What is a petty cash book ?

Petty cash transactions are unique transactions for they involve dismal amounts of money. It refers to small day to day transactions that the organization undertake. This transactions are not directly recorded in the main cash book for they are many in a day and are small in nature. Therefore, a special ledger account is introduced in the main cash book system, commonly known as a petty cash book.

A petty cash book is a ledger account which is an extension or a subsidiary account emanating from the main cash book. Although in this session, our focus is on books of original entry, the petty cash book follow the double entry principle. As the name suggests, it is a ledger account that is used to record all cash purchase transactions that are of small amounts. It is a fund system that track small day to day purchase activities such as buying of postage stamps, transport from the office to town Centre, parking fee, air time, car wash expense, tea leaves for making tea in the offices, just to mention but a few. Petty cash is part of the overall business system that records how cash move from one account to another and how the fund is spent.

A petty cash book is kept under a petty cashier who is answerable to the main cashier. The petty cash system is operated in two approaches;

1.Ordinary petty cash system

2.Imprest petty cash system

Ordinary petty cash system

This is a system where by the main cashier extends some lump sum amount of cash to the petty cashier to utilize in payment of small day to day expenses of the organization. Once the petty cashier receives the cash, he or she will use it to the end and then present the expenditure report to the main cashier who reviews it before any additional funding.

Advantages of Ordinary Petty Cash System

1.It is easy to maintain for it does not require a lot of balancing of the amount spend and the amount to be topped up by the main cashier to maintain a cash float.

2.Suitable for small organizations for only one petty cashier and one main cashier may be required to maintain this kind of petty cash system.

3.It is cheap and less time consuming because the transactions involved are not many especially like in the case of the big organizations.

4.Easy to coordinate small cash activities-that is any receipt of cash and how it is spend is straight forward.

5.Low probability of losing cash through colluding for the staff dealing with petty cash are view and each can monitor every cash movement.

Disadvantages of Ordinary Petty Cash System

1.Duplication of main cashier responsibilities. If the management is not careful, the main cashier’s assignments will be the same as the petty cashier’s assignment for the number of the transactions are few and may require one cashier.

2.Not suitable for the large organizations which have many transactions.

3.High chances of cash misuse especially if the few cashiers collude due to lack of separation of duties.

Imprest Petty Cash System

This is a petty cash system where by a float (original sum given by the main cashier) is maintained at the end of a specific period of time. Imprest system involves setting of a specific amount of cash to be used by the petty cashier within a specific period of time. After the petty cashier spends the cash given, the report is presented to the main cashier who reimburses the petty cashier to ensure that he/she restores the original cash issued earlier as agreed (a float). Therefore, in the beginning of every period, the balance b/d in the petty cash book under imprest system is the same.

Advantages of Imprest System

The following are the advantages of a firm using imprest system as compared to the ordinary petty cash system.

1.The imprest system is an arrangement which brings down the probability of misuse of cash. For instance, the float can be immediately reduced if it is found to be more than enough for the agreed period.

2.Under this system, the chief cashier periodically checks the record of petty cash and cases of errors caused by the petty cashier can easily be detected and corrected by the main cashier.

3.Improve cash handling efficiency; imprest cash system allows for proper handling of cash for there is order and hence no cases of faulty transactions. The petty cashier has an absolute responsibility of managing certain amount of cash.

4.The imprest system enables significant saving to be effected to post small items to accounts in the ledger since it uses an analysis system that collects small items together into weekly or monthly totals.

5.There is no chance of misappropriation of cash by the petty cashier for the cash under the imprest system is usually very small.

Disadvantages of Imprest Petty Cash System

1.Costly. It is expensive to maintain this type of petty cash system because it requires competent cash personnel

2.Time consuming. There are so many cash activities to be coordinated between the main cashier and the petty cashier and this takes a lot of time

3.Cash losses. The system exposes available cash to losses because one cash float is maintained throughout which may just be theoretical but in actual sense, there may be shortages

4.Not suitable for small organizations for it requires qualified staff and the small firms may not afford

5.Too cash demanding-now that a certain level of cash float has to be maintained all through, this may result to some cash transferred from a better investment to fill the missing gap in the float.

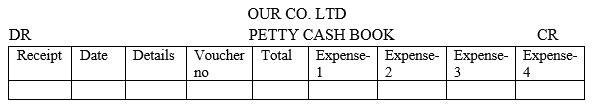

Petty Cash Book format

A petty cash book has the following nature of format

Details of the Petty Cashbook format

Petty cashbook has two main sides, namely Debit Side abbreviated as DR and Credit Side abbreviated CR.

