Process costing account for a single product with abnormal gain: introduction; abnormal gain; abnormal output; actual loss; actual output; accounting treatment and examples

1.1 Introduction

How do we handle a case of process costing account where there is only abnormal gain? How do we prepare process costing accounts for a case of single product where abnormal gain exists? This matter should not bother you for we have provided a reliable and permanent answer to your worries. As a learner, entrepreneur or tutor you need to first comprehend the meaning of terms that accompany this concept. They are as discussed below;

1.1.1 Abnormal Gain

Definition-1: Abnormal gain is the reduction of the unexpected number of substandard units of output which is gotten at the end of the production process. In other words, it is a case where the expected substandard units produced at the end of the production process have reduced.

For example, if the expected substandard units were estimated to be 130 and the actual substandard units turned out to be 100, then the abnormal gain is 30 units.

NB: Abnormal gain represents reduction of total substandard units which occurs under abnormal favorable conditions. It is gain that can be controlled by the producer by improving the or maintaining the good windfall occurring. So, if the actual substandard units are less than the expected/normal substandard units arising, then this difference is what represents abnormal gain. Such gain may arise when the either the following circumstances occur;

Use of new innovation.

Workers’ improved productivity.

Industrial re-engineering.

1.1.2 Abnormal Output/Production

Definition-2: Abnormal output is the standard output which is realized at the end of the production process way above the expected or normal output under the condition of abnormal loss.

For example, if the expected output was 1,800 (initial units (2,000)-minus normal loss of (200)) and if the actual output turns out to be 1,850, then the 1,850 units are referred to as abnormal output.

1.2 Facts about Abnormal Gain and Abnormal Output

The following are the facts that you should know and you need to know about abnormal gain and abnormal output.

1.2.1 Abnormal Gain

NB1: Abnormal gain is NOT a computed value. Instead, it is an observable number of units at the end of the production process. In other words, you cannot predetermine it as we usually do in the case of normal loss. For example, if the normal or expected loss was computed in the beginning of the production process and found to be 200 units, and at the end of the process the actual loss was 170 units, then the abnormal gain is the 30 units (200-170).

You can use this formula to determine the abnormal gain;

Abnormal Gain=Actual Loss-Normal Loss (condition is the actual loss should be less than the normal loss).

NB2: Abnormal Gain is realized or determined at the end of the production process.

NB3: Abnormal Gain is the difference between the actual loss realized and normal loss.

1.2.2 Abnormal Output

NB1: If there is normal or good output, there is also abnormal output under circumstances of abnormal gain occurrence.

.NB2: Abnormal output is the opposite of normal output. It is output which is way above the expected/normal output at the end of the production process as stated in the definition above.

NB3: Abnormal output is NOT an estimation. It is actual physical units realized at the end of the production process.

NB4: Abnormal output is NOT used in computation of cost per unit/average cost used when transferring the output from the current production process to the next one or to the finished goods account. It should be noted that we still use the normal/good output.

1.3 Facts about Actual Loss and actual Output

The following are the facts that you should know and you need to know about Actual Loss and actual Output in the case of abnormal gain occurrence.

1.3.1 Actual Loss

Under the circumstances of abnormal gain, the following are key point you need to note about actual loss;

NB1: Actual loss is NOT a computed value, instead, it is an observable value. It is the number of sub-standard units actually realized at the end of the production process when abnormal gain has occurred. It is determined by physically counting the total number of sub-standard units produced at the end of that particular production process.

For example, if 1,000 Kilo grams of the input material of raw materials were used in production and at the end of the process physical counting of actual units produced were 900 Kilo grams. Then actual loss is 100 units.

NB2: Actual Loss can only be;

- Less than Normal Loss: A case of Abnormal Gain.

And CANNOT be

- Equal to Normal Loss: A case of NO Abnormal loss or Abnormal gain.

- More than Normal Loss: A case of Abnormal Loss.

1.3.2 Actual Output

Under the circumstances of abnormal gain, the following are key point you need to note about actual output;

NB1: Actual output is the physical output after actual loss has taken place at the end of the production process.

NB2: Actual output is NOT as good as good output. This is the physical units actually realized at the end of the production process.

Accounting treatment of abnormal gain

2.1 Introduction

Unlike the cost of units of normal loss, the cost of units of abnormal gain is added to the total cost of the good output or normal output.

NB: The reason for adding the cost units of abnormal gain to the total cost of the good output is twofold;

1.The abnormal gain is an additional good output that was not planned for and so there is need of incorporating the additional good output to the current good output. This implies that the total number of good outputs will increase.

2.Determination of average or cost per unit of the good output should be based on normal aggregate cost. So, the cost of units of abnormal gain category must be added to the total cost.

2.2 General Guideline Steps to Post Abnormal Gain Transactions

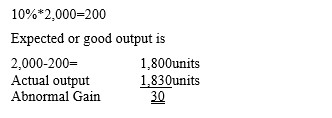

Step One: The units of abnormal gain category (valued at good output price) is debited to process account;

Step Two: On sale of units of abnormal gain category (i.e., scrap).

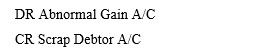

NB: In this step two, if the units under the ABNORMAL GAIN are sold, the sales proceeds gotten reduces abnormal loss account value (the scrap value). So, the accounting entry will be as follows;

NB: Remember that the Abnormal Loss A/C details have already been debited in the Scrap Debtor A/C. So, the above credit entry is meant to reduce the abnormal loss account debit value.

Step Three: On balancing the ledger account

Since the balancing figure in the abnormal Gain account is on the debit side always, it is a case of gain on sale, hence

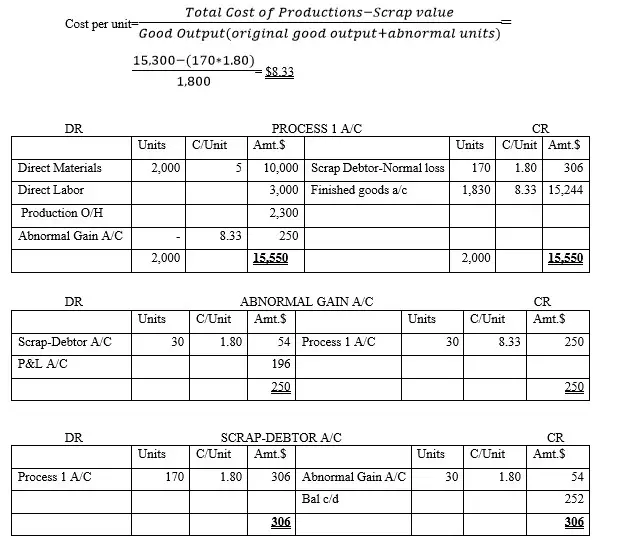

2.2.1 Example

The following is the production report for Normal producers co. ltd.

2,000 Kilograms of direct materials @ $5 per kg were introduced in process 1

Labor cost paid $3,000

Manufacturing overhead $2,300

Expected loss was 10%. After the end of process 1, the actual output was 1830 Kilograms.

Finally, the units representing normal loss were sold at $1.80 per Kg.

Required

Prepare the relevant ledger accounts and record the above transactional activities

Solution

Workings

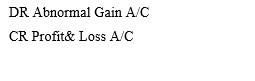

W-1: Determination of the normal loss

NB: If the actual output is more than the expected output, then the cost per unit is the total cost of production, plus cost of the units representing the abnormal gain NET of scrap value of the units representing normal loss divided by the good production as shown in working-2 below;

W-2: Determination of per unit cost of good production.