Ledger account & Generally Accepted Accounting Principles (GAAP)

The process of recording business activities in any ledger account or financial statement is governed by the Generally Accepted Accounting Principles (GAAP). This are the common laid down principles, standards and procedures to guide recording of transactions. They are set by authoritative bodies namely Financial Accounting Standards Board (FASB) that decide the guidelines of bookkeeping. The learner should keep on referring to them to appreciate their application in daily recording of business transactions.

The GAAP principles are classified in to three major categories, namely

-

Accounting Concept

-

Accounting Principles

-

Accounting Conventions

Accounting Concept/assumptions

Accounting concept are the common traditions or surroundings or environs or settings upon which science of accounting is based. They lay down the foundation for accounting principles. They are ideas essentially at mental level and are self-evident. These concepts ensure recording of financial facts on sound bases and logical considerations.

These are;

-

Separate entity concept-owner of business and the business itself are two different persons.

-

Money measurement concept-only transactions that can be assigned monetary value are considered in accounting.

-

Going concern concept-a business is assumed to continue operating and its assets should be recorded at cost not market value. Going Concern Concept Accounting assumes that the business entity will continue to operate for a long time in the future unless there is good evidence to the contrary (unforeseeable future). The enterprise is viewed as a going concern, that is, as continuing in operations, at least in the unforeseeable future. In other words, there is neither the intention nor the necessity to liquidate the particular business venture in the predictable future. Because of this assumption, the accountant while valuing the assets does not take into account forced sale value of them (or market value). In fact, the assumption that the business is not expected to be liquidated in the foreseeable future establishes the basis for many of the valuations and allocations in accounting. For example, the accountant charges depreciation on fixed assets.

-

Accounting period concept-the relevant timeline within which the financial status of the business can be declared.

-

The Accrual Concept; the accrual concept is based on recognition of both cash and credit transactions. In case of a cash transaction, owner’s equity is instantly affected as cash either is received or paid. In a credit transaction, however, a mere obligation towards or by the business is created. This concept advocates that income should not only be recognized and recorded when actual cash is received, but also when it is earned. Similarly, the concept advocate that expenses should not be recognized when cash is actually paid but even when it has been incurred.

Accounting Principles

Accounting principles are basic guidelines that provide standards for scientific accounting practices and procedures. They guide as to how the transactions are to be recorded and reported. They assure uniformity and understandability. They include;

-

Realization Principle; this perception advocates recording of only those business dealings which are actually realized. For example Sale or Profit on sales will be taken into account only when money is realized i.e. either cash is received or legal ownership is transferred or both.

-

Matching Principle; It is referred to as matching of expenses against incomes. It means that all incomes and expenses relating to the financial period to which the accounts relate should be taken in to account without regard to the date of receipts or payment.

-

Full Disclosure Principle; this principle guides on matters of information significance. It advocates that all significant information must be disclosed for the sake of the users of accounting data. Practically, this principle emphasizes on the materiality, objectivity and consistency of accounting data which should disclose the true and fair view of the state of affairs of a firm. The learner should note that, material information refers to any accounting information which when disclosed can influence the decision maker to take an alternative course of action. The opposite is true, immaterial information does not influence ones decision making.

-

Duality Principle; every business transaction has double effect-ie double entry principle. According to this principle, every transaction has two aspects i.e. the benefit receiving aspect and benefit giving aspect. These two aspects are to be recorded in the books of accounts.

-

Verifiable Objective Evidence Principle; under this principle, accounting data must be verified. In other words, documentary evidence of transactions must be made which are capable of verification by an independent party. Failure to verify such accounting data implies that it is not reliable and or not dependable, i.e., these should be biased data. Verifiability and objectivity express dependability, reliability and trustworthiness that are very useful for the purpose of displaying the accounting data and information to the users.

-

Historical Cost Principle; business transactions are always recorded at the actual cost at which they are actually carry out. This principle advocates that any time an asset is acquired, it should be recorded at its actual cost and the same is used as the basis for all subsequent accounting purposes such as charging depreciation on the use of asset.

