Bad Debts and Provision for Doubtful Debts

The argument behind provision for bad debt is that at the end of the financial period, some of the debtors may not be able to pay. So, if this is the case, when they default, the organization will not be in a position to capture such an eventuality hence it will not reflect in the books of accounts. Therefore, the entrepreneur need to create a provision to safeguard his financial reports. The rationale of providing for bad debt is because we doubt a certain percentage of the sundry (total) debtors may fail to pay. This is also referred to as provision for doubtful debts. Doubtful debts is not an operating expense for it does not involve any actual cash out flow. It is an allowance.

Provision for doubtful debts is similar to the case of depreciation provision discussed earlier. The amount of provision for doubtful debts to be charged to the relevant accounts is based on the debtor value (net) at the end of the financial period. From past experience with the existing debtors, the management sets a percentage of the debtors to be profiled as doubtful. In this case, the percentage to be used will either be high or low depending on the level of doubts as to whether the debtors will pay or not. Therefore, if the resulting doubtful amount computed is increasing, it implies the level of doubts have increased and the vice versa is true that if the provision for doubtful debt computed is decreasing, it means the level of doubts is decreasing too. This variations are normally incorporated in the books of accounts. The entrepreneur/learner need to note that provision for doubtful debt is an additional deduction after bad debts have been subtracted from the gross debtor amount.

Bad debts on the other are the irrecoverable debts which have already been written off and the management is sure that the debtor amounts classified as bad debt will never be paid. The reason being that may be the owner of the business (debtor) closed down his/her business due to inability to be in operation, could have died, or became insane or out of his/her mind and not able to run the business or otherwise. In such a case, the debt due is written off as a financial loss and then charged as an operating expense in that financial period. All this transactions around the debtor perspective is considered when preparing books of accounts. The following scenarios will be utilized to demonstrate the accounting treatment of such activities.

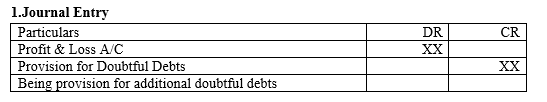

Scenario One: First time Provision for Doubtful Debts

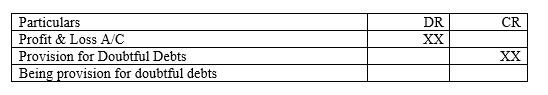

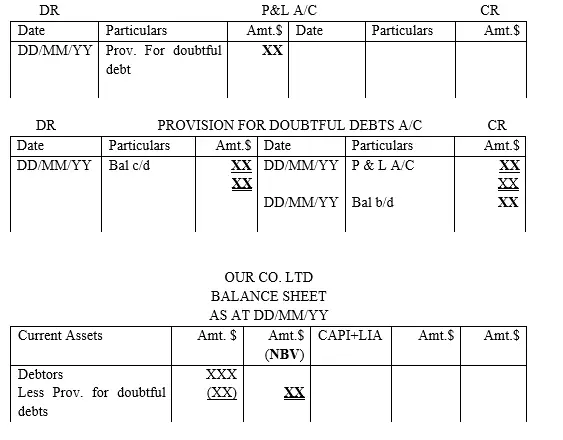

Provision for doubtful debts are normally provided for at the end of the financial period. For the case of first time provision for doubtful debts, it is incorporated either when the organization is a new one or the organization has been managing its debtors without a debt provision policy. Therefore, when the organization decides to introduce a provision for doubtful debts for the first time, it will do so by journalizing and posting the transaction in the respective ledger accounts as follows;

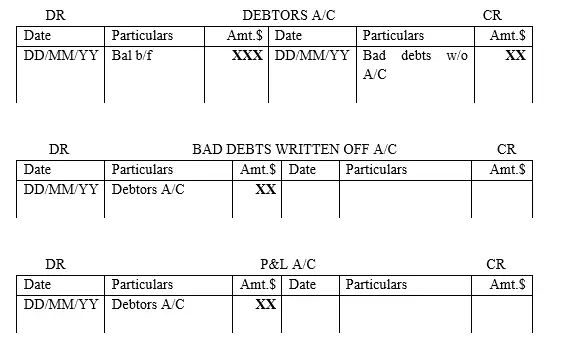

1.On creation of provision for doubtful debts for the first time;

NB: That the first provision for doubtful debt amount computed is assumed to be an operating expense hence charged to profit and loss account

