Process accounts for a single product with work in progress (WIP) valued using FIFO method: computation of equivalent units; why use FIFO and example

1.1 Introduction

Definition: Valuation of Work in Progress (WIP) is the physical assigning of the monetary value of the closing WIP inventory. This objective can be achieved by use of different valuation methods which may include and not limited to;

a). First in First Out method.

b). Average cost method.

However, in this article, the focus is on FIFO inventory valuation method as follows;

1.2 FIFO Valuation Method

This approach of valuing WIP advocates that before production of new output, the manufacturer processes the opening inventory of WIP first to completion. Then start new output. The new output will either be complete at the end of the financial period or be incomplete hence forming the closing WIP of goods.

Therefore, the valuation of completed units is done in three phases;

Phase 1: Determine the cost incurred or paid to complete production of opening WIP inventory. You see, opening WIP is actually units whose process of producing them started in the previous financial period and did not end. It crosses over to the next or current period.

Phase 2: Determine the cost incurred or paid to produce new output. That is cost of units started in the current period and completed before the end of that period. You see, producing these complete units was in the same year of production.

Phase 3: Determine the cost incurred or paid in production of WIP inventory. You see, closing WIP is actually units whose process of producing them started in the current financial period and were not completed at the end of the financial period. It therefore crosses over to the next or proceeding period.

NB: In FIFO method, opening WIP does not lose its identity.

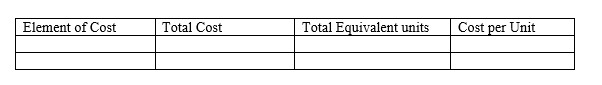

2.2 Statement of Cost

This is a statement that is used in cost accounting to express the cumulative cost as per inputs used, equivalent units and cost per unit. The format is as shown below.

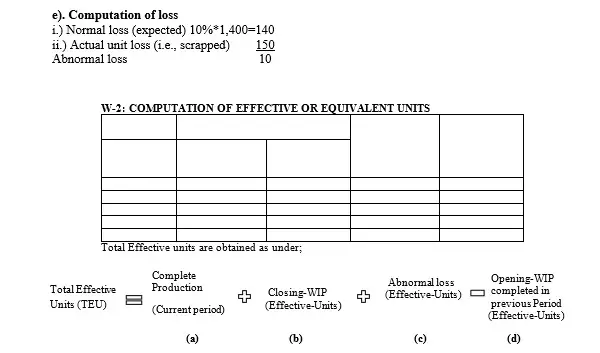

Computation of equivalent units-FIFO method

3.1 Introduction

Fist in First Out (FIFO) is one of the methods of valuing inputs in process costing amongst other methods such as Last in First out and the average methods. The following points will help you to justify the reasons as to why FIFO method is more reliable.

3.2 Justification of Use of FIFO Method

1). This method is applicable when the opening WIP is given in lumpsum amount and the stage of completion is indicated.

2). This method is also applicable if the degree of completion and value of WIP in terms of material, labor and overheads is given.

3.3 Example

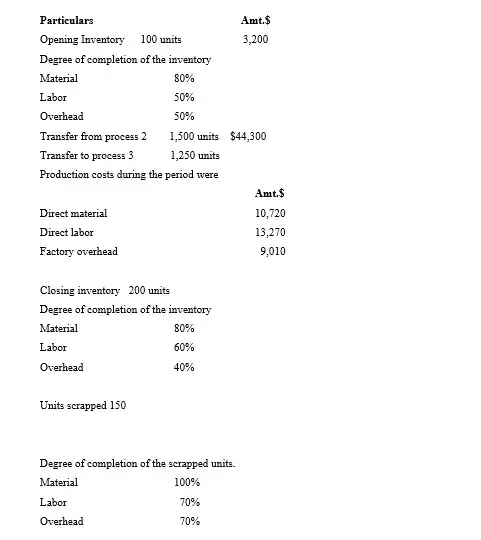

Water Melon co. ltd. provided you with the following production data for Waterloo products.

Additional information

Normal loss (expected loss) was 10% of production.

Scrapped units were sold at $6.25 per unit.

Required

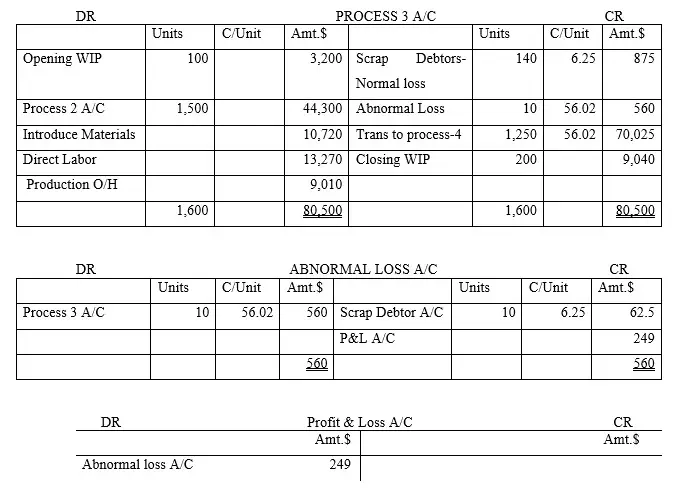

i). Prepare the process 3 account using the FIFO method approach.

