Appropriation of profit and loss account

In part two, the focus was on accounting treatment of equity capital and by extension the net profit of the business whereby we concluded that net profit can be divided into various uses such as for general purposes and other more specific tasks such as redemption of shares. This transaction is undertaken with help of appropriation of profit and loss account as it is in the case of partnership. This is an account which facilitate distribution of profits/(losses) made at the end of the financial period.

The term appropriation means allocating or apportioning of profits and/or losses to various purposes after charging business expenses. Mostly, the appropriation of profit and loss account involves charging of non-business expenses such as dividends and other expenses such as partners salary which is associated with the owners of the business especially partnership business. For the purposes of taxation, any appropriations made are categorized as disallowable expenses. Therefore, appropriation of profit and loss account differ with profit and loss account in that the former focus of non-business expenses which are charged to the net profit of the year whereas the latter (ie profit & loss account) is used to charge business expenses which are paid or incurred from the third party point of view. In the next two lessons, the discussion is on the accounting treatment of dividends which is subjected to appropriation process. The item is classified in to two, namely; interim and final dividend whether of ordinary or preference shares.

Lesson One; Interim Dividend

Interim dividend is profit that is declared and paid/distributed to the shareholders before the year ends. It is an appropriation expense for it is paid to the owners of the business and not to a third party. It is referred to as interim for it is determined and paid to the shareholders by the management either at the end of the first quarter of the year, semi-annual or after the third quarter of the year. You should know that this declaration in the course of the year implies that before the end of the year, there is an actual cash outflow.

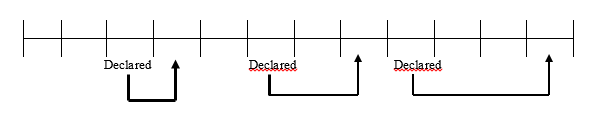

Just to clarify this concept, if declaration of interim dividend is done in March, the payment is done in April or there about and if declaration of interim dividend is in June, payment is done in July or around that time and so on and so on. The following number line demonstrates how this takes place.

NB: The entrepreneur/learner should NOTE that the decision of declaring dividends whether interim or final in nature, translates to a business activity and immediately the business assumes a liability to pay the shareholders the dividend dues thereof. That is, the decision to pay dividends is a business transaction as we discussed in level one of the accounting tutorial series, for that decision can be assigned a monetary value.

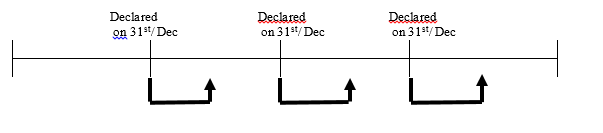

The following number line demonstrates how this takes place.

If dividends are declared in the month of March 2020, it is paid in April the same year 2020.

If dividends are declared in the month of June, 2020, it is paid in August the same year, 2020.

If dividends are declared in the month of Sept, 2020, it is paid in December the same year 2020

The accounting treatment of interim dividend in the books of accounts is as follows;

On declaration of interim dividend in the month of March

DR Appropriation of profit and loss a/c

CR Dividend payable a/c

Comment; on declaring of interim dividend, the management creates a current liability between the time of declaration and actual payment.

On actual payment of interim dividend in the month of April

DR Dividend payable a/c

CR Cashbook

Comment; on payment of the dividend, the liability is cleared hence the dividend payable account is closed down by counter debiting the account.

On declaration of interim dividend in the month of June

DR Appropriation of profit and loss a/c

CR Dividend payable a/c

Comment; on declaring of interim dividend, the management creates a current liability between the time of declaration and actual payment.

On actual payment of interim dividend in the month of August

DR Dividend payable a/c

CR Cashbook

Comment; on payment of the dividend, the liability is cleared hence the dividend payable account is closed down by counter debiting the account.

On declaration of interim dividend in the month of September

DR Appropriation of profit and loss a/c

CR Dividend payable a/c

Comment; on declaring of interim dividend, the management creates a current liability between the time of declaration and actual payment.

On actual payment of interim dividend in the month of April

DR Dividend payable a/c

CR Cashbook

Comment; on payment of the dividend, the liability is cleared hence the dividend payable account is closed down by counter debiting the account.

In a nutshell; by the end of the whole financial period, all dividends declared are actually paid before the year ends hence interim dividend is not a current liability at the end of the financial period.

