Service costing method: definition; objectives; characteristics; applicability; unit costing; multiple costing and advantages

1.1 Introduction

In this article, I have used two key definitions to clarify this concept to you as a learner, or tutor.

Definition-1: Service costing is an operation costing method which entails assigning of cost-on-cost unit which is a standardized service product and not physical good.

OR

Definition-2: Service costing method is a way of ascertaining cost incurred or paid to make it possible to offer services to the end user.

NB: That service costing is an output costing method for the main objective of accumulating costs is to determine the average cost or cost per unit of “service provided” at the end of a certain period. So, the basic activities that the producer or manufacturer undertakes is to do cost ascertainment per unit service of a single service provision. The per unit service cost is computed by dividing total production cost by the number of units manufactured. Examples of service provision are such as railway transport, air transport, hospital service provision and school educational provision. Other domains with such service provision are such hotel accommodation, restaurants, power generation etc.

1.2 Objectives of Service Costing Method

The specific objectives of service costing method which is the universe of output/unit costing, are as follows;

1). To determine the total cost a consumer of a certain service will pay or incur or will pay the service provider.

2). To determine whether a certain service being provided to the client or service user is profitable or not.

3). To classify the cost elements that are consumed in providing a specific service.

4). To control costs associated with the services being provided by an organization. This involves use of comparison of cost elements for different periods.

Characteristics of service costing method

The main features of service costing are as following:

(1) All completed products are intangible. In service costing methods, the targeted unit cost is not visible.

(2) Cost/expenses are divided in to fixed and variable costs. This is because it is necessary so as to ascertain the cost of service and the unit cost of service.

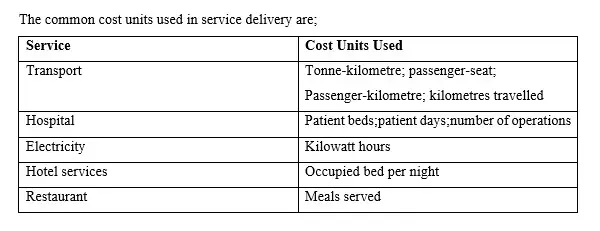

(3) The cost unit are expressed in a simplified manner for the sake of cost cumulation. For example, one cubic litres of water are $12, cost per meal in school for each student is $7, rent per month is $1,000 and one kilowatt (unit) are $5 etc.

(4) Aggregate or total cost is always divided (average) by the overall service provided.

(5) Total cost is determined on the time or period basis although not always. In other cases, we have alternative ways such as orders made by clients.

(6) Service costing is suitable for both internal or external service provisions.

(7) Data sheets are commonly used to record cost data to aid in determination of the cost value of a service provided or rendered.

Applicability of service costing method

Service costing methods are suitable in manifold areas such as;

- Transport service industries.

- Hotel or food industries

- Power supply (electricity) industry

Steps of service costing methods

The steps followed in costing each product under service costing method is different. Before, we focus on the steps, let us first understand the concept of unit and multiple costing.

2.1 Unit Costing

Unit costing is a method of costing service rendered is based on the criteria of common or uniform identity of the cost unit. Therefore, the general rule of the thumb is that cost units that are identical should have identical costs. Unit costing is applicable for the cases where a single product is the cost object.

2.2 Multiple Costing

Multiple costing is a service costing method where the cost units produced are not the same. In other words, they do not share identity. In this case, the products (cost unit) are different in so many logistics such as what each product demands as far as materials are concerned, laborer qualification, fixed overheads and even the processes for each product.

Now, with that in mind, the following steps are adhered to when costing products.

Step 1: Assess in which class the service rendered falls into. Is it unit or multiple costing.

From the previous discussion, the way of costing service provided is either on unit cost or multiple cost basis. The reason of undertaking this stage in costing is because each service provided fits in either. Remember if the appropriate cost unit is selected, this fosters the assigning of costs to the cost object in the right manner. In this step, identify the most logical cost unit for each cost object (product).

Step 2: Identify all fixed costs associated with that cost unit/or cost object.

The various costs associated with the service being provided should be sorted out such that all fixed costs are gathered together. Fixed cost are the economic resources that the service provider needs to pay for or incurs whether service is provided or not. It is a periodic cost.

Step 3: Identify all the relevant variable costs associated with that cost unit/or cost object.

The various costs associated with the service being provided should be sorted out such that all variable/relevant costs are gathered together. Variable cost are the economic resources that the service provider needs to pay for or incurs when service is provided. It is cost which change with changes in volume of service offered.

Step 4: Sum up all the costs-both fixed and variable cost.

In step 4, the total cost, both fixed and variable are added together towards achievement of the overall cost for the service provided.

Step 5: Determine the total number of cost units which is the basis of costing the service being provided.

The service provider has to determine the total cost unit (quantity wise) associated with the service provided. For example, the total number of kilometers covered, total litres consumed, total kilograms consumed etc.

Step 6: Compute the per unit cost for the service provided.

