Correction of trial balance errors

The trial balance subject has been introduced and discussed in the first two levels in this accounting tutorial series whereby it was clarified that the main function of this financial statement is to summarize the account balances for all accounts affected by the transactions of that particular accounting period. Also, by extension, the statement aids in detecting errors that could have occurred during that period. In this chapter, further discussion will be undertaken to demonstrate the implications of those errors on the specific accounts affected, financial statement and the strategies to use to correct them. Therefore, in this chapter the discussion will be guided by the following specific objectives, namely;

i)To describe the step by step procedure of identifying and correcting the error

ii)Preparation of adjusted net profit/loss statement

iii)Preparation of adjusted statement of financial position

Part one: Correction of errors

In level two, the focus was on the systematic procedure or guidelines on how to identify the errors whether they are detected or not detected by the trial balance. In that level, we only focused on intermediate issues that may occur and are easily corrected. That is the errors which were looked at was assumed to have occurred during preparation of the ledger account or the financial position. In level three, the focus is more interrogative with the assumption that the entrepreneur/learner has grown his business to a medium size and has also faced some cases of errors which are manageable or if they are class room learners, they are in advanced level in Accountancy.

Therefore, in level three aspects of errors originating from source documents and books of original entry will be incorporated. In a nutshell, from lesson one to lesson four all aspects of accounting have been factored in. To start, lesson one gives us the general guideline to adhere to in any situation we face.

Errors affecting the books of accounts of any business will be due to wrong calculations or wrong entries made on either;

The source documents

Prime books or books of original entries

Ledger account

Trading account components,

Profit and loss account components

Statement of financial position components.

Therefore, correction of errors of any nature is pegged on the eight steps summarized as follows

STEP ONE; Identification Error Originality

Using rolling back technique, as per information provided, trace the origin of the error that occurred. That is, whether it originated at the stage of recording transactions in the source documents; during recording of transactions in the prime books or books of original entries; or posting information in the ledger account; during preparation of trading account components or profit and loss account and or in preparation of statement of financial position. This approach will aid the accountant or the entrepreneur if he or she is the one solving the problem so as to comprehend the items affected by that error. This is because an error which occurred during preparation of source document will affect several account items as compared to an error that occurred during preparation of either trading or profit and loss account.

STEP TWO; Classify or assess the type of error that has occurred

This step aid you to understand the course of action to undertake to rectify the mistake or the error. Error are broadly classified in to errors that affect or are detected by the trial balance which are of arithmetic or errors which do not affect the trial balance commonly referred to as errors not detected by the trial balance.

STEP THREE; Assess the nature of effect the error has caused on the identified item

The nature of effect may assume many forms.

One; the primary effect of increase or decrease on the item affected. One should consider whether the effect of the error resulted to overstating or understating of the item of our focus. This will assist in knowing the adjustment approach to be used to correct the error.

Two; multiplicity effect whereby the error affect several items at once. When this scenario occurs, the accountant or the entrepreneur will consider all the items affected by listing them down and then adjust each case at a time

Three; recurring effect whereby an error keep on repeating itself if it is not corrected in the first instance. If this nature of an error occurs, the accountant is supposed to trace back the period when the error occurred for the first time and then move forward correcting the error in the proceeding periods up to the current period in question.

STEP FOUR; Extract the respective affected ledger account(s)

This stage involves opening of the respective ledger accounts and transferring the erroneous information as it is. At this point, the entrepreneur or accountant is in a position to tell the status quo of the account. At the same time, this step aids one to vividly understand the approach to use to correct the error.

STEP FIVE; Journal entries

This step involves preparation of journals to correct the errors. As you can remember in the previous discussions we concluded that journals are used for correction of errors among other functions. One advantage of using journals in correcting errors unlike the direct adjustment of the respective ledger account is that there is a narration/short explanation of the action undertaken. This helps in accountability to interested parties to know the reason the changes were made on a particular account or financial statement.

STEP SIX; Adjustment of the respective ledger account(s)

This step involves posting of journal information to the respective ledger account or accounts so as to correct the balances brought down. The adjusted ledger accounts are used to prepare the correct balance sheet or statement of financial position.

STEP SEVEN; Adjustment of profit and loss account

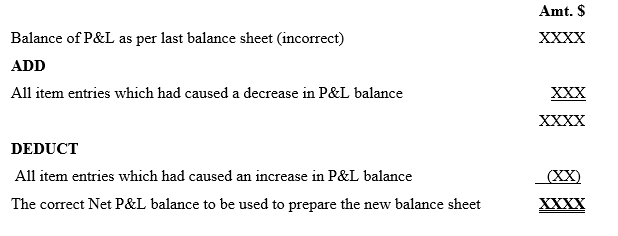

This step involves making remedial entries in the profit and loss account so as to arrive at the correct net profit/or net loss for the period. To achieve this objective, one prepares an adjusted profit and loss statement where by the incorrect profit and loss account balance as appearing in the financial statement is recorded first, then;

Add: All entries which had decreasing effect on the P&L account

Less: All entries which had an increasing effect on the P&L account

STEP EIGHT; Adjustment of the balance sheet/statement of financial position

This step involves preparation of the new corrected/adjusted balance sheet. To achieve this objective, the entrepreneur need to consider the adjusted or corrected ledger accounts previously affected by the error in question and other accounts with no errors and the adjusted P&L account balance established in step seven.

The aforementioned eight general steps of correcting errors applies to all account items, be it of asset, capital, liability, income and/or expenses nature. In lesson two simplified illustrative steps of correcting the commonly affected items is presented to give the entrepreneur an overall picture of how these corrections are made. So a few items have been considered and illustrations used for that purpose.

Lesson One; Source Documents-Step by Step Correction of Errors

As we had discussed in level two of this accounting tutorials, source documents are the notes that are used to record the genesis of any transaction. They are the official papers that are used to prepare books of original entry. They include debit note, credit note, invoice, goods received note, delivery note and purchases order among others.

Since this is the document(s) where transactions are recorded for the first time, chances are that such errors are recurring in nature and they will be inherited to all the other documents if not noticed early in advance. However, whenever they are identified, the right correction measures are undertaken. The common error that may occur are;

1.) Error of original entry. This is the most probable error to take place in the source document. For instance, when a transaction takes place and it is wrongly recorded in a certain manner, then that error remain like that and it will be recurred to all the other books of account. For instance, it will be transferred to the books of original entry, then posted to the respective ledger account and to the financial statement such as trading and profit and loss account and statement of financial position.

