Rate of specific direct job cost overhead allocation method

1.1 Introduction

Definition: Rate of specific direct job cost overhead allocation method is an approach of allocating overhead costs to a cost object such as a unit of a good or service where by the accountant computes an appropriate rate of absorbing the overhead cost based on the historical overhead cost and specific direct cost which has already been incurred or paid as per past data or books of accounts of the cost object such as a capital project of similar nature to the one being undertaken.

NB: This approach works well were the cost estimator feels that there is a specific direct cost which is more associated or attached to changes on the overhead costs as compared to other direct costs. For instance, if the much changes occurring on overhead cost is connected to direct raw materials, or direct labor especially where the technology used is labor intensive or machine hours where the technology is capital intensive, then the direct raw material cost base, or direct labor cost base or direct machine hours will be used in that order.

Steps of specific direct job cost overhead allocation method

First, to establish the appropriate rate, the following steps are followed under “rate of specific direct job costs.”

2.1 Step 1: Identify the total overhead cost as per historical data.

Identify the total overhead cost as per historical data -see books of accounts.

2.2 Step 2: Identify the specific direct cost incurred or paid for similar a project.

Identify the specific direct cost incurred or paid for that similar project to the one being undertaken. For example, direct labor, direct raw materials or direct expense.

2.3 Step 3: Compute the rate of absorption.

Compute the rate of absorption by dividing the total overhead cost value with the specific direct cost value of the direct cost driver chosen as follows;

If material cost is the overhead cost driver

2.4 Step 4: Use the computed rate to allocate the overhead cost to the cost object.

NB1: The amount of overhead cost gotten represents the share to be added to the specific direct cost previously belonging to the cost object.

NB2: That the specific direct cost can be composed of direct raw materials, direct labor and direct expenses.

EXAMPLE

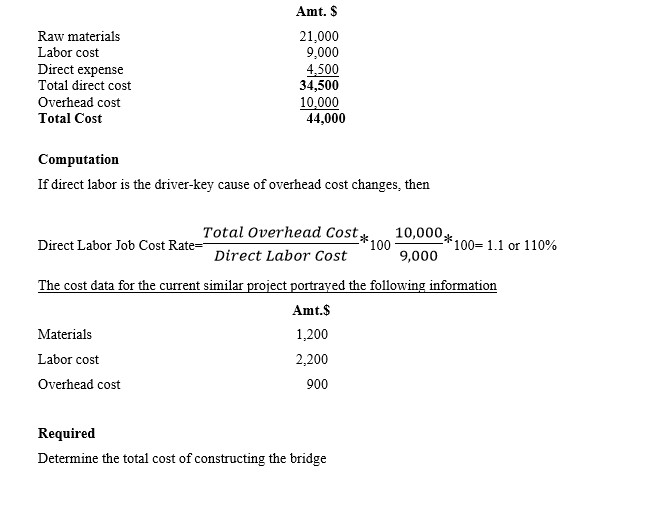

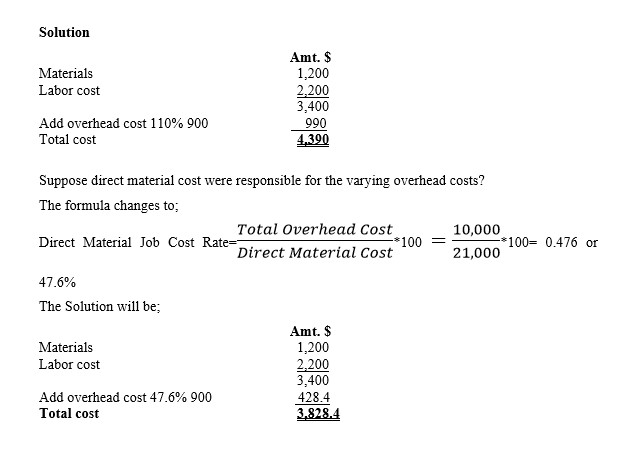

Pawpaw ltd won a contract to construct a foot path within the factory setting. The historical data for similar foot path undertaken in the past one year was as follows (allow me to use the same monetary values as per the previous case of Pavilion co ltd)