2. Posting to respective ledgers

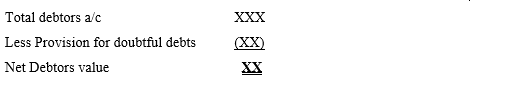

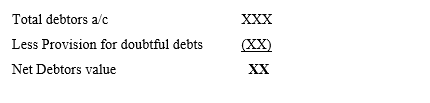

NB1: The implication of the above journal entry is that the total value for debtors is not as stated in the debtor ledger account hence the need to adjust it to reflect the true monetary status (NBV-debtors). This is achieved by undertaking the following adjustment;

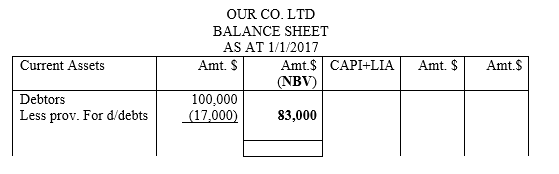

NB2: The net debtor value is usually reflected in the balance sheet at the end of the year. It is sometimes referred to as debtor net book value.

NB3 Provision for doubtful debts account is cumulative in nature and as other accounts are closed down at the end of the financial period, this account remains open to accommodate additional provisions made in the future.

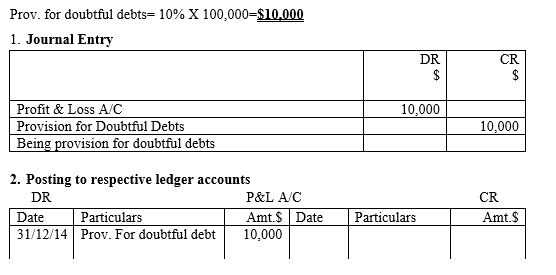

Illustration 1- Journal entry of provision for bad debts

31/12/2014 Our Co. ltd had sundry debtors of $100,000. The management fills that the whole amount may not be paid. To ensure that the profit of the year is not exaggerated, it was decided that a policy of providing for doubtful debts be put in place where by a 10% of net debtors at the end of the financial period was assumed appropriate based on the past experience the organization had with its debtors.

Required;

Show the journal and the corresponding accounting entries in the respective ledger accounts and prepare the balance sheet extract to show the debtor monetary status