Corrective measures;

Step one: At the stage when the error is identified, that is the point at which rectification measures should be taken. This calls for application of rolling back technique until all the effect is reversed.

Step two: To achieve this objective, the entrepreneur/learner need to identify the nature of the error that has occurred and then adjust. The entrepreneur/learner should tract the related documents in the other levels of recording such as books of original entry and then the corresponding ledger account and may be the affected financial statement

Step three: Adjust the error from the source document up to the last book of accounts affected.

ILLUSTRATION ONE

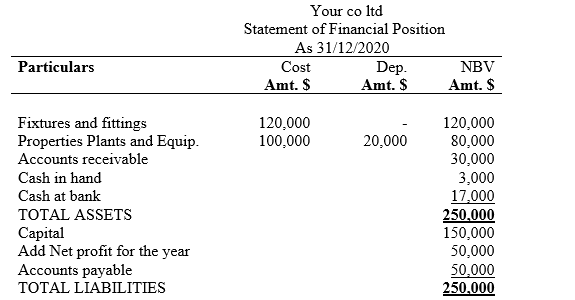

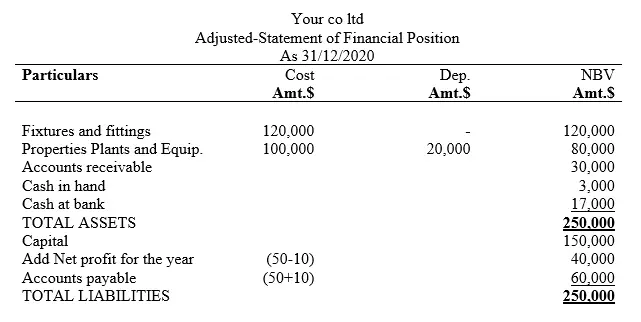

Your co. ltd accounts clerk provided you with the following balance sheet for the year ended 31/12/2020

Additional information

The properties plants and equipment were acquired on 1st/1/2019 and depreciation policy was set at 20% per annum at cost as per the board meeting which was held on 15th/11/2018. Unfortunately, the clerk recording the minutes during the board of directors meeting indicated that the depreciation rate was 10% per annum at cost. This was what was applied on the PPE to compute depreciation.

Required;

Correct the error and prepare the adjusted balance sheet as at 31/12/2020

Solution

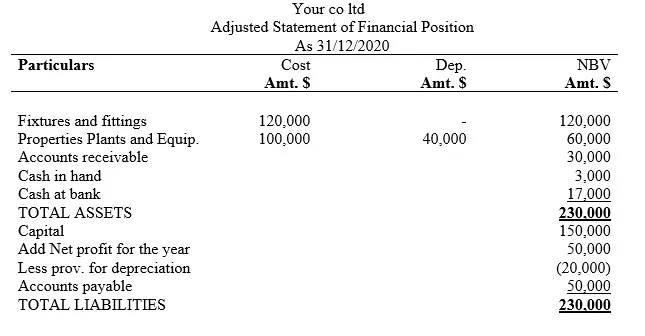

This is the point, that PPE was charge with the wrong depreciation amount for a period of two years. In other words, depreciation was understated for it was computed as 10% pa instead of 20% per annum. Therefore,

The wrongly calculated depreciation amount for the two years of 2019 and 2020 was

10%*100,000=10,000*2=20,000

Accounting implication;

The above error implies that the net book value of PPE was overvalued and again the net profit was also overvalued. For instead of deducting 40,000 from P& L account, only 20,000 was charged.

To adjust that problem, entrepreneur will make the following journal entries

DR P&L a/c 20,000

CR Provision for Depreciation 20,000

Therefore, the adjusted balance sheet will be as follows

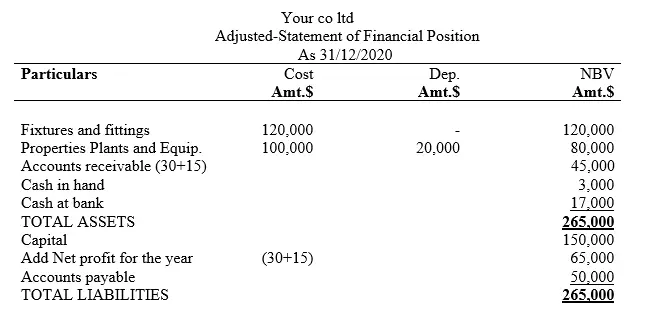

Lesson Two; Books of Original Entry-Step by Step Correction of Errors

Some errors may also occur at the point of either transferring data from the source documents in to the books of the original entry or from the books of the original entry to the respective ledger accounts. In this case, the entrepreneur/learner need to be extra careful for the accounting implication may be manifold.

Errors occurring at the book of the original entry level means that it was well recorded in the source document but wrong recording went to the proceeding documents. It should be noted that there is no specific approach of correcting such an anomaly for the methodology to be adhered to will be dictated by the error implications thereof. Here we go…

ILLUSTRATION TWO

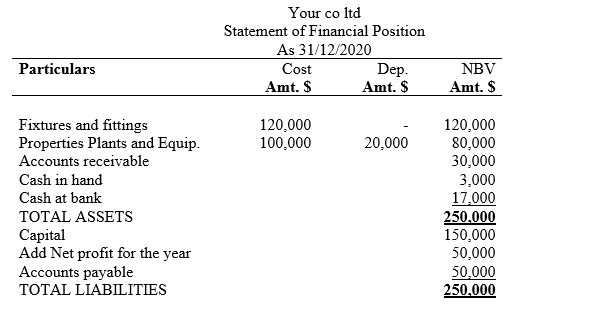

Assume the facts of illustration one above and therefore the balance sheet was as follows;

Although the balance sheet balanced, the accountant discovered that both accounts receivable and payable had some discrepancies as stated below

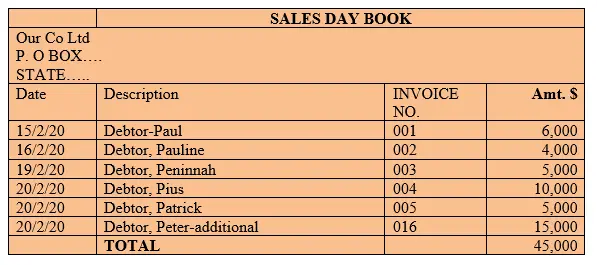

a) -When the total amount of individual debtors were being transferred from the outgoing invoice to the sales day book which is a book of original entry, that amount of $15,000 belonging to debtor Peter was overlooked hence was not part of the total amount for all the debtors

b) -Accounts payable report was wrongly recorded as $50,000 in the purchases day book which is a book of original entry as shown in the balance sheet while the correct amount was $60,000.