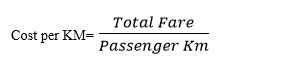

Determination of the cost per cost unit is undertaken at this level. In this stage, the service provider divides the total cost (i.e., both fixed and variable cost) by the total cost unit consumed. For example, if we take the case of transport service. To determine the cost per kilometer,

Illustration

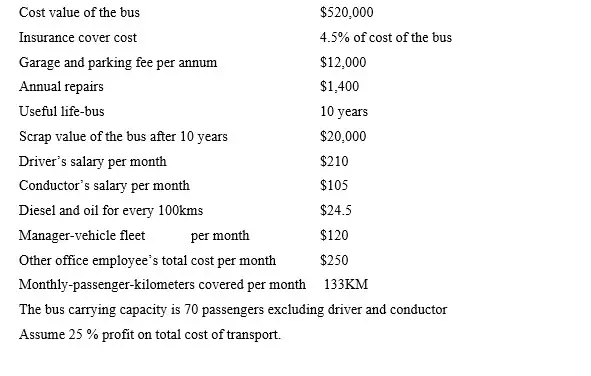

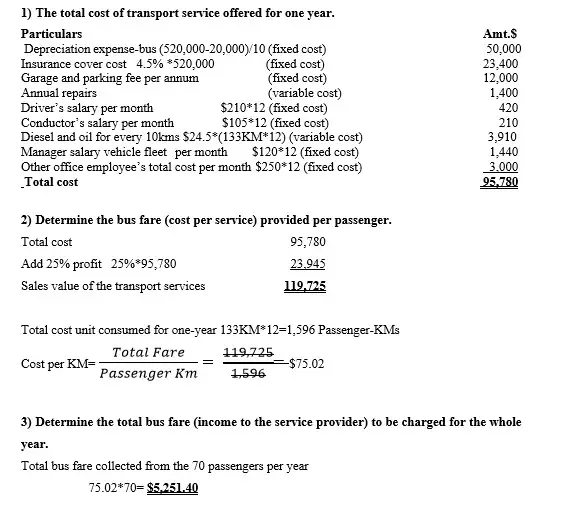

Quick Comfort travelers co. ltd provide transport services to those clients or passengers who go for tourism or special occasions in far places. The following information was provided to you so as to compute the cost per unit of service.

Required

- Determine the total cost of transport service offered for one year.

- Determine the bus fare (cost per service) provided per passenger.

- Determine the total bus fare (income) to be generated by the service provider for the whole year.

Solution

Conclusion

The operation costing of service-based product is simple determination of the total cost incurred or paid for the service provided then divided by the total cost units consumed. In this approach, the profit margin dictates how much to charge a client.

Cost units in service costing is the bottom line and any service provider need to familiarize with the generally accepted metric of measuring that variable in that industry.

Example

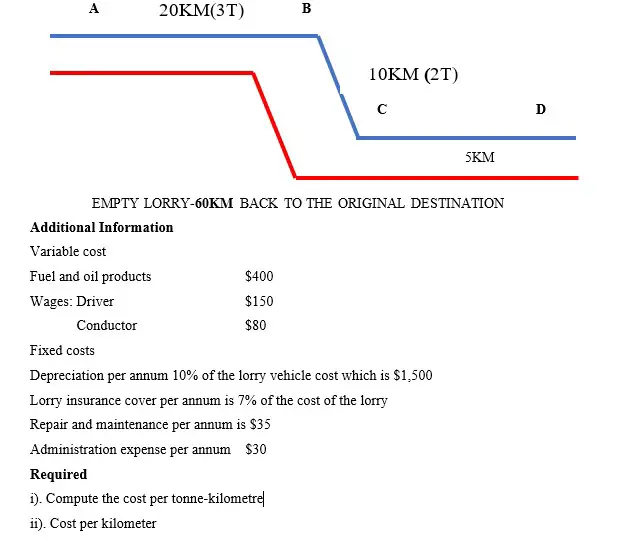

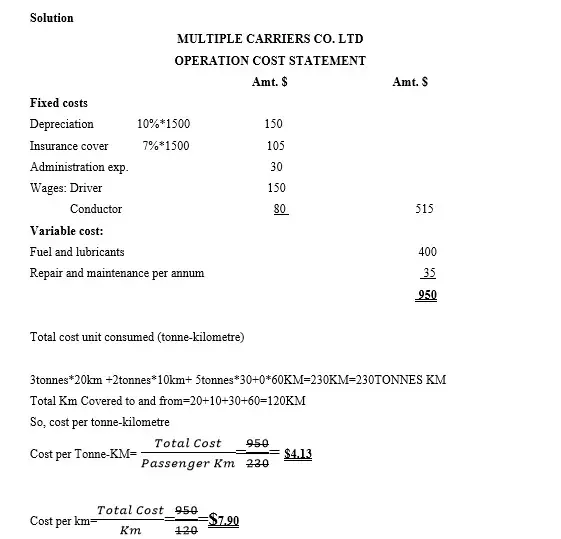

Multiple carriers co. ltd is a national carrier of cargo know in Texas City USA. The company has a routine mandate of distributing cargo to various destinations (A to D and back) in a month as shown in the following diagram

Advantages of service costing method

- Simple to compute the total cost for the whole service being provided.

- The method is suitable to a specific sector. This approach targets the invisible products which cannot rely on other methods of costing such as hospital and road transport services.

- Cost effective-this method is not complicated and does not cost the organization to prepare it.

- Flexible-the method is time adjustable such that if the time period covered is less than a year or more than a year, the cost per unit is still deterministic.

- Since service profession demands professionals, the method is worked out by experts who are gurus that area and this improves the quality of work done.

- Time saving. The method of service costing involves cost elements which are straight away understandable and so computation of the final cost is within a short time.

Disadvantages of service costing method

- Only applicable on costing of intangible assets.

- Not common amongst traders. This costing method is not commonly practiced and so it is not of much help to the end users.

- Not easy to identify service costing elements. Sometimes the cost elements are intertwined such that it is hard to separate them.