What are books of original entry?

This are documents where information or data contained in the respective source documents are transferred. It is also known as prime book, or subsidiary books or daybook or journals. It should be noted that the information in the source document is usually raw and unprocessed. These information is transferred to books of original entry in a summarized manner. Four things the learner need to understand at this point is that,

-

One; information in the source document is TRANSFERRED to the books of original entry but not posted. This is because at this stage the principle of double entry of debiting and crediting simultaneously does not apply. Note that, when recording information emanating from books of original entry to the ledger account, we are posting. But for the time being, you should note that we transfer information from source document to books of original entry.

-

Two; the information in the books of original entry is summative in nature where by transactions for either a weeks’ or a month are transferred herein.

-

Three; the corresponding book of original entry has a link to the source document and hence information is not just transferred from any source document to a certain book of original entry but for every specific source document, it is related to another specific book of original entry. The two documents are connected as far as the information therein is concerned.

-

Four; Books of original entry are classified in to two categories; those ones for recording credit transactions and others used for recording cash transactions only as it will be revealed in this section. For now, below section provides a brief of the importance of books of original entry as follows.

Importance of books of original entry

-

It is summative in nature. It discloses the total number of transactions that affected a particular item within a certain period of time.

-

Used in trailing an erroneous entry in the ledger

-

Used to prepare ledger accounts

-

Aid in the auditing exercise

Types of books of Original Entry

The following are the books of original entry that are mainly used by businesses.

-

Purchases day book

-

Purchases returns book/Returns outward book

-

Sales day book

-

Sales returns book/Returns inward book

-

Cash book

-

General Journal

For each book of original entry, we will define, align it to the right stage of transaction and source document it is matched with, explain its role and give an illustration for better understanding of the learner. The illustration or example to be given will be extracted from the examples/illustrations used in level one tutorial series whereby it will involve further substantiation of the items thereof. The illustrations that will be used will take care of the details found in both source document and book of original entry. The respective specimen document will be used where necessary to ensure that the learner understand the flow of information from one point to another. In addition, the documents will be anchored on the steps followed when undertaking a transaction from stage one up to the last stage when the transaction is complete. In the following discussion, the learner need to understand that (1) up to (5) books of original entry are the documents that are mainly used in the ordinary business activities, whether of credit or cash transaction nature, while (6) book of original entry (ie general journal) is used for other purposes which are unique to the business as it discussed thereafter. So in this discussion, we will first focus on the ordinary credit transaction, then cash transactions.

Credit Transactions

This is transaction that involves purchase or sale of goods in exchange with cash at a later date. In this case, the buyer is supplied with the goods but pays for them at a later date. Then obviously the counterparty in the same transaction (ie the seller) is receives the cash at a later date. This kind of transaction is also referred to as deferred payment. We will consider both scenarios where the business of our concern has purchased and has sold on credit.

Stage one: Purchase of goods on Credit

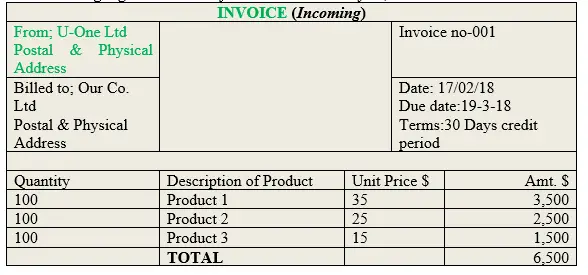

This is the first step the buyer of goods undertake after ordering goods from the preferred seller(s). At this stage, the seller has already supplied the goods to the buyer and has sent an invoice thereafter. The invoice contains details similar to the ones in the local purchase order document which is a source document unless there were some discrepancies thereof which require some adjustments of the invoice amount.

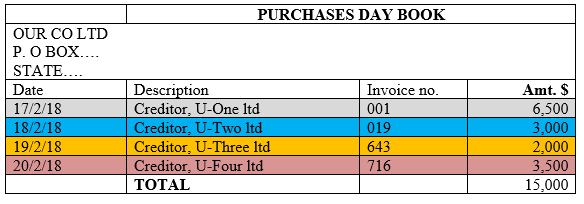

Purchases Day Book

This is a book of original entry which is used to record information from the incoming invoice. The document is prepared by the buyer of goods. In the illustration that follows, it is Our Co. ltd which prepares the purchases day book or journal. It should also be noted that, in level one of this tutorial series, we considered purchase of goods from only one seller. In level two tutorial series, we further consider a case where by the buyer has bought goods from several suppliers hence he/she has received invoices (incoming) from each seller. Therefore, the following is a demonstration of the link between the respective source document and the book of original entry that is prepared after a certain period of time.

