Accounting Treatment of Operating Income- (Scenario one)

Operating income is business gain or returns incidentally generated or earned within a specific period of time usually one year.

Case 1 : Per Annum Operating Income

In this case, the business receives only one year income amount, whether in cash or by check. See illustration below

Illustration

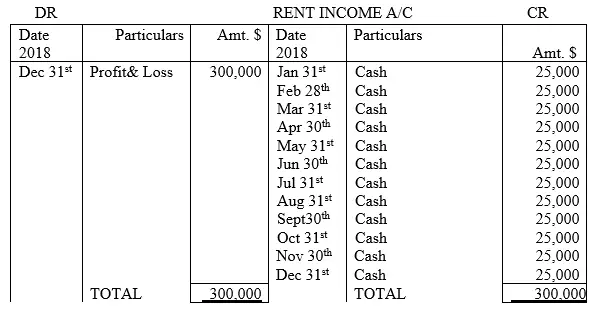

Assume that Our Co. ltd received rent income of $25,000 per month in cash for twelve months for the year 2018,

Required;

i)Record the transactions in the rent income account

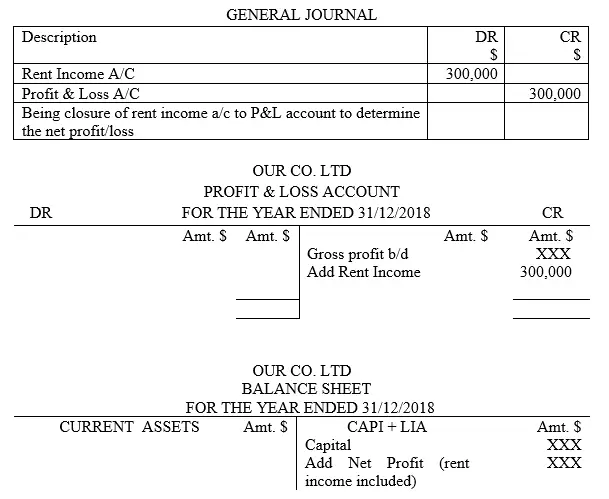

ii)Extract a profit and loss account for the year ended 31/12/18

iii)Extract a balance sheet as at 31/12/18

Solution

NB1: As per general rules for accounting entry, number six, stated in level one accounting tutorial series, it was concluded that all income accounts have credit totals

Therefore, all operating incomes are usually closed down to profit and loss account at the end of the financial period with one year’s amounts. For instance, in this case, the income account is closed to P&L a/c with $300,000. This is because in scenario one case one, the income received of $300,000 was for a period of one financial period. To understand how this is done, the following journal entry is made

NB2: Although the rule of charging a one year’s amount is a general rule in accounting, in reality, the income received may either be more or less than one year’s amount. If the total income received is less than the expected one year’s amount, the amount of income not yet received is referred to as earned income and forms part of the total per annum income although not yet received at the end of the period under investigation. The earned income is also known as accrued income or income in arrears. On the other hand, if the income received in a particular year is more than one year’s amounts, the excess income received is referred to as income in advance and the extra income received is not part of that year’s income.

NB3: That the rule we have already learned in level one accounting tutorial; that all income accounts have credit TOTALS does not hold as far as the case of accrued income and income in advance scenarios are concerned ( general rules for accounting entry, number six, in level one accounting tutorial series). Therefore, in level two tutorial series, you will realize that an income account can assume either a debit or a credit balance brought down (b/d).

The accounting treatment of this type of transactions is twofold. Therefore, the entrepreneur can opt to use either a direct or indirect approach.

Option One: Direct Accounting Approach

In this case, the income account is directly closed to P&L account whereby one year’s amount is charged in the respective income account as though the whole amount of income had been received by the organization at the end of the financial period. As a result, the income account will have either a debit or credit balance brought down (b/d). If it is a DR balance b/d, this represents income in arrears or accrued income hence in the balance sheet, it is classified as a current asset. If it is a CR balance b/d, this represents income in advance hence in the balance sheet, it is classified as current liability.

Option Two: Indirect Accounting Approach

In this case,

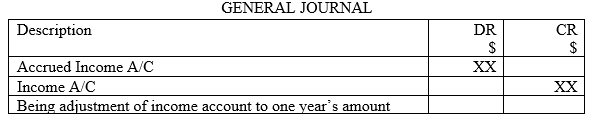

A new account is introduced to record either the amount in shortage or in excess of what is expected in that particular year. If it is a case of accrued income, a corresponding accrued income account is opened whereby the amount needed to fill one year’s income is posted in this account and at the same time recorded to the respective income account. Using a general journal, this process can be demonstrated as follows;

After creating a new accrued income account, double entry is made as shown in this general journal hence making the income account reflect a whole year’s amount. At this point the account is closed down to P&L account. For the new accrued income account, it represents a current asset hence posted to the balance sheet at the end of the financial period.

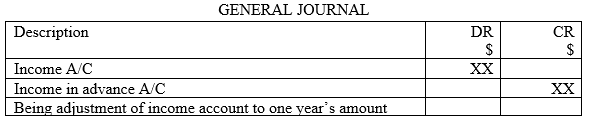

On the other hand, if it is a case of income in advance, a corresponding income in advance account is opened whereby the excess amount over and above the year’s income is posted in this account and at the same time recorded to the respective income account so as to adjust it so as to reflect one year’s income. Using a general journal, this process can be demonstrated as follows;

After creating a new income in advance account, double entry is made as shown in this general journal hence making the income account reflect a whole year’s amount only. At this point the account is closed down to P&L account. For the new income in advance account, it represents a current liability hence posted to the balance sheet at the end of the financial period.