Required,

Correct the above errors and extract an adjusted balance sheet as per that date.

Solution

Case “a”

Let us interrogate the implication of each case at a time for they appear to be the same. First, let us look at case (a). In this case, the $30,000 was not the correct figure for the outgoing invoice for debtor Peter amount was missing in the list of debtors. The scenario was as follows

NB1: This transaction which was not included in the sales day book implies that;

-the amount recorded in the accounts receivable was understated by $15,000

-sales account was also understated by the same amount.

-also profit and loss account was understated by $15,000 for it means that sales account was credited with total sales value of $30,000 instead of $45,000

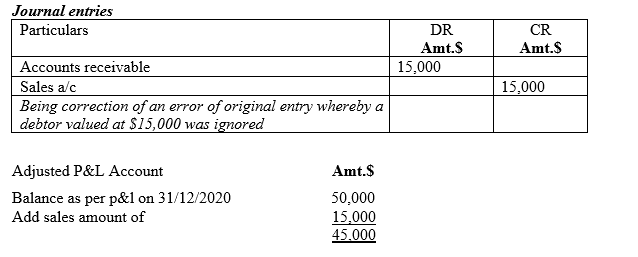

Corrections;

To rectify the aforementioned error, the following are the corrective measures;

Case “b”

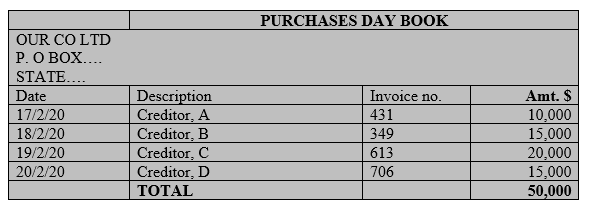

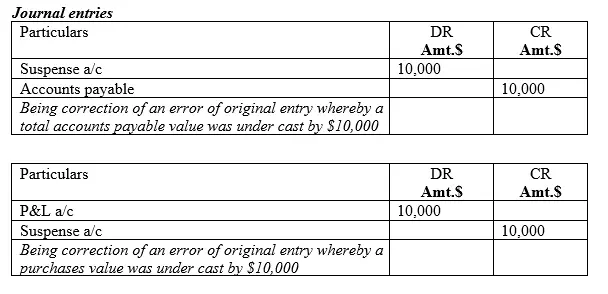

In case b, accounts payable report was wrongly recorded as $50,000 in the purchases day book which is a book of original entry as shown in the balance sheet while the correct amount was $60,000. This what probably transpired, that the purchases day book was recorded as follows;

Now, this case is different from case a. This is because all the individual creditor accounts were included in the purchases day book. Only that the grand totals was wrongly recorded as $50,000 instead of $60,000. This means that accounts payable amount as appearing in the statement of financial position was correct but the grand total value was less by $10,000. Therefore, by extension, the purchases amount was under casted by $10,000. Hence cost of goods sold was under cast and at the same time P&L account was over cast.

The corrective measures are as follows;

Lesson Three; ASSETS-Step by Step Correction of Errors

Assets are properties or goods owned by the business in a particular period and can be assigned a monetary value. As discussed earlier in the previous level one and two, these assets are classified in different manner based on diverse criteria used. In this discussion, we will focus on each category of asset and consider type of error and the effect/impact (ie an increasing or decreasing effect) on that particular asset, its implication to both trial balance and the balance sheet statements of the business and the steps to undertake to correct such errors. Remember that the type of asset under scrutiny dictates the extent of financial implications of the business. To achieve this objective we will make use of different scenarios and illustrations to demonstrate this concept

1.) Non-Current Assets

Fixed assets are also referred to as non-current assets as per IFRS and they are properties or goods owned by the business and can be assigned a monetary value and exist in the business for a period of one or more than one year. It also suffers economic losses on usage commonly referred to as depreciation. Depreciation may fall under the class of wear and tear, if it is a case of physical goods; depletion, if it is a case of minerals, obsolescence, if it is a case of technology and impairment/amortization, if it is a case of intangible assets such as copyrights, franchise, patent rights, trade marks or any other intellectual property rights.

Error affecting Non-Current Assets

If an error has for instance, an increasing impact on fixed/non-current asset, the financial implication is manifold depending on the circumstances surrounding the subject matter. The first question the entrepreneur/learner need to ask him or herself is whether the asset is subject to depreciation provision or not.

Case one: If no Provision for Depreciation

This is a rare case for most of the fixed assets under go wear and tear process (ie depreciation). But for the sake of the beginners in Accountancy, let us assume that the fixed asset does not have such a provision. In this case, if the error causes an increasing effect to the fixed asset, this implies that both the fixed asset value and the balance sheet asset totals are overvalued.

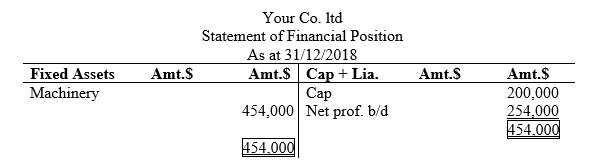

ILLUSTRATION ONE

The balance sheet/statement of financial position of Your co. ltd as at 31/12/2018 was as follows;

