What is accounting information?

In level one of this accounting tutorial series, you were briefly introduced to some few basic Accounting terms and concepts so as to have a starting point. This second edition is a building block of level one where by concepts and advanced approaches of bookkeeping will be introduced to you. Again in level one, the nature of business was majorly a single ownership business. In other words a sole proprietorship.

A sole proprietorship is the smallest form of business entity that one can establish. Now that we are in the mood of entrepreneurship, this small unit of business is referred to as a Micro-Enterprise (ME). As the organization grows, it turns out to be a Small Enterprise (SE), then further grows to Medium Enterprise (ME) and finally Large Enterprise (LE). Hence the concept of Small and Medium Enterprises (SMEs) such as partnerships and joint ventures is incubated in that manner. As the SMEs grow, the turn out to be large organizations such as private limited company where by capital is raised by more than two owners up to a limit of fifty (50). Any growth beyond this level, the organization can go public where by the owners of the firm can raise capital/finances from the public through registering in the securities exchange market. In this case ownership is increased to unlimited number of persons. Such firms are referred to as public limited companies. In the previous level one of this tutorial module, we simply focused on micro small enterprise accounting records using a basic accounting cycle.

In level two of our tutorial series, we will consider accounting processes of small enterprises where by the capital of the organization is raised by one person or the business has grown due to plough back of the profits generated in the previous financial period. As a learner, do not forget that as your business scales to the next level of operation, this will be reflected in your new balance sheet after one or several years of operation. This means that the original balance sheet will portray different values for its assets, capital and liabilities. The values will have varied for there are transactions which take place during the period of operation where by at the end of it either you generated profits, suffered losses, introduced new capital or you withdrew some assets either in cash or non-cash form for personal use.

Similarly, as the business expands, the number and nature of transactions vary in number and complexity. As an entrepreneur, you need advanced accounting knowledge to tackle such challenges. Level two series and the proceeding ones will equip you to learn your business more comprehensively. Therefore, remember that the preceding level will always usher you to the next level and you will always interrogate the same accounting cycle you learned in level one only that it will comprise of more details. The same applies to its components as discussed in this book series. This advancement in more and more accounting knowledge is key. As a professional or entrepreneur, more accounting knowledge is necessary as we shall discuss after highlighting the specific objectives the entrepreneur need to achieve at the end of this training. Therefore, in this series, the learner will achieve several specific objectives as indicated herein.

-

To appreciate and apply the role of accounting information

-

To prepare adjusted balance sheet at the beginning of a new financial period

-

To record business transactions in the respective ledger accounts using source documents and books of original entry

-

To extract a trial balance from the ledger accounts balances

-

To identify and correct errors affiliated to trial balance

-

To carry out end of the year adjustments using journal entries and relevant ledger accounts

-

To prepare adjusted trading and profit and loss account for the business and extract an adjusted balance sheet

Role of Accounting Information

Accounting information is a perquisite in day to day operations of any business, be it small, medium or large. Anybody with accounting information derives the following advantages/benefits;

-

Management tool:

The success of any business requires proper management. The term management is a broad aspect in the world of business. There are many definitions attached to this concept but in general terms, management is the art or science of overseeing the affairs of the business. I am a philosopher of the analogy that the owner of a business will either manage or damage his business. So, one is either the managing director of his business or the damaging director where by the consequences of the latter position are not welcoming. Management is not a onetime event but it is a continuous process. It is an act of establishing an enabling environment to ensure the players can work in harmony towards the common goal (s) of the business itself. Management entails FIVE functions. Since this is not a Managerial class, I have listed and briefly defined each function and the role accounting information play to benefit the owner of the business.

-

Planning; it is the first step in management which involves making decision on courses of action (strategies) to be undertaken to ensure the business succeeds in the future. It entails preparing a roadmap to be followed by the business. Hence the owner of the business need to formulate policies, objectives and schedule procedures to be followed for one to succeed. Accounting knowledge will aid in assessing the financial muscles of your business to know whether the set objectives are attainable or not. For example, the balance sheet at hand can be used to interpret the financial position by considering the cash in hand or at bank or the capital base.

-

Organizing; this is the act of dividing or categorizing of business activities in to their relevant aspects so as to avoid confusion and foster orderliness on how activities are to be performed. It entails establishing of sections, departments which have to work in congruence towards the common goal of the business. Accountancy information is vital to evaluate the available resources, whether financial or otherwise so as to determine the viability of the business. For instance, owners of small business need to consider establishing the key departments for financial abilities may be limited. Any unreasonable allocation of resources or wrong investments may strain the business hence collapse. This can be assessed using the accounting information available.

-

Staffing; it is the act of employing people to work with. It also involves developing them through trainings and lastly firing where by the worker part ways with the organization. Accountancy information is of paramount importance for rate of cash flows (in and out) will dictate the affordability level to hire quality professionals.

