Direct overhead apportionment method: introduction; steps of direct apportionment; example; advantages and disadvantages

1.1 Introduction

The following definitions elaborate for us the inner meaning of direct overhead apportionment method which is a type of non-reciprocal overhead apportionment method.

1.1.1 Definition-1

Direct overhead apportionment method is a secondary or non-reciprocal overhead cost distribution approach or method whereby the overhead costs associated with the service department(s) are straight away charged to the respective production department(s).

1.1.2 Definition 2

Non-Reciprocal Overhead Apportionment Method is an approach or technique of distributing overhead costs amongst departments in a straight away manner without considering those service departments which serve one another in a reciprocal or equal way. For example, department “X” uses its resources to serve department “Y” and on the other hand, equally or almost equally the latter department (of course Y) uses its resources to serve department “X”. This reciprocal relationship is ignored.

This approach ignores any inter-services between or amongst service departments themselves. That is, if there is a service department serving another service department, the overhead costs apportioned to that department is not re-distributed. This method is the opposite of the reciprocal overhead apportionment methods.

Steps of direct overhead apportionment method

The secondary overhead distribution method is applicable in apportioning overhead costs if the following SIX simple steps are followed. That is;

Step 1: Identification of the most suitable basis for apportionment.

For each service department, identify the best or most suitable apportionment basis to use during the process. For example, unit of production which is suitable when single product is being produced or direct labor cost is okay which applies when the conversion process is labor intensive.

Step 2: Summation of overhead costs for each service department.

Add up all the overhead costs associated to each respective service department. This is in preparedness to distribute the costs to the respective production Centre or departments.

Step 3: Distribution of overhead costs of the first service department.

Distribution of overhead costs of the first service department to the respective production department(s). In this case, the appropriate base is used.

Step 4: Distribution of overhead costs of the second service department.

Distribution of overhead costs of the second service department to the respective production department(s). In this case, the appropriate base is used.

Step 5: Distribution of overhead costs of the third service department.

Distribution of overhead costs of the third service department to the respective production department(s). In this case, the appropriate base is used.

Step 6: Distribution of overhead costs of the Nth service department.

Distribution of overhead costs of the Nth service department to the respective Nth production department(s). In this case, the appropriate Nth base is used.

Example

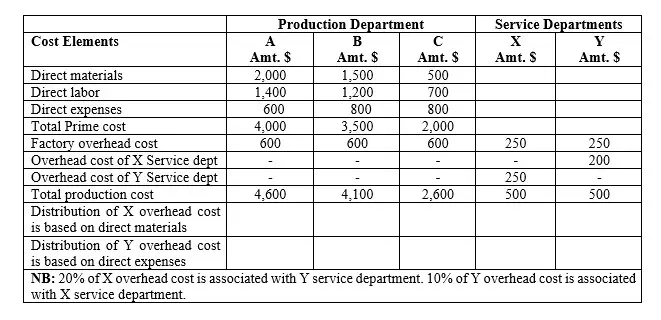

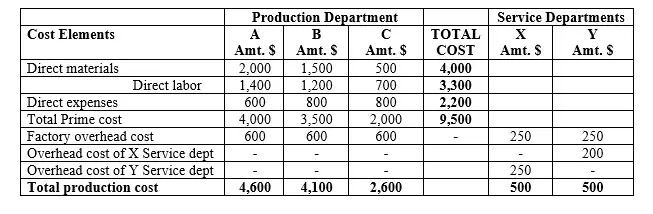

Most Beautiful Garden ltd. co. is a company which has specialized in production of women beauty ornaments. The following cost information was provided to you by the management to help them prepare the cost statement for all the five departments. The data was provided as indicated below;

Required

Using direct overhead apportionment method

i). Compute the total overhead cost apportioned to A, B and C production departments.

ii). Determine the total cost for the three production departments.

Solution

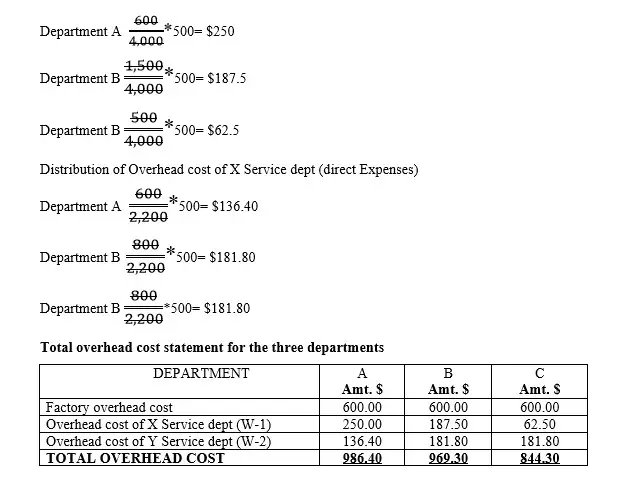

i). Computation of the total overhead cost apportioned to A, B and C production departments.

Workings;

Distribution of Overhead cost of Y Service dept (direct materials)

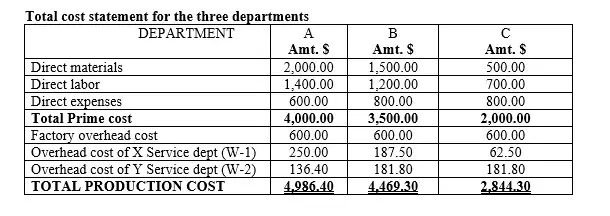

ii). Determine the total cost for the three production departments.

Advantages of direct overhead apportionment method

1). Simple to compute.

Direct overhead apportionment method is simple for it involves assigning overhead costs directly to the respective production departments.

2). Not time consuming.

Direct overhead apportionment method is computed within a shorter period of time for the procedure is simplified. This is time saving to the producer.

3). Accurate in assigning overhead costs.

Direct overhead apportionment method is more accurate for it is straight forward to the apportioning mission and hence no meandering. So, chances of making mathematical errors are low.

4). Simple to interpret.

Direct overhead apportionment method are user friendly when it comes to understanding the message therein. Since the method used is simple, it accommodates so many users as far as understanding the concept is concerned.

5). Help in setting the selling price.

Direct overhead apportionment method is the yard stick to compute the correct price of a commodity or final product.

6). More popular than the other methods.

Direct overhead apportionment method is a simple method of spreading the overheads and so it is commonly used by many producers. Hence very beneficial to many people.

Disadvantages of direct overhead apportionment method

1). Assumes the apportionment base used is uniform for all departments

Direct overhead apportionment method assumes that even the service overhead costs should share the same base which may mislead the producer and do wrong apportionments.

2). Ignores the inter-service department apportionments.

Direct overhead apportionment method directly transfers the service overhead costs to the respective production departments. This is disadvantageous for the bases of inter-service overhead apportionment between or amongst the service departments may be distinct and the results gotten may cause a derailment of correct results.

3). Not practical or not logical

Direct overhead apportionment method is to some extent not logical for all organizations have different bases that they use. So, this method may not apply all over the world.