Rules and guidelines in recording transactions in a ledger account and balancing the ledger account

The process of recording transactions in a ledger account is simple to understand. One is required to do more practice on this exercise so as to familiarize with the procedures. The guidelines that the learner needs to comprehend for the successful recording of business transactions in a ledger account are explained as follows;

-

Any transaction that takes place will always have a dual effect (double entry principle).

-

The effect caused by any transaction, will affect at least TWO accounts as follows;

-

Either the value of one account will increase while the other one will decrease

-

Either the value of one account will decrease while the other one will increase

-

Either the value of both accounts will simultaneously increase

-

Either the value of both accounts will simultaneously decrease

-

The double entry principle always applies whether the transaction effect assume (i) to (iv). That is; for every DEBIT entry, there must be a corresponding CREDIT entry in the respective account affected and the vice versa is true.

-

The nature/class of the account affected is what determines whether to DEBIT (ie debit entry) or CREDIT (ie credit entry) a particular account.

-

There are FIVE nature/classification of accounts as discussed earlier in this study guide which mainly include;

-

Assets

-

Capital

-

Liability

-

Income

-

Expenses

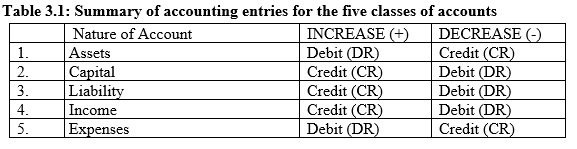

NB: The entrepreneur/learner should know that any transactions that take place always affects only the five classes of accounts, regardless of the type of business under consideration. Whether a business is of merchandise, manufacturing or service provider. Table 3.1 provides a summary of accounting entries made in each case above.

Step by Step procedure of recording business transactions in a ledger account

The process of recording business transactions in a ledger account is simple. The learner should follow the steps described below to ensure zero-error entries as demonstrated below.

-

STEP ONE: Consider every transaction that has taken place at a time. That is, take each transaction one by one and identify the accounts affected by that particular transaction. Always two or more (at least two) accounts are affected by a single transaction.

NB: The hint of the accounts affected, is always directly or indirectly (implied) stated from the transaction statement given. For example, if the owner of the company started a business with cash. The word ‘start’ is implied. In other words, it gives a lead that capital is one of the accounts affected by that transaction. Whereas the word ‘cash’ means that on the other hand, cash account has been affected and it is directly stated. There are other many examples as we shall see as we advance in this tutorial.

-

STEP TWO: Classify the accounts affected as per Table 3.1 above.

-

STEP THREE: Assess the transaction effect which took place (ie either increase or decrease) on the respective ledger accounts under consideration.

-

STEP FOUR: Guided by Table 3.1 above, make the double entry in the respective accounts which will be a debit entry followed by a corresponding credit entry or the vice versa, that is make a credit entry followed by a corresponding debit entry in the respective accounts. At this stage, you may notice that more than two accounts have been affected by a single transaction and this will result to either making of several debit entries with a corresponding single credit entry or the vice versa. Whichever way, the total debit and credit values should be equal due to the double entry rule.

-

STEP FIVE: Balance the ledger accounts and extract a trial balance. Step five will be analyzed next. Then apply the rules and steps discussed earlier to demonstrate how business transactions are recorded. We will use several illustrations using the balance sheet items first and later introduce income and expense items.

Three Step by Step procedure of balancing ledger account

-

Step 1: Add the amounts on both the DR and CR side of the ledger account. The outcome is that, either the two sides are equal or different in amounts. If the two sides are equal, then that account is closed down. In other words it does not exist and will not appear in the trial balance.

-

Step 2: Determine the difference between the amount on the debit and the credit sides by subtracting the smaller amount from the larger amount.

-

Step 3: The difference established should be posted to the side with a shortage (ie. smaller amount). This is to make sure that the two sides balance.

NB1: The difference realized in step 3 is recorded on the side with a lesser total amount which can either be the debit or credit side of that particular account. This difference amount is referred to as balance carried down abbreviated as bal. c/d and the date of balancing the account is indicated on the date column to represent the time the balancing event took place.

NB2: The balance c/d is just meant to balance the two sides of the ledger account. But the fact is that one side is bigger (either DR or CR side) than the other one. Therefore, the balance carried down figure (bal c/d) is recorded on the opposite side below the totals as balance brought down (bal. b/d) as it will be illustrated later. This balancing figure turns out to be called balance brought down, abbreviated as bal. b/d.