-

Balance Sheet Equation Principle; under this principle, all asset value are equal to the sum of capital and liabilities of the organization. In other words debit entries=credit entries.

Accounting Conventions

Accounting conventions include those customs and traditions which are adhered to when recording transactions in the financial statement. They are methods or procedures that are widely accepted. When transactions are recorded or interpreted, they follow the conventions. Many times, however, the terms-principles, concepts and conventions are used interchangeably.

These include the following;

-

Materiality Convention; the issue of materiality cut across matters of information, monetary amount, procedure and nature. For instance, Error in description of an asset or wrong classification between capital and revenue expenditure would lead to materiality of information problem. Say, If postal stationery of ` C500 remain unused at the end of accounting period, the same may not be considered for recognizing as inventory on account of materiality of amount. Again, the procedure laid down by a specific firm dictates whether a materiality problem has occurred or not. For instance, one firm may classify an expense as general expense while a similar expense is specifically classified otherwise. As far as nature of a transaction is concerned, some transactions are by nature material irrespective of the amount involved. e.g., audit charges, loan to directors etc.

-

Consistency Convention; this Concept says that the Accounting practices should not change or must remain unchanged over a period of several years. That is if a transaction is classified as a fixed asset in the current period, it should not be treated as current asset in the next period. This does not mean that a firm cannot change the policy.

-

Conservatism Convention; conservatism concept states that when alternative valuations are possible, one should select the alternative which fairly represents economic substance of transactions but when such choice is not clear select the alternative that is least likely to overstate net assets and net income. It provides for all known expenses and losses by best estimates if amount is not known with certainty, but does not recognizes revenues and gains on the basis of anticipation.

-

Timeliness convention; this concept argue that every transaction must be recorded in proper its proper time. Normally, when the transaction is made, the same must be recorded in the proper books of accounts. In short, transaction should be recorded date-wise in the books. Delay in recording such transaction may lead to manipulation, misplacement of vouchers, misappropriation etc. of cash and goods. This principle is followed particularly while verifying day to day cash balance.

-

Industry practice convention; each industry has its own characteristics and features and in a similar way each one of them or firms in each industry follows the principles and assumption of accounting to perform their own activities. Some of them follow the principles, concepts and conventions in a modified way. For example, service industry and merchandise or manufacturing firms maintain their accounts in a specific manner. Similarly, non-profit making organizations prepare income and expenditure account to find out surplus or deficit.

Those are the accounting concepts, principles and conventions used in accounting. For the time being, they may not be making a lot of sense to the learner. However, in the proceeding higher levels of this tutorial series, their relevance will be demonstrated by specifically indicating the transactions linked to them. It should be noted that these concepts, principles and conventions (GAAP) will further be indexed at the back of each tutorial study materials for revision purposes and for the learner to appreciate their applicability.

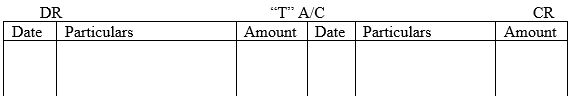

Ledger Account Format

An account shortened as A/C has a capital letter “T” format. However, for the case of a ledger account, the left hand side is referred to as debit side shortened as (DR) and the right hand side is referred to as credit side shortened as (CR). Other details are as explained below;

The ledger account is further sub-divided into three columns on each side. That is date, particulars and amount columns. The date column is used to record the transactions affecting that particular item as per the time it occurred. This column takes care of the chronological aspect we had discussed earlier.

The particulars column is also referred to as detail, explanation or description column and this is the column that provides a short narration on the cause of the change in value of that particular item. For example, if a transaction has caused an increase in value of the item in question, the explanation will be recorded briefly in that column. That is, if for instance, a transaction is affecting cash account due to purchase of motor vehicle, then in the particular column of cash account is where we will indicate motor vehicle as the description against the value of that transaction. However the side to record is dictated by the nature of account affected and whether the change was an increase or a decrease. The amount column is where the monetary value of the transaction is recorded.