What is a trial balance?

The entrepreneur/learner should recall that in the accounting cycle, once the ledger accounts have been established and balances extracted, the next step is to prepare a trial balance. A trial balance is a summary of all the transactions which took place within a specified financial period. A trial balance is simply a financial statement which depicts the summary of debit and credit balances for all accounts. To prepare a trial balance, all the accounts with debit balances or totals are posted on the debit side of the trial balance and all accounts with credit balances or totals are posted on the credit side of the trial balance.

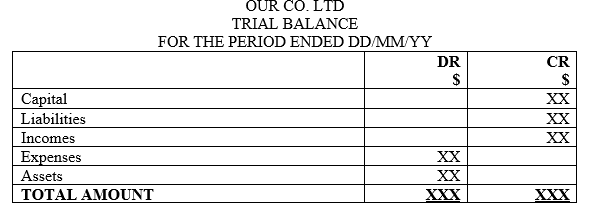

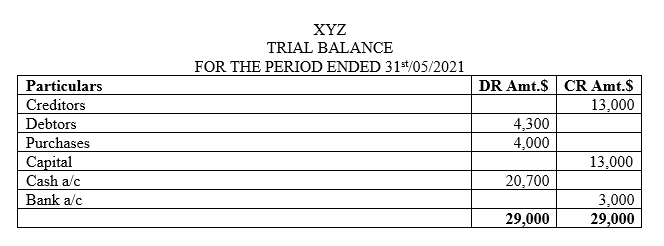

Trial Balance Format

NB1: Opening inventory is part of the trial balance components and it is recorded on the debit side.

NB2: Closing inventory is indicated as additional information. Hence, it is not part of the items in the trial balance

The learner needs to understand that a trial balance is prepared for twofold reasons. One, it is a summary of all ledger account balances at the end of the given period and two, it is used to assess whether there was erroneous accounting entries. Therefore, if the debit and the credit sides of the trial balance are the same, it is assumed that there were no errors committed during the preparation of the ledger accounts. Otherwise if the two sides do not balance, there is existence of errors which need to be corrected. The entrepreneur/learner should note that although the two sides of the trial balance may be equal, this does not guarantee a zero error accounting entries per se for there are some types of errors that may not be detected by the trial balance as it will be discussed in level two of this tutorial series.

Steps in preparing a trial balance

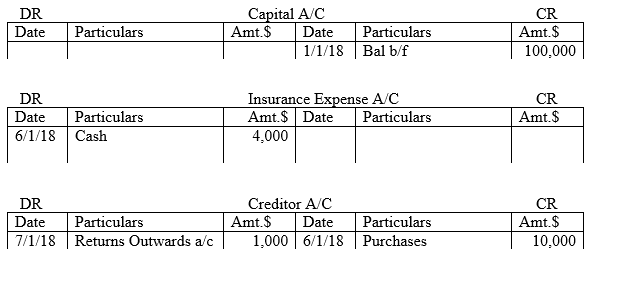

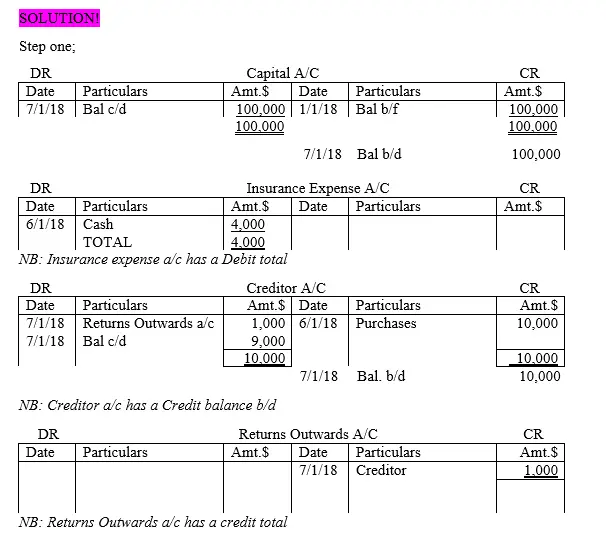

Step one;

