Secondary overhead cost allocation methods

1.1 Introduction

Secondary methods of allocation of overhead cost are an overhead assigning method which is used when the overhead cost driver to be used as the basis for the allocation is not clear. This method therefore is referred to as “Overhead Apportionment Methods”.

1.1.1 Definition

Secondary methods of allocation of overhead cost (overhead apportionment) is a logical way which the management designs to help in assigning overhead cost on the cost objects or cost Centre.

Principles of apportionment of overhead expenses

Now, before we look at the in-depth details of this methodology, the following are the principles to be adhered to during overhead apportionment. They are;

2.1 Proportional Benefits derived from the economic resource utilized

Under this principle, it advocates that the overhead cost should be assigned to a particular cost object if it is crystal clear that the cost object received that actual benefit. It is an approach which works if the actual benefits can be proxied or measured. A good example is the square meters occupied by the office, section or department.

2.2 Potential Benefit

Potential benefit approach applies where it is not easy to measure the actual benefits that accrue to a particular department or individuals once the economic resources are utilized (overhead cost) to produce certain product. So, based on the expected future benefits, apportionment of the overhead costs is done on a section, or department such that the more the potential benefits the more the overhead cost charge.

For example, the cost of a dispensary at the work place can be apportioned based on the number of employees staying with their family hence seeking medical care from there in each department, which is a potential benefit.

2.3 Ability to Pay

Ability to pay is a principle which advocates that overhead cost can be apportioned to a department that can afford to pay or recover the overhead cost later by having another way of generating income or having salability characteristics.

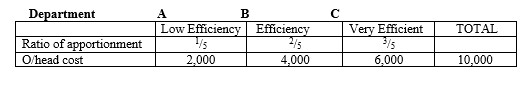

2.4 Efficiency Method

Efficiency method advocates that the apportionment of overhead cost should be pegged on the department’s level of production efficiency such that the department which easily meets the set production targets are assigned more overhead costs for they are more efficient which in turn means that the production cost per unit has to be lower as compared to those other departments which are less efficient. The following table below helps you to understand this approach.

Total overhead cost was $10,000

2.5 Specific Criteria Method

Specific criteria method is also referred to as survey method/criteria for the approach advocates that the apportionment of the overhead cost should be done after proper interrogation to find out which department or section or region is more suitable to apportion the costs to.

Steps of secondary allocation of overhead cost

3.1 Introduction

There are two main stages of secondary allocation (i.e., apportioning of overhead costs) of overhead costs to the various departments. These steps are, namely; one, primary and two, secondary step;

- Primary Apportionment of Overhead Costs.

- Secondary Apportionment of Overhead Costs.

Step 1: Primary Apportionment of Overhead Costs

In this step 1, the prevailing circumstances are that the bases of apportioning the overhead costs are benefit-derived. That is, the apportionment of the various overhead costs is based on the degree at which the department has gotten benefits from that economic resource (overhead cost). Again, the benefits are common or cut across all the departments or cost objects or units. For example, overheads such as fire insurance cover costs, repairs and maintenance costs, and rent costs.

