Introduction to Accounting

Accounting as a discipline has a long history that is not captured in this module. However, as an entrepreneur/learner, it is necessary to understand the meaning of this concept and what it entails.

There are several definitions that describe the term accounting. But generally, Accounting is the general step-by-step recording, classifying, summarizing and interpreting business or economic transactions that take place within a specific period of time in a business. Accounting is further classified in to three, namely; financial accounting, cost accounting and management accounting. The focus in this tutorial series, is on Financial Accounting. The entrepreneur need to understand that financial accounting is different from book keeping. Many entrepreneurs who try to keep books of accounting assume that they under take financial accounting process. This is not true. The point is one, that they do book keeping which entail systematic recording of business transactions as they take place. This is not a matter of underrating what entrepreneurs do for the book keeping activities they undertake are a sub-set of financial accounting. The main difference between book keeping and financial accounting is that in the case of book keeping, the records may be incomplete and again the information may not be reliable for decision making. For financial accounting, it is a decision making tool for the information therein is based on the generally accepted accounting principles and standards and it is complete for managerial use. The whole process of accounting is summarized by use of an accounting cycle. At the end of this lesson, you as an entrepreneur should be able to carry out all the processes that are in the accounting cycle as it will be revealed.

Accounting Cycle

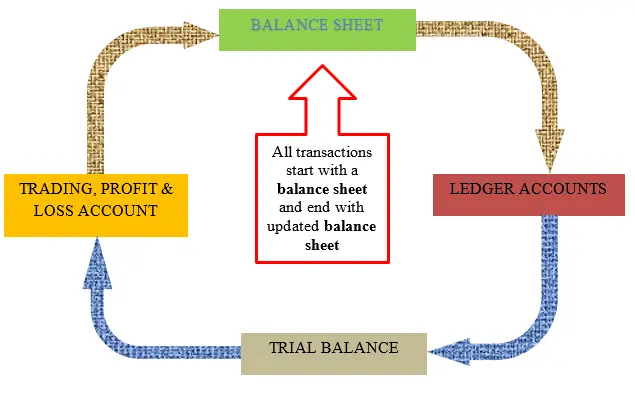

Accounting cycle is a step by step procedure of recording, classifying and summarizing accounting transaction information that has taken place in a business of any nature within a specific period of time, usually a year. Accounting cycle of a business is the step by step recording of accounting information in the balance sheet, then post the information to the ledger accounts, followed by extraction of trial balance. The last step is to prepare a trading, profit and loss account to extract gross or net profit or (loss) respectively. Then a new balance sheet is prepared. This process is as summarized in Figure 1.1 below;

Advantages of accounting knowledge

-

Timely decision making; you will be in a position to make the right decision concerning performance of your business. Even if one assumes all is well for his or her business, this assumption cannot change the reality. The fact remains that if a business is lowly performing, no positive change can occur by the owner assuming that there is no problem. So there is need of keeping track on the performance of one’s business venture which is only possible with accounting knowledge.

-

Planning; the concept of planning is a continuous and futuristic process. If one does not plan to succeed, he or she plans to fail. Accounting skills will aid you to lay down courses of actions which can help you to achieve the set goals. Accounting uses indicators such as balance sheet and profit and loss account which gives a hint on the performance of your business hence be in a position to plan from a well-informed platform.

-

Control function; with accounting knowledge, you will be in a position to use accounting records to compare the current performance or financial position of your business with the previous one and identify causes of deviation and further take corrective measures. This aids you to avoid guess work when taking a certain course of action and also it minimizes cases of repeated errors.

-

Financial accessibility; if you wish to have your business or project funded by potential investors and creditors, they will focus on the financial performance of your business. If financial records are not available, it is then unfortunate for it becomes difficult to predict the level of solvency of the firm and this may discourage funding agencies from financing your business project. Banks use the financial records one have as strength to finance one’s project(s).

-

Taxation purposes; knowledge in accounting is advantageous for you as the business owner for you are in a position to understand how taxation system operates and influences your business performance. The knowledge helps you to avoid cases of tax evasions and also take advantage of tax avoidance which may be beneficial to the business through reduced tax liabilities hence increased profitability.

There are other more advantages that you will have after reading these tutorial materials for accounting is more practical than one can imagine. This introductory part you have read ushers you to further discussion of our main lessons in Accounting. This first level demonstrates how the accounting cycle operates, using simple illustrations. It is at this level whereby the basic concepts used in accounting are clarified through definitions and explanations.