Joint Cost

Definition

Joint cost is economic resources used or consumed in the process of producing two or more products at the same time. That is produced jointly. A good example of such products is petroleum products such as paraffin, petrol, diesel and gas. During the refinery process, all those products are produced simultaneously.

In other words, the cost elements are classified on the basis of cost or resources that are commonly used to produce two or more products which within a certain stage or process remain twins or joint until past the point of split-off. So, the costs paid or incurred within this section of production is referred to as joint. Otherwise after that stage, each product consumes its own resources separately. You should not that after split point, there may arise one good being main and other one being minor (i.e., by-product) in that order.

1.1 Joint Cost Allocation

The argument behind joint cost allocation is that at the end of the day, whatever has been produced will be sold to generate revenue. Now it is therefore logical to find out the corresponding total cost associated with each individual product. So, this brings in the decision on how to allocate the joint cost between or amongst the final products realized. To achieve this objective, the producer or manufacturer has to devise a methodology to allocate the joint cost in a manner such that each category of final product reflects equivalent cost associated to its final state of production. There two main methods of allocating this cost, namely;

- Physical allocation approach

- Monetary based allocation approach

Physical Allocation Of Joint Costs

This is a method of allocating the joint cost based on the commonly shared physical characteristic or trait of the final output of a product. The physical method of allocating joint cost is further classified in to;

- Quantitative Physical method-it is a method which entails actual measurable approach of assigning value on the common characteristic/trait to be used

- Predetermined Standard Method-it is a physical method of basing allocation of joint cost using already calculated index value to guide on the allocation. Most of the times it is the index used is based on the past experience on production of the products involved.

The following are examples of some of the physical characteristics which are used in this approach,

Weight

Mass in kilograms or grams

Sizes or volume

Surface Area

Length etc.

Steps Of Physical Allocation

Step-1: Determination Of Total Joint Cost

Determine the total joint cost for all the units produced, for both main and minor products at the point of splitting.

Step-2: Identify The Common Trait Or Characteristic

Identify the common trait or characteristic that applies in all the categories of the products produced.

Step-3: Cost Allocation

Allocate the cost based on the step-2 common characteristic identified.

NB: Allocation of joint cost should only be on the main or primary output products of the joint process, but not the incidental/minor or what we call by-products or scrap.

Step-4: Compute The Cost Per Unit

Determine the cost per unit of each category of the products produced.

Illustration One

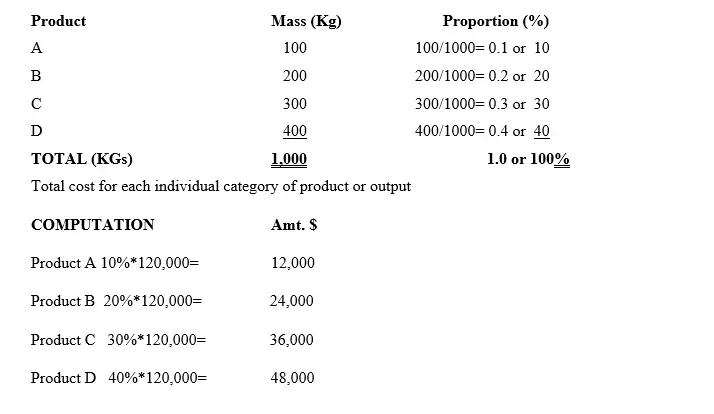

XYZ Ltd has a total joint cost of $120,000. There are four categories of final output gotten of products A, B, C and D. Those products were measured using their mass. The total mass for the four categories was as follows;