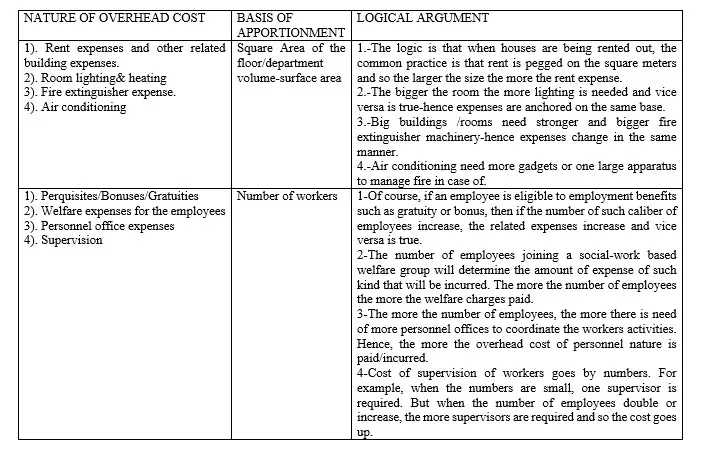

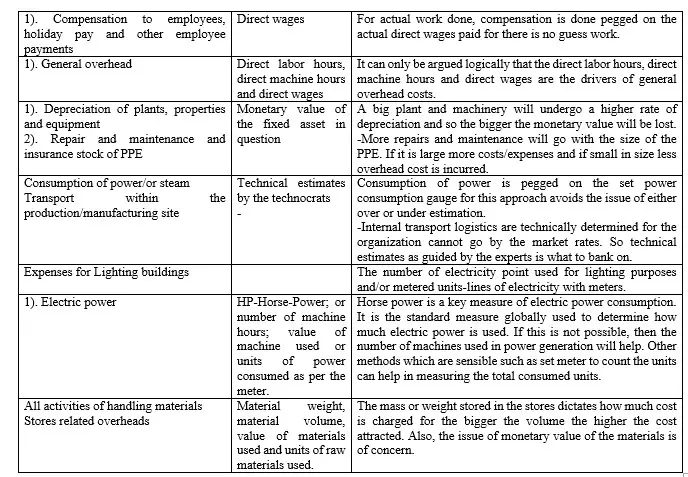

NB: That the basis of apportioning the overhead cost is a matter of self judgement and therefore, one should ensure that logic prevails. The following bases are the common anchorage used in primary apportionments.

Logical basis of primary apportioning of overheads

Step 2: Secondary Apportionment of Overhead Costs

This step 2 is also referred to as re-apportionment of service department overhead and it arises because overhead apportionment should only be charged on the production or manufacturing affiliated departments ONLY. So, if the department is not directly associated with production or manufacturing, then any overhead cost already apportioned to such service department should be re-apportioned to the other production related departments. Such kind of service departments are such as stores department, cost office department, personnel department, planning and progress department, tool room department, hospital and dispensary department, machine maintenance department and electrical maintenance department etc.

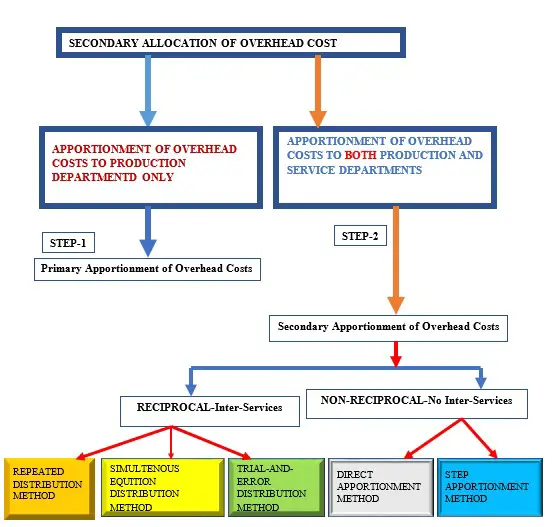

Diagrammatic summary of secondary allocation of overhead costs

4.1 Introduction

To comprehensively demonstrate the secondary allocation of overhead costs, as a learner or entrepreneur you need to internalize the fact that the process is first of all a logical or reasonable allocation of overhead costs when no clear bases of doing so. Then number two you need to know that this is the process also known as apportionment of overhead cost and it fall under two circumstances;

- Where the apportionment of overheads involves both production departments and service departments. But the service departments do not inter-transfer services to one another.

- Where the apportionment of overheads involves both production departments and service departments. However, the service departments have inter-transfer services to one another.

These two circumstances are as indicated in the diagram below;

Methods used in computation of overhead costs under secondary distribution (re-apportionment)

5.1 Introduction

The diagrammatic figure above simply summarized the approaches used in apportionment of overhead costs. These methods are further but briefly substantiated as follows;

a). Non-Reciprocal Overhead Cost Apportionment Methods

i). Direct overhead apportionment distribution method,

ii). Step overhead apportionment method and

b). Reciprocal service overhead apportionment method.

i). Repeated overhead cost distribution method.

ii). Simultaneous overhead cost distribution method.

iii). Trial-and-Error overhead cost distribution method.

5.2 Non-Reciprocal Overhead Cost Apportionment Methods

The non-reciprocal method used are;

5.2.1 Direct Distribution Overhead Apportionment Method

As the name suggests, the apportionment of all service department overhead costs is transferred to the specific production department straight away without first re-distributing the cost amongst each other.

