Accounting Cycle review

This chapter entails only one part which is further categorized in to four lessons to tackle accounting cycle issues in depth. It is an advanced review of the same aspect looked at earlier. Therefore, at the end of the four lessons herein, the entrepreneur/learner will be able;

-

To describe the Accounting Cycle using international financial reporting standards

-

To explain the statement of financial position components as per IFRS

-

To prepare statement of financial position using;

-Horizontal and vertical format

-Gross and net asset format

-

To explain the implication of Statement of Financial Position to Entrepreneur’s Business

Components of Accounting Cycle

Part one, generally introduces you to the same accounting cycle which we internalized in both level one/beginner and two/intermediate of this accounting tutorial series. The four lessons in part one, cover in detail the themes around the same accounting cycle.

Accounting Cycle Components Review as per IFRS

This chapter entails only one part which have four lessons tackling accounting cycle issues in depth. It is an advanced review of the same aspect looked at earlier. Part one, generally introduces you to the same accounting cycle which we internalized in both level one and two of this accounting tutorial series. The four lessons in part one, cover in detail the themes around the same accounting cycle.

By the end of level three/advanced level, the entrepreneur/learner will be able;

-

To describe the Accounting Cycle using international financial reporting standards

-

To explain the statement of financial position components as per IFRS

-

To prepare statement of financial position using;

-Horizontal and vertical format

-Gross and net asset format

-

To explain the implication of Statement of Financial Position to Entrepreneur’s Business

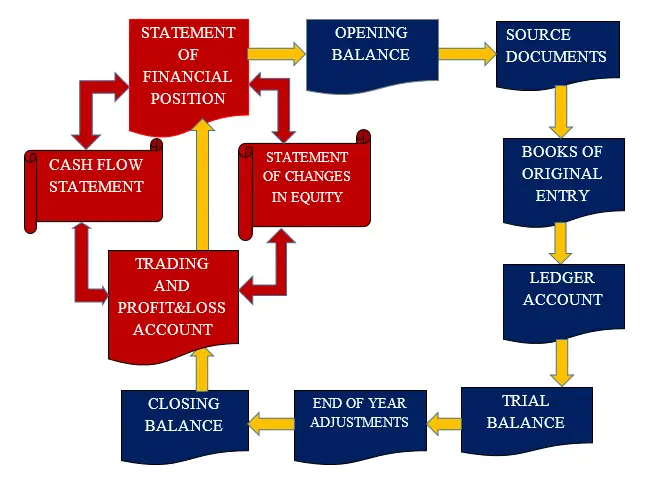

In this lesson, accounting cycle is further interrogated with specific focus on the advanced details of the individual components thereof. Therefore, the details of the accounting cycle in this book is represented as follows;

Summary of the Accounting Cycle

The accounting cycle figure above tells it all as pertains the in depth procedures of all activities that take place in accounting process. The following sub-headings provide the necessary guidelines to be adhered to.

-

Statement of Financial Position; from the previous discussion in level one to three, we agreed that the starting point for any business is the statement of financial position originally referred to as balance sheet. Although many authors in accountancy believe that the starting point for the book keeper or the accountant t start tracking business events is when a business transaction take place such as purchase or payment of a debt, this is not conceptual enough. The starting point is the financial position of the business. The concern of the entrepreneur should be the current position of the business. It is at this point when one is in a position to put a distinction between his or her financial position and that of the business.

The mentality with most entrepreneurs/learners is to purport that if they have the cash or the non-cash resources with them, ready to transact on behalf of the business, then that is good enough to assume that transactions for the business has commenced. This is always the wrong footing for there is a high chance for the entrepreneur to transact in the name of the business, but still fail to demarcate those transactions and his or her personal transaction. This leads to improper accounting for the right approach should be that any money initially belonging to the owner of the business but now used for the business, then it should be assumed that the owner has lend the business. The principle of separate legal entity should apply. Therefore, the starting point is the financial position. As we concluded in level one, the financial position of the business will be zero, if it is a case of new business. For a continuing one, it can also be zero or something more than zero to more precise.

-

Opening Balances; this is the second step whereby the accountant identifies the opening balances to be posted in the respective ledger accounts ready to proceed with record keeping of transactions of the proceeding period. The opening balances are usually extracted from the closing figures of assets and liabilities only as they appear in the closing statement of the financial position (ie balance sheet). This will include items such as non-current assets such as properties, plants and equipment, accounts receivables, prepayments, accrued income, cash and cash equivalents. On the other hand liabilities will include capital, retained profits and other reserves, non-current liabilities, accounts payables, accrued expenses and income in advance among other items as per the balance sheet.

NB: The entrepreneur need to note that the opening balances form part of the recordings done in the respective ledger accounts before any further recording is done which should emanate from books of original entry via the source documents.

-

Source documents; this is notes where transactions are recorded immediately when a transaction take place. The entrepreneur/learner need to refer to our level two accounting tutorial for the point of detail.

-

Books of Original Entry; again, this is the note where transactional information from the source documents are recorded. It is also referred to as prime books or subsidiary books. Level two of this tutorials carry full details. So the entrepreneur/learner need to re-visit the subject matter.

-

Ledger Account; being a chronological record of all business transactions that affect a particular item, it is a tool that keeps track of such changes occurring in any business. Again this aspect is no different from what we discussed earlier.

-

Trial Balance; the trial balance is a summary of all accounts with either debit or credit balances. This trial balance is transitional in the sense that the balances indicated herein are further subjected to end of the year adjustments. This can be achieved either by directly adjusting the trial balance using the additional information at the end of the year or using accounting worksheet which is a tool used to aid accountants and bookkeepers complete the accounting cycle and formulate year-end reports like revised trial balances, revised journal entries, and financial statements.

-

Closing Balance; this is the end results reflected in the trial balance statement after the necessary end of year adjustments. These new balances at the end of the financial period are used to extract the comprehensive income statement r the trading and profit and loss account and by extension appropriation accounts.

-

Comprehensive Income Statement; this is the financial statement used to determine the net profit and/or (loss) at the end of the financial period. It is at this point that the entrepreneur/learner will establish whether there was monetary benefits that can trickle down t the owners of the business in form of dividends and/ or any reserve to be retained for future expansion of the business. This statement is the yardstick to preparation of the final adjusted statement of the financial position of the business.

-

Cash Flow Statement; this is a financial statement prepared to establish sources of cash resources and how such cash resources were used. This financial statement deals with actual cash in and out of the organization in the course of the financial period. Unlike other financial statements which are based on accrual concept in the generally accepted accounting framework, the preparation of this statement is governed by International Accounting Standard-no 7. Its structure is based on sources and usage of cash resources of the business within one financial period categorized under operating activities, investing activities and financial activities.

-

Statement of Changes in Equity; this is a financial statement that is prepared to portray in a summative manner, the changes that took place as pertains to owners’ equity. Remember that the owners of the business have a goal of increasing their wealth/net worth. This is demonstrated using this kind of statement.

NB1: According to International Accounting Standard-no. 1, it is a requirement for organizations especially public limited organizations to prepare/present four financial statements at the end of each financial period, namely; comprehensive income statement, statement of financial period, cash flow statement and statement of changes in equity.

NB2: The entrepreneur/learner should note that the additional financial statements aforementioned herein will be incorporated in this book. For now, the introduction of these statements is for providing a clear overview of the accounting cycle.