Capital Cost

Definition

Capital cost is economic resources forfeited by the firm to finance acquisition of non-current assets for day to day running of the business. In other words, the intention of cost incurred is to acquire an asset for long-term accruing benefits such as purchase of fixed assets which will be used for day-to-day operations of the business as stated earlier on. In other words, the intention of such cost is to acquire assets not for re-selling. Such fixed asset can be for instance, motor vehicles for transport purposes, and machine for production activities. Such that if you consider a proprietor with a private school, he or she may buy a school bus for children transportation purposes. Yes, the asset is a fixed one and it is for furthering business activities.

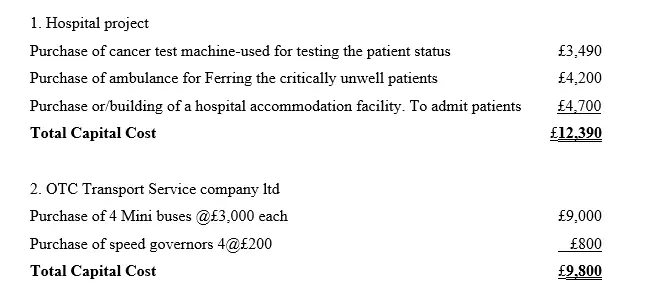

Scenario Of Capital Cost

Notes On Capital Cost

- Capitalization: Other costs that are incurred for the sake of making the capital good/non-current asset to be more useful such as legal fee and installation expenses, they are normally capitalized. Firms capitalize on costs of a capital good when they expect to utilize a purchase over a long time.

Definition: Expense capitalization is the process of adding up such expenses to become part of capital cost.

- The capitalized amount of cost becomes part of the amount to be depreciated like any other amount such as capital good(s).

- CAPITAL COST-Is a one-time expenditure-in other words, it is not in the class of operational cost which is recurring every other time.

- Depreciation charges of capital goods-provision for depreciation is not a tax allowable expense

- Wear and tear allowance of capital goods-wear and tear allowance is a tax allowable charge and it is a tax relief to the concerned firm.

- Capital cost is also referred to as capital expenditure as explained in beginners level articles in com

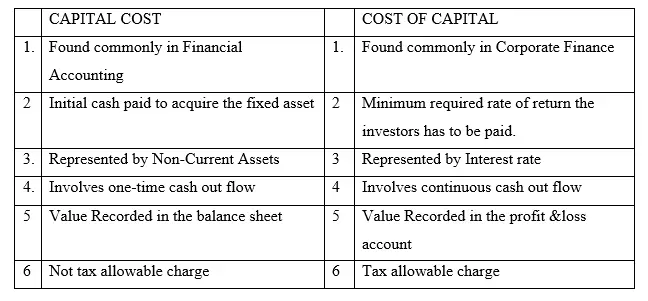

Difference between capital cost and cost of capital

Advantages Of Capital Cost

- Capital Cost which is initial may be much but it saves the firm from every other day spending. For instance, decision to buy other than leasing an asset.

- It increases income generation capacity of the firm which is portrayed through increased sales.

- Monetary value of the firm is increased-Capital Expenditure adds to the value of the balance sheet which is important when it comes to mergers and acquisitions.

- Capital cost increase has a corresponding increase in asset tangibility which help in securing of external debt financing.

Disadvantages Of Capital Cost

- Capital cost is very costly and can result to much cash out flow which can fix a firm in to liquidity problems.

- Capital costs attract other additional costs which could not be there if the initial cost was not incurred. For instance, repairs and maintenance to protect the value of the investment

It is not possible to project the future cash flows for there is always full of uncertainties

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.