Accounting treatment of a contract job: direct materials; labor; overheads; ppe; sub-contracts; certified; retention money and examples

Contract job has its unique technicalities for it to be operational. Some of the key aspects or components that you need to understand and know how to undertake the accounting treatment are as follows;

1.1 Direct Materials

Contracts are characterized by materials which are directly assigned for a particular job. The origin of the materials may either be:

-Purchased for contract purposes: In this case, the contractor purchases the raw materials to be used specifically in this project.

Accounting Logistics of direct materials;

a). Purchased materials-

DR Contract Account

CR Cashbook

b). Unused materials at the end of the contract (surplus)

Represented as a DR balance b/d in the contract A/C and posted in the balance sheet/statement of financial position as CURRENT ASSET

c). Materials issued from stores/warehouse

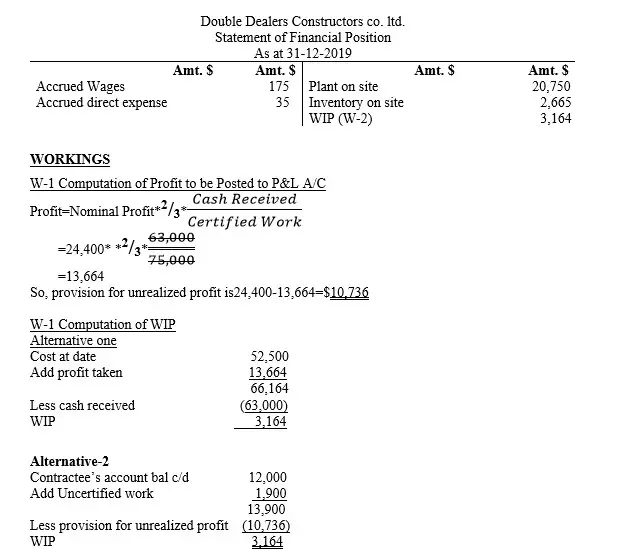

If there is one or more contracts using direct materials from the same store, then the monetary value of the materials posted to each contract is debited in the respective contract accounts and then a single credit entry is made in the stores control account as follows

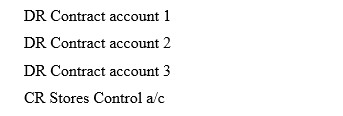

d) Unused raw materials from the store

If materials from store are not fully utilized by a particular contract, they are returned to the stores again. The accounting entry will be;

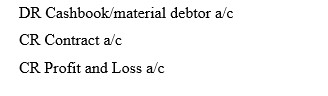

e) If the materials which are in surplus are disposed/sold

If the surplus materials are sold while at the contract site, then the accounting entries are recorded as follows;

If the proceedings/sale resulted to profits

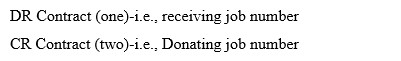

f) If raw materials are transferred from one contract to another contract

If surplus materials are needed by another contract

g) If the client promises to contribute some raw materials to the site

If the client promises to provide any materials towards the completion of the contract, the contractor should open a separate material account for that purpose. So that any transaction related to those materials can be recorded/tracked using that particular account.

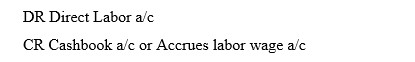

1.2 Direct Labor

All laborers working directly or full time in a particular contract are referred to as direct labor and their wages and payments is charged on the debit side of the contract account.

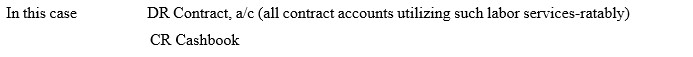

1.3 Indirect Labor

This is labor which does not serve a particular contract. A worker may be serving in his or her capacity in two or more projects. If this is the case, then this is referred to as indirect labor and the costs associated to such a laborer such as salary or wages should be apportioned amongst or between the two or more contracts.

1.4 Plant and Machinery

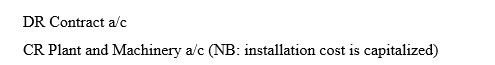

This is capital cost incurred or paid by the contractor to facilitate the completion of the contract. The cost value is charged in that contract. That is the cost is debited.

NB1: That when the plant and machinery is charged to the contract account, the plant and machinery a/c is closed down for this asset has become part of the cost of the contract.

