Scenario two: Accounting Treatment of Operating Expenses

Operating expense is consumed asset or resources incidentally paid or incurred within a specific period of time usually one year.

Case 1: Per Annum Operating Expense

In this case, the business pays for operating expense for only one year, whether in cash or by check. See illustration

Illustration

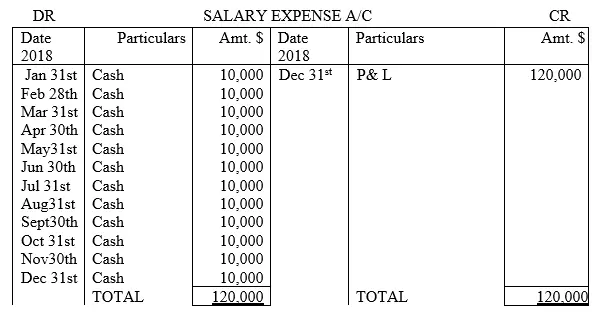

Assume that Our Co. ltd paid salary of $10,000 per month in cash for twelve months for the year 2018,

Required;

i)Record the transactions in the salary expense account

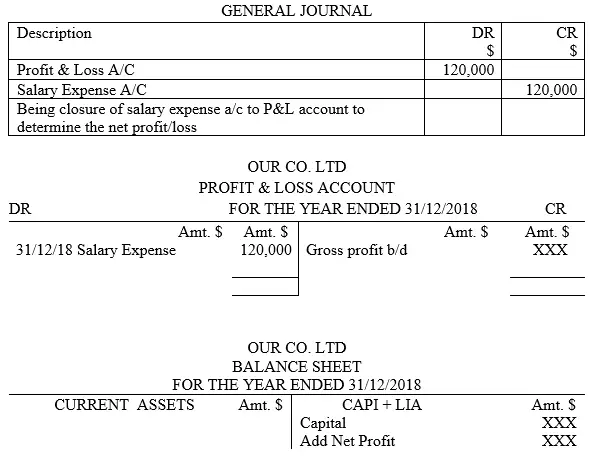

ii)Extract a profit and loss account for the year ended 31/12/18

iii)Extract a balance sheet as at 31/12/18

Solution

NB1: As per general rules for accounting entry in level one accounting tutorial series, it was concluded that all expense accounts have debit totals

Therefore, all operating expenses are usually closed down to profit and loss account at the end of the financial period with one year’s amount. For instance, in this case, the expense account is closed to P&L a/c with $120,000. This is because in scenario two case one, the salary expense paid of $120,000 was for a period of one financial period. To understand how this is done, the following journal entry is made

NB2: Although the rule of charging a one year’s expense amount is a general rule in accounting, in reality, the expense paid may either be more or less than one year’s amount. If the total expense paid is less than the expected one year’s amount, the amount of expense not yet paid is referred to as accrued expense and forms part of the total per annum expense although not yet paid at the end of the period under examination. The unpaid expense is also known as accrued expense. On the other hand, if the expense paid in a particular year is more than one year’s amounts, the excess expense paid is referred to as prepaid expense and is not part of that year’s operating expense although it was paid in that financial period.

NB3: That the rule we have already learned in level one accounting tutorial; that all expense accounts have debit TOTALS does not hold as far as the case of accrued and prepaid expense scenarios is concerned (see general rules for accounting entry, number 5, in level one accounting tutorial series). Therefore, in level two tutorial series, you will realize that an expense account can assume either a debit or a credit balance brought down (b/d). The accounting treatment of this type of transactions is dual. The entrepreneur can opt to use either a direct or indirect approach as was the case of operating income.

Option One: Direct Accounting Approach

In this case, the expense account is directly closed to P&L account whereby one year’s amount is charged in the respective expense account as though the whole amount of expense had been paid by the organization. As a result, the expense account will have either a debit or credit balance brought down (b/d). If it is a DR balance b/d, this represents prepaid expense hence in the balance sheet, it is classified as a current asset. If it is a CR balance b/d, this represents accrued expense hence in the balance sheet it is classified as current liability.

Option Two: Indirect Accounting Approach

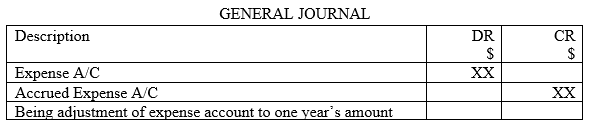

In this case, a new account is introduced to record either the amount in shortage or in excess of what is expected in that particular year. If it is a case of accrued expense, a corresponding accrued expense account is opened whereby the amount needed to fill one year’s expense is posted (ie CR) in this account and at the same time recorded (ie DR) to the respective expense account. Using a general journal, this process can be demonstrated as follows;

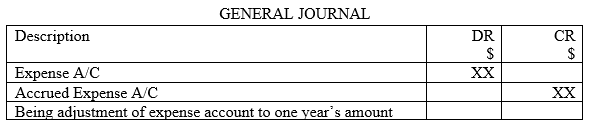

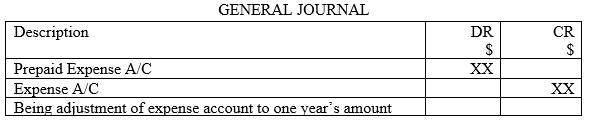

After creating a new accrued expense account, double entry is made as shown in this general journal hence making the expense account reflect a whole year’s amount. At this point the account is closed down to P&L account. For the new accrued expense account, it represents a current liability hence recorded to the balance sheet at the end of the financial period. On the other hand, if it is a case of prepaid expense, a corresponding prepaid expense account is opened whereby the excess amount over and above the year’s expense is posted in prepaid expense account and at the same time recorded to the respective expense account so as to adjust it reflect one year’s expense. Using a general journal, this process can be demonstrated as follows;

After creating a new prepaid expense account, double entry is made as shown in this general journal hence making the expense account reflect a whole year’s amount only. At this point the account is closed down to P&L account. For the new prepaid expense account, it represents a current asset hence recorded to the balance sheet at the end of the financial period.