Rate of total direct job costs overhead allocation method

1.1 Introduction

Definition: Rate of total direct job costs overhead allocation method is an approach of allocating overhead costs to a cost object such as a department or unit of a good or service. In this case, the accountant computes an appropriate rate of absorbing the overhead cost based on the historical overhead cost and Total Direct Cost which has already been incurred or paid in that department. The historical data is accessible through past data or books of accounts of the cost object such as a capital project of similar nature to the one being undertaken.

Steps of total direct job costs overhead allocation method

To establish that appropriate rate, the following steps are followed under “rate of total direct job costs”

2.1 Step 1: Computation of Appropriate Allocation Rate

Identify the total overhead cost as per historical data-see books of accounts

2.2 Step 2: Identify the total direct cost incurred or paid for that project

Identify the total direct cost incurred or paid for that project similar to the one being undertaken

2.3 Step 3: Compute the rate of absorption

Compute the rate of absorption by dividing the total overhead cost value with the total cost value of the direct cost as follows;

2.4 Step 4: Use the computed rate to allocate the overhead cost to the cost object.

NB1: The amount of overhead cost gotten represents the share to be added to the direct cost previously belonging to the cost object.

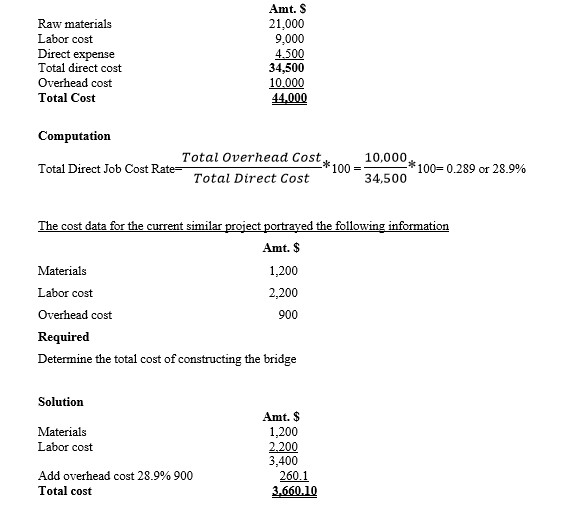

NB2: That the total direct cost can be composed of direct raw materials, direct labor and direct expenses.

EXAMPLE

Pavilion ltd won a contract to construct a bridge across river Pavilion. The historical data for similar bridges undertaken in the past one year was as follows;

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.