Solution

Working

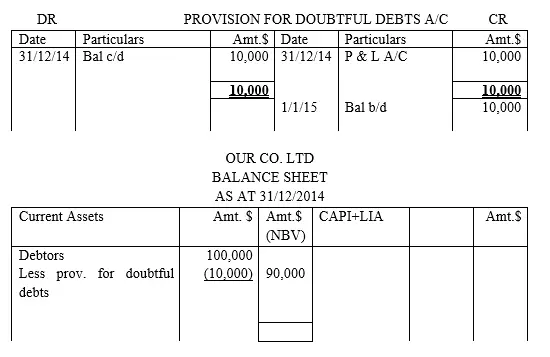

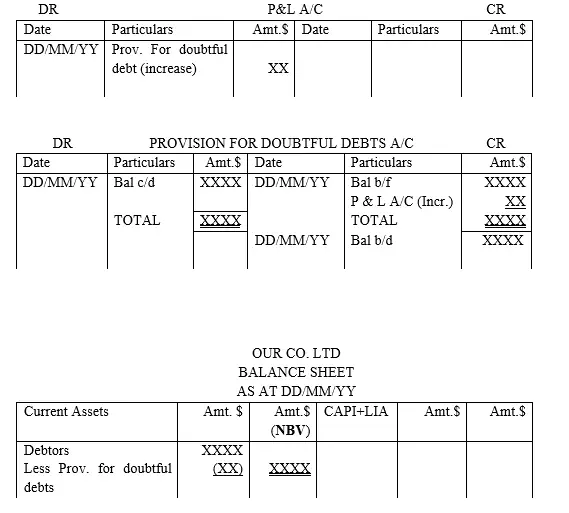

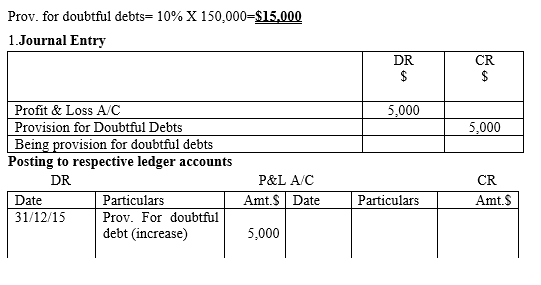

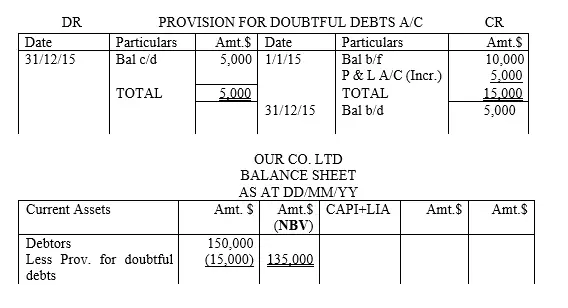

Scenario Two: Increase in Provision for Doubtful Debts

If the value of debtors increase, the level of doubtful debts also increase. This implies that, the current provision for doubtful debts computed is more than that of the previous period. To account for this variations, it is only the incremental amount (current provision for doubtful debts less previous year’s provision for doubtful debts) which is debited in the profit and loss account and the same amount is credited in the provision for doubtful debt account to update it. If this is accomplished, the entrepreneur need to note that the provision for doubtful debt account amount will be equivalent to the one arithmetically computed. Finally, in the balance sheet, the overall provision for doubtful debt amount is deducted from the net debtor value to determine the net book value closing balance brought down for the debtors.

The journal and accounting entries are as follows;

On increase of provision for doubtful debts;

NB: That the amount of increase of provision for doubtful debt amount computed is assumed to be a loss to the business hence debited to profit and loss account

2.Posting to respective ledger accounts

NB1: The implication of the above journal entry and ledger account entries is that the total value for debtors is not as stated in the debtor ledger account hence the need to adjust it to reflect the true monetary status (NBV-debtors). This is achieved by undertaking the following adjustment;

Illustration Two - Journal entries of provision for bad debts to show the debtor monetary status

Assume the facts in illustration one of Our Co. ltd that the closing balance for debtors was $100,000 and that on 31/12/2015 the company had sundry debtors of $150,000. If provision for doubtful debts was still 10% of total debtor amount.

Required,

Show the journal and the corresponding accounting entries in the respective ledger accounts and prepare the balance sheet extract to show the debtor monetary status

Solution

Working

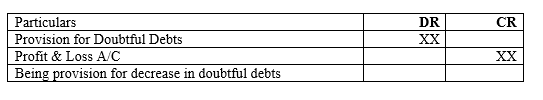

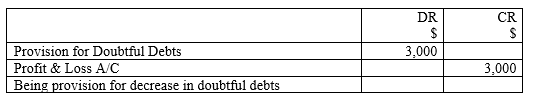

Scenario Three: Decrease in Provision for Doubtful Debts

If the value of debtors decrease, the level of doubtful debts also decrease. This implies that, the current provision for doubtful debts computed is less than that of the previous period. To account for this variations, it is only the amount of decrease (current provision for doubtful debts less previous year’s provision for doubtful debts) which is credited in the profit and loss account and the same amount is debited in the provision for doubtful debt account to update it. If this is accomplished, the entrepreneur need to note that the provision for doubtful debt account amount will be equivalent to the one arithmetically computed. Finally, in the balance sheet, the overall provision for doubtful debt amount is deducted from the net debtor value to determine the net book value closing balance brought down for the debtors.

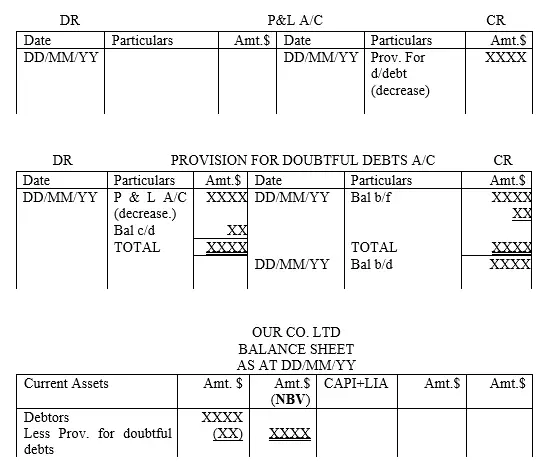

The journal and accounting entries are as follows;

On decrease of provision for doubtful debts;

1. Journal Entry

NB: That the amount of decrease of provision for doubtful debt amount computed is assumed to be a gain to the business hence credited to profit and loss account