-

Directing; is the act of guiding, supervising and motivating of subordinates to ensure they work towards the right direction. Accountancy awareness help the owner of the business for information such as change in sales level between two or more financial periods can be a Key Performance Indicator (KPIs) to assess whether sale persons are heading to the right direction. Hence the manager can either re-direct them through further trainings on improving efficiency or motivate them through commissions as a way of encouraging the team.

-

Controlling; it is the last step in management and it is the art or science of comparing actual results and the budget, determine the variances and undertake the necessary courses of action. What do I mean? For a business to succeed, one has to plan for future activities to be undertaken which entails budgeting. For example planning on the level of production, setting sales targets for the year and the maximum operating expenses to be paid or incurred. After setting of the budget, the next step is the actual results realized which can either be as per the budget, or they may deviate. The deviations can either be favorable or negative where by the management is required to undertake the appropriate measures to correct the deviations. This is possible if accounting information is available. For example the profit and loss account and the balance sheet of two financial periods will help in comparing the two to know whether the organization operated within the budget or not. If this accounting information is missing, then guesswork will apply.

-

Taxation: This is payment of government liabilities. A business does not operate in a vacuum. The government in power has a right to benefit from the profits generated by the business for it creates an enabling business environment. Proper accounting system will aid the owner of the business to determine the correct tax liability to pay. Also good accounting system will help to determine the tax avoidance and tax evading cases to take advantage of and to avoid punitive issues by the government respectively.

-

Loan facilities: Updated accounting information assist in accessing loan facilities. Sometimes the owner of the business may have financial difficulties that may require external financial aid. Am sure if you are in business and at some point you walked it to the bank to enquire on loan facilities being offered by the bank, one requirement is to furnish that financial institution with a bank statement or account records of your business for one year or so. If you do not have one, the only thing that happened to you is either panicking or concocted one to purport that the financial affair of your business are in order. This is frustrating and you may forfeit a credit facility no matter how cheap it may be. For instance, I have witnessed with the most governments both in the developed economies such as United States of America (USA), Japan and United Kingdom (UK) and those in the emerging economies are now planning for economic stimulus programs to cushion SMEs from the shocks caused by the Covid-19 pandemic. Regardless of how cheap it may be, most likely those to benefit may be required to provide several financial statements.

-

Auditing: involves trailing of business transactions and evaluating of financial position of the organization by auditors who are professionals. One of the aim of auditing is to establish the true and fair view of the business to the owner and third parties if need be. Accounting information such as balance sheet and profit and loss account among others are key in carrying this exercise. The good thing about this process is that one is in apposition to know whether the available resources have been properly utilized and also it aids in enhancing accountability and transparency.

-

Business opportunities: Availability of accounting information such as cash flow statement, trading account and profit and loss account will aid in winning a business opportunity. For instance, some big organizations may be in need of agency services whereby they may wish to collaborate with small businesses to act as their agents. The first thing they would like to know from you is whether you have been in operation for a certain period of time. This calls for one to produce financial statements. This scenario has become common especially in this era of information technology and financial innovations where businesses act as bank agents.

-

Awareness of the financial health of your business: This refers to financial position of your business. Components of financial statement such as balance sheet can be used to determine some financial distress indicators which can help one to know whether the business has a brighter future or it is bound to go under. For example, with accounting knowledge, you will be able to determine accounting ratios which can guide you on the financial state of your organization hence take the appropriate actions to save the situation.

-

Future succession/amalgamation: Accounting information aid in transfer on business interest from one person to another. As mentioned earlier, a business starts small as micro, then to small scale, to medium and then large. In the initial growth stage, the owner is everything and enjoys all benefits and suffers all the losses. But as the organization grows big, other interested parties may start eyeing the same. The original owner may opt to either dispose the business, or sell some of his shares, or merge with another business with the same interest. This call for proper accounting system for in such circumstances, there is need of determining of the good will to be paid by the incoming party (ies). Therefore accounting records will aid in business valuation process.

Quality Features/characteristics of good Accounting information

The fact that availability of accounting information is beneficial, it must attain a certain quality threshold for not all accounting information is important. Those good characteristics are;

-

Reliability; Refers to accounting information be verifiable and useful to those in need of it. Is the information provided dependable in making sound financial or managerial accounting decisions?

-

Realistic; refers to how accurately the information is a true representation of the natural or real life situations. Are the aspects presented by the accounting statements attainable?

-

Understandability; Does the information represent clear communication to the accounting information users such that there is no confusion or contradiction of events or results?

-

Relevance; Financial information should be matched to the useful events that it represents. For example, financial information should be for accounting based activities of the organization otherwise it will be irrelevant.

-

Consistency it implies that transactions of similar nature should be treated so throughout a specific financial period although changes can still be done form time to time. For example, accounting information for general expenses should compose certain elements all through.

-

Comparability this means that users of accounting information should be able to compare and contrast accounting information of firms of similar industry and make common conclusions.

-

Objectivity implies that accounting information presented or prepared should not be bias. It should not imply to favor some parties and not others.