Other details are;

Receipt column; used for recording all cash transferred from the main cashier to the petty cashier cash box or account

Date; for recording dates when each transaction take place, whether involving cash receipt or payment

Details; this is the particulars column also referred to as description column and it is used to provide a short narration of the nature of transaction that has taken place

Voucher no; it is the column for indicating the serial number corresponding to a peculiar transaction for the purposes of future references

Total; is the column for indicating all one type of expense that was paid in the course of the day. It is a expense summary column for the individual expenses paid

Expense column-one; column for recording expenses of type one e.g stamp expenses

Expense column-two; column for recording expenses of type two e.g airtime expenses

Expense column-three; column for recording expenses of type three e.g tea leaves expenses

Expense column-four; column for recording expenses of type four e.g transport expenses

Similarities between cashbook and petty cashbook

The following are the key similarities between cashbook and petty cashbook

1. Both are used for recording cash transactions only

2. Both are prime books or books of original entry

3. Shifting of transaction information to both books is referred to posting and not transfer as it is in the case of source documents

4. Both use double entry principle

5. Both books have DR and CR sides

6. Both are balanced at the end of the day

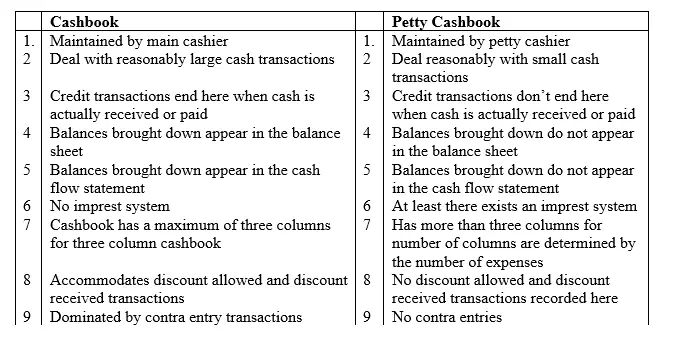

Differences between cashbook and petty cashbook

Although most businesses keep both main cashbook and petty cashbook, many students and laymen don’t differentiate the two. The following are the key differences between the two books of original entry as indicated in the table below

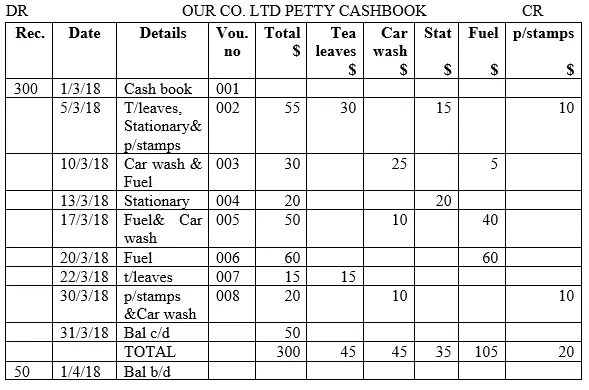

Example of petty cash book - ordinary petty cash system

From the following transactions in the month of March 2018, prepare a petty cash book for Our Co. ltd considering the two scenarios of an ordinary petty cash system and imprest petty cash system.

1st/03/18 main cashier gave the petty cashier $300.

5th/03/18 bought some tea leaves $30, pens $15 and postage stamps $10.

10th/03/18 paid $25 for van wash, fuel $5

13/03/18 bought pens and pencils $20.

17/03/18 paid for fuel $40 and car wash $10.

20/03/18 paid $60 for fuel.

22nd/03/18 bought tea leaves for $15

30th/03/18 paid expense for postage stamps $10, car wash $10

Solution

It should be noted that the b/d on 1/4/18 is $ 50 and the petty cashier may be permitted to continue using this amount until it is fully exhausted or can be reimbursed some more funds. This is the case of ordinary imprest system

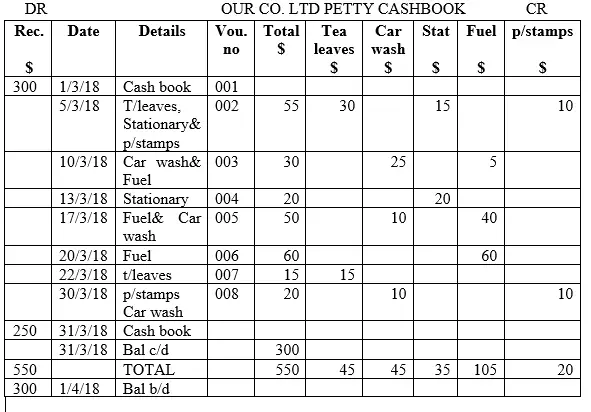

Example 2- cash imprest system

The learner need to note that, in the case of petty cash imprest system, the entries are the same as those of the ordinary only that the aspect of FLOAT is maintained every time. This is demonstrated by the way the petty cash book balance is computed. We will assume the facts in the above illustration 5 of ordinary petty cash system and prepare a petty cash book where by imprest system applies as follows;

1st/03/18 main cashier gave the petty cashier $300.

5th/03/18 bought some tea leaves $30, pens $15 and postage stamps $10.

10th/03/18 paid $25 for van wash, fuel $5 .

13/03/18 bought pens and pencils $20.

17/03/18 paid for fuel $40 and car wash $10.

20/03/18 paid $60 for fuel.

22nd/03/18 bought tea leaves for $15

30th/03/18 postage stamps $10, car wash $10

Solution

It should be noted that the balance brought down every time a new period starts should be the same as the original amount that was given to the petty cashier by the main cash book cashier. This is referred to as the float. In the petty cash book with imprest system approach, the main cashier assess the total expenses paid for by the petty cashier and then reimburse an equivalent amount. That is, at any time, the total of petty cash balance and all expenses that have not been reimbursed to the petty cashier is equal to the agreed float.