NB2: At the end of the contract, the Net Book Value (NBV) of the plant and machinery is credited in the contract account. This implies that the economic resources that has been consumed by the contract is the difference between cost and Net Book Value of that plant and equipment which is simply the amount of depreciation for that period.

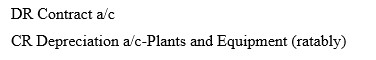

1.5 Partially utilized Plant and Equipment

Some plants and equipment are used partially in several contracts. Now, in such a case, it is not possible to permanently assign the asset on a particular project. So, the depreciation cost or expense is apportioned to each contract proportionately.

NB3: Now you can see that the cumulated depreciation will be apportioned on each contract accordingly. For you should know that it is the depreciation part (lost economic value) which is apportioned for it represents the cost paid/incurred of plant and equipment nature.

This accounting entry is achieved as follows;

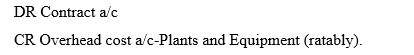

1.6 Overhead Cost

This is the indirect cost which cannot be straight away be associated with the project. Such as office expenses and common supervisory staff wages. Such cost will be apportioned to the contract on some ratable format.

1.7 Escalation Clause

It is a provision that the two parties in a contract agree upon. That the price of the contract will be adjusted in the future based on the economic circumstances. Such that during contract execution, if the price for the raw materials skyrocket, then the price of the contract will be adjusted as agreed.

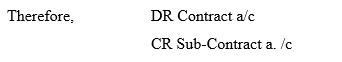

1.8 Sub-Contracts

This is a part or section of the main contract that require a specialist or expert. This is sub-contracting and the cost thereof is part of the main contract. Such that the total cost of sub-contracting is charged on the debit side of the main contract account.

1.9 Cost Plus Contracts

With this kind of contracts, the contractor is not in a position to reasonably estimate the final price of the contract or job. Hence, he/she uses some percentage of the cost value of the contract to adjust the price

1.10 Extra Work to be Done

This is the extra assignment that the client may add to the main contract as time goes by which was not part of the price agreed upon earlier on. The extra work may be substantial or minor.

If substantial, a new contract is undertaken and given a new job number. Hence the accounting entries will be

If the additional task is a minor one, then

1.11 Certified and Uncertified work

This is the two monetary value aspects of the whole contract determined by an expert, namely the engineer who can be the architect. Now, since a contract assignment usually take more than one period such as two years and so on. Therefore, it is not practical for the contractor to wait to be paid once the contract is complete. It will be long overdue. So, the architecture carries out a valuation process after sometime to establish the degree of completion of the project so far. Through this procedure, there arises two parts of the contract, namely; the completed work and the incomplete work. In this case, the complete part of the contract is certified by the architecture and a certificate of completion is awarded to the contractor and the remaining part which is incomplete is uncertified (i.e., no certificate is awarded).

NB1: Both certified and uncertified represent Work in Progress (WIP). Remember that the whole contract is not complete but the architecture is in a position to assess the degree of completion and assign a monetary value for payment purposes.

NB2: The Certified work approved by the engineer is valued at contract price basis and hence it carries some profits therein.

NB3: The Uncertified work unapproved by the engineer is valued at cost price basis and hence it carries some profits therein.

NB4: Both Certified and the Uncertified work is charged on the credit side of contract account.

NB5: The monetary value of both Certified and Uncertified works by the engineer is reduced by the amount of cash paid by the client/contractee or any reserve created for profit purposes.

1.12 Payment of Certified Work

Payment of certified work by the contractee/client is on the basis of a fixed percentage of the monetary value of the certified work. For instance, if the certified work is $15,000, the agreement to pay may be something like 80% of that amount which is

$12,000. This ratio which represents the amount of cash paid by the client is referred to as cash ratio.

1.13 Retention Money

Retention money is that part of certified monetary value that is not paid to the contractor for the sake of security to ensure that the contractor finished the assignment in time.

The retention amount is (X-percentage amount of certified work paid). So, like in case (6.12) above the retention amount is $3,000 which the 20% of the total certified amount.

