Halsey Premium Plan: Definition; Characteristics; Example; Advantages& Disadvantages

1.1 Definition:

Halsey Premium Plan is an incentive scheme where by the employer sets a standard time such that when the worker is undertaking the task, he or she adheres to it when doing each job or operation but then the worker is given wages for the actual time, he or she takes to complete the job or operation at the agreed rate per hour plus a bonus equal to (usually) one-half (50% of the time saved) of the wages of the time saved. The proponents of this scheme were Halsey, Doolittle, and Emerson.

NB: You should note that, the common practice in this scheme, the bonus may vary from 33.5 % to 66.5 % of the wages of the time saved.

This method of payment is pegged on rewarding of the employee with some bonus for finishing the task before the standard time limit. Generally, the bonus set aside is a percentage of the wages gotten by the employee. So, for Halsey Premium Plan, an employee is paid a bonus of 50% for the time saved plus the salary for the actual time spent on the job.

1.2 Characteristics of Halsey Premium Plan

- Halsey Premium Plan sets a standard time in advance to lay a roadmap to the employees as they engage, they are already aware of the expectations thereof.

- Halsey Premium Plan is dominated by a guaranteed income for the employees and the worker gets the guaranteed irrespective of whether he or she meets the firm performance target or not.

- Halsey Premium Plan is characterized by 50% bonus structure which is pegged on the time saved by the employee.

1.3 Formula for Halsey Premium Plan or Method

So, how is the total wage income under Halsey Premium Plan computed?

Wage Income = (Hours worked x Rate per hour) + (Time saved x Rate per hour x 50%)

OR

WI = (HW x RH) + (TS x RH x 50%)

NOTE: That the TS is time saved which is the difference between the standard time and actual time used to complete the task as follows;

TS= ST-AT

Where:

TS is time saved

ST is standard time

AT is actual time used in completing the task

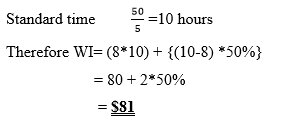

EXAMPLE

Roosevelt works with ABC manufacturing firm which deals with production of three types of products, namely; A, B and C. Roosevelt has specialized in production of product B and the following is a production schedule for the 8 hours worked per day.

ABC manufacturing co. ltd has the following wage rate terms and condition for the employees it has engaged in production.

Time rate of wages is $10 per hour.

Standard output 5 units per hour.

Actual hours worked 8 hours.

Actual output 50 units.

REQUIRED

Determine the total wages paid to Roosevelt

Solution

WI = (HW x RH) + (TS x RH x 50%)

Time taken 8 hours

Wage rate per hour $10

1.4 Advantages of using Halsey Premium Plan to Compute Labor Cost

- Halsey Premium Plan is a simplified approach for calculating the labor cost.

- Halsey Premium Plan assures employees of some income at the end of the day

This method incorporates some pre-determined income for the employee and this is very much encouraging to the workers.

- Halsey Premium Plan reduces the overall cost of production for the organization

The 50% component in the formula of Halsey Premium Plan implies that the firm is saving 50% of the production cost. So, the paying of employees a 50% of the saved time, at the same time the 50% not paid to the workers is a cost saving element for there was additional output which was associated to that particular employee being paid the bonus.

4.. Halsey Premium Plan is an employee motivating tool

The 50% bonus element is good enough to propel the employee to work more harder even when he or she had an history of low performance.

5.. Less labor turnover

Halsey Premium Plan of additional 50% of the saved time is a way of creating a feeling of security among workers as the plan assures a minimum hourly rate or guaranteed wage. This makes the workers concentrate on production other than looking for greener pastures.

6.. Not punitive

Halsey Premium Plan aims at rewarding the efficient workers by way of payment of bonus, but that does not mean punishing the less active employees. Instead, they are not penalized. They are spared.

1.5 Disadvantages of using Halsey Premium Plan to Compute Labor Cost

- Compromise to quality of the work done

Many employees under Halsey Premium Plan find themselves being ignorant of the quality of the output associated to them as long as quantity is taking the lead. This is disadvantageous to the organization when it comes to matters of reputation of its products in the market.

2. Management faces sharp criticism from the employees.

The Halsey Premium Plan provokes the Workers for paying them 50% of the saved time which means the balance (50% retained by the firm) is not termed as fair by the employees who have worked hard to achieve these results.

3.Cumbersome to set the standard time.

Halsey Premium Plan faces controversies and hot debate from the employees for there is no universally accepted time rate set by both parties. This creates a bad relationship between the employers and employees across most organizations.

4. Lack of optimal utilization of firm resources

The Halsey Premium Plan is known for wastage of raw materials due to workers focusing on more and more output. For they always avoid any process which takes their time planned or budgeted for more output. This results to carelessness in handling the resources of the firm such as raw materials.