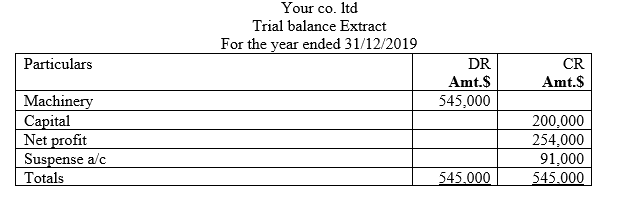

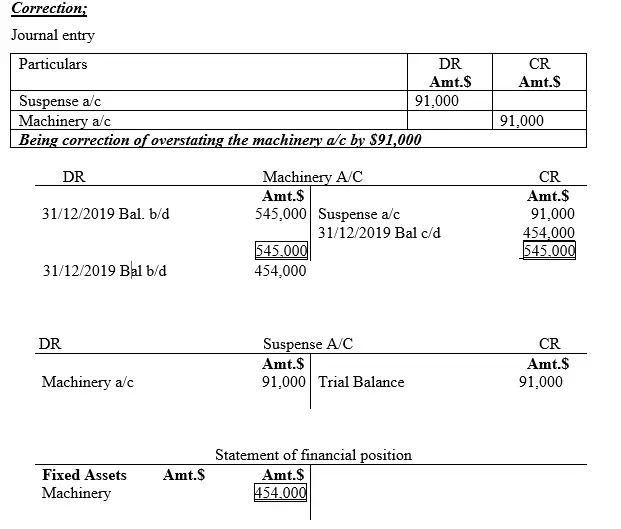

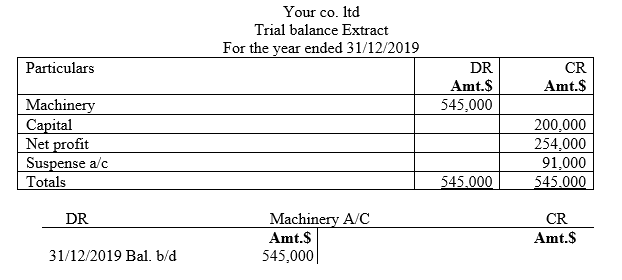

On 1/1/2019, the opening balance brought forward for machinery account of Your co. Ltd of the previous year 2018 was wrongly indicated as $545,000. On further investigation by the chief accountant, it was established that, this account was overstated by $91,000.

Hint: There was no transaction related to machinery account that took place in 2019 and again the error aforementioned was noticed after preparation of final books of account on 31/12/2019.

Interpretation;

This error implies that:

One; this is an arithmetic error for it involves wrong addition/or subtraction of figures for the machinery account.

Two; it makes the trial balance not to balance. In other words, the error is detected by the trial balance by failing to balance on its both sides. It involves use of suspense account for its correction

Three; the balance sheet also referred to as statement of financial position is overstated.

Four; machinery account was overstated by $91,000

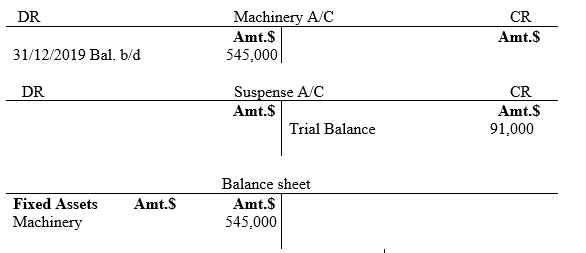

Current position in books of accounts before correction

NB: In this case, a suspense account is created to ensure that the trial balance statement balances.

Case two: If there is Provision for Depreciation

Provision for depreciation is a common practice by businesses for most of the fixed assets under go wear and tear process (ie depreciation). In this case, if the error causes an increasing effect to the fixed asset, this implies that several accounts and financial statements of the business will be affected, namely; the fixed asset itself; associated provision for depreciation for fixed asset; profit and loss account and balance sheet.

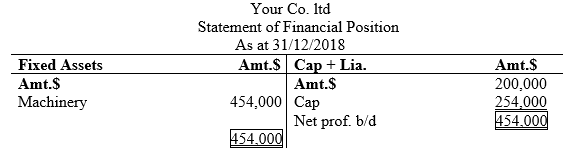

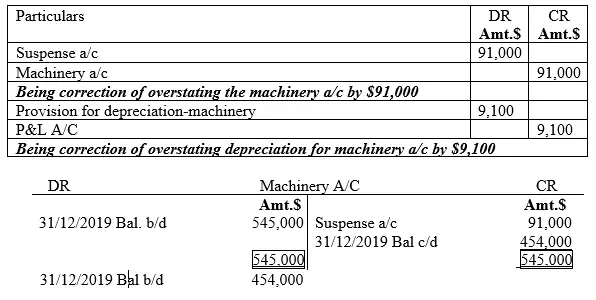

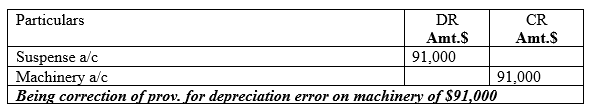

ILLUSTRATION TWO

Assume the facts of previous illustration one that, Your co. balance sheet/statement of financial position was as follows;

On 1/1/2019, the opening balance brought forward for machinery account of Your co. Ltd as extracted from the previous year 2018 was wrongly indicated as $545,000. On further investigation by the chief accountant, it was established that, this account was overstated by $91,000.

There was no profit made or any transaction related to machinery account that took place in 2019, EXCEPT that the management introduced a new provision for depreciation policy with effect from 1/1/2019 of 10% per annum of the net book value.

Hint: the error aforementioned was noticed after preparation of final books of account on 31/12/2019.

Interpretation;

This error implies that:

One; this is an arithmetic error for it involves wrong addition/or subtraction of figures for the machinery account.

Two; it makes the trial balance not to balance. In other words, the error is detected by the trial balance by failing to balance on its both sides. It involves use of suspense account for its correction

Three; net profit is understated

Four; the balance sheet also referred to as statement of financial position is overstated as far as the machinery asset is concerned.

Five; machinery account was overstated by $91,000

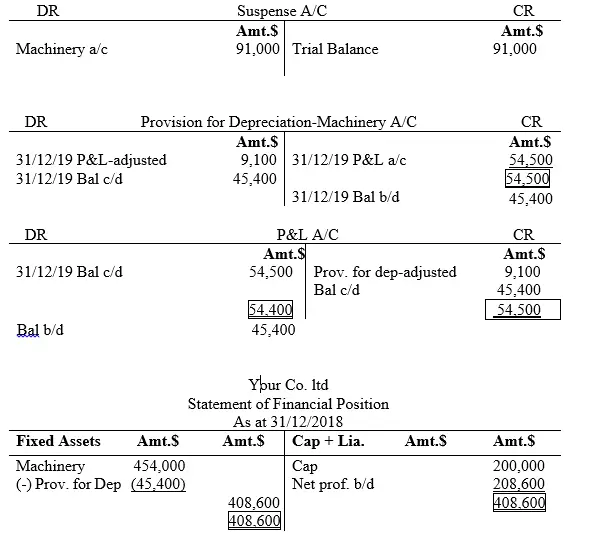

Six; provision for depreciation account is overstated

Seven; the depreciation amount charged to profit and loss account is overstated hence net profit understated.