Instructions to the Learner:

The learner/ entrepreneur need to note that the cases that follow have been retrieved from illustration three of level one tutorial series whereby Zack, (the buyer-Our Co. ltd) bought goods from only one seller (trade creditor-U). In this case, we will assume that the goods were bought from different suppliers (ie U limited is sundry creditors). That is, the transactions between Our Co. ltd and U ltd where made up of four creditors, namely; U-1, U-2, U-3 and U-4 and the details of the goods bought from each creditor is shown in the respective source document. Therefore, you are advised to re-visit “illustration three” which was used in level one/beginner series and interrogate the workings and the entries made in the respective ledger accounts for familiarization purposes.

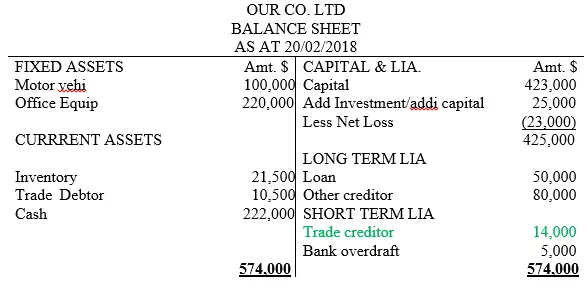

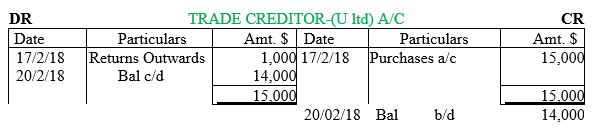

In this section, we will only demonstrate how information from the various source document is transferred to the respective books of original entry. However, when we will be discussing on how to further post information from books of original entry to the respective ledger accounts in part two as the course unfolds, we will then utilize the same illustration we are dealing with in this section for full comprehension. Therefore, let us first look at the balance sheet details as they appeared in level one series. There we go now. The balance sheet and the specific trade creditor ledger account extract are as indicated (NB: The trade creditor value of our concern is shaded in green color)

NB: That from above data, the purchases amount of $15,000 is the total amount of the goods that were bought on credit by Zack on 17/2/18 from U ltd, although goods worth $1,000 were returned to one of the sellers on the same date. The transactions were as indicated

Illustration 1

Our Co. ltd bought goods on credit from four different suppliers as follows;

17th/02/18 bought goods on credit from U-One limited of $6,500

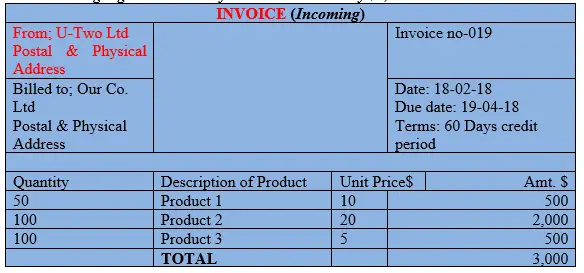

18th/02/18 bought goods on credit from U-Two limited of $3,000

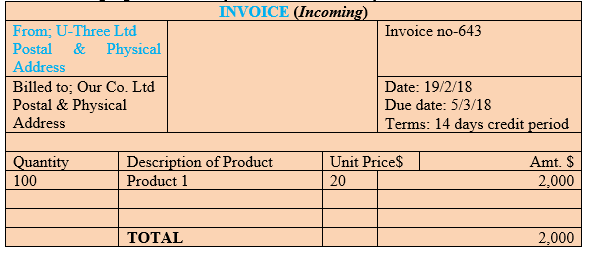

19th/02/18 bought goods on credit from U-Three limited of $2,000

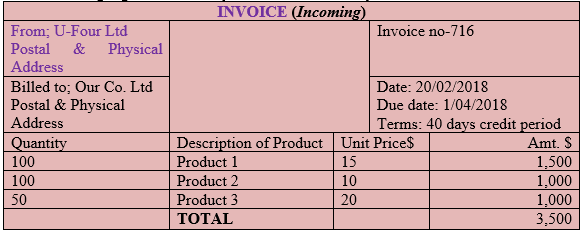

20th/02/18 bought goods on credit from U-Four limited of $3,500

NB: That the four suppliers will prepare and sent respective invoices which will be of different format although they will carry basically the same information. Also for clarity purposes, I have attached the relevant transaction against the relevant source document used. Therefore, the corresponding invoices that will be sent to Our Co. ltd as the buyer of goods by the four suppliers will be as follows;

17th/02/18 bought goods on credit from U-One limited of $6,500

18th/02/18 bought goods on credit from U-Two limited of $3,000

19th/02/18 bought goods on credit from U-Three limited of $2,000

20th/02/18 bought goods on credit from U-Four limited of $3,500

The corresponding book of original entry where the information in the various invoices are transferred to is the purchases Day Book as shown below;