Accounting treatment of opening and closing inventory (final accounts-scenario 3)

In this case, it is assume that the business has both opening and closing inventory

Illustration

Assume that the business was a continuing one and the opening and closing inventory and the purchases made in the course of the year under investigation are as indicated below;

Opening inventory (70 units) $7,000

Purchases (1000 units) $100,000

Closing inventory (40 units) $4,000

Sales (1030 units) $257,500

Required;

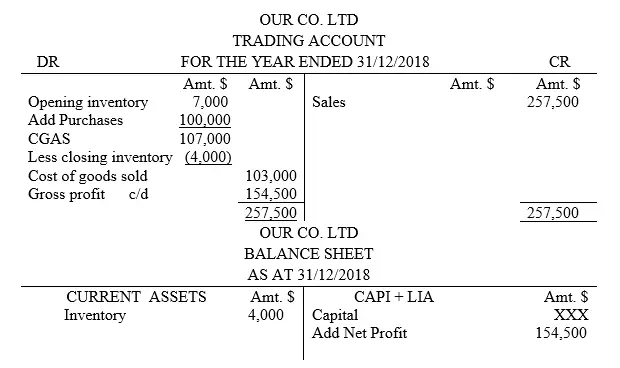

i). Determine the gross profit/loss for the business for the period ended 31/12/18 using both arithmetic and accounting approach

ii). Extract the balance sheet as per that same date

Solution

Alternative one

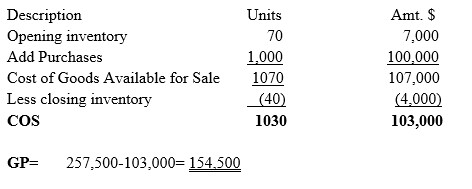

Computation of COI

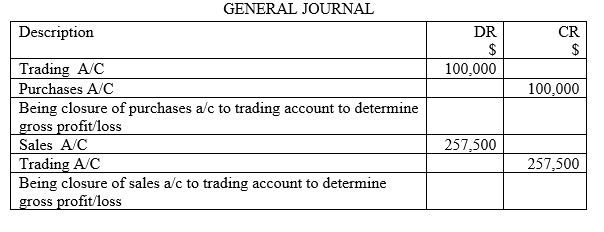

Alternative two

NB1: That although the purchases for the year was 1000 units, and units sold were 1030, the extra 30 units could be either;

i.From the opening inventory units or

ii.From the units purchased that year

The accounting International Accounting Standards number two (IAS 2) adopted by the firm determines whether (i) or (ii) is considered when determining what portion of purchases form the opening inventory.

NB2: Further, the entrepreneur/learner should note that the IAS 2 inventory valuation approach adopted by the organization determines the monetary value of the closing inventory.