Users of Accounting Information

In practice the users of accounting information are varied and numerous and to a certain extent depending on the type of business involved. Normally the users of accounting information will include the following:

-

Internal Users

-

Business owners: Anybody who starts a business aims at creating wealth through profit generation. The owners of an organization use the accounting information to assess whether their capital resources are well utilized by the management to generate more income or not. For your information, they are the actual investors who have forgone their cash resources now to generate more returns. From the books of the accounts, they will establish accounting ratios such as Returns on Equity, Returns on Investment and Returns on Assets so as to know if they are benefiting from their venture or not.

-

Investors: This are also referred to as potential investors for they are other individuals, either firms or natural persons who have financial interest in the firm in question. So, before one invests in a particular firm, he/she would like to know the financial position to avoid losing his financial stake. Therefore, before one engaging himself on a venture, it is wise to interrogate the business books of accounts

-

Management; the management is the agent who undertakes the day to day activities of the organization on behalf of the owners. They need the accounting information to establish whether the performance of the business is as per the owners’ expectations or otherwise.

-

Employees; are the implementers of the decisions made by the management and they need the accounting information to assess the performance of the firm for the results provided guide them to conclude if their job security is assured or not.

-

External Users

-

Lenders; This are financiers of a business and their aim is to assess the financial power of the firm in question for they do not want to lose their money due to non-profitable activities. Therefore, they look at the financial position of the firm before assisting

-

Vendors/or Suppliers; this are sellers of goods and services to the organization and their concern is whether they can engage the firm in a viable way without losing their cash. Customers; the concern of the clients is to establish whether the business is reliable in its deals. This is because the customers does not wish to create royalty on a product that is short lived or unreliable. They will know this if they can access the financial statements of the firm.

-

Tax authorities; as mentioned earlier in this accounting series, accounting information is needed for accurate computation of tax liability for the government. Failure to rely on good accounting system, you may pay more tax or land in to problems such as tax evasion issues which definitely turn to be punitive.

-

Competitors; although this are opponents of an organization in question, accounting information is necessary for comparison purposes amongst firms especially those in the same sector

-

Government; the government is in need of business data to assess the economic activities in an economy. This can only happen if the data is available through financial statements prepared by the firms

-

Public; although the public may not bother much on an organization’s financial statements, they get to know the social economic activities undertaken by the organization to see if it is beneficial or not and may be raise an alert to the government to correct such issues.

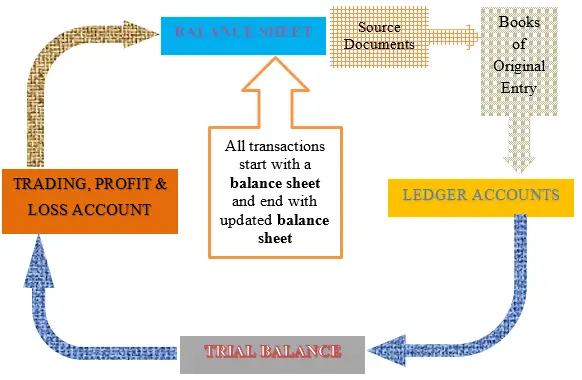

Now that you have appreciated the various perspective of accounting information, the next section is to re-visit the accounting cycle. This time round, we can refer to it as adjusted or revised accounting cycle for it is a new version of the initial one we discussed in level one accounting tutorial series.

Adjusted accounting cycle

Remember in the first level of this tutorial series, accounting cycle was defined as a systematic recording of accounting information in the balance sheet, then posting the information to the ledger accounts, followed by extraction of trial balance. Then, the last step is to prepare a trading, profit and loss account to extract gross or net profit or (loss) respectively. Lastly a new balance sheet is prepared. This process is not as straightaway process as it was expressed in the level one tutorial. This was for easy understanding of the learner, otherwise for the sake of clarity, orderliness and accountability, a professional accountant initiates any business transaction by recording the information in authentic documents. This calls for consideration of other accounting steps to be adhered to before the final recording in the ledger account is undertaken.

Therefore, in level two/intermediate we will consider source documents and books of original entry and how they are utilized by accountants to aid in establishing ledger accounts. After accounting information is recorded in the closing balance sheet at the end of the previous period, the same information is posted (not transferred) to the respective ledger accounts whereby the account items with debit balances and credit balances are recorded in a corresponding new ledger account on the debit and credit side respectively. For example, in the closing balance sheet, the debtor’s value will be posted to a new debtors account on the debit side with the value being the opening balance for the next period. The same thing applies to all other balance sheet item with debit balances and credit balances in that order. However, the learner need to note that, for inventory, no new account is opened for its value is determined at the end of every end of financial period through stock taking process as per IAS 2. Also the learner need to note that for expenses and income, they are not part of balance sheet components and the accounts are normally closed at the end of the financial period either to trading account or profit and loss account depending on where they belong. However, as it shall be observed in this series and other advanced levels of this tutorial, that there are some cases where expenses and income assume balances brought down (b/d) as it is explained in this level two series. Let us now first interrogate the additional components of the original accounting cycle we had discussed earlier. This is how it looks like;