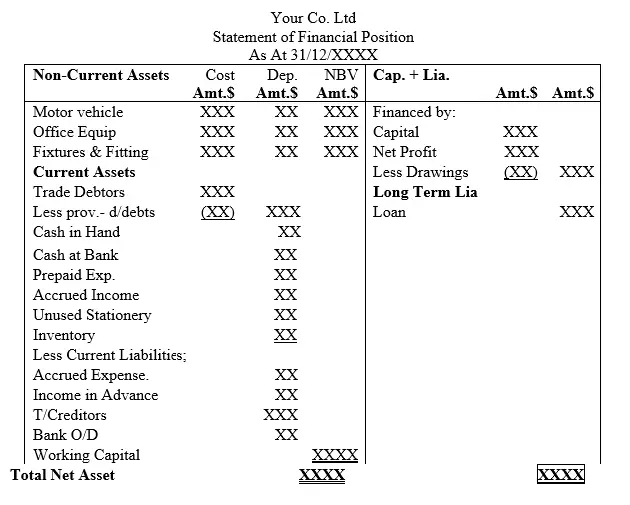

For level one/beginner and two/intermediate, the focus has been on the vertical format whereby the structural aspect of this statement is the capital letter “T”. The two levels in this tutorials majored on the vertical format for the sake of familiarization of how to prepare balance sheet. A detailed T format is as shown herein

b). Statement of Financial Position; Horizontal Format

The horizontal format is not different from the vertical format as shown below

Notes

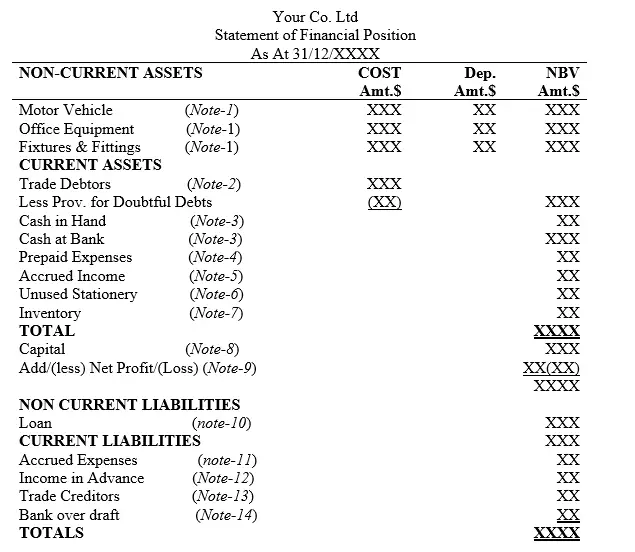

The following short notes comprehensively explain the detailed components of statement of financial position whether vertical or horizontal approach is used. This is explained as follows;

Note 1: The non-current assets components of balance sheet depreciate with use through wear and tear process as discussed in level two of this tutorial series. According to IFRS these assets are collectively referred to as Properties Plants and Equipment (PPE) and their presentation in the statement of financial position is governed by the IAS no 16.

Note 2: Trade debtors are also known as sundry debtors or total debtors. The fact is that, as an organization grows, the number of debtors increase. The monetary value of debtors presented in the statement of financial position is the aggregate one net of provisions associated with this balance sheet item. According to IFRS, this balance sheet item is known as accounts receivables. The entrepreneur need to note that since the number of trade debtors may increase, the recording of transactions affiliated to this balance sheet component may be subjected to errors or the accounting clerks may collude to with interested parties to corrupt the debtor system. As a result, preparation of total debtor control accounts also referred to as sales ledger control account is prepared to counter check the entries. This aspect will be discussed in level three of these accounting tutorials.

Note 3: This note focuses on cash in hand and cash at bank. In some accounting books, it is named as cash and bank. This means the same. The cash and bank elements are the most liquid assets of the business and their values appearing in the statement of financial position are the adjusted ones. What do I mean by this? The entrepreneur/learner need to understand that due to transaction timing mismatch, some of transactions affecting both cash and bank accounts may not be recorded yet at the end of the financial year. That is, may be on transition state by the time books of accounts were being closed. This calls for bank reconciliation. Therefore, the monetary values of bank and cash values appearing in the balance sheet are the reconciled ones as per bank reconciliation statement.

Note 4: The prepaid expenses appearing in the statement of financial position of a business at the end of the period are not expenses as it apparently sounds. It is a current asset due to the fact that the business had paid this element of expense in advance and this means that if the business did not pay in that manner which resulted in to an actual cash out flow, then such cash will be in the business at this time. Therefore, this item is as good as current asset. Another thing to be noted is that as the new financial period rolls out, a prepayment account is used to record the opening balance value of this item. This can take the form of a prepayment account or the corresponding expense account will portray a debit balance brought forward (bal b/f) for this is another financial period. This aspect will be discussed further in this level three.