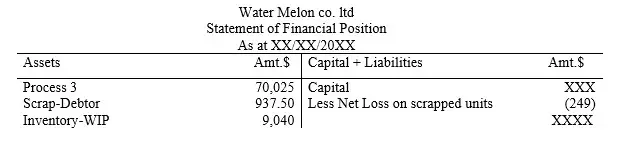

ii). Extract the statement of financial position as at that time (i.e., balance sheet).

Solution

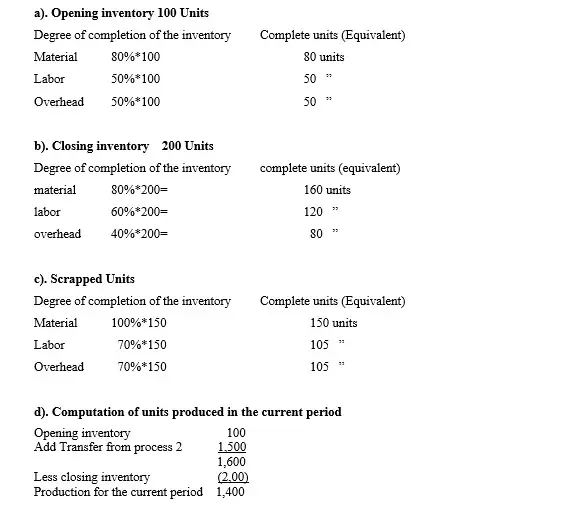

Workings

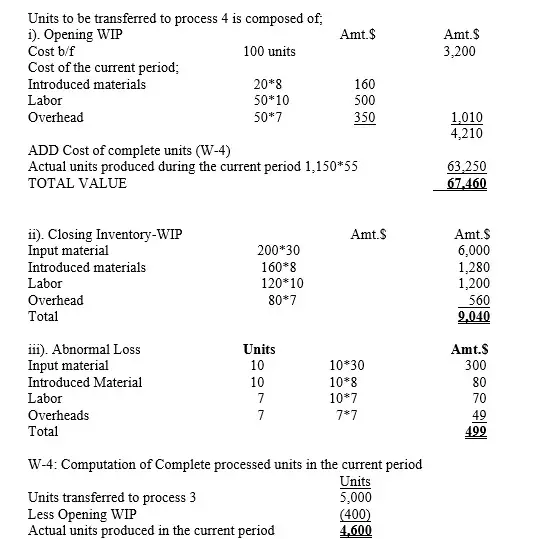

NB: Remember that the total cost of this input materials of $44,300 is inclusive of the cost of producing the units associated with normal loss which were 140 and were disposed/sold at $6.25. So, in actual sense, the correct cost for the input materials is;

44,300-(140*6.25) = $43,425

ii). Introduction Materials

Introduction material here is additional costs whose cost is straight away stated as 10,720. This cost amount is well captured during the production process within the period given.

iii). Labor

Labor cost is straight away stated as 13,270. This cost amount is well captured during the production process within the period given.

iv). Overhead

Overhead cost is straight away stated as 9,009. This cost amount is well captured during the production process within the period given.

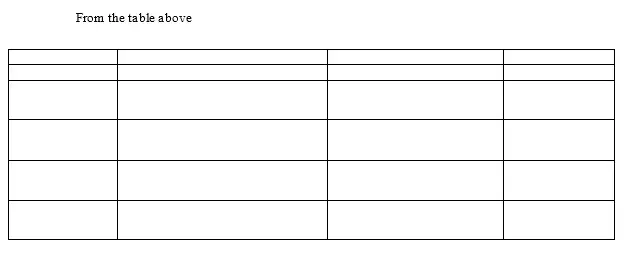

W-3: Computation of entries to be transferred to process 4 A/C according to average valuation method.

Evaluation statement

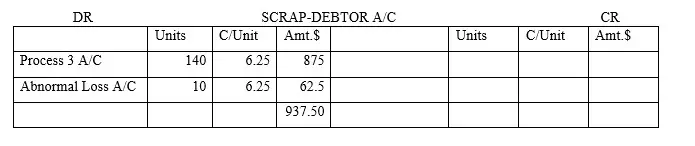

Determination of the monetary value of the 10 scrapped units

10*6.25= $62.50

ii). Extraction of statement of financial position as at that time (i.e., balance sheet).