What is a ledger account?

Definition; The term ledger account are two words in one. A ledger is a book where accounts are kept. Therefore the two terms can be used together but not interchangeably for they don’t mean the same. An account is a chronological record of all business transaction that affect a particular item, be it an asset, capital, liability or any other categorization as it will be explained later in this tutorial. An account keeps track of all business transactions that affect a particular item. In this definition, three key words have been used, that is; business transaction, chronological record and keeping track.

Definition one; Business transaction is any business activity which occur within a specific period of time and can be assigned a monetary value . Business transactions are mainly categorized in to two; cash and credit transactions. In every financial year, several business transactions take place and they strictly fall under those two classes of activities.

-

Cash transaction is business activity which involves immediate (ie spot) exchange of goods and services with other goods and services especially in the case of barter trade/ or trade-in cases which is not common or it may also refer to the immediate exchange of goods and services with cash. It should be noted that the term “cash” does not necessarily refer to hard cash in terms of hard currency or notes but it implies spot/immediate payment for the goods or services bought. The cash payment may take the form of cash, check, money order or electronic transfers. Evidence for cash transaction is either cash receipt or cash payment voucher. It should be noted that all cash transactions are recorded in cash or bank accounts.

-

Credit transaction is also referred to as deferred payment and it entails exchange of good and services with payment being done at a later date. Either after a week, month or year(s) based on the nature of the credit terms and conditions agreed upon by the two parties. Credit transactions may involve sale or purchase on credit.

-

Credit sale occurs when the business in question sales goods now but receives the cash in a future date. This transaction results to debtor-creditor relationship between the selling firm and the buyer (customer). In this case, the selling firm will use trade debtors account (current asset) instead of cash account to record that transaction if the goods sold were for trading purposes. If the goods were of capital nature, the selling firm will use the term “other debtor” account (fixed asset) to record the transaction instead of cash account. Then the alternate account to be considered to make a double entry is sales and asset disposal account respectively. The learner should note that, although the credit transactions aforementioned are purely non-cash in nature, cash or bank account will be affected the moment the debtor pays for the goods at a later date.

-

Credit purchase occurs when the business in question buys goods now but pays the cash in a future date. This transaction results to creditor-debtor relationship. In this case, the firm which have purchased on credit basis will use trade creditors account (current liability) instead of cash account if the goods bought were for trading purposes. If the goods were of capital nature, the firm purchasing the goods will use the term “other-creditor” account (long term liability) to record the transaction instead of cash account. Then the other account to be considered to make a double entry is purchases and fixed asset account respectively. The learner should note that, although the credit transactions aforementioned are purely non-cash in nature, cash or bank account will be affected the moment the purchasing firm pays for the goods at a later date.

Definition two; Chronological record; When we say an account is a chronological record, it implies that the book keeper will record all business transactions affecting that particular item in that specific ledger account in an orderly manner guided by the time it took place. Such that the transaction which took place first will be recorded first, then the second one in that order up to the last one. Therefore, when recording the event’s order of occurrence, they should not be mixed up.

Definition three; keeping track”. This term has two implications. One, all transactions causing an incremental or decline change in value of a certain item will only be recorded in that particular account, either on the left hand side or right hand side depending on the nature of transaction. Therefore, we avoid opening another similar account any time a transaction affecting that kind of an account occurs. For example, if we have ten transactions affecting item cash, then only one cash account will be used to record all those transactions but not ten cash accounts for the ten transactions for a cash account will keep track of all account activities affiliated to it. The same thing applies to all other ledger accounts representing other transactions.

Keeping track also implies that whenever a transaction affecting a particular item occurs, whether causing an increase or decrease in value, this change is physically represented in the business. For instance, if cash has been received of let’s say $30,000, as this transaction is being added in the cash book to show an increase, there must be a corresponding cash amount in the cash box of the same amount. If at a later time some $10,000 is withdrawn for personal use or for further business deals, the amount of cash in the cash a/c will be showing $20,000 and similarly the same amount will be physically available in the cash box. Further, if the owner of the business started the business capital in terms of furniture amounting to $100,000, the amount recorded as an increase in the furniture account should equally be represented by furniture physically available in the firm’s premises whose monetary value is as indicated in the furniture account. The same thing applies to all other accounts except inventory account .

Classification of Ledger Accounts

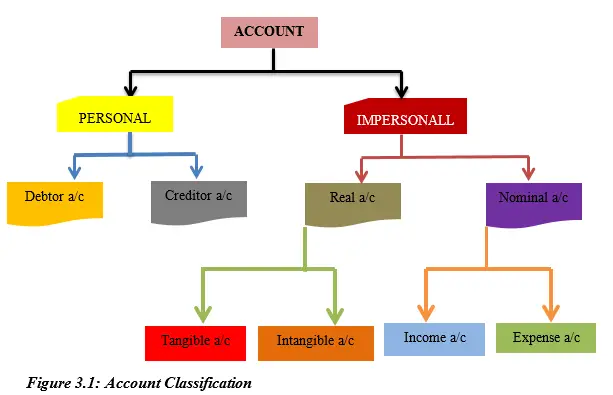

All accounts affected by the different transactions are classified into different categories as summarized in Figure 3.1 below

Figure 3.1 summarizes the types of accounts that are generally affected by business transactions. Accounts are broadly classified in to personal and impersonal categories. Personal accounts are accounts which represent a relationship between the firm in question and individual(s) whether natural persons such as Moses, Purity and John or artificial person such a limited company and partnerships etc. Personal accounts are further sub-divided into debtors and creditor accounts. Debtor account represents a relationship between the firm selling the products and the person who buys on credit. In this case, the debtor account represents a current asset. On the other hand, the creditor account represents a relationship between the person buying the products and the person who sell on credit. In this case the creditor account represents a current liability. Such examples of account are trade creditors and capital accounts. Impersonal account is the opposite of personal account hence the account does not represent a form of debtor–creditor relationship. This account is further classified as real and nominal types. Real accounts represent assets or properties or goods that one owns. It is further classified as either tangible or intangible accounts. Tangible accounts entail those items/assets which physically exist such as buildings, land, cash and fixtures and fittings. Intangible category involves assets which are invisible such as patent right, copyright and franchise etc.

Nominal accounts represent non-touchable items. This classification of account is further sub-divided into income and expense items. Income is gain generated in the course of doing business. Sometimes it can be referred to as returns. Income is further sub-divided into trading, capital gain and operating income. Trading income is returns or gain generated as a result of undertaking the ordinary trading activities of the organization such as gross profit. Capital gain is established due to disposal of a fixed asset. This aspect has been deeply tackled in the advanced course series. The other category of income is referred to as operating income. This category entails incidental income generated in the normal business activities. A good example is net profit of a business.

Expenses are also classified as a nominal account component. Expenses are defined as consumed asset. They are further demarcated into trading expenses such as purchases and carriage inwards which is also referred to as transport expense on goods purchased and operating expenses. Operating expenses are paid or incurred to enable the firm to generate income. Example of such operating expenses is electricity, carriage outwards, insurance and salaries just to mention but a few.

For more discussion on classification of ledger accounts,please visit our blog.