Trading,profit and loss account and its use

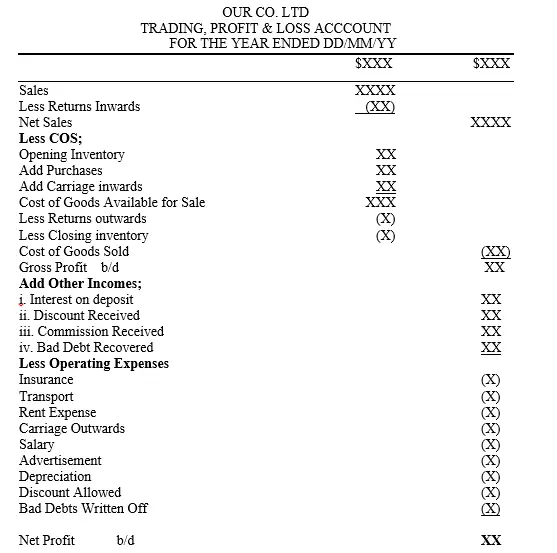

The last step in the accounting cycle involves determination of the trading profit/loss also known as gross profit/loss whereby a trading account is utilized for that purpose. Then further analysis is performed to determine the net profit or net loss by establishing a profit and loss account. The net profit or net loss realized is added or subtracted to the capital value in that order. The two financial statements are prepared as one. The format is as illustrated below;

Trading,profit and loss account format

Presentation of this financial statement is in TWO formats, namely;

- “T” format (also referred to as vertical format)

- Horizontal format

1.“T” format (also referred to as vertical format)

The T format looks like capital letter “T”as the name suggests and the presentation of the items in the financial statement appears as depicted below;

Observation: You can see that the items are recorded in the financial statement in both sides (ie DR & CR) from top, downwards to the bottom. Hence representing a vertical flow of the items.

2. Horizontal format

The horizontal format entails presentation of items in a parallel approach. Such that the items are indicated on the extreme left and the figures are indicated on the extreme right hand side. The proponents of this format ignores the aspect of indicating the DR and CR side on the financial statement. However, this does not mean that they ignore the double entry principle as they record the items. For the purposes of comparing the two formats we use the same items as in the vertical case to prepare the horizontal format as follows;

Tip

The entrepreneur/learner should note that, in the previous conclusion on expenses and income, the items of trading, profit and loss account as indicated in the financial statement above were as a result of closing down the respective items to either trading account or profit and loss account. You can also recall that unlike other class of accounts which have either debit or credit balances, we observed that income and expense accounts have credit and debit totals respectively. These specific accounts are closed down to the trading, profit and loss account with one year’s amount. Therefore, the learner should understand that preparation of trading profit and loss account is not a mere transfer of income and expense items but it involves double entry principle where all income accounts are closed down to either trading or profit and loss account by making a debit entry. Whereas, all expense accounts are closed down to either trading or profit and loss account by making a credit entry. This is demonstrated as follows;

-

At the end of the financial period,

DR Income Account (close the respective income account)

CR Trading account or Profit & Loss Account

-

At the end of the financial period

DR Trading account or Profit & Loss Account

CR Expense Account (i.e close the respective expense account)

The following illustration will help demonstrate how to prepare the both trading, profit and loss account and the balance sheet at the end of the financial period.

Example of preparing trading,profit and loss account

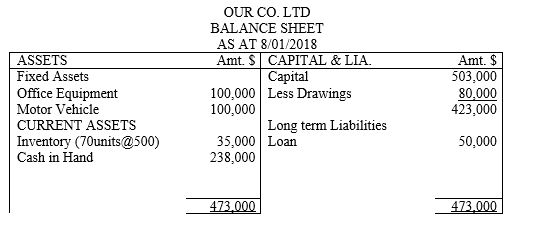

Assume that the following balance sheet information as on 8th/1/2018 for Our co. ltd is provided to you as follows

Additional information

The following transactions took place in the month of February 2018

February 10th paid the following expenses on cash:-

-Electricity $10,000

-Insurance $6,000

” 11th owner brought additional check of $25,000 in to the business from personal savings

” 12th received some commission income of $5,000 in check form

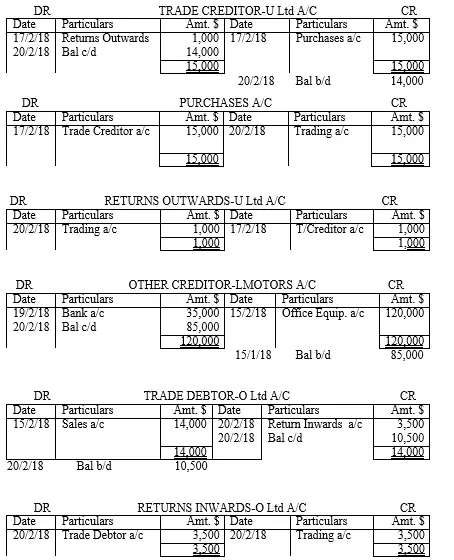

” 14thsold 20 units of stock on credit to O ltd for $14,000

” 15th bought new office equipment on credit for $120,000 from L Motors ltd

” 17th bought 30 units of stock on credit from U ltd for $15,000

” 18th returned 2 units of stock to supplier valued at $1,000 for they had some discrepancies

” 19th paid L Motor ltd a check of $35,000 after agreeing with the bank manager

” 20th O ltd, a customer returned some 5 units of stock amounting to $3,500

Required

-

Record the above transactions in the respective ledger accounts and extract the balances thereof as at 20th/2/2018

