Ledger accounts - advanced review

This part of the study will basically look at an in depth issues of the ledger account. Part one of level two series illustrated to you how to prepare the source documents and books of original entry in preparation to post the information to the respective ledger accounts. So, in this part, it will guide you on technical issues in preparation of ledger accounts. The appropriate GAAP will be attached in each aspect of ledger account discussion where necessary. To ensure flow of knowledge, part two illustrations will be a carry forward of part one examples we have already tackled so that the entrepreneur can link the transformation of information from the books of original entry to the ledger accounts.

In the previous level one accounting tutorials, we discussed all the aspects of ledger accounts. Transactions were directly recorded in to the respective ledger accounts. However, this is not usually the common practice. In part two, level two of this accounting tutorial series, the focus will involve recording of transactions in ledger accounts where by the procedure of POSTING information from the books of original entry to the respective ledger accounts will be incorporated. In addition, for each transaction, the internationally accepted accounting principles, concepts and conventions (GAAP) which apply thereof will be matched if need be,. This will enhance the practicality and appreciation of the GAAPs in Accountancy. In this lesson, the term posting will be used for the shifting of information from the books of original entry to the respective ledger accounts for the double entry principle applies whereby for every debit entry, there is a corresponding credit entry.

Recording Transactions in the Ledger Account

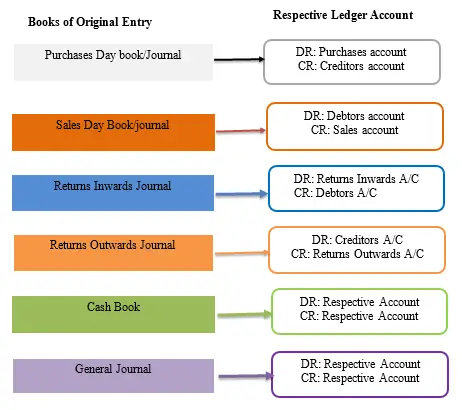

In this lesson, we will demonstrate the posting of transactions in ledger account using the respective books of original entry. Therefore the following is a diagrammatic presentation of the process of posting transactions to the ledger accounts which is the followed by an empirical illustration.