2.Posting to respective ledger accounts

NB1: The implication of the above journal entry and ledger account entries is that the total value for debtors is not as stated in the debtor ledger account hence the need to adjust it to reflect the true monetary status (NBV-debtors). This is achieved by undertaking the following adjustment;

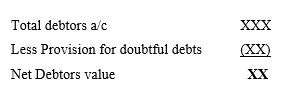

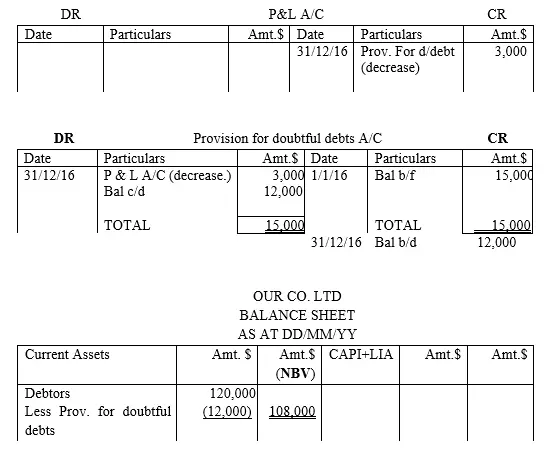

Illustration Three

Assume the facts in illustration one and two (continuation) of Our Co. ltd and that on 31/12/2016 the company had sundry debtors of $120,000. If provision for doubtful debts was 10% of the total debtor amount.

Required;

Show the journal and the corresponding accounting entries in the respective ledger accounts and prepare the balance sheet extract to show the debtor monetary status.

Solution

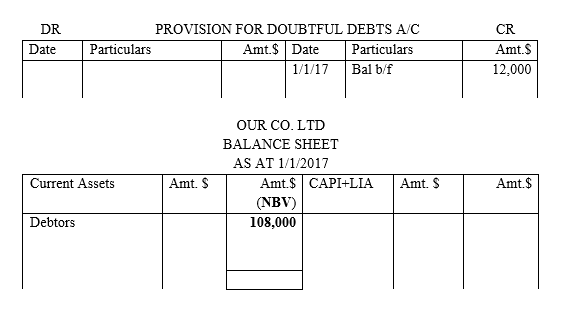

Working: Prov. for doubtful debts= 10% X 120,000=$12,000

1. Journal Entry

2. Posting to respective ledger accounts

Scenario Four: Bad Debts written off

As it was stated in the introduction part of the intermediate level of this tutorial series, bad debts written off is a financial losses that occur when the debtors fails to honor their amount due. If the management establishes a genuine reason to conclude that the amount unpaid is a financial loss, the accountant is advised to write off that amount. Unlike in the case of provision for doubtful debts which is an allowance created by the management, bad debt is categorized as financial loss and it is an operating expense. Further, it can be identified by management either at the end of the financial period as it is in the case of provision for doubtful debts, or before the year ends. The very moment this issue is raised, the amount is posted to the respective accounts as follows;

1. On recognition of bad debt

DR Bad debts written off XX

CR Debtor account XX

Being adjustment/reduction of debtor value due to bad debt written off

2.At the end of the year the year

DR Profit and Loss A/C XX

CR Bad Debts Written off A/C XX

Being closure of bad debts a/c to p& l account

3. Accounting entries will be as follows;

Illustration Four

You were provided with the following accounting information of Our Co. ltd for the year 2017 as follows

Additional information

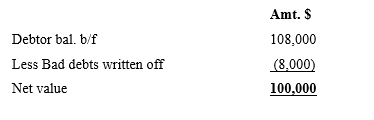

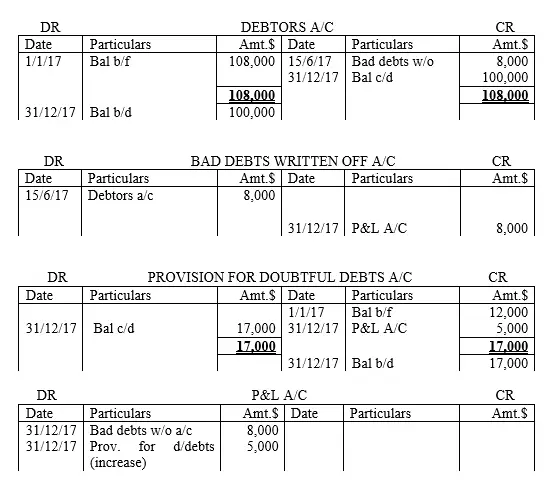

1.On 15/6/2017 a debtor who was declared bankrupt was unable to pay his dues amounting to $8,000 hence the management decided to write the amount off

