Accounting Treatment of Operating Income - Case 3: Income in Advance

In this case, we will focus on income received in excess of the expected one financial period’s income. The following illustration demonstrates the accounting treatment

Illustration

Suppose on 31/12/2018, Our Co. ltd received rent income of $400,000 by check?

Required;

i) Record the transactions in the rent income account

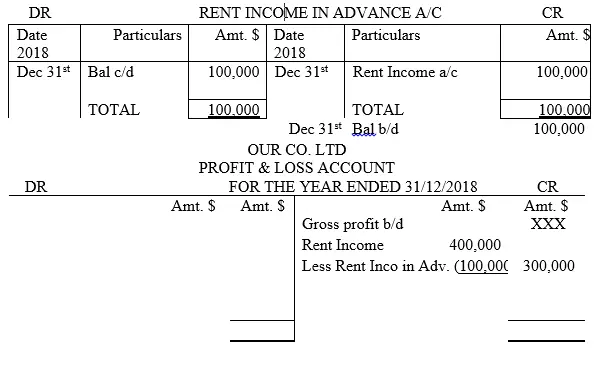

ii) Extract a P& L account at the end of the year 31/12/2018

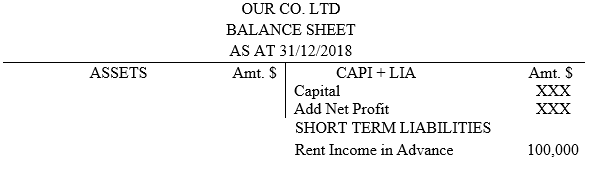

iii.). Extract a balance sheet as at 31/12/2018

Solution

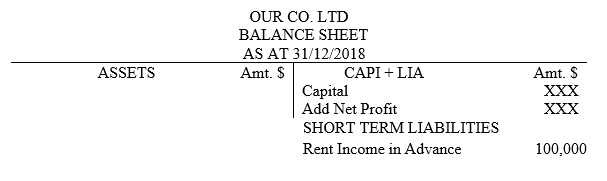

NB: The learner need to understand that, sometimes the client may decide to pay more money for rent than it is required. May be for his or her own convenience in the future. When this happens, it means that the extra cash received should be excluded from the year’s annual income for this amount belong to the next financial period. It is income in advance. In this question, where the tenant has paid more than the month’s amount, that amount is bolded. In regard to this case, the amounts of the month of January, May, September, and November are bolded to distinguish them to the rest of months where normal rent income was received. Therefore, as a result, the organization has received $400,000 by the end of the year. The accounting treatment is as follows,

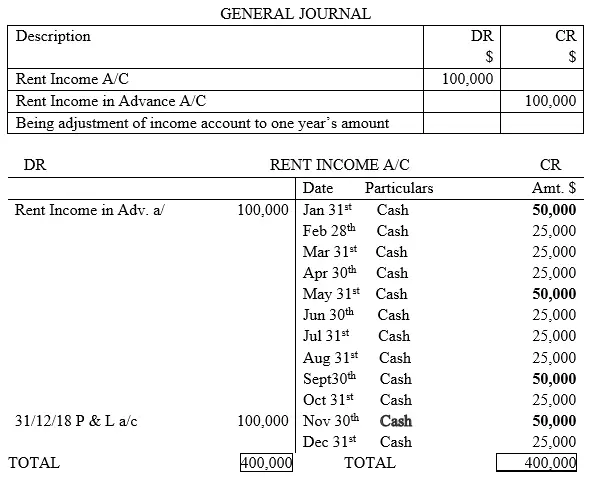

Option one: Direct Accounting Approach

Option two: Indirect Accounting Approach

Journal Entries