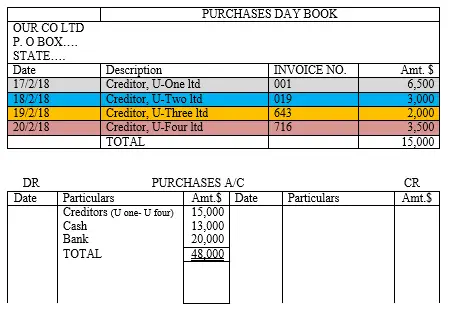

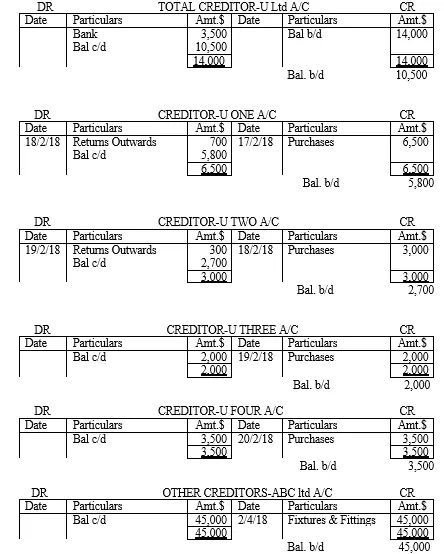

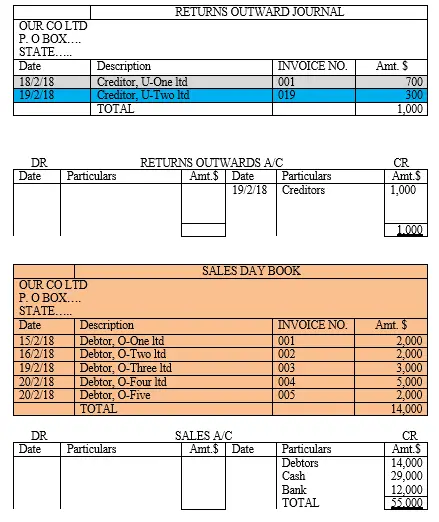

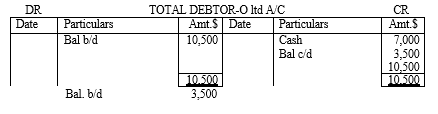

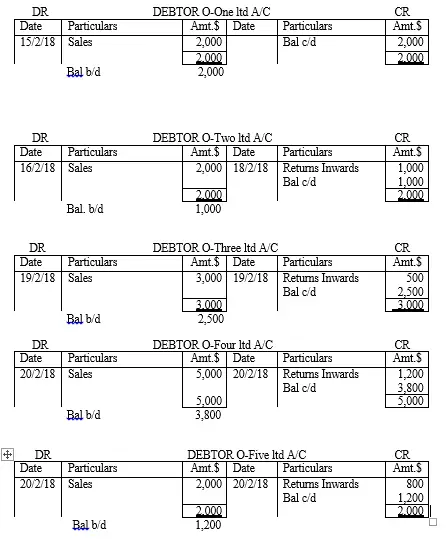

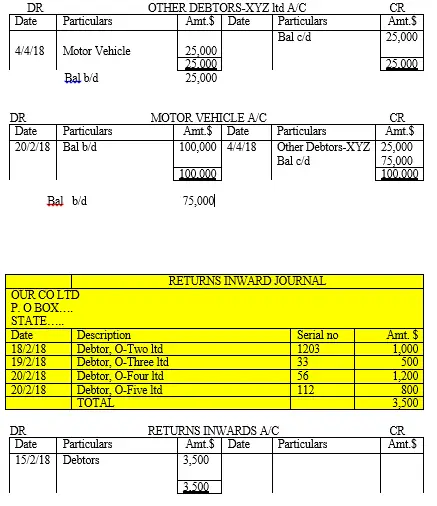

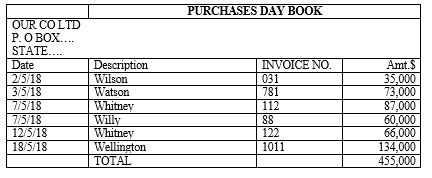

For a start, we will re-visit the illustrations in part one in the current level two tutorial series and complete the procedure of posting the information from the books of original entry to final ledger accounts before considering a new case. To achieve this objective, we have extracted for you the specific examples of books of original entry from our past illustrations and for every book of such nature, I have matched it with the corresponding ledger accounts as shown in illustration 1 below

Example of posting to ledger accounts

NB: that the ledger accounts where these information is posted to are kept in the general ledger. A General Ledger (GL) is a master ledger book where all accounts of a business are kept/maintained. Here we go;

General Ledger

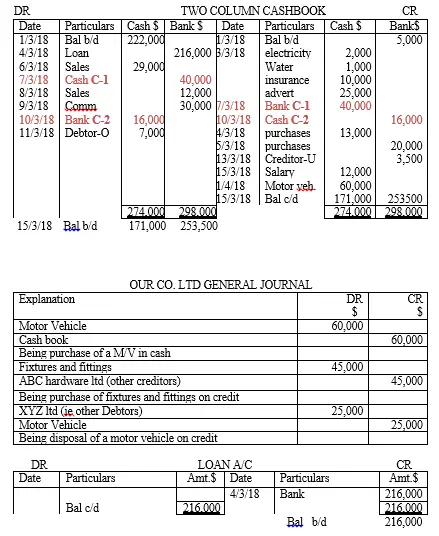

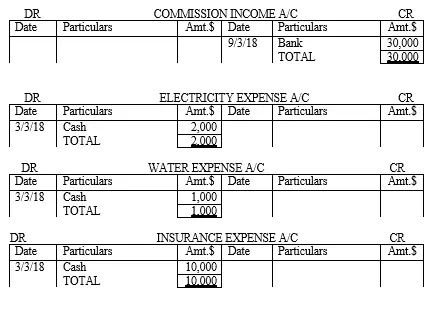

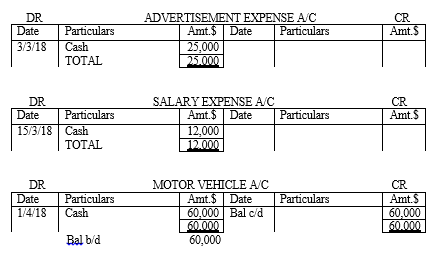

NB: The transactions recorded in the two column cashbook is based on the double entry principle for a cash book is both a book of original entry and at the same time a ledger account. Therefore, to complete the entries in the cashbook, a corresponding DR or CR entry is made in the respective ledger account.