Note 5: The accrued income appearing in the statement of financial position of a business at the end of the period are not income per se’ as it apparently appears. It is a current asset due to the fact that the business had provided the service(s) but actual cash inflow is not yet received by the end of the financial period. Therefore, this item is as good as current asset. Another thing to be noted is that as the new financial period rolls out, an account is used to record the opening balance value of this item. This can take the form of accrued income account or the corresponding income account with a debit balance brought forward (bal b/f) for this is another financial period. This aspect will be discussed further in this level.

Note 6: Unused stationery item is unique in that its acquisition is categorized as an operating expense. This classification applies if all units of stationery are used up at the end of the financial period, hence the monetary amount thereof is charged in the profit and loss account. If it is partly used up, then the accounting treatment is twofold. That is, the part of stationery cost which is used up at the yearend is charged to P&L account and the balance is treated as a current asset or as inventory of unused stationery.

The journal entries will be as follows;

i) On acquisition/purchase of stationery

DR Stationery A/C XXX

CR Cash/or Bank A/C XXX

ii) On full usage of the stationery items

DR P&L A/C XXX

CR Stationery A/C XXX

iii) On partial usage of the stationery items

DR P&L A/C with the portion used up XX

CR Stationery A/C XX

NB: The unused portion of stationery will be categorized as a current asset item

Note 7: inventory as used in level one and two is for finished goods. Also referred to as merchandized goods which are completely produced. The entrepreneur/learner should understand that in addition to inventory of finished goods, there are also other cases of raw materials which are unused at the end of the financial period especially with cases of manufacturing organizations. Such materials are termed as closing inventory of raw materials. On the same breathe, some raw materials are utilized in production but by the time the year has come to an end, the goods are incomplete. Such materials which are in the state of being processed are referred to as closing inventory of Work in Progress (WIP). The entrepreneur/learner need to note that any closing inventory is classified as current asset whether it is of finished goods, work in progress or of raw materials. In level three, the focus will be inventory of all categories.

Note 8: Capital is owner’s equity or claim. It is the personal contribution that the owner of the business makes towards start of the business.

Note 9: Net profit is generally referred to as firm reserve. If it is ploughed back in to the business, it is referred to as retained earnings or if it is distributed to the shareholders, it is referred to as dividends. It should be noted that if it is ploughed back to the organization, it becomes part of the capital hence it is owner’s equity or claim. More light will be shade on it shortly.

Note 10: Loan is a long term external debt which is repayable with interest within a period of more than one year. The principal part of the loan forms part of long-term liability of the organization while the loan interest part is an operating expense, hence charged in the P&L A/C at the end of the year.

Note 11: Accrued Expense appearing in the statement of financial position of a business at the end of the period are not expenses as it apparently appears. It is a current liability due to the fact that the business had received or enjoyed the service(s) in advance and this means that if the business did not pay it results to an actual cash out flow in the future hence an obligation. Therefore, this item is as good as current liability. Another thing to be noted is that as the new financial period rolls out, an accrued expense account is used to record the opening balance value of this item. This can take the form of accrued expense account or the corresponding expense account with a credit balance brought forward (bal b/f) for this is another financial period. This aspect will be discussed further in this level.

Note 12: Income in advance appearing in the statement of financial position of a business at the end of the period are not an income as it apparently appears. It is a current liability due to the fact that the business had received the cash before providing the service(s). Hence an obligation. Therefore, this item is as good as current liability. Another thing to be noted is that as the new financial period rolls out, an income in advance account is used to record the opening balance value of this item. This can take the form of income in advance account or the corresponding income account with a credit balance brought forward (bal b/f) for this is another financial period. This aspect will be discussed further in this level.

Note 13: Trade creditors are also known as sundry creditors or total creditors. The fact is that, as an organization grows, the number of creditors increase. The monetary value of creditors presented in the statement of financial position is the aggregate one net of provisions associated with this balance sheet item. According to IFRS, this balance sheet item is known as accounts payable. The entrepreneur need to note that since the number of trade creditors may increase, the recording of transactions affiliated to this balance sheet component may be subjected to errors or the accounting clerks may collude to with interested parties to corrupt the creditor system. As a result, preparation of total creditor control accounts also referred to as purchases ledger control account is prepared to counter check the entries. This aspect will be discussed in level three of these accounting tutorials.

