What is a return inwards journal?

This is a book of original entry which is used to record goods which have been returned by the buyer to the seller due to some discrepancies(Stage Four: Goods Returned by the Customer (Optional)). It is prepared by the seller using information from the outgoing debit note. This is where it starts, when the seller receives some complaints from the buyer of goods due to some discrepancies (using a damaged goods note) such as physical damage, wrong quality or quantity or wrong specifications. The seller prepares a debit note and sends it to the buyer to correct the anomaly. In return, the seller uses the outgoing debit note information to prepare a return inwards journal. In the next illustration four, we will demonstrate how transactions recorded in the outgoing debit note are moved to the respective book of original entry that is returns inward journal.

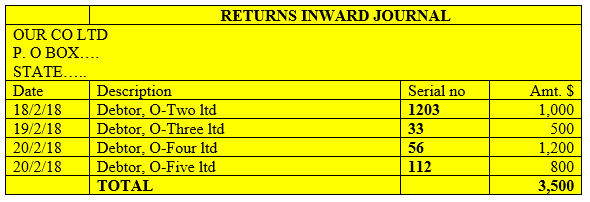

Return inwards journal example

18-02-18 goods worth $1000 were returned by O-Two ltd to Our Co. ltd

19-02-18 goods worth $ 500 from O-Three ltd had some discrepancies and were returned to Our Co. ltd

20-02-18 goods worth $1,200 from O-Four ltd had some discrepancies and were returned to Our Co. ltd

20-02-18 goods worth $ 800 from O-Five ltd had some discrepancies and were returned to Our Co. ltd

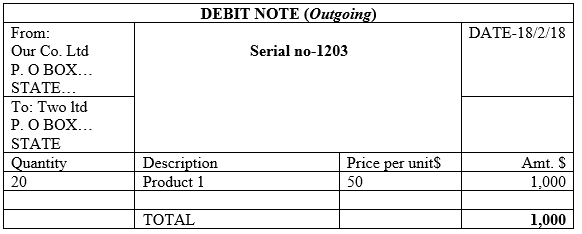

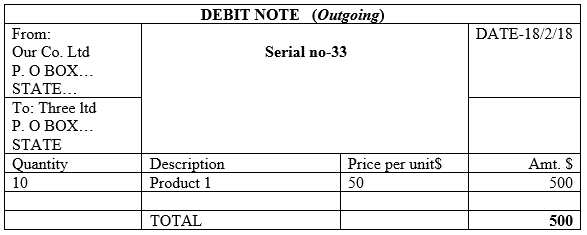

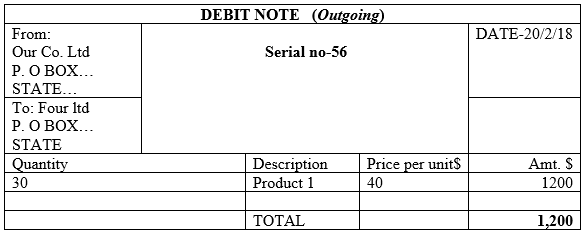

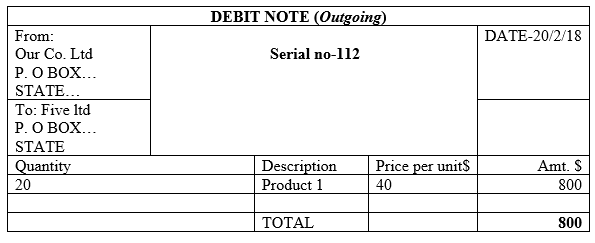

The corresponding source documents and the affiliated prime books used are as follows;

18-02-18 goods worth $1000 were returned by O-Two ltd to Our Co. ltd

19-02-18 goods worth $ 500 from O-Three ltd had some discrepancies and were returned to Our Co. ltd

20-02-18 goods worth $1,200 from O-Four ltd had some discrepancies and were returned to Our Co. ltd

20-02-18 goods worth $ 800 from O-Five ltd had some discrepancies and were returned to Our Co. ltd

The corresponding book of original entry used is;

NB1: The learner need to notice that no DEBIT or CREDIT columns that has been used for all the documents utilized to record the various transactions, the amounts are recorded on the amount column. This is because the dual principle does not apply at this stage. In fact this is the reason why we transfer information from the source documents to the respective books of original entry.

NB2: Information in the outgoing debit note is used to prepare returns inwards journal.