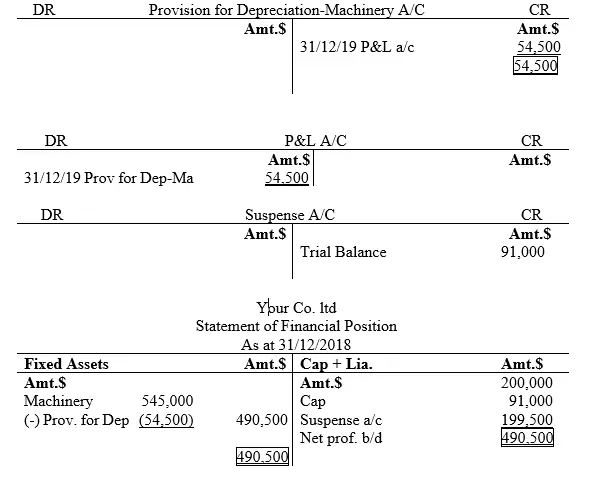

Current position in books of accounts before corrections

Workings for provision for Depreciation;

10% of 545,000= 54,500

Correction;

Journal entry

Correct Workings for provision for Depreciation;

Journal Entry to correct the provision for depreciation error

10% of 454,000= 45,400

10% of 545,000= 54,500

Difference = 9,100

2.) Current Assets

Current assets are properties or goods owned by the business and can be assigned a monetary value and exist in the business for a period of less than one year. It does not suffer economic losses on usage as it is in the case of fixed assets. Examples of current assets are; debtors, prepaid expenses, inventory, accrued income, cash and bank, just to mention but a few.

Error affecting Current Asset

If an error has for example, an increasing impact on current asset, the financial implication is also manifold depending on the circumstances surrounding the subject matter. Unlike in the case of fixed assets, the current assets do not undergo wear and tear process (ie depreciation). Therefore, the focus as far as financial implication is concerned is different as compared to that of fixed or non-current assets. To elaborate this concept, we will consider cases of various current assets and interrogate the financial implications thereof.

Case three; Error affecting Debtor’s Value

Debtors are current assets arising in a business when goods have been sold on credit. The type of error affecting this balance sheet item may either be detected by the trial balance or may not. The financial implications occurring in the business is dictated by the type of error and the extent of effect on debtor value. This concept is substantiated by the following illustrations.

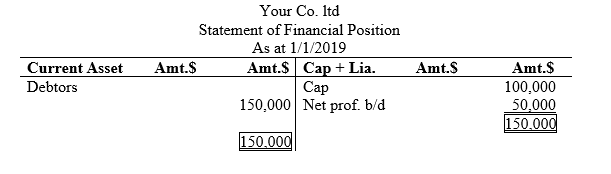

ILLUSTRATION THREE

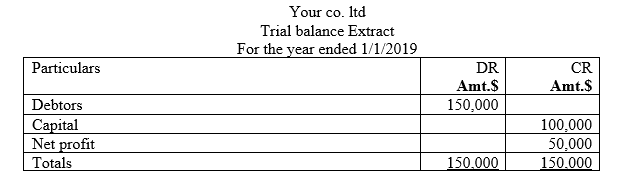

The opening balance sheet for the year 2019 for Your Co. ltd was as shown below

The following transactions took place in 2019

31/1/19 it was noticed that goods sold on credit to Patricia of $45,000 in 2018 were wrongly recorded in the books of Patrick. Assume that no other transaction that took place in that month.

Required

i) Show the financial implications/position before the corrections were done on 31/1/2019

ii) Show the corrections and the final financial position after the error was corrected

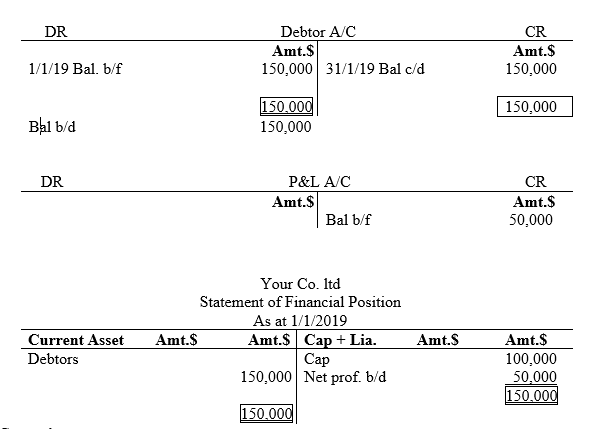

Solution

Interpretation

i) The following is the current financial implications;

The type of error that occurred is referred to as error of commission. This is an error whereby a transaction is posted in the wrong account but of the same class of account. In this case, the credit sales were wrongly debited in Patrick’s debtor account instead of Patricia’s debtor account. Yet the two accounts are in the personal account category.

The trial balance did not detect the error. In other words, the trial DR and CR sides balanced.

Debtors account remained the same only that some inter-debtor adjustments are necessary

Net profit did not change

Current position before error correction;

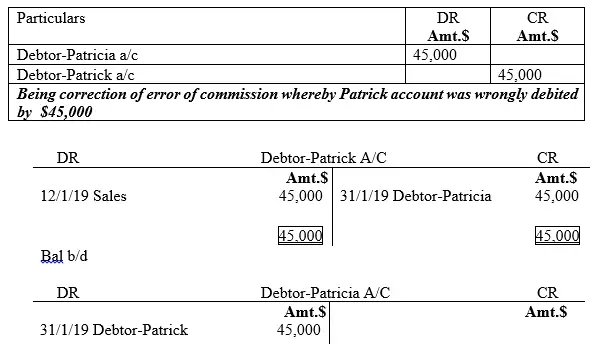

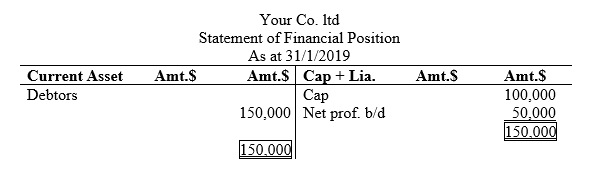

Correction

Journal entry

Note: That the error did not cause any imbalance in the trial balance and that is why the trial balance remained the same. However, when the trial balance totals are equal, it does not mean that there are no errors per se’.