Example 2-Posting to ledger accounts

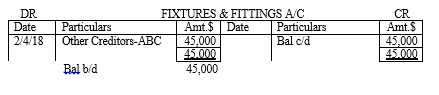

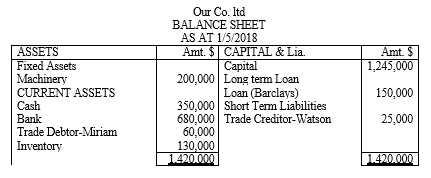

The following is the balance sheet of Our Co. ltd as at 1/5/2018

The following transactions took place in the month of May 2018

2018 May 2nd purchased goods from Wilson on credit for $35,000

3rd purchased goods from Watson on credit for $73,000

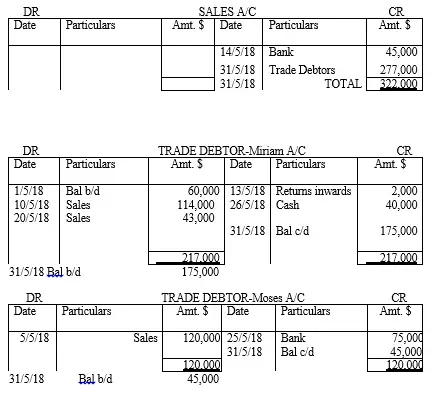

5th sold goods on credit to Moses for $120,000

7th purchased goods from Whitney on credit for $87,000

7th purchased goods from Willy on credit for $60,000

10th sold goods on credit to Miriam on credit for $ 114,000

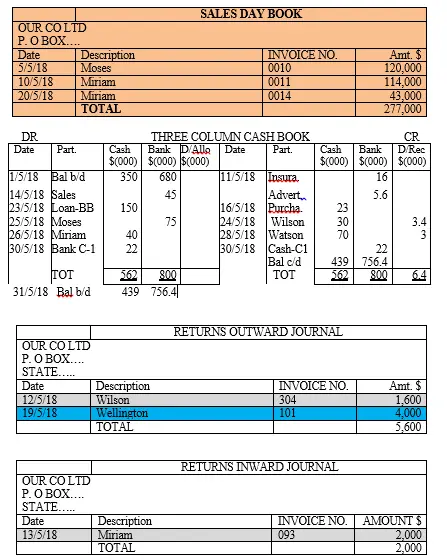

11th paid the following expenses by check;

-insurance $16,000

-advertisement $5,600

12th returned goods to Wilson $1,600

12th purchased goods from Whitney on credit for $66,000

13th Miriam returned goods of $2,000 to the business

14th sold inventory on cash $45,000 by check

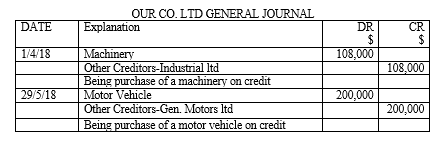

15th bought machinery costing $108,000 on credit from Industrial ltd

16th bought goods for $23,000 on cash basis

18th purchased goods on credit from Wellington $134,000

19th returned goods worth $4,000 to Wellington

20th sold goods on credit to Miriam on credit for $ 43,000

23rd borrowed loan from Barclays Bank of $150,000 on cash

24th paid Wilson in cash $30,000 clearing the full debt

25th received a check from Moses of $75,000

26th received cash of $40,000 from Miriam

28th paid Watson $70,000 in cash clearing the full debt

29th bought motor vehicle from Gen. Motors ltd on credit for $200,000

30th withdrew cash from bank to the cash till for office $22,000

Required

-

Record the above transactions in the respective book of original entry and further post them in the corresponding ledger account