Lesson Two; Final Dividend

In addition to interim dividend, the management may declare a final dividend at the end of the year. This type of dividend is also referred to as proposed dividend and it is a current liability to the business unlike the case of interim dividend for it is declared at the end of the financial period when final accounts are being prepared and hence payment is always undertaken in the proceeding financial period. The following number line shows how final dividend is treated in books of accounts.

Accounting treatment of final dividends is as guided by the above number line;

On declaration of final dividends on 31st/Dec 2018

DR P&L Appropriation account XXX

CR Dividend Payable a/c XXX

NB1: The dividend payable is also referred to as proposed dividend and it is classified as a current liability in the balance sheet

NB2: In 2019 when the dividends are paid, the accounting entry will be as follows;

DR Dividend payable a/c XXX

CR Cashbook XXX

NB3: This procedure applies for the following financial periods

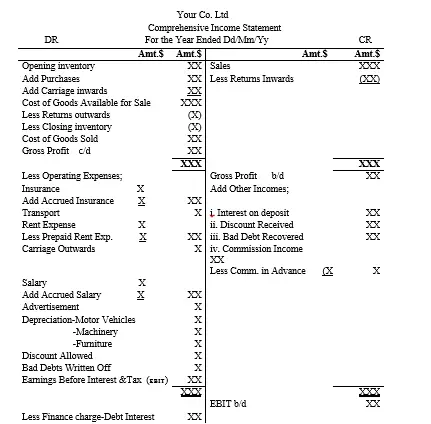

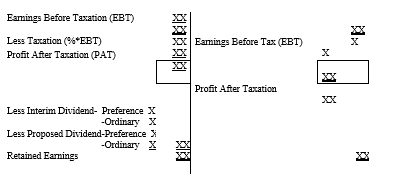

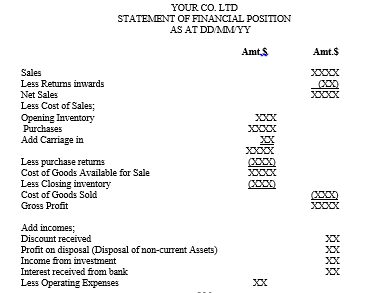

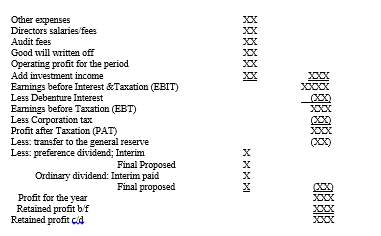

All the three parts in this discussion culminates to the following full format of comprehensive income statement;