5.2.2 Step Overhead Apportionment Method

The step approach of overhead apportionment entails first considering the overhead cost of the most serviceable department (highly ranked) and distribute the amounts to the other service departments. Once that is done, the next highly ranked service department cost is re-distributed to other lowly ranked service departments and then the chain continues until the remaining service department cumulated overhead cost is now distributed to the production department.

NB: That (i) and (ii) are two methods of apportioning overheads in a non-reciprocal approach. Whereas, the method (iii) below is a reciprocal method of distributing overhead cost.

5.3 Reciprocal Overhead Cost Apportionment Methods

Reciprocal methods are the opposite of non-reciprocal and they are defined as follows;

The term reciprocal means the reverse or opposite of a variable as compared to another. For instance, the reciprocal of 2 is 1/2 and the reciprocal of 1/2 is 2. As far as service departments are concerned, this implies that two or more service departments serve each other. So, in such circumstances, some appropriate weights have to be assigned to such departments so as to ensure that the net service overhead cost of the concerned service department is considered for the apportionment. There are three such reciprocal methods which are namely: -

5.3.1 Repeated overhead cost distribution method.

5.3.2 Simultaneous overhead cost distribution method.

5.3.3 Trial-and-Error overhead cost distribution method.

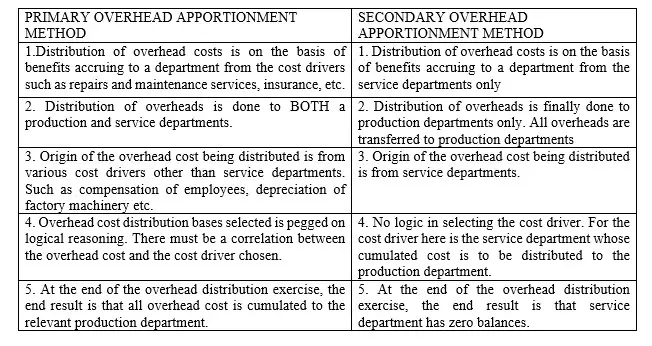

Difference between primary and secondary overhead distribution method

The secondary and primary overhead apportionment methods are not the same in so many aspects. The following are the main differences between the two methods. Namely;

Advantages of secondary overhead allocation method

1.Help in pricing of final products which have been produced.

Secondary overhead apportionment or distribution method helps in ensuring that all indirect costs are captured so as to fully determine the exact cost per unit which in return act as the basis of setting the selling price.

2. Uses scientific method in apportioning overhead costs.

Secondary overhead apportionment or distribution method uses empirical methods such as repeated distribution method and simultaneous equation hence there is no biasness in determining the amount of overhead cost to be transferred to each department.

3. Avoids cases of double accounting of overhead cost at the departmental level.

Secondary overhead apportionment or distribution method helps in ensuring that assigning of the overheads is done only once to the appropriate department. This eradicates cases of counting or assigning costs twice on the same department.

4. Eliminates cases of omissions of overhead costs.

Secondary overhead apportionment or distribution method ensures that all overheads are pilled on the production departments without leaving some or all overhead costs of the service departments.

5. Eliminates circumstances of over and under absorption of overheads.

Secondary overhead apportionment or distribution method ensures exact amount of costs are transferred to the right departments and that the estimation is done in a more appropriate manner. This ensures that the planned costs are equal to actual overhead costs.

6. Promotes transparency and accountability amongst employees.

Secondary overhead apportionment or distribution method ensures that the employees especially production assistants and accountants does not exaggerate the total overheads by recording the wrong the amounts.

Disadvantages of secondary overhead allocation method

1.Complicated approach of accounting for overhead costs.

Secondary overhead apportionment or distribution method uses scientific methods such as repeated distribution method and simultaneous equation which are cumbersome and time consuming.

2. Not popular amongst firms. So, it is not fully utilized hence less beneficial to firms.

Secondary overhead apportionment or distribution method uses scientific method and so not every firm makes use of it. This makes many firms loss an opportunity to effectively price their final products produced.

3. Costly to apply.

Secondary overhead apportionment or distribution method is expensive to maintain for there is need to delegating the exercise to a qualified accountant who can turn out to be costly in terms of salary.

4. Misleading when it comes to pricing of the products.

Secondary overhead apportionment or distribution method involves mathematical models which if not well interpreted may result in to wrong apportionments which will mislead the end users of the final information.