Committed cost

Definition:

Committed cost is consumed economic resources of a firm based on a specific criterion used by the management out of their own choice they have come up with that they think is the best to their knowledge (i.e., at their discretion). This implies that the decision already made by them cannot be changed. It is fixed or constant.

NB: Many students or scholars think fixed or constant costs are just constant or fixed as far as level of production is concerned. This is not true for if we consider the aspect of decision-making by the management, the so referred to as fixed cost also vary based on discretion criterion. The term “Discretion” means at one’s will. Its upon one’s judgement to make a particular decision. In other words, one is at liberty to choose to or not to. So, on this basis, a certain element of cost may remain fixed or constant.

Example 1

Committed cost will involve a set a side amount of cash outflow which is already known that this amount will flow out of the business as an expense so as to meet a certain need. For example, the management may set aside some constant $105 to pay lease fee for a machine bought on lease terms re-payable for 5 years. This is actually a constant obligation to pay to the other party that amount and the business cannot run away from that. Hence has to remain committed as the name of the cost is referred to as. Other examples may include the well-known cases of hire purchase installment contributions which are constant/fixed all through the set period.

Applicability Of Committed Cost Scenario

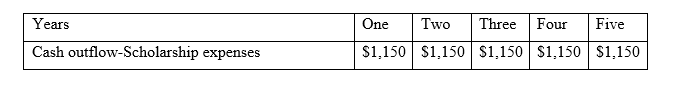

One: Student Scholarship commitment fee per semester

If a sponsor has sacrificed to finance education for some students in a certain school or higher level of learning institution, then the sponsor which can be a natural person or an institution may commit some amount of cash, let say $1,150 spread over five years within which the scholarship is valid. So, in the books of account of the sponsor, a constant/fixed allocation of the amount will be as follows;

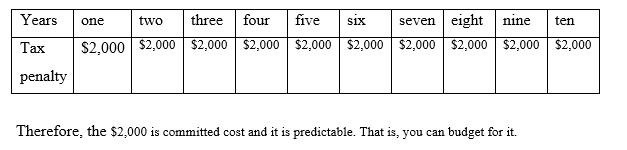

Two: Tax Penalty by a tax authority

In a tax dispute, the two parties may come to an agreement that for the tax payer to afford to meet the tax burden, they may enter in to an agreement that the tax payer to assign the agreed upon lumpsum amount over a certain period of time, say ten years. For example, if the total amount is $20,000 to be paid to the government, the amount can be spread over the 10 years as follows;

Advantages Of Committed Cost

Some of the advantages of committed costs over other unplanned costs in a business are;

- Budgeting for the cost is possible

One can budget for the same such that no single time that one will default the charges leading to breaching of the contract thereof.

- Fostering of operations accuracy

with this set amount to be paid over a stipulated period of time, it is possible to interrogate the cost implications and improve on the operations of the business by planning better to reduce the cost impact thereof.

- Committed cost implies that it is possible to boost profitability of the organization.

It is a tool to measure the soundness of the management team to see how efficient it is in its decision making in matters of setting profitability targets.

Disadvantages Of Committed Cost

- Breach of this commitment in form of cost to be paid can land an organization to financial crises. Especially when the economy turns out to be bad and probably it was initially less expected.

- It is not a must that the committed cost to be efficiently allocated by the management for the latter may have hidden agenda to steal from the company for personal gain. Like in the case of agency cost.