-

Extract a trial balance as per 31st/05/2018

-

Prepare Trading account and profit and loss account for the month ended 31/5/2018

-

Prepare a balance sheet as at 31/5/2018

Solution

Step one: Recording transactions in the books of original entry

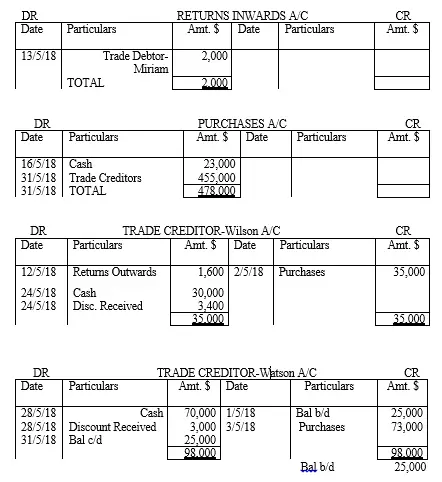

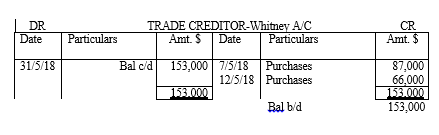

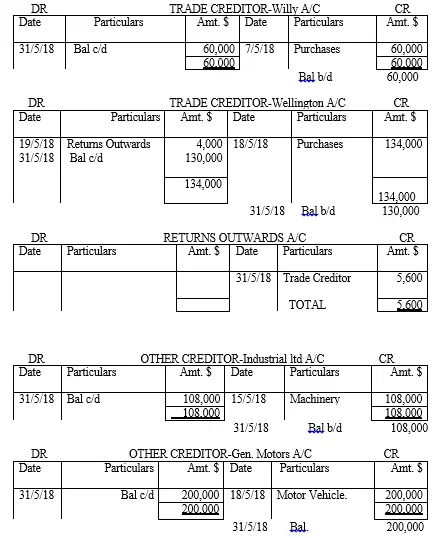

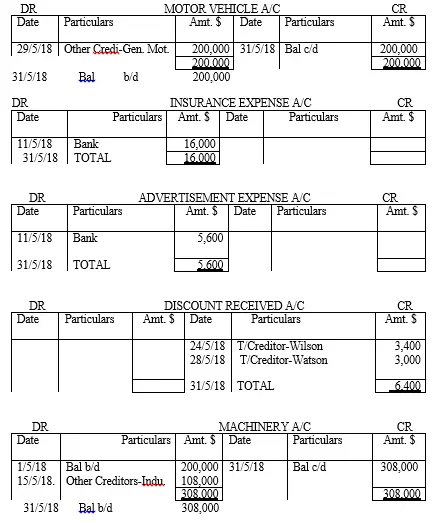

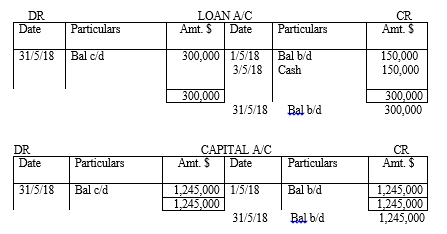

Step two: Posting transactions to the respective ledger accounts (note-1)

GENERAL LEDGER (GL)

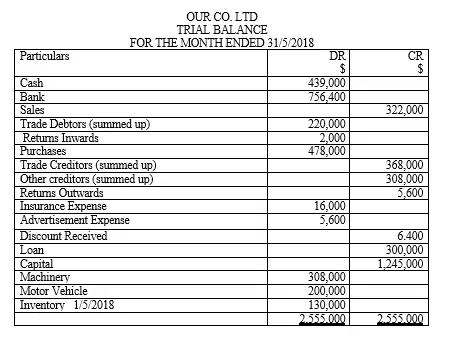

Step Three: Extraction of a Trial Balance

Additional information

Closing inventory on 31/5/2018 was $497,600

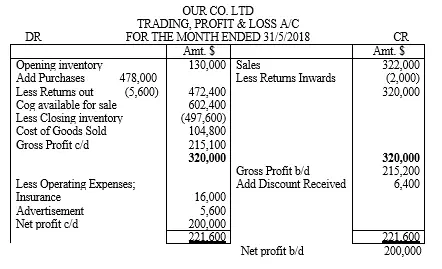

Step Four: Preparation of Trading account and profit and loss account (note-2)