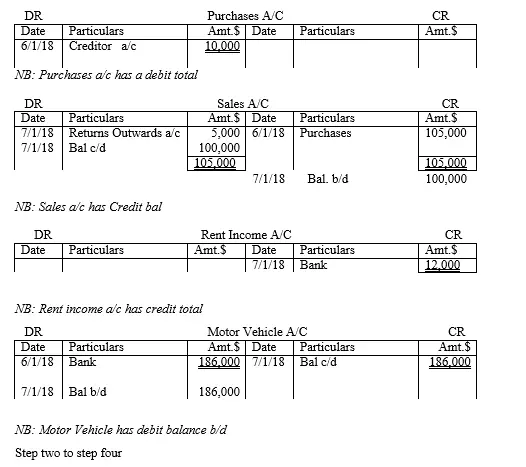

Extract the balances brought down or account totals if it is a case of income or expense accounts from all available accounts at the end of the financial period

NB1: Step one is achieved by balancing all the ledger accounts provided

NB2: Whether balance brought down or totals are of Debit or Credit nature is determined by the nature of the account-ie asset, capital, liability, expense or income

Step two;

Post all Debit balances to the DEBIT column of the trial balance statement

Step three;

Post all Credit balances to the CREDIT column of the trial balance statement

Step four;

Add all debit and credit entry figures as they appear on the DR and CR column of the trial balance

Outcome;

The two sides will be equal

Precautions when preparing trial balance

When preparing the trial balance, the following perspectives must be considered

1.Ledger accounts with equal debit and credit totals

2.Bank overdraft

3.Balance brought down and balance carried down

Ledger accounts with equal debit and credit totals

As a learner/instructor, you need to consider those accounts whose DR and CR totals are equal. In such a scenario, the account is closed down and it is excluded in the trial balance. This is because the trial balance is a financial statement where we post only ledger accounts with DR Or CR balances which are more than zero (0) value.

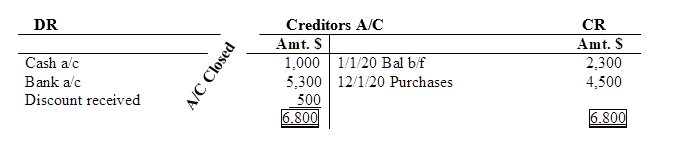

Illustration one

If accounting entries appear as follows;

The above account has a total DR balance of 6,800 made up of cash, bank and discount received while the CR side has a similar total of 6,800 made up of b/f of 2,300 and purchases of 4,500.

Such an account with full entries on both sides does not appear in the trial balance

Bank overdraft in trial balance

Bank overdraft is an over withdrawal of cash from bank which is more than what the bank customer has deposited.

The reason for the learner or entrepreneur to be careful is that there is no account known as bank overdraft a/c. so many are the times one may be tempted to open such an account which is not correct according to accounting practices.

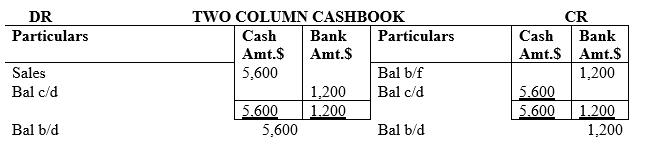

So the question is, what should one do when he or she overdraws from his bank account? The answer is very simple. We do not open a bank overdraft account. Instead, the cashbook, the bank column is the tool that represent such a transaction.

For your information, in case of a bank overdraft, the amount is recorded on the CR side of the cashbook. This is as demonstrated below;

Illustration two

Therefore, if there exists a CR balance in the bank column in the cashbook, then that is a case of bank overdraft and it is treated as short term liability. In the trial balance it appears as a bank account entry but the amount is recorded on the credit side of the trial balance as shown below;

The $3,000 credit balance in the trial balance represents a bank overdraft.

Balance brought down and balance carried down in trial balance

Balance brought down (i.e. bal b/d) and balance carried down (bal c/d) are two but different transactions. The difference between the two is that when preparing the trial balance, it is the balance brought down (bal b/d) which matters.

That is, although the two balances are the same in value, they are used differently.

When preparing the trial balance, the balance brought down (bal b/d) is the one considered. Such that if the balance is a DR balance b/d, it is recorded on the DR side of the trial balance. On the other hand, if the balance brought down (bal b/d) is a CR balance, it is recorded on the CR side of the trial balance.

For balance carried down (bal c/d) it is only used when balancing the respective ledger accounts. So, as a learner/ entrepreneur, never use the balance c/d to prepare the trial balance for this is against the accounting principles and conventions.

Characteristics of trial balance

1. A summary of all information from the respective ledger accounts-This financial statement captures all details of accounts utilized in the business in the specific financial period

2. It is made up of three parts, namely; particulars column, debit column and credit column. The particulars column entails a short narration of the name of the account with either a debit or credit value.

3. It is a financial statement-it is a financial statement prepared at the end of the financial period to show accounts balances brought down

4. It's debit entry and credit entry is a corresponding or a replica of all the accounts with debit and credit balances brought down or totals.