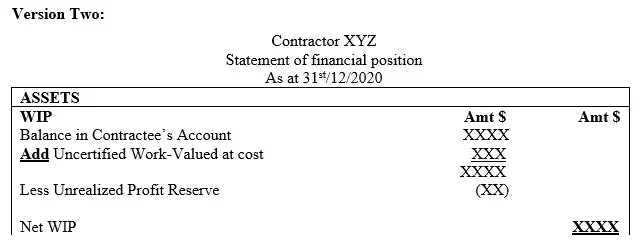

1.14 Accounting treatment of both Certified and Uncertified Work in Progress

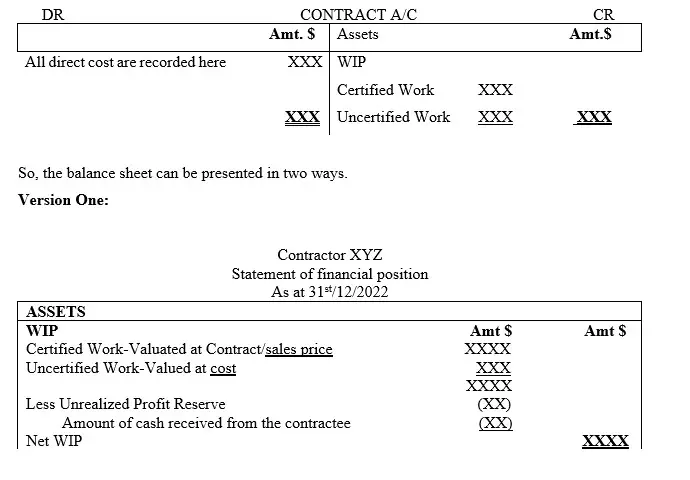

You should know this one thing that both the certified and uncertified works form part of the assets of the contractor. So, in the books of accounts of the contractor, these two aspects appear under assets column in the balance sheet/statement of financial position, net of any cash received from the client and any reserves for unrealized profit. Again, the same items are presented in the contractor’s contract account. So, this will be the correct presentations in the books of accounts.

In the contractor’s contract ledger account;

NB: Unrealized Profit Reserve is the part of profit associated with the incomplete contracts yet to be transferred to the costing profit and loss account.

1.15. Conditions for determining Profit on Uncompleted Contracts

a). Profits are calculated only on the certified works

b). If the Certified Work monetary value is 1/4 of the contract price; No profit computation.

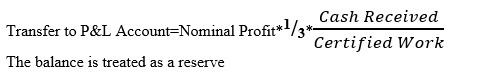

c). If Certified Work monetary value is between 1/4 and ½ of the contract price, 1/3 of the profit disclosed as reduced by the percentage of the cash received from the contractee, should be transferred to the profit and loss account. This is expressed as;

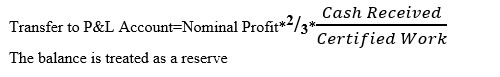

d). If Certified Work monetary value is between 1/2 and less than 90% of the contract price, 2/3 of the contract price profit disclosed, as reduced by the percentage of cash received from the contractee, should be taken to the profit and loss account. That is;

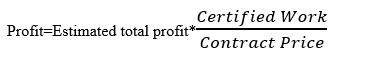

e). If the contract is towards completion and it is reasonably possible to estimate the total cost then the estimated profit to be transferred to profit and loss account will be that proportion of total estimated profit on cash basis which the certified work bears to the total contract price. In short, the profit to be transferred to P&L is;

NB1: The three formulas are the most suitable models at reasonable level of the contract and towards the tail end of the contract completion. So, these two methods are the most reliable ones in contract costing.

NB2: Notional profit=Monetary Value of Work Completed Less Cost Incurred to Complete that Work.

Example 1

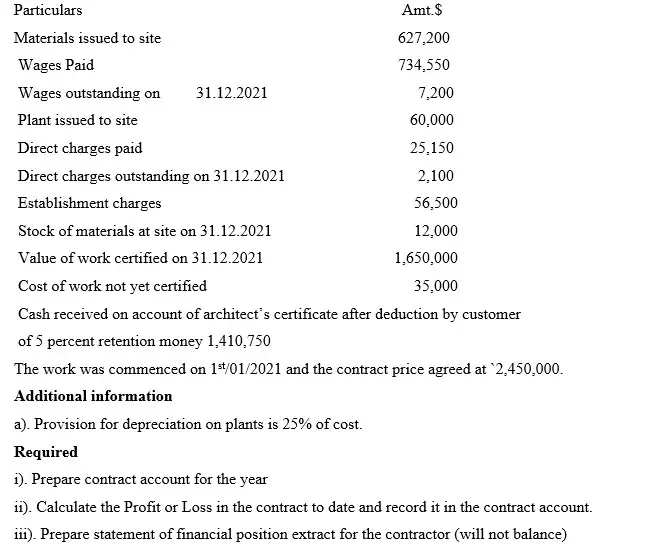

Smart constructors co. ltd won a tender on 01/01/2021 to undertake a certain contract that involves construction of building mall to be used as a town business Centre. The following are the details of the contract no. 1121.