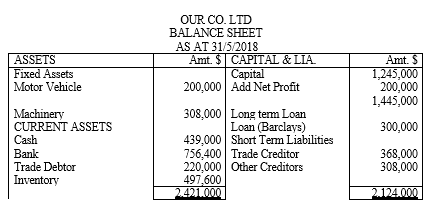

Step Five: Preparation of Balance sheet (note-3)

Summary

-

-

The recording of transactions in ledger accounts using information from the respective books of original entry is governed by the Duality Principle; that is, every business transaction has double effect-ie double entry principle. According to this principle, every transaction has two aspects i.e. the benefit receiving aspect and benefit giving aspect. These two aspects are to be recorded in the books of accounts. In other words, for every transaction that takes place, the accountant/entrepreneur must make a DR entry followed by a corresponding CR entry or the vice versa. Also, one can make several DR or CR entries, followed by a corresponding single CR or DR entry. The point is the sum of the two entries must be the same; therefore,

-

All the information in the books of original entry are POSTED to the respective ledger accounts using the double entry principle

-

- Matching Principle; It is referred to as matching of expenses against incomes. It means that all incomes and expenses relating to the financial period to which the accounts relate should be taken in to account without regard to the date of receipts or payment. Therefore,

-

the preparation of trading, profit and loss accounts requires matching of incomes received or earned within a specific period of time and the corresponding expenses paid or incurred within the same period the income aforementioned was generated. That is the reason why if we are computing profit for the year;

-

We adjust the incomes and expenses/costs so as to EQUALLY match them. For instance, if all purchases were all sold, then we directly get the difference between the two. Also if all purchases were not sold at the end of the financial period, (ie there exists a closing inventory), then we have to consider the total cost of goods available for sale, then subtract the closing inventory as demonstrated in the preparation of trading, P& L a/c.

-

We only consider the DR and CR totals for all expenses and incomes respectively unlike other items of asset, capital and liability nature. Hence, the expense a/c and income a/c have no balances brought down (b/d) at the end of the period under consideration.

-

In the illustration 2 aforementioned and any other similar illustration that will follow, the preparation of trading, profit and loss account is not a matter of mere listing or matching of incomes and expense. It entails a double entry principle and that’s why the expense and income accounts thereof were closed down to the respective trading and P &L accounts.

-

In addition to note (1) a, the accounting concept/assumption referred to as; The Accrual Concept; the accrual concept is based on recognition of both cash and credit transactions. In case of a cash transaction, owner’s equity is instantly affected as cash either is received or paid. In a credit transaction, however, a mere obligation towards or by the business is created. This concept advocates that income should not only be recognized and recorded when actual cash is received, but also when it is earned. Similarly, the concept advocate that expenses should not be recognized when cash is actually paid but even when it has been incurred.

-

-

Balance Sheet Equation Principle; under this principle, all asset value are equal to the sum of capital and liabilities of the organization. In other words debit entries are equal to credit entries. That is, when the learner is preparing the balance sheet also known as statement of financial position, the two sides has to balance as a matter of principle.

-

The first balance sheet is the original one and is referred to as the opening balance sheet. This balance sheet was for an already operating business, the assets and liabilities will not assume zero values (see the opening balance sheet in this illustration). The second balance sheet is prepared after several transactions had taken place in the course of the financial period in being looked at. Hence it is an adjusted balance sheet and it represents the closing balance sheet for it disclosed the monetary value of the assets, capital and liabilities of the organization at the end of the financial period. Therefore, an adjusted balance sheet is the statement of financial position of a business at a particular period and it reveals the adjusted monetary value of the assets and liabilities of that organization. It should further be noted that this closing balance sheet at the end of the financial period turns out to be the opening balance sheet at the beginning of the next financial period in question before the relevant transactions of the next period are put into consideration.