Proportion of direct costs overhead allocation method

1.1 Introduction

Definition: Proportion of direct costs overhead allocation method is an approach which involves allocation of the various overhead cost as recorded in their respective General Ledger (GL) to direct costs in different jobs being undertaken by the organization such as direct raw materials, direct labor cost and/or direct expenses. Such that if the expected proportion that the overhead represents the direct cost is something like 15%, then the direct cost as per that job will be allocated 15% of the overhead cost from the respective General Ledger (GL).

EXAMPLE

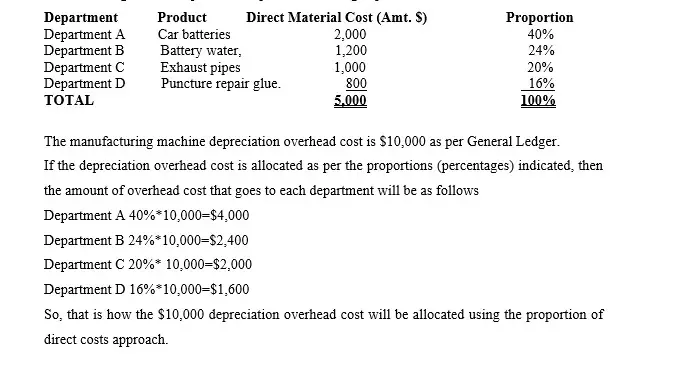

Mazeras firm manufactures all types of motor vehicle accessories. Currently, the firm is manufacturing four main products as per the following departments

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.