Batch costing method: definition; characteristics; applicability; steps; advantages; disadvantages and examples

1.1 Introduction

Definition

Batch costing is one of the assignments of job costing which entails manufacture of a large number of items at the same time. Such as accessories of vehicle spare parts or other batch affiliated products.

From this definition, lets learn the term “batch”. A batch is a cost unit which consists of a group or combination of identical (homogenous) items. The batch which is a cost unit and made up of many items put together, they are identified by use of a single number. For example, a manufacturer may have manufactured 10,000 pairs of shoes which of course are identical. In this case, the 10,000 represent a cost unit and only a single number such as SS-1002 will be used.

Characteristics of batch costing method

1). Products are manufactured in batches.

2). All batches produced has similar or identical item one to the other.

3). Each batch is assigned only one identification number for identification purposes.

4). Cost per unit is determined by dividing the total cost of a batch with the total identical units in each batch produced.

5). Products lose their identity during processing for they are all assumed to be the same in every way.

Applicability of batch costing method

This method of costing is commonly used in the following industrial environment;

a). Garment manufacture

b). Manufacture of toys

c). Manufacture of motor vehicle accessories

Steps of batch costing method

The following are logical steps of determining the cost of a batch and also the individual cost of the identical products.

Step-1: Estimate the direct materials for the batch.

Identify the total direct cost for the whole batch as far as materials are concerned. The materials for the batch are the most relevant and not the ones for the individual product.

Step-2: Estimate the direct labor for the batch

Consider incorporating labor cost to the batch being produced. The workers who participate in complete manufacture of the batch are factored in. So, their salaries and wages are added to the direct material cost.

Step-3: Estimate the direct expense/cost for the batch.

The direct expenses related to the manufacture of the batch is added the other two categories of direct cost to determine the prime cost for the batch.

Step-4: Estimate the indirect cost such as overhead for the batch as per the apportionment basis.

If there is any overhead cost, be it variable or fixed, an absorption rate is determined to take care of the indirect cost to be added in to the batch.

Step 5: Pricing process

After determination of the total manufacturing cost of the batch, a certain predetermined percentage is used to calculate the profit margin which when added to the total cost will translate in to selling price of the batch.

Example 1

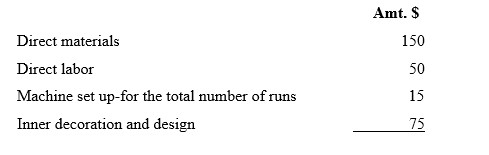

Tulip ltd is a key manufacturer of wedding rings. A customer has ordered a batch of 600 wedding rings with 0.45% content of gold cataract. The following is the additional information on the cost of a typical batch of 100 wedding rings.

Direct laborers are paid on a piecework basis.

Tulip limited absorbs manufacturing overhead costs at a rate of 20% of direct wages cost. 5% is added to the total manufacturing cost of each batch to determine the selling, distribution and administration overhead cost. The profit margin is 25% of total cost value.

Required

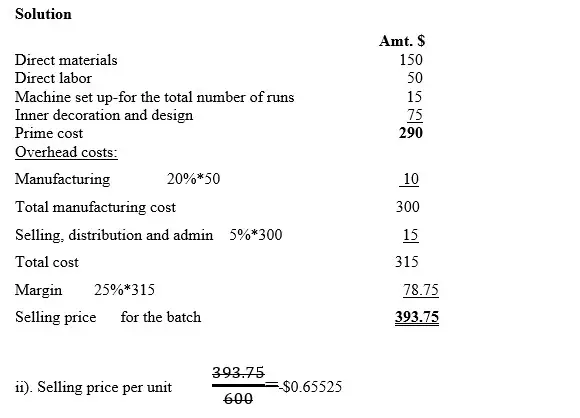

i). Determine the selling price of the whole batch

ii). Determine the price of each unit of the products forming the batch

Example 2

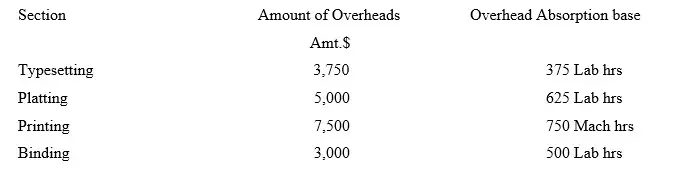

Morning Hours High speed printers co. ltd budget report for the year 2022 is as indicated below