2.At the end of the year, the management again felt that the remaining debtors would probably not pay all the amount due and to be on the safe side, they decided to increase provision for doubtful debts amount by 5%

Required

1.Post the aforementioned transactions in the respective ledger accounts to demonstrate how you can account for bad debts written off and provision for doubtful debts

2.Extract the new balance sheet

Solution

Computation of net debtor value

Provision for doubtful debts=

5%X100,000= 5,000

Scenario five: Bad debts Recoverable

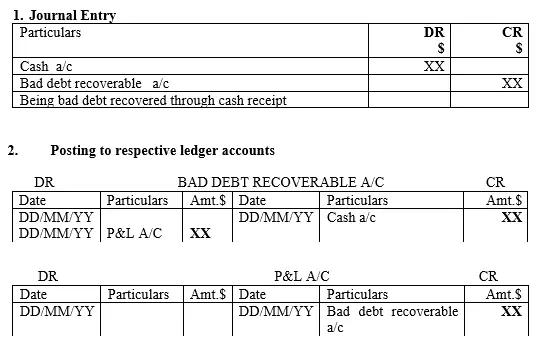

From the previous discussions on bad debts written off, you have realized that the amount written off is classified as a financial loss hence charged in the profit and loss account at the end of the financial period. The reason of doing so is when there is no hope of the amount due be paid by the debtor in the future. However, sometimes this amount is recovered especially when the concerned debtor revives his business or a windfall occurs. The recovery can take place either on the same year it was written off or in a different year in the future. Then the question that arises is how to treat this kind of transaction in the books of accounts. Remember this amount had been classified as an operating expense in the year it occurred and may be after three or five years the same amount is paid to the business by the debtor. As an entrepreneur, do you ignore it? Or do you trace back the year it was classified as an operating expense and do some adjustments? The answer is “NO.

If a bad debt had been written off in the earlier periods hence treated in the books of accounts as an operating loss, it is treated equally as an operating income in the year it is recovered. The journal and accounting entries made are as follows;

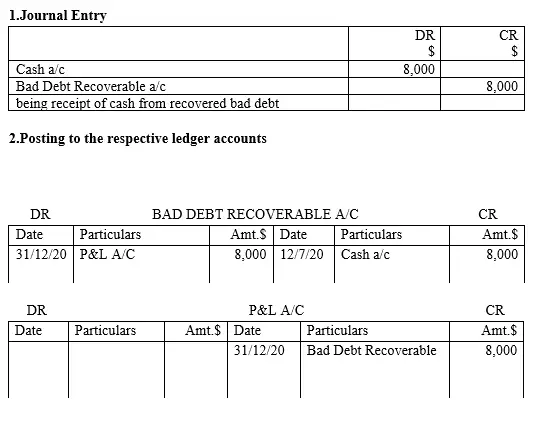

Illustration Five

Suppose on 12/07/2020, Our Co. ltd informed you that the bad debt written off in 2017 of $8,000 was later paid to the business by the debtor by cash for he had revived his business afterwards (re-visit illustration four of and see the facts thereof).

Required

1.Show the journal entry for this transaction and post the same transaction in the respective ledger accounts

Solution

NB: In conclusion, the learner need to note that, if a bad debt is written off in one year and later recovered, then it is treated as an operating expense in the year it was a bad debt and treated as an operating income in the year it was recovered in that order.