Case four; Error affecting Inventory Value

Inventory is current asset arising in a business when goods remain unsold at the end of the financial period. Errors may occur on this item causing an overestimation or under estimation of the monetary value. This concept is substantiated by the following illustrations.

ILLUSTRATION FOUR

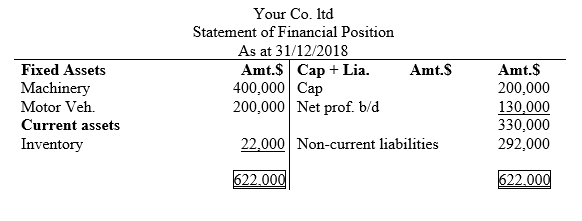

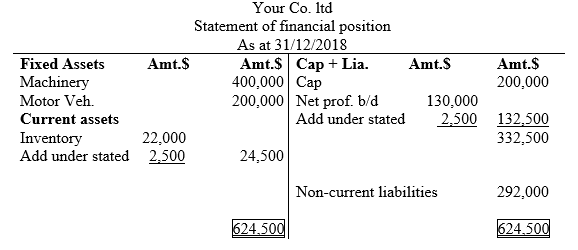

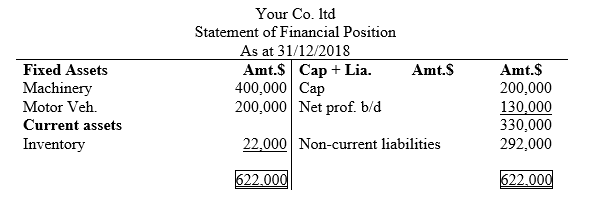

The following statement of financial position of Your Co. ltd was extracted on 31/12/2018

Suppose the closing inventory was undervalued by $2,500

Financial implication

Overall current assets are undervalued

Net profit is also undervalued

Correction;

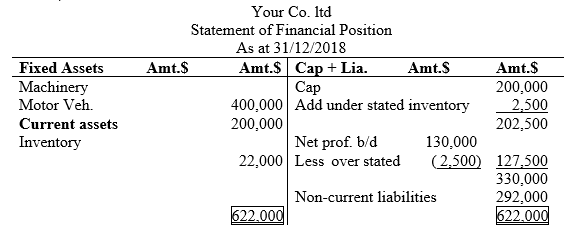

ILLUSTRATION FIVE

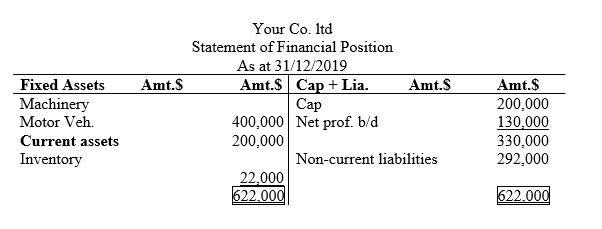

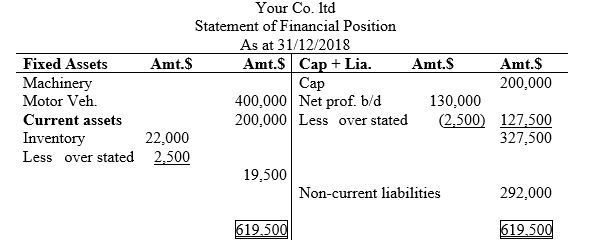

The following statement of financial position of Your Co. ltd was extracted on 31/12/2019

Suppose the closing inventory was overvalued by $2,500

Financial implication

Overall current assets are overvalued

Net profit is also overvalued

Correction;

Note: That, if closing inventory is undervalued, the net profit is also undervalued and both should be adjusted upwards. Whereas, if the closing inventory is overvalued the net profit is also overvalued and both should be adjusted downwards. Therefore, there exists a direct relationship between the valuation of closing inventory and the net profit.

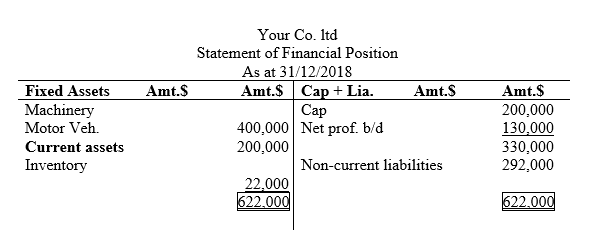

ILLUSTRATION SIX

The following statement of financial position of Your Co. ltd was extracted on 31/12/2018

Suppose the opening inventory was undervalued by $2,500

Financial implication

No effect on the overall current asset values

Net profit is on the other hand overvalued

Capital from the previous period (ie 2017) had been undervalued due to undervalued Closing inventory which turned out to be the opening inventory of 2018

Correction;

Note1: That, the capital is positively adjusted for it was brought forward from the previous year of 2017 which is a sum of the 2016 net profit brought forward plus the 2017 net profit which had been undervalued due to the closing inventory which was valued less by $2,500 and became the opening inventory of 2018. Therefore, for the statement of financial position of 2018, capital is undervalued but the net profit is overvalued such that the two entries sets off the incremental and declining effects. Hence maintaining the same status quo of the balance sheet.

Note2: That, for the closing inventory of year 2018, will remain constant. This is because the valuation of inventory is independent of other inventory related transactions such that we only consider the value assigned to the closing inventory but not the previous opening one.