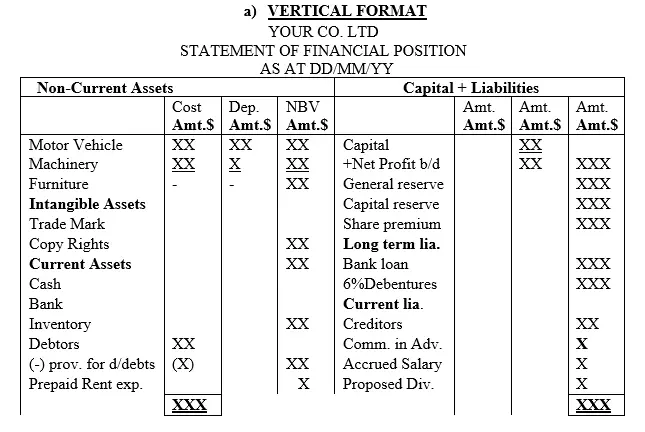

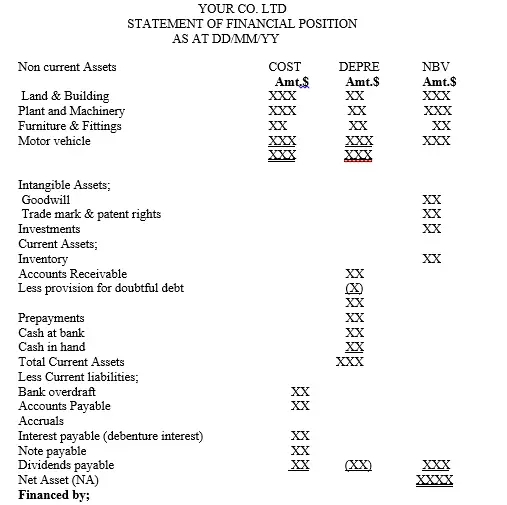

a) VERTICAL FORMAT

OR

b) HORIZONTAL FORMAT

NB1: Total dividend declared in a year is made up of either, interim or final or both such that if the year is a good one, a certain percentage (%) of the nominal value of the shares will be declared as dividend for the year. Further, the management may decide to first declare an interim dividend of a certain percentage and as the year ends, the remaining percentage is declared. This implies that the quantitative amount of interim dividend and final dividend forms the total dividend at the end of the year.

ILLUSTRATION

Suppose the Profit after Tax (PAT) for the year ended 31/12/2020 was $200,000 and dividends were declared as follows;

Interim 5%

Final 5%

Total 10%

Assume that the issued and fully paid ordinary shares were 100,000 at a nominal price of $10 per share

Required

Determine the total dividend declared

Solution

Interim 5%*1,000,000= $50,000

Final 5%*1,000,000= $50,000

Total dividends $100,000

Therefore, the retained earnings after tax and dividends will be;

$

PAT 200,000

Less interim div 50,000

Final div 50,000 100,000

100,000

NB: Dividends are calculated on the basis of the percentage nominal value of the shares issued and fully paid

Final accounts-part five: Statement of Financial Position

As an entrepreneur/learner, you should recall that from level one up to the third level, our starting and ending point has been the balance sheet also referred to as statement of financial position. In the next one lesson our focus will be this financial tool

Lesson One; Format for Statement of Financial Position

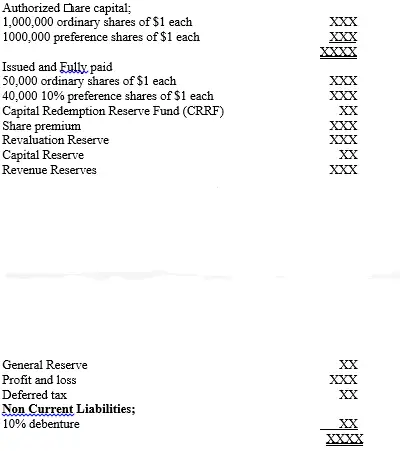

Part five gives an analytical presentation of statement of financial position of the business. As discussed earlier, balance sheet is the starting and the ending point in accounting cycle model. Statement of financial position represents the accounting or balance sheet equation. The overall format of statement of financial position of a company is as shown below;

OR

b) Horizontal Format

Summary

Final accounts is the culmination of all the business activities for a whole financial period. The main financial statement that ought to be prepared is comprehensive income statement and statement of financial position.

Under comprehensive statement, all aspects of incomes and expenses, be it for trading or operating purposes are incorporated. For business expenses, they are charged in the profit and loss account whereas for dividends paid, they are treated as appropriations. The directors’ salary or remuneration is treated as a business expense unlike in the case of partnership where such expenses are charged to the profit and loss appropriation account. The format for the comprehensive statement should be demarcated to show the income in this order;

EBIT-Earnings before Interest and Taxation

EBT, that is Earnings before Taxation and

PAT is Profit after Tax

The statement of financial position is prepared as usual except that unpaid dividends are recorded in the statement as current liabilities.

You should in a nutshell note the following;

Director’s salaries: Salaries, fees and other expenses in relation to the directors are expenses as far as company accounts are concerned. This is different from that of Partnerships & Sole traders which are shown as appropriations – expenses.

Audit fees; All companies are required to prepare the accounts which should be audited and therefore any fees paid in relation to audit and accountancy is an expense.

Debenture interest; Loans taken up by companies are called debentures. The interest paid on these loans are charged as an expenses and unpaid amount are shown as current liabilities in the business.

The debenture is classified under non-current liability.

Companies pay corporation tax on the profits they earn. This is shown in the accounts because a company is a separate legal entity unlike for sole traders and partnerships whose tax is shown as drawings.

The tax is listed under those 3 items as shown in the appropriation (under/over provision for previous period, transfer to deferred tax corporation tax for the year).

The under provision and corporation tax relate to direct liability to the government and therefore is a deduction from the net profit for the period .

Transfer to deferred tax is to cater for future possible tax liability.