Summary

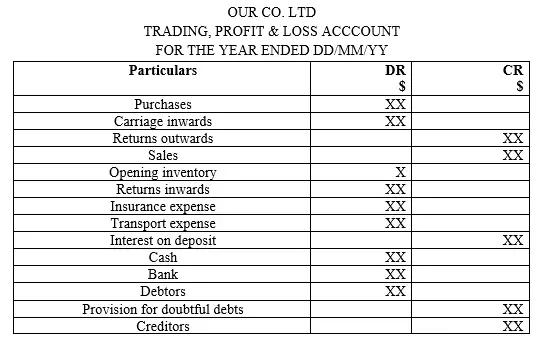

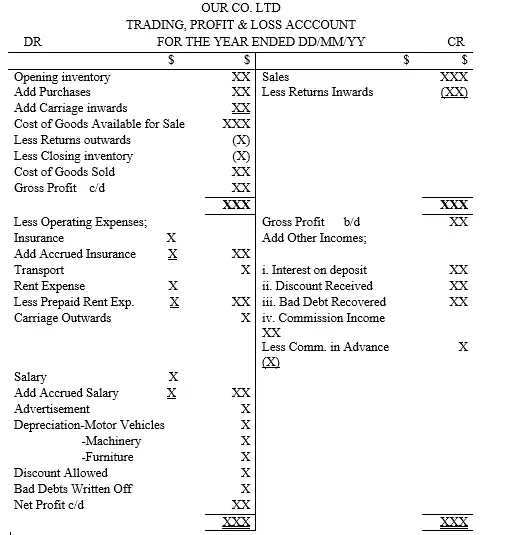

This section in the accounting tutorial series provided a point of detail to the entrepreneur/learner on the issues that an organization face at the end of the financial period and the adjustments that are required. In addition, the applicability of the generally accepted accounting principles in accountancy were incorporated for the entrepreneur to appreciate them in the day to day recording of business transactions. It demonstrated the methodology used in accounting for operating expenses, operating incomes, and provisions such as depreciation and doubtful debts. In each case, illustrations were considered for better understanding of each concept introduced. This summary culminates by presenting the bigger picture of the trading account, and profit and loss account and balance sheet with incorporated adjustments as discussed earlier.

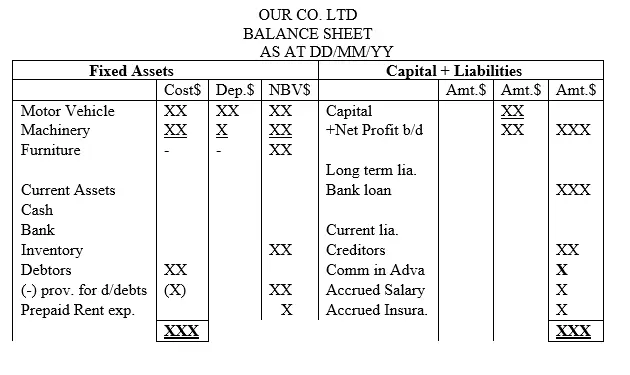

In level one/beginner of this accounting tutorial series, a general format was provided although it was assumed that there was no end of the year adjustments. In intermediate level, end of year adjustments have been incorporated and a general illustration to show how the end of year adjustments are undertaken is put in place so as to prepare the learner to tackle similar cases in their day to day book keeping or in an examination set up. The general format aforementioned is based on the information gotten from the ledger accounts of Our Co. ltd which have been summarized in the trial balance, plus the additional information which will guide the entrepreneur/learner on the adjustments to be done at the end of the financial period as shown in below

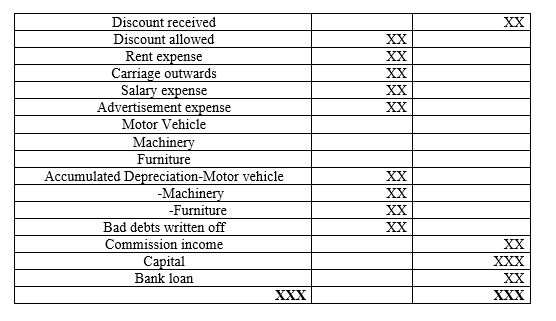

Trial Balance-General Format

Additional information

This is the nature of additional information you will be getting form examiners or you will be facing in your business

1. There was accrued insurance and salary expense at the end of the year hence the values indicated in the trial balance are not a “one” year’s amount

2. Rent had been prepaid by a certain amount by the end of the year hence some of the amount indicated in the respective account belonged to next yea

3. Bad debts recovered were not yet considered by end of the year

4. Some of the commission income received was for next year-ie in advance

5. There was closing inventory at the end of the year of a certain amount

6. Provision for doubtful debts is to be increased by X% of the current debtor value

7. Provision for depreciation for Motor vehicle and machinery were on straight line basis

8. Provision for depreciation for furniture was on reducing balance basis at a rate of X% of the net book value

Required;

1. Prepare trading account and profit and loss account for the year ended dd/mm/yy

2. Balance sheet as at dd/mm/yy

Trading Account and Profit and Loss Account-General Format

Balance Sheet-General Format