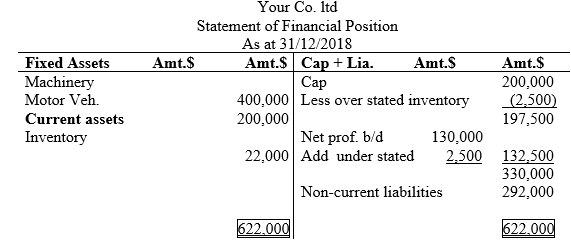

ILLUSTRATION SEVEN

The following statement of financial position of Your Co. ltd was extracted on 31/12/2018

Suppose the opening inventory was overvalued by $2,500

Financial implication

No effect on the overall current asset values

Net profit is undervalued

Capital from the previous period (ie 2017) had been overvalued due to overvalued Closing inventory which turned out to be the opening inventory of 2018

Correction;

Note1: That, the capital is negatively adjusted for it was brought forward from the previous year of 2017 which is a sum of the 2016 net profit brought forward plus the 2017 net profit which had been overvalued due to the closing inventory which was valued more by $2,500 and became the opening inventory of 2018. Therefore, for the statement of financial position of 2018, capital is overvalued but the net profit is undervalued such that the two entries sets off the incremental and declining effects. Hence maintaining the same status quo of the balance sheet.

Note2: That, for the closing inventory of year 2018, will remain constant. This is because the valuation of inventory is independent of other inventory related transactions such that we only consider the value assigned to the closing inventory but not the previous opening one.

Note3: That, if opening inventory is undervalued, the net profit is on the other hand overvalued. Therefore, capital value is adjusted upwards whereas for net profit, it should be adjusted downwards. If opening inventory is overvalued, the net profit is on the other hand undervalued. Therefore, capital value is adjusted downwards whereas for net profit, it should be adjusted upwards. Hence, there exists an indirect or inverse relationship between the valuation of opening inventory and the net profit.

Lesson Four; LIABILITY-Step by Step Correction of Errors

Liabilities can be classified into two for this purpose, capital and external debts such as non-current and current liabilities. Our focus will be on capital although in the illustrations we will use will tackle the treatment of the external debts.

Capital is the owner’s contribution or net worth. It is also referred to as special liability and it is a balance sheet component. Capital indicated in the balance sheet/statement of financial position originates from the previous period and it is adjusted by profit, loss, investment or additional capital and drawings. Therefore, any transaction affecting those aspects aforementioned may either cause a decrease or increase in value of capital. To adjust the capital value, a reverse entry is made.

The entrepreneur/learner should also note that the errors occurring on the four items may also originate from errors affecting other account items. Therefore, it is the responsibility of the entrepreneur to judge correctly at what point or stage he or she should start correcting the error(s). The following illustrations elaborates this perspective further as follows;

ILLUSTRATION ONE

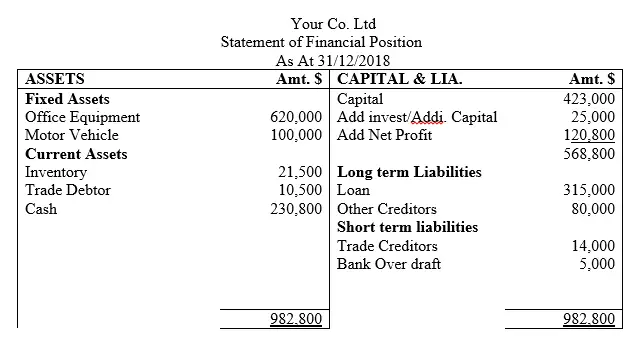

The following statement of financial position was extracted from the books of Your Co. ltd for the year ended 31/12/2018

After the statement of financial position had been prepared on 31/12/2018, the entrepreneur realized that the following errors had occurred;

i) A loan of $350,000 was gotten from Fidelity bank on 31/12/2016 and the agreement between the bank and the business was that the principle and interest of 1.2% per annum is repayable within a period of 10 years on reducing balance basis. This charges were paid in December 2018 in cash but was not accounted for in the year 2018 as supposedly.

ii) The additional investment originated from a motor vehicle that was contributed by the business owner in January 2018 but in actual sense, the owner was purely using the fixed asset for his domestic purposes

iii) Trade creditor value included some stationery bought on credit from General office suppliers ltd for office use which had cost $4,000. The stationary was not yet to be used by the time the year ended.

Required

Correct the above errors and extract the adjusted balance sheet

Solution

Financial implications summary;

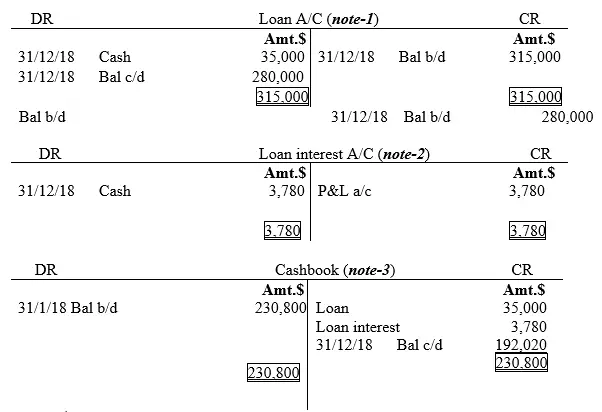

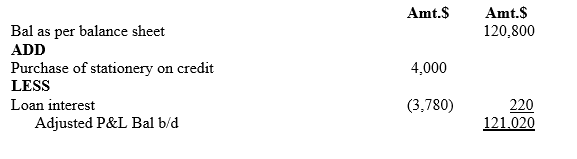

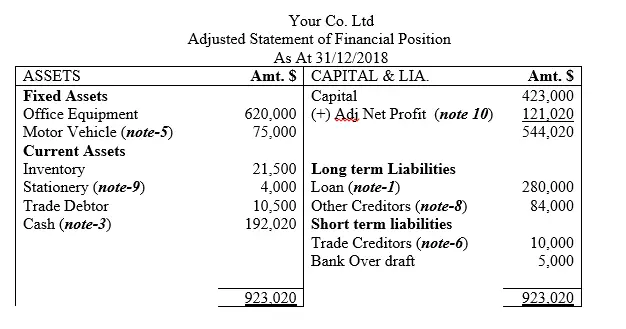

i) -Net profit; the net profit is overstated for the loan interest was not charged in the P&L account.

-Capital was overstated too and need to be adjusted downwards

-loan principle amount is also overstated for it was not adjusted against the cash payment made at the end of the year

Loan interest is undervalued for no account was created for that purpose

-cash is also overstated and need to be adjusted downwards to take care of both the loan interest and principle repaid.

