Process accounts for a single product with work in progress (WIP) valued using average method: computation of equivalent units; why use average method and example

1.1 Introduction

It is only in an ideal situation where all materials are fully used to produce complete units of a product. But in reality, when production process starts, there are many cases where the producer will experience availability of some unused raw materials either in the beginning or at the end of the year or both. On the same breath, output can either be complete or partially finished.

So, as a result of this technicalities, the aspect of WIP is pivotal in this discussion. This article focuses on the process costing in an environment where there is Work in Progress. To achieve this objective, the following concepts have been well articulated for you as a learner to equip yourself in analyzing and solving the process costing at this higher level.

1.2. Terms used in Work in Progress (WIP)

The following terms are commonly used in this thematic matter.

1.2.1 Equivalent Units

Definition; Equivalent units is as explained in our article on process accounts for a single product -with work in progress (WIP). Just refer to that article to learn more about the definition, the 4 points on logic behind equivalent units, total equivalent production, formula for computing cost per unit etc.

Valuation of Work in Progress (WIP)

2.1 Introduction

Definition: This refers to the physical assigning of the monetary value of the closing WIP inventory. The common inventory valuation methods used are, namely;

a). First in First Out method.

b). Average cost method.

In this article, the focus is on average method as follows;

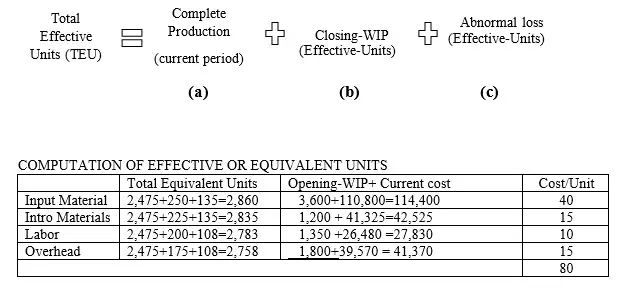

Computation of equivalent units-average valuation method

3.1 Introduction

Average method is one of the methods of valuing inputs in process costing amongst other methods such as First in First Out and Last in First out and approaches. The following points will help you to justify the reasons as to why average method is more reliable.

Average cost method is a more suitable method of valuing inputs in process costing.

3.2 Justification of Use of Average Method

1). This method is applicable when the opening WIP is given in terms of materials, labor and overheads BUT the stage of completion is not given.

3.3 Example

Mighty Factories co. ltd produces product Tee which sells in the market at a very high speed. The following information relate to its production which is through several processes. The details of its production are as indicated below. Product Tee was at process “C” where by this process level received units from process “B” then after process “C” was over, the output was sent to finished goods account which is the final stage. See the details

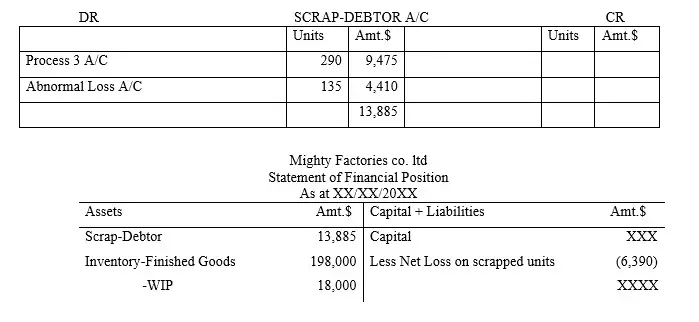

Estimated loss is 10% of the good output. The scrapped units were selling at $32.67

Required

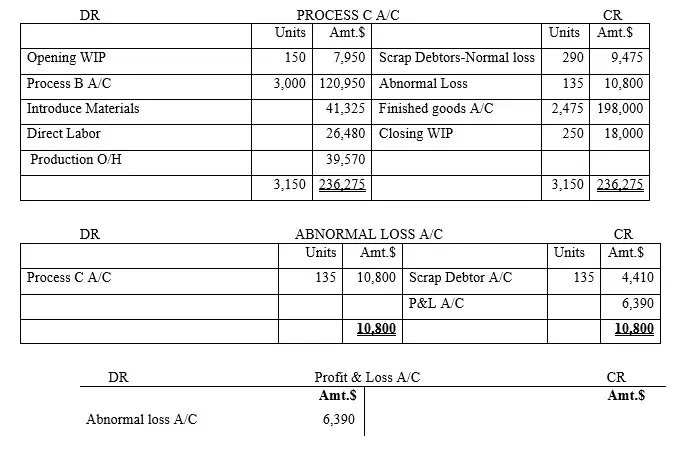

i). Prepare the process “C” account using the average method or approach.

ii). Extract the statement of financial position as at that time (i.e., balance sheet).

Solution

Comment on of the following inputs used in process C;

i). Input Material

Input material is always represented by the number of complete units transferred from the previous process. In this case it is process B and the units were 3,000 at a total cost of $120,950. This is a case of 100% complete materials as we discussed earlier on in our tutorial.

NB: Remember that the total cost of this input materials of $120,950 is inclusive of the cost of producing the units associated with normal loss which were 290 and were disposed/sold at $32.67. So, in actual sense, the correct cost for the input materials is;

120,950-(290*32.67) = $111,475

ii). Introduction Materials

Introduction material here is additional costs whose cost is straight away stated as 41,325. This cost amount is well captured during the production process within the period given

iii). Labor

Labor cost is straight away stated as 26,480. This cost amount is well captured during the production process within the period given.

iv). Overhead

Overhead cost is straight away stated as 39,570. This cost amount is well captured during the production process within the period given.

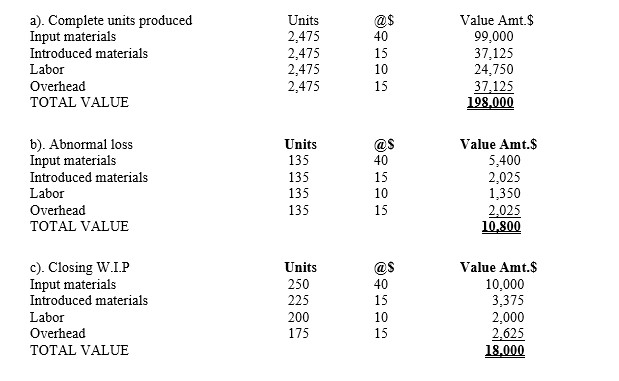

W-3: Computation of entries to be transferred to Finished Goods A/C according to average valuation method