-

Prepare a trial balance as per the given date of 20th/2/2018

-

Prepare trading , profit and loss account to determine the gross and net profits/or (loss) respectively for the period ended on 20th/2/2018(T-Format)

-

Prepare a balance sheet as at 20/2/2018

Solution

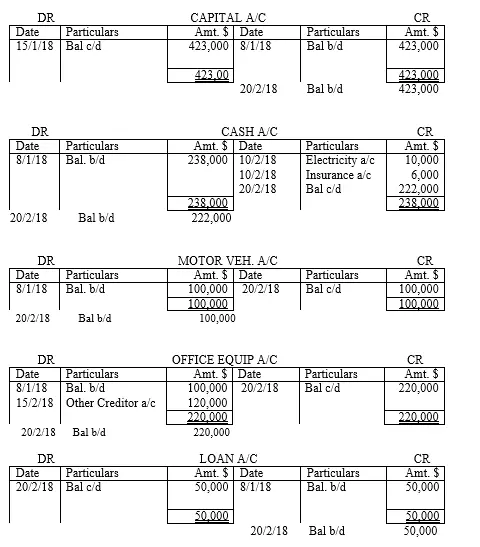

The entrepreneur/learner need to understand the following points: One; the opening balances in the respective ledger accounts as shown below were gotten from the previous balance sheet of Our co. ltd dated 8th/01/2018 and second, the inventory account will be replaced by purchases account and sales account if more goods are bought or sold respectively. Lastly, if goods are returned by debtors or by the business in question, then return inwards and return outward accounts will be used to represent those changes in addition to debtor and creditor accounts respectively.

The balances b/d were as shown in these accounts and the additional transactions from 10/2/2018 were recorded as shown below.

-

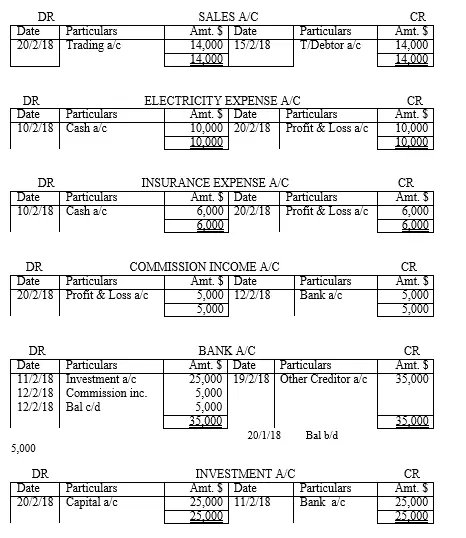

Preparation of the ledger accounts and extraction of the balances b/d and account totals where applicable

-

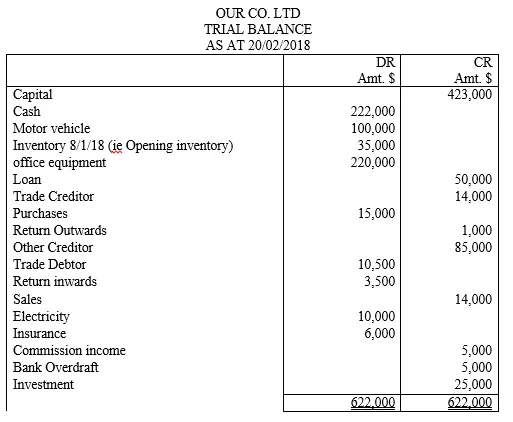

Preparation of trial balance

Closing inventory was (w1) $41,500

Workings (w)

Workings (w)

W1 inventory analysis

Amount ($)

Feb 10th Opening inventory 70 units@500 35,000

” 14th Sold (20) units

Balance 50 units

” 17th Bought 30 units

Total 80

” 18th Returned (2) units to the supplier

Balance 78

” 20th +5 units were returned to the business by a customer

Closing inventory 83 @ 500 $41,500

NB: The determination of the stock value is based on the International Accounting Standard number 2 (recall)

-

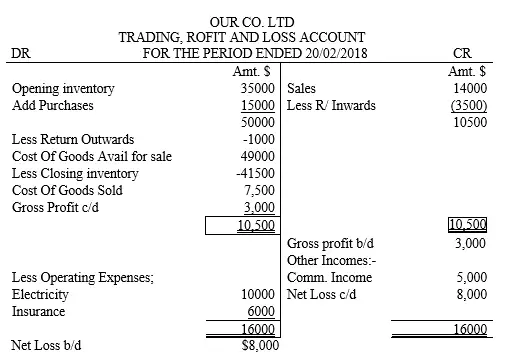

Preparation of trading , profit and loss account to determine the gross and net profits respectively for the period ended on 20th/2/2018

-

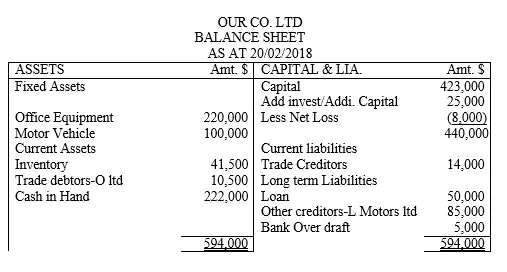

Preparation of a balance sheet as at 20/2/2018

More examples on this discussion are illustrated in the below practice questions

Thank you very much for dedicating your time and effort to read and learn basic accounting skills through this materials. In level two/intermediate level of this series, you will build on level one/beginner block of knowledge. So it is advisable to first be well averse with level one accounting skills so as to fully comprehend the proceeding levels. Let's look at accounting information