Accounting Treatment of Operating Income - Case 2: Accrued Income

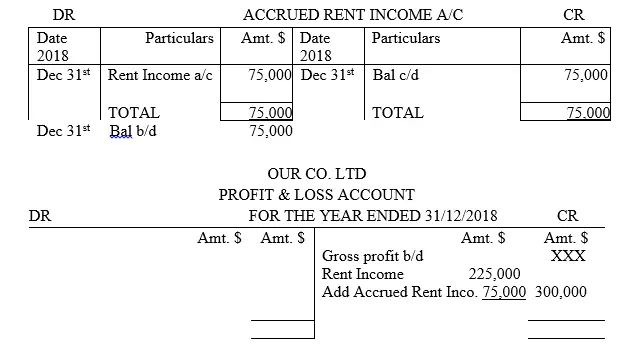

Accrued income is earned income. It is income that has been generated by the organization but cash associated to that income is not yet received by the time the year comes to an end. Accrued income is classified as a current asset for it represents cash yet to be received by the business in the future.

Illustration

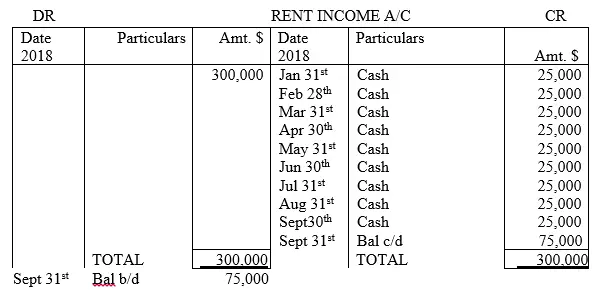

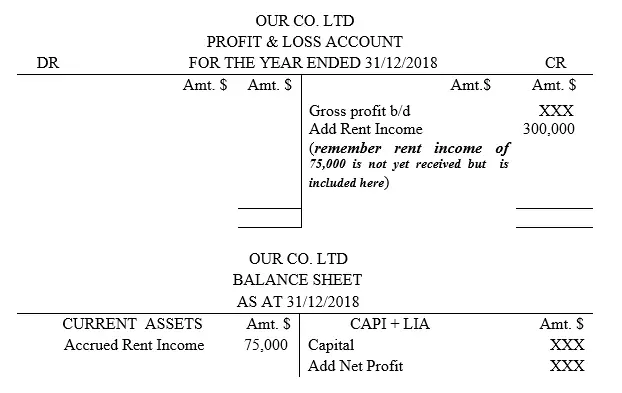

By 31/12/2018, Our Co. ltd had actually received cash of $ 225,000 rent income. Assume rent income is usually $25,000 per month

Required;

i)Record the transactions in the rent income account

ii)Extract a P& L account at the end of the year 31/12/2018

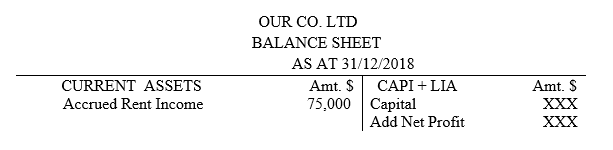

iii)Extract a balance sheet as at 31/12/2018

Solution

Option one: Direct Accounting Approach

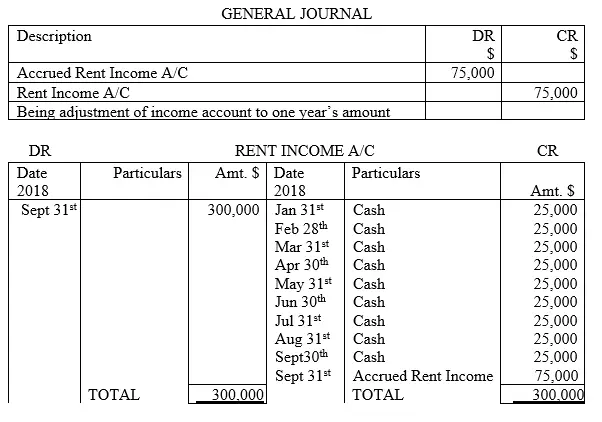

Option Two: Indirect Accounting Approach

Journal Entries

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.