5. It is flexible-it is a financial accounting tool that can accommodate changes which took place in the course of the year such as accruals, depreciations etc

Example preparing a trial balance

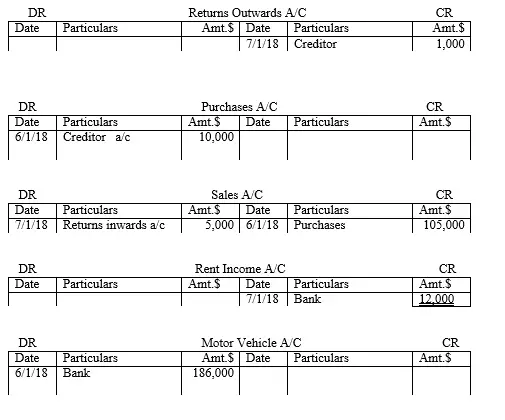

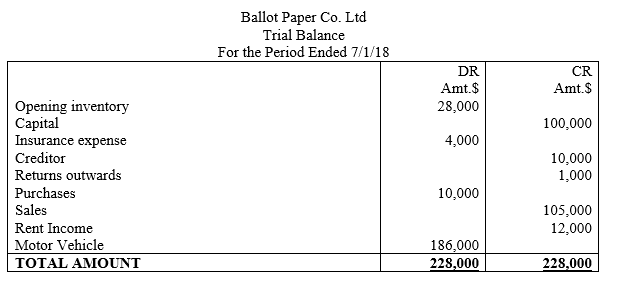

Ballot Paper Co. Ltd had provided you with the following ledger accounts with details therein as follows;

Additional information

Opening inventory on 1/1/18 was $14,000

Closing inventory on 7/1/18 was $7,500

Prepare the trial balance for the as at 7/1/18

NB:

Opening inventory is part of current period’s purchases hence it is posted on the Debit side of the trial balance

Closing inventory is assumed will be sold next financial period hence not for the current period. Therefore, it is excluded in the trial balance of the current period

Advantages of trial balance

1. It helps in cross checking if the entries made in different ledger accounts were done correctly. This is important for it helps the accountant confirm if there are any errors to correct them in time before preparation of other financial statement starts

2. Summary of all participating ledger accounts-this is a good tool to confirm whether all accounts with non-zero balance has been included in the preparation of financial statements

3. Quick source of information for the preparation of financial statements-this is the platform where one draws accounting information to prepare financial statements such as comprehensive income statement and statement of financial position

4. Platform for end of year adjustments-this is the conduit used to adjust end of the financial period changes that affect some ledger accounts such as accruals and prepayments

5. A tool for detecting errors-this is the parameter that is used to detect errors occurring in the course of the financial period. Although not all errors will be detected, it to some extent used as a tool to identify errors of a certain category.

Disadvantages of trial balance

1. It does not detect all the errors-one of the reasons of preparing the trial balance is to detect errors. But the tool is selective in detecting for there are some errors which are not detected by this tool such as error of commission and error of compensation

2. Duplication of efforts-even when we have not prepared a trial balance, we can still prepare other financial statements for we can pick the information from the respective ledger account. This means we can do without it. And therefore, preparing one to access the same information we can get directly from the ledger account is double work

3. Provides limited information pertaining the financial position of the business-a trial balance only entails a summary of the transactions that took place in the financial year. Therefore, it may not be relied up on by the stakeholders of a business to know more of the organization financial health.

4. Not cost effective-preparation of the trial balance consumes financial resources yet its usefulness is limited. Further, the same information it carries is also available in other financial statement such as balance sheet and profit and loss account

Types of trial balance

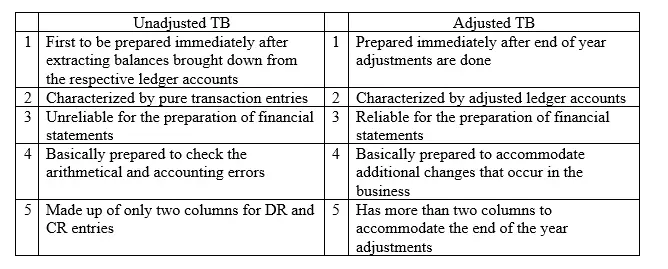

Based on the criteria of end of the year adjustments done, a trial balance is categorized in to two;

Unadjusted trial balance and

Adjusted trial balance

This is as illustrated in Table 1.1 below

Table 1.1 Difference between unadjusted and adjusted trial balance