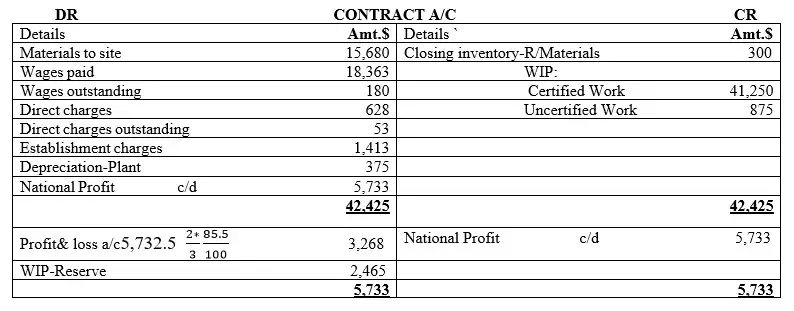

Solution

Example 2

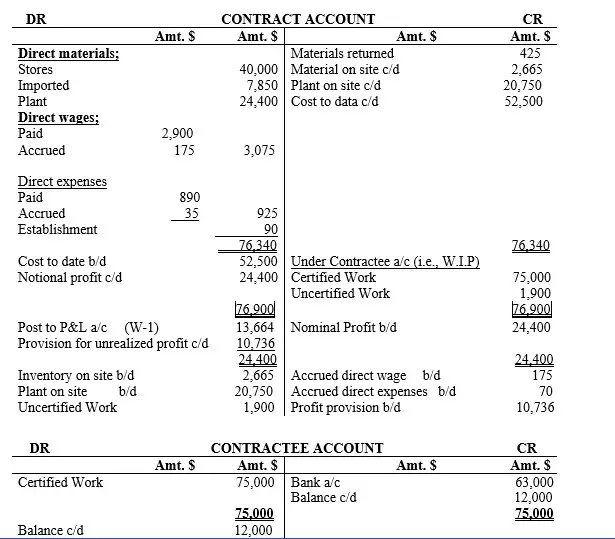

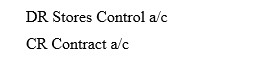

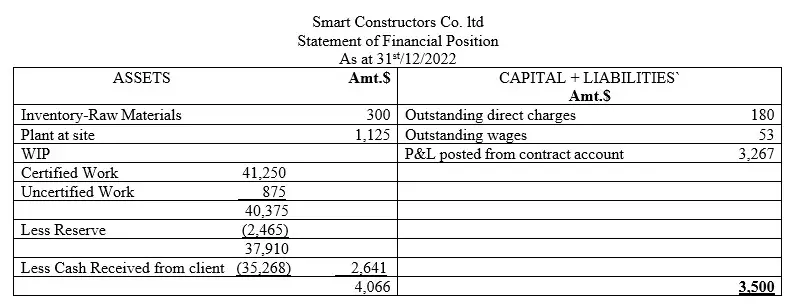

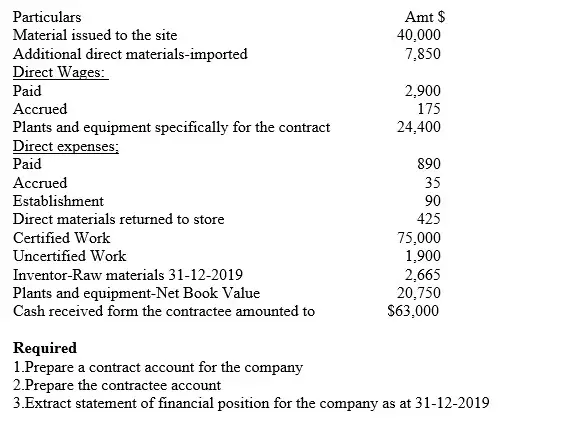

Double Dealers constructors co. ltd. had a contract of building a double bridge amounting to $100,000 which it won and started immediately on 1/1/2019. The following is the additional information about the logistics of this contract no 112-B

Solution