NB3: i) If the bal. b/d is on the DR side, it is referred to as a debit balance

ii) If the bal. b/d is on the CR side, it is referred to as a credit balance

Illustration one

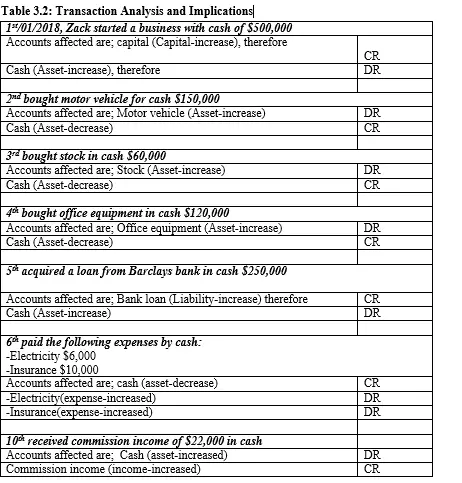

In illustration one, the transactions considered cut across the five nature of accounts as stated below

Zack started a business known as Our company ltd. on 1st/01/2018 with cash of $500,000. Further, the following transactions took place

2018 January 2nd bought motor vehicle for cash $150,000

3rd bought stock in cash $60,000

4th bought office equipment in cash $120,000

5th acquired a loan from Barclays bank in cash $250,000

6th paid the following expenses by cash:-

-Electricity $6,000

-Insurance $10,000

10th received commission income of $22,000 in cash

Required;

-

Record the above transactions in the respective ledger accounts and extract the balance brought down (ie b/d) thereof

-

Prepare a balance sheet as at 10th/1/2018

Solution

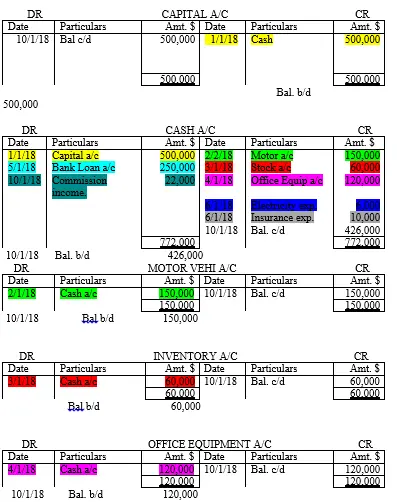

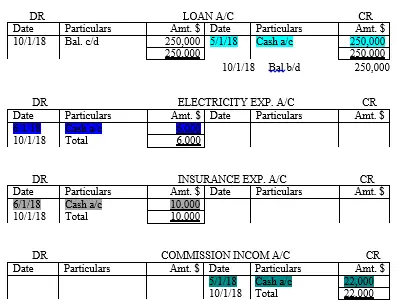

The respective ledger accounts are as follows. Different COLORS has been used to straight away guide you on the various accounts affected simultaneously by the same transaction.

Solution

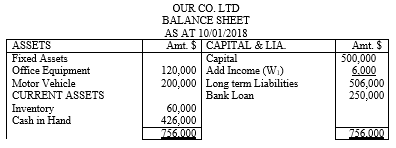

The corresponding balance sheet statement representing those transactions is as shown below

Workings

W1 Although the expense and income accounts affected (ie electricity, insurance and commission income in that order) are not balance sheet items, we consider them to determine the net gain or loss in the aforementioned illustration. Therefore, as per the records, it is clear that a gain of 6,000 (ie 22,000-16,000) was realized which was added to the original capital value. Hence the new value of capital is 506,000.

General Rules for Accounting Entry

The accounting entries are basically recorded as it has been demonstrated in illustration one. In this case, there are some key observations the entrepreneur/learner should take note of;

-

One, the entries recorded in each account concerns only the two (or more) accounts affected by a particular transaction. Such that when recording the transaction, the title of one account become the narration of the alternate account affected by the same transaction. That is, for example, if cash and loan are the items affected;

§ In the cash a/c, loan a/c is used as particular/description and on the other hand,

§ In the loan a/c, cash account is used as the particular/description. You can review illustration one above to confirm those entries again.

-

Two, all assets have debit balances brought down (DR bal b/d), except bank account which can assume either debit or credit balance b/d as it will be illustrated in an advanced example.

-

Three, all capital accounts have credit balance brought down (CR bal b/d).

-

Four, all liabilities accounts have credit balance brought down (CR bal b/d).

-

Five, all expense accounts have debit totals

-

Six, all income accounts have credit totals

-

Seven, double entry principle applies regardless of the number of the accounts affected such that a single transaction may result to two or more accounts being debited with a corresponding single credit entry to complete the double entry. It should be noted that the sum of the two or more debit entries should be equal to the single credit entry and the vice versa is true.