Note 14: Bank overdraft is a short-term liability that arises when the business arranges with the banking institution (ie bank) to withdraw more cash than it has deposited. There is no account known as bank overdraft account as it is in other cases. A bank overdraft exists when the bank account has a credit balance brought down (bal b/d) at the yearend. It should be noted that an organization may have several accounts in different bank institutions where by some may portray debit and others credit balances. The entrepreneur need to remember that it was concluded in level one that all assets have debit balance except bank account which can assume both debit and credit balances. Therefore, if a bank account has a debit balance, then that is a case of current asset. Unlike if the bank account has a credit balance, then that turns to be a bank overdraft and it is classified as a current liability.

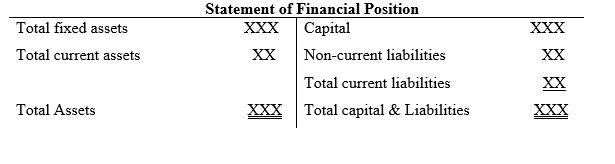

c). Gross Approach-Statement of Financial Position

Whether the format of a balance sheet is vertical or horizontal, it can be presented in a gross manner. In this case, all the assets are recorded on one side and all the liabilities are classified together. This is the approach that was used in case (a) and (b) in the previous discussion. So for the sake of clarification, just re-visit that part and familiarize yourself with the format. O key, if you are not in a position of doing so, the general format for the gross approach is as follows;

d) Net Asset Approach-Statement of Financial Position

The net asset approach considers the financing aspect of the business and therefore working capital is incorporated as shown below. (Hint; for the sake of full understanding of the approach, horizontal format is used for this demonstration)

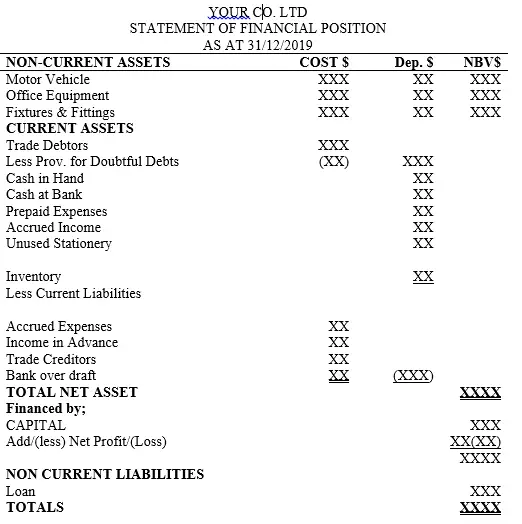

Vertical Format-Net Approach

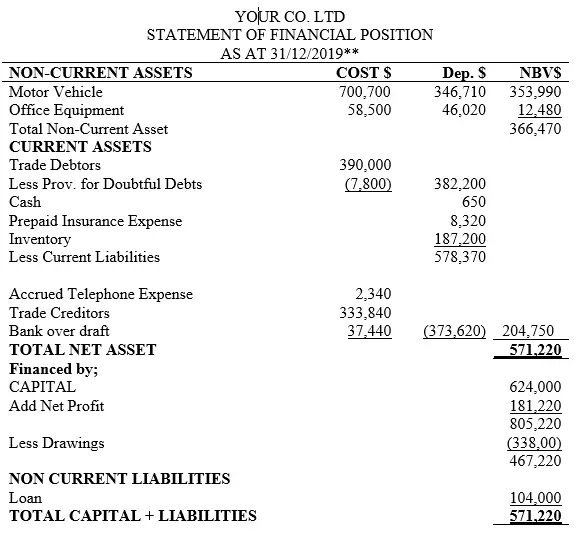

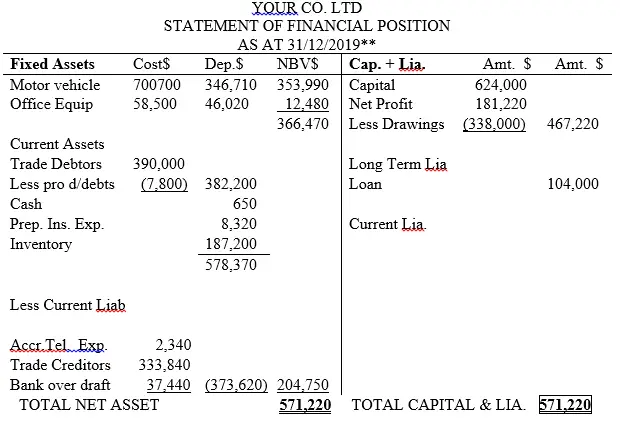

Illustration one

NB: (Extract from intermediate level Quiz with answers)

Vertical format-Net Asset Approach

Horizontal Format-Net Asset Approach

Illustration two

NB: (Extract from level 2/intermediate Quiz with answers)

Consider the same balance sheet used in illustration one in the case of the vertical format aforementioned. The horizontal format will be as follows