Further Assumption

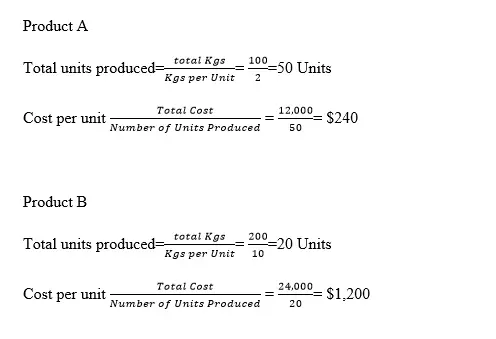

One unit of product A has a mass of 2Kgs

One unit of product B has a mass of 10Kgs

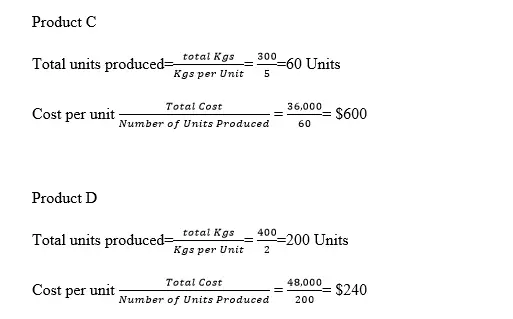

One unit of product C has a mass of 5Kgs

One unit of product D has a mass of 2Kgs

Required

Determine the cost per unit of each category of product

Solution

Monetary Based Allocation Approach

This method is further classified in to:

- Sales value at split-off method

- Estimated Net Realizable value (NRV) method

- Constant gross-margin percentage NRV method

Market Value Based Cost Allocation Method

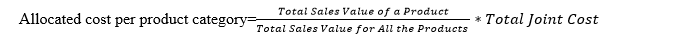

The commonly used method of joint cost allocation is Market Value Method. It is also referred to as sales value method. This approach/formula is the most commonly used one for it is postulated that the sale value of the product itself reflects the cost incurred or paid for it to be produced. In this case, the basis of allocating the joint cost is on the basis of the respective market value of the items produced.

Formula used is;

Example

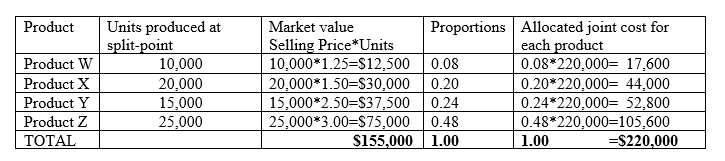

Joiners co. Ltd is a manufacturing company which deals with production of W, X, Y, and Z beauty products. In the month of July 2022, the company produced the four products at a total joint production cost of $220,000. The following units were produced: W, 10,000 units; X, 20,000 units; Y, 15,000 units; and Z, 25,000 units.

Additionally, the prevailing market price of the four categories of output was as indicated below;

Product W was selling at $1.25,

Product X was selling at $1.50,

Product Y was selling at $2.50, and

Product Z was selling at $3.00.

NB: That the assumption is that the beauty products were sold at the stated split-off point market or sales values.

Required:

Calculate the joint production cost allocation using the market value method for each product.

SOLUTION

Advantages Of Joint Cost Allocation

- Help in setting selling price for a product

Joint cost allocation method aid in ensuring that the selling price is pegged on the actual cost of each category of a product

- Help in profitability determination

When the cost per unit is precisely determined, the setting of the profit margin becomes easy for it is a matter of assigning the appropriate percentage based on the cost of production if mark-up approach is used.

- Separability of the various products

The methods available for joint cost allocation eliminate the confusion that would be there if there was not tool available to split the products as supposedly.

- Allocation of resources

By the fact that it is possible to allocate joint costs to specific products makes the management have a road map of allocating the economic resources to a process, department or section for they know at some point distinction will be possible

- Budgeting is made possible

Budgetary activities are made possible and the concerned department can plan and allocate financial resources to any economic activity.

- Promotion of marketing segment/arm

With ability of allocate joint costs shades more light on the selling price to be set for each category of product. And more so, the set selling price does not suffer the risk of over or under pricing.

Disadvantages Of Joint Cost Allocation

- Cumbersome to compute the cost.

The process of allocating joint costs to a product is generally a lengthy process especially when there is no automated system to do so.

- Time consuming

The process of assessing the amount of cost to allocate on a particular set of products is time wasting as compared to another case where the cost is for a particular product.

- Challenges of classifying costs which are termed as joint

Different organization in the same industry have diverse methods of joint cost allocation and this causes disparity on how to compare performance amongst those firms.