Cost Ascertainment-Material Costing

Cost Ascertainment for materials is the process of identifying cost incurred or paid to acquire raw materials needed for the production of a product. There are diverse logistics of handling raw materials such as purchase, store, control and actual issuance of the materials from the stores for actual production which require inventory valuation. The valuation methods are diverse as used by different organizations.

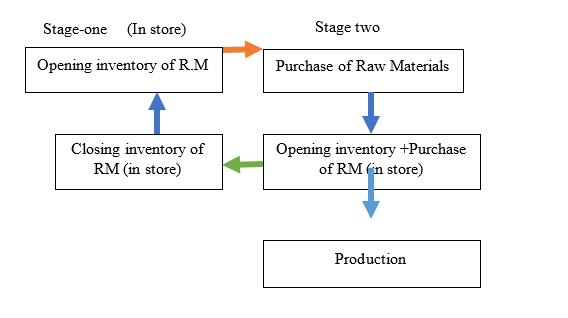

Diagrammatic approach in ascertainment of material cost

Actual material cost used in production of a product is diagrammatically portrayed as follows;

Steps of cost ascertainment of materials

Step one; Determination of the cost of opening inventory of raw materials. This is anchored on the inventory valuation methodology adopted, FIFO, LIFO., simple average and weighted average.

Step two; Add cost of raw materials purchased

Step three; Transfer raw materials to production Centre

Step Four; Determination of the cost of closing inventory of raw materials. This is anchored on the inventory valuation methodology adopted, FIFO, LIFO., simple average and weighted average.

Example

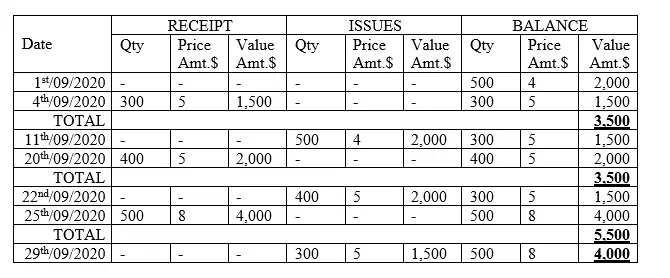

The following details were extracted from store ledger card of Honey Moon Co. Ltd for the month ended of 30th/09/2020

Date

1st/09/2020 Opening inventory of raw materials 500 units valued at $2,000

4th/09/2020 Received 300 units @ $5 each

11th/09/2020 Issued 500 units

20th/09/2020 Received 400 units @ $5

22nd/09/2020 Issued 400 units

25th/09/2020 Received 500 units @ $8

29th/09/2020 Issued 300 units

Required;

i). Determine the cost of raw materials used in production of the final product. Assume that there was no wastage of raw materials during production. (Hint-use FIFO method)

SOLUTION

It should be noted that the cost of raw materials used in production is $5,500 (i.e 2,000+2,000+1,500) which is the total cost of all materials issued to the production section for manufacturing purposes.