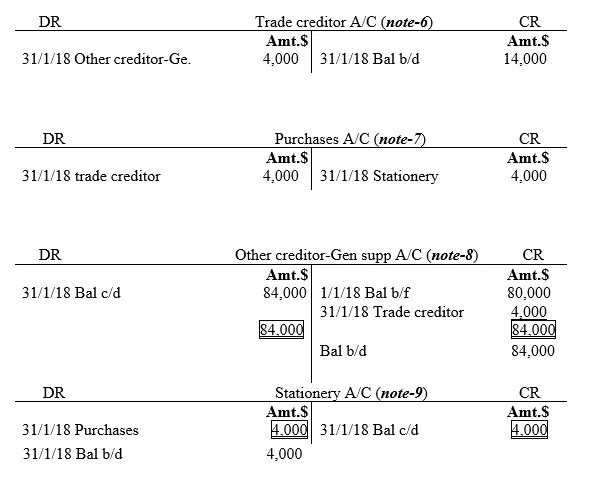

The ledger accounts opened to correct the error were as follows;

Working for loan interest

1.2%*315,000= $3,780

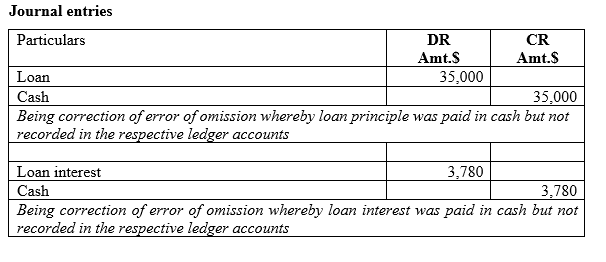

ii) Capital was also exaggerated due to additional capital which was erroneously considered to involve motor vehicle transferred to the business by the owner, yet it was not the case. Motor vehicle was also overstated for the additional capital was in form of motor vehicle.

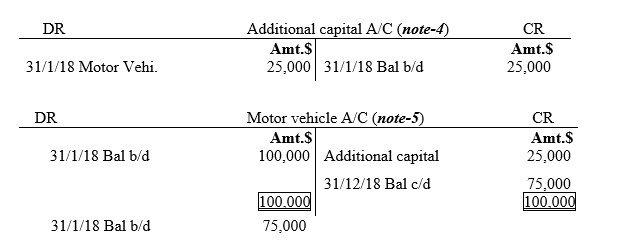

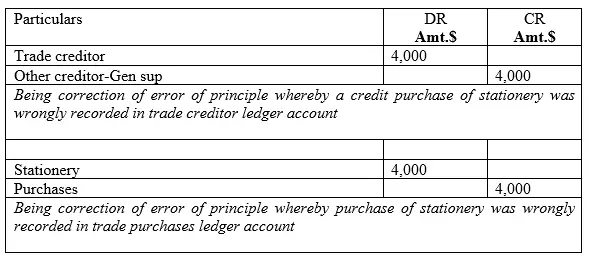

iii.) Trade creditor was overstated for the stationery bought on credit was categorized as goods for re-selling.

Net profit was understated for the purchases were overstated by wrongly incorporating stationery as a trading item which by extension increased the cost of goods sold

Stationery was undervalued for it was missing in books of accounts as a current asset for it had been treated as a purchase.

Other creditor account was undervalued for it was missing in books of accounts as a current liability for it had been treated as trade creditor

Journal entries

Preparation of adjusted Profit & Loss account statement as at 31/12/2018 (note-10)

NB: The entrepreneur should note that the account for additional capital/investment was independent to net profit and was written-off against motor vehicle. Hence eliminated from the balance sheet but it does not form part of the adjustments done in the adjusted profit and loss statement.

Preparation of adjusted statement of financial position as at 31/12/2018

Part two: Adjusted Net Profit/Loss Statement

Preparation of adjusted net profit/loss entails consideration of all types of account items that had been affected by the error(s) under interrogation. The account items may be either be of asset, capital, liability, expense or income nature. If the item affected by the error(s) has a positive or negative implication to profit/loss balance, then it is factored in preparation of this statement.

Lesson One; Preparation of Adjusted Net Profit/Loss Statement

This procedure involves use of a format so as to summarize the entries as per their effect to profit/loss balance. The following format will aid in determination of the adjusted P&L statement

Adjusted net profit/loss statement for the period ended 31/12/XXXX

Part three:Adjusted Statement of Financial Position

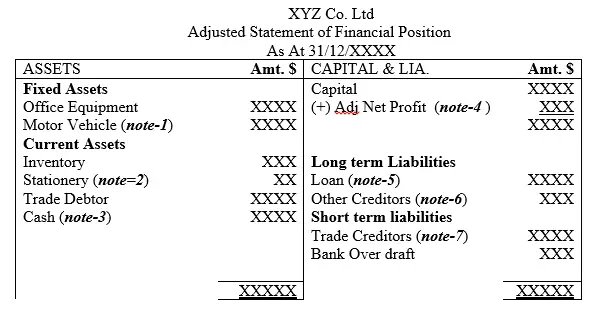

After the determination of the correct P&L balances, the next step is preparation of the adjusted/correct statement of financial position. This procedure entails consideration of the correct P&L balance and the adjusted accounts which were adjusted through journal entries.

Lesson One; Preparation of Adjusted Statement of Financial Position

The balance sheet format is used to summarize the new changes caused by the errors under interrogation. The process considers the new correct balances of the various ledger accounts affected by the specific errors which are used to construct the new balance sheet or statement of financial position. The entrepreneur need to note that, if there are accounts which have not been affected, then their original balances brought down are assumed to be correct hence used in the preparation of the financial statement.

The general format should be as follows;

NB: The balance sheet items with notes appended to them implies that they have new correct balances brought down while those without such notes means that they were not affected by the error(s) hence their balances were assumed to be as they were originally and are correct.

Summary

This chapter reviews the trial balance perspective and has demonstrated the changes that can occur on the trial balance items due to errors. The chapter has highlighted the general approach of correcting those errors and how to prepare the adjusted profit and loss account statement. In addition, the format for the preparation of adjusted statement of financial position has also been presented in this chapter.

In a nutshell, this chapter has reviewed the trial balance statement from the point of view of errors which may require an overhaul of the entries made in source documents, books of original entry, and ledger accounts hence calling for re-engineering of the trial balance, P&L account and new balance sheet with the correct entries. The chapter ushers the entrepreneur/learner to better skills of undertaking advanced steps of preparing end of the year adjustments which is our next topic.