Variable overheads

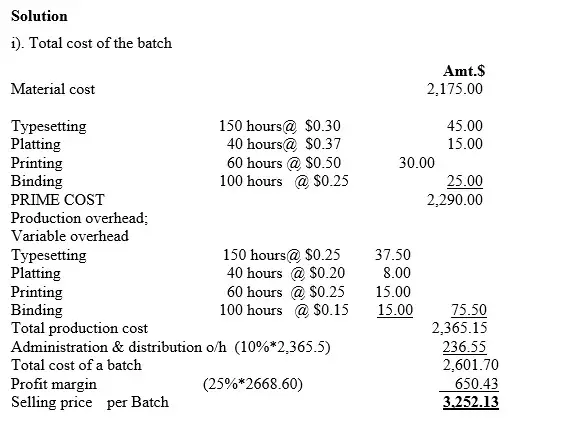

Selling and administration overheads are charged at 10% of manufacturing cost and profit margin is set at 25% on total cost

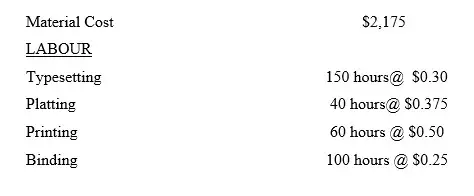

An order for 2000 receipt books was received from a trader. The batch number set for the order was 1010. The additional information below is for this job number 1010

The machine hours used on this job were 50

Required

i). Compute the total cost of the batch

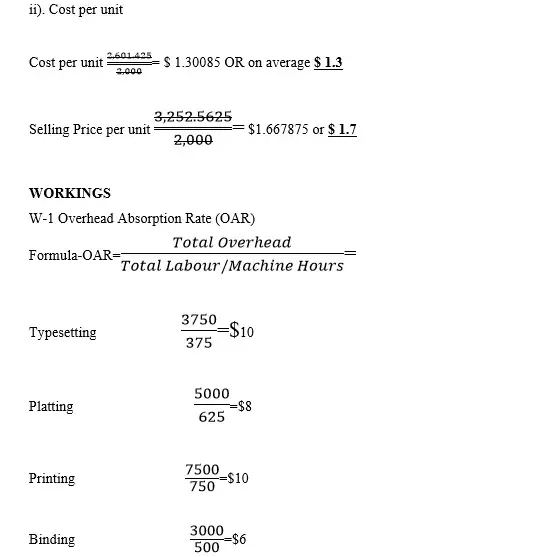

ii). Compute the cost per unit

iii). Compute the selling price of the batch

iv). Compute the selling price per unit

Advantages of batch costing method

1). Accounting recording is easy for the products are in batches instead of costing for individual items. For example, the total cost is determined from the batch point of view instead of summing up the cost of each item.

2). Cost per unit is determined by averaging approach which is more convenient when the producer want to set the selling price. You see average cost is uniform across all the items of the batch.

3). Economies of scale. Since the total cost is charged on the whole batch, the average cost of a unit is minimized.

4). Easy approach of supervising or managing the batch activities for all the batches undergo the same process. This ensures that the individual quality of each unit of a product is increased.

5). Improved way of resource allocation. Since production is in terms of batches, each individual item of the batch is assigned equitably.

Disadvantages of batch costing method

1). Separation of one batch from another is a complex activity for the batches are almost the same in all ways.

2). Cumbersome process of producing in batch format. This approach of processing output is confusing unlike in another case where the production is of one product per job.

3). Risky venture for if there occurs a case where some of the inputs are faulty